Remember the chart we released on December 13, 2016, showing that developers moved up the most in the first leg of the bull market and gave up the least during the pull back?

We have uncovered another jewel.

Amarillo Gold (TSXV:AGC, FRA:72A) checked off all the boxes we look for in a gold company, and as we met with management and delved deeper, we realized this could be one of the most undervalued developers out there.

The company is led by mining legend, Buddy Doyle, and has a PFS-level project, located in a mining-friendly jurisdiction. In fact, the project obtained a crucial permit last year and will now proceed forward rapidly.

If you have a short attention span, just read this:

-Current market cap of C$30 million, ~C$3.3 million cash

-1.5 million ounces of gold resource

-Post-NPV5 of US$178 million (C$240 million), updated PFS in February 2017

-The License Preliminary Permit (LP), the most difficult license to obtain, granted in May 2016

-Buddy Doyle, President and CEO, discovered the Diavik diamond deposits in 1994/1995. Key member of the multi-million ounce Minifie gold deposits at Lihir in 1987/1988.

Preliminarily, an astute investor will have a hard time not reading on. The company is trading significantly under its intrinsic value, with numerous x-factors that the market just has not seen. However, we believe Amarillo’s news flow slated for 2017 will be too hard to ignore, and management has stated plans to ramp up marketing. Everything is falling in place for Amarillo to make a splash in the New Year.

Current Price: C$0.38

Shares Outstanding: ~80.3 million

Market Capitalization: C$30.5 million

52-Week Range: C$0.06 – C$0.68

Cash: ~C$3.3 million

The Past-Producing Mara Rosa Project In Goias, Brazil

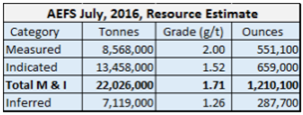

Amarillo Gold’s flagship asset, Mara Rosa Project, is a greenstone belt, shear-hosted meso-thermal gold mineralized system. In a recently updated resource model, Mara Rosa increased its measured and indicated resource by 53%, or to 1,210,100 ounces of gold. The project has another 287,700 ounces of gold in inferred for a total of 1,497,800 ounces of gold.

Mara Rosa is made up of 60,000 hectares in exploration permits and 2,600 hectares in mining permits, with the Posse Deposit as the main gold accumulation, split into two main zones, Posse North and Posse South.

The Posse Deposit was discovered in 1982 and operated as a small-scale mining operation, before moving to open pit from 1992 to 1995. During this time, a total of 80,000 ounces was produced, 31,000 of which were extracted using heap leach and a 600 tonne per day CIL plant. Amarillo acquired the Posse Deposit in 2003 for US$450,000, and was RTO’ed in November 2005 as Amarillo’s listing project.

To date, the Mara Rosa project has had 283 exploration holes drilled for a total of 33,000 meters around the Posse Deposit. Since its public inception, Amarillo has raised over C$22 million for exploration, and completed a NI 43-101 compliant PFS in November 2011. Highlights of the PFS include:

-Initial seven-year mine life with 2.5 million tonnes per year throughout

-Average gold production of 124,000 ounces per year;

-Total cash operating cost of $524 per ounce;

-Gross revenue of US$1.044 billion, assuming $1,200 per ounce gold;

-Pre-tax NPV5 of US$283 million and an IRR of 37.9%;

-After-tax NPV5 of US$178 million and an IRR of 26.6%;

-Estimated start-up capital of US$184 million;

-Recommendation to proceed to feasibility study.

Since the project has already been in production, the infrastructure around it is excellent. There are nearby major roads and hydroelectric grid power. Furthermore, it is located in a competitive gold belt, 35 kilometers from the 4 million ounce Chapada mine (Yamana); 62 kilometers from the 1.5 million ounce Pilar Mine (Yamana); and 100 kilometers from 1 million ounce Serra Grande mine (AngloGold/Kinross).

In any other gold market, this project would have proceeded to production. Unfortunately, Mara Rosa was not immune to the bear, and the project was shelved… until now.

Readers by now will know all our development stories have blue sky potential. This is definitely the case for Amarillo Gold, who’s deposit is still open in some areas. For example, the northern part of the orebody has never been drilled to depth. If the grads remain consistent at 1.5 g/t and widths average at 25 meters, there is potential for at least another 250,000 ounces of gold. Furthermore, Amarillo believes there is still significant upside in additional discoveries in Posse Deposit clones along the same structure, and new gold mineralization altogether.

Lavras Do Sul Project – Exploration Asset With Ounces

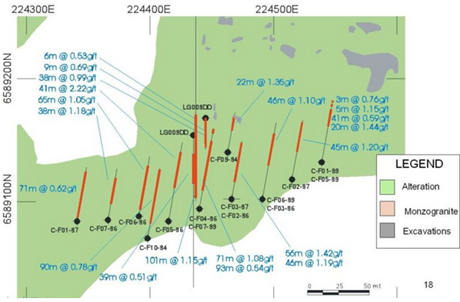

Very quickly we want to highlight the Lavras do Sul Project, located in Rio Grande de Sul, in souterhn Brazil. The project covers 19,000 hectares of exploration permits and private mineral holdings. The gold is hosted in structurally controlled alteration zones, with two known zones of significant disseminated gold mineralization, Butiá and Cerrito.

The project has seen major historical workings, with gold rushes during the 1880s and 1930s, during which it is estimated that about 350,000 ounces of gold were extracted. There are numerous artisanal excavations through the area, with previous diggings concentrated in the oxides due to the lack of technology at the time. Thus, all grades below 4.0 g/t were ignored, leaving gold bound in sulphides and lower grade oxides. This was confirmed when a state-owned company drilled holes at the Butiá and Cerrito zones in 1985 and returned assays of ~1 g/t gold in the sulphides.

Rio Tinto consolidated the area in 2004, and after confirming previous drilling and testing an oxide blanket concept, deemed the project too small (< 10 mullion ounces), and auctioned optioned the property to Amarillo in September 2006.

Amarillo believes there is excellent potential for both oxide and sulphide. The previous owners have drilled 46 holes with intersections including:

- LG003GD (RTM) 175 meters at 0.75 g/t Au (Butiá)

- LG004GD (RTM) 181 meters at 0.87 g/t Au (Butiá)

- BB-11-85 (CBC) 104 meters at 1.03 g/t Au (Butiá)

- BB-01-85 (CBC) 184 meters at 0.93 g/t Au (Butiá)

- BB-02-84 (CBC) 47 meters at 1.04 g/t Au (Butiá)

- C-F06-86 (CBC) 65 meters at 1.05 g/t Au (Cerrito

- C-F10-84 (CBC) 90 meters at 0.78 g/t Au (Cerrito)

- C-F07-89 (CBC) 101 meters at 1.15 g/t Au (Cerrito)

- C-F04-86 (CBC) 71 meters at 1.08 g/t Au (Cerrito)

The gold mineralization at both zones is still open. And only two zones have been drill tested. There is very good potential to find other zones. In the future, the company plans on performing further reconnaissance and drilling out the Cerrito extension. This is an exciting area that we are attributing no value. It’s a free call option.

Amarillo – Buddy Doyle’s Trifecta

As mentioned earlier, Amarillo is led by mining legend, Buddy Doyle. He brings to the table over 30 years of experience in mining and exploration worldwide, 23 years of which were with Rio Tinto. He led the exploration team that discovered the Diavik Diamond Deposit in Canada (1994-1995) which turns over $800 million per year, and was a key member of the team that discovered the 37 million ounce Lihir gold deposit in Papua New Guinea (1987-1988). Buddy is now concentrating all of his efforts on Amarillo, which we suspect will be the trifecta in his storied career.

Another key and recent member of Amarillo we would like to mention is Scott Eldridge, CFO. Scott is a well-known financier in the resource industry, and is the co-founder of Euroscandic International Group, a company offering accounting and investment banking services to natural resource companies. To date, he has raised over $500 million in combined equity and debt financing for mining projects varying from exploration to construction financing. Buddy is serious about getting Mara Rosa to production and Scott will be the obvious point-man moving forward.

Paper, Price and Financing

Amarillo has just closed a C$3.3 million financing, and now has a total of 80.3 million shares outstanding. Testament to management’s prudence, the raise was done without warrants, which is almost unheard of in his tumultuous markets. Thus, the risk of dilution is currently minimal with only 5.1 million warrants outstanding (average price C$0.25), and another 2.4 million options outstanding (average price C$0.27).

The company recently closed C$3.3 million has been earmarked for updating the PFS; tailing facility engineering; advancing towards obtaining the installation licence (LI) permit; and related activities in preparation for a bankable feasibility study (BFS).

At its current price, Amarillo is one of the cheapest developers in the gold space and Brazil:

On a per ounce basis, the average Brazilian developer trades around $55/ounce. Amarillo currently trades 75% discount, and has just as robust economics as its peers. The fact that AGC is currently working on improving its PFS makes the company that much more attractive.

The company is currently revising its 2012 PFS with some significant changes, including: updating the exchange rate from R1.90/$ to R3.20/$; increasing the resource estimate from 1,174,900 ounces at 1.67 g/t to 1,210,100 ounces at 1.71 g/t; decreasing the strip ratio from 8:1 to 6.4:1; and significantly decreasing the capex. Amarillo has indicated moving to contract workers, from our estimate this will decrease capex by at least US$30 million.

This revision will bring about a significant re-rating. Considering Amarillo is already undervalued, we predict AGC will be one of the best performing gold stocks of 2017. Depending on funds, the BFS can be completed in as fast as eight months, with the company also working on Lavras do Sul to ensure there are no extended periods without news.

The numbers speak for themselves, and Brazil has proven itself to be a very mining-friendly jurisdiction. The fact that Amarillo has obtained the most difficult of all licenses should also not be forgotten. Management is in full marketing mode and will be relentless this year. In fact, the team will be in Toronto from January 12 to 13th. If you are interested in meeting with Buddy and Scott, please send us an email at sean@palisadeglobal.com.

Palisade Global Investments Limited holds shares of Amarillo Gold. We receive either monetary or securities compensation for our services. We stand to benefit from any volume this write-up may generate. The information contained in such write-ups is not intended as individual investment advice and is not designed to meet your personal financial situation. Information contained in this report is obtained from sources we believe to be reliable, but its accuracy cannot be guaranteed. The opinions expressed in this report are those of Palisade Global Investments and are subject to change without notice. The information in this report may become outdated and there is no obligation to update any such information. Do your own due diligence.