France reported last week that its summer hosting of Euro 2016, Europe’s soccer championship, added $1.26 billion to its economy.

This is good news, for sure, and worth celebrating.

But here’s the thing: Why doesn’t France put as much effort into supporting its businesses and markets as it does its soccer franchises?

After all, the country has an entrepreneurship problem—as in, business growth and its labor market are struggling.

A lot of the blame lies at the feet of its labyrinthine web of regulations, which the Organization for Economic Cooperation and Development (OECD) once called

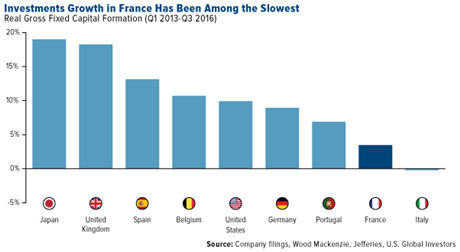

“unnecessarily complex.” Barriers to entry in several key industries, including architecture, accounting and legal services, are prohibitively high, which has decimated the country’s labor market in the last few years. More than 25 percent of all working-age French under the age of 25 are unemployed right now, a meaningfully higher rate than for youth in the European Union (18 percent unemployment), United States (10 percent) and Japan (4 percent). Household savings rates are skyrocketing, consumer confidence is on life support and investments growth has been sluggish.

As a result of all this, economic growth in France is among the worst for major EU economies. There it will remain, sadly, unless officials commit to strengthening competition by streamlining its tax system and reforming regulations. But at least it has some great soccer clubs.

Surging Demand for California Munis

By comparison, look at California, whose economy

just surpassed France’s in size. Say what you will about the state and some of its colorful residents, it’s successful because it recognizes talent and fosters an environment in which innovation and entrepreneurism can thrive. Silicon Valley is seeing a boom right now, which has helped the state government generate budget surpluses. Debt is being paid down, and the state’s rainy-day savings account is growing. This has contributed to California enjoying its highest credit rating since the turn of the century, Bloomberg reports, and caused demand for its municipal debt to climb.

At the same time, California munis can be volatile because state revenue depends on wealthy taxpayers whose incomes are tied closely to the stock market. According to Bloomberg, the top 1 percent of earners paid half of the state’s income tax revenue in 2014.

It shouldn’t come as a surprise to anyone, then, that California has one of the highest Gini coefficients, a measure of economic inequality, in the nation. Although some might balk at this, I think it’s proof there are huge, life-changing opportunities in California, and in the U.S. in general, that can turn “regular folk” into billionaires almost overnight.

Speaking of which, check out our latest slideshow,

“10 Living, Self-Made Billionaires.”

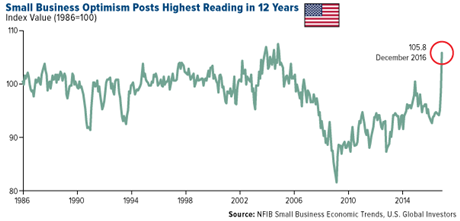

Small Business Optimism in the U.S. Is Soaring Right Now

As further proof that France should do more to open up its economy, look at what President-elect Donald Trump’s pledge to lower taxes and slash regulations is doing to business optimism here in the U.S. Last month, the Index of Small Business Optimism soared a phenomenal 7.4 points to 105.8, its highest reading since 2004. The

National Federation of Independent Business (NFIB), which conducts the survey, reported that attitudes toward capital spending and job creation in particular surprised to the upside. Research firm Evercore ISI called it a “blowout report,” and I have to agree.

In their commentary, the NFIB’s William Dunkelberg and Holly Wade expressed cautious optimism that the incoming administration could satisfactorily relax some of the regulatory burden on businesses.

“Politicians say they want to create jobs, but their regulations and laws… only increased the cost of hiring a worker, and that is not good for job creation,” they wrote.

(Consider compliance-related paperwork alone. In fiscal year 2015, Americans spent a jaw-dropping 9.78 billion—yes,

billion—hours complying with federal rules and regulations, according to a recent report from the

Office of Management and Budget (OMB). That’s up nearly 4 percent from 2014.)

Many chief executives of large multinationals have been very receptive to Trump’s proposals, taking him at his word that he can succeed at fostering an improved business environment in the U.S. Ford recently scrapped plans for a Mexico factory, while Fiat Chrysler announced a $1 billion investment in Michigan and Ohio, expected to create up to 2,000 new jobs. After meeting with the president-elect this week,

Jack Ma, founder and CEO of Chinese ecommerce site Alibaba, said he was committed to adding 1 million U.S. companies to his hugely popular online shopping platform. The chief executive of active wear company Under Armour told CNBC that it would be bringing jobs back to the U.S., specifically Baltimore, where it’s headquartered. And on Thursday, Amazon unveiled plans to grow the number of its full-time, U.S.-based jobs by 100,000—from 180,000 today to over 280,000 by 2018.

As I’ve said many times before, there’s a lot of uncertainty surrounding Trump, who will be sworn into office this Friday. At the same time, businesses and investors clearly like what they’re hearing. Appearing on CNBC last week, legendary economist

Robert Shiller perfectly summarized this distinction, saying that “nervousness can go along with optimism.” Although he didn’t vote for Trump, Shiller acknowledges that animal spirits are running high, adding that he sees the Trump equities rally spilling over into the housing market this year.

Joining Shiller in offering a balanced assessment of Trump is my old friend Alexander Green, whose writing skills I admire and opinions I greatly respect. In his

most recent blog post, Alex makes a convincing case against Trump’s protectionism, which are “not good for the economy or the market” and “undermines American economic growth.” Although investors have moved billions into the stock market since the election, the Trump rally could easily turn into the Trump correction, Alex says, “unless he changes his tune” on international trade.

“Why does a flat-panel HDTV that cost more than $10,000 in 2003 cost less than $400 today? Globalization,” he writes. “How can you walk into a Marshalls store and buy a fine cashmere sweater for 35 bucks? Globalization. Why does an $8 million supercomputer from 20 years ago sit in your pocket and cost less than $200? Globalization.”

U.S. Economy Could Get a Boost in the Near Term

The World Bank contributed to the wave of good news last week, making encouraging projections for the U.S. economy in light of Trump’s business-friendly policies. In its flagship report on global economics, the financial institution explained that expansionary fiscal policies—including tax cuts and plans to

upgrade America’s infrastructure—could boost U.S. economic growth as high as 2.5 percent this year and 2.9 percent in 2018.

This would be a welcome surprise, as growth slowed considerably in 2016 to 1.6 percent, down from 2.6 percent in 2015, according to the World Bank.

Learn how you can invest in America!

China Likely to Remain Top Engine of Global Growth

And the good news isn’t limited to the U.S. Across the Pacific Ocean, China saw its producer price index (PPI) in December rise 5.5 percent, its fastest pace in more than five years and fourth consecutive positive reading after 54 straight negative ones.

The country’s PPI, which measures prices received by producers at the first commercial sale, is strengthening on higher commodity prices. What’s more, there’s an 85 percent correlation between China’s PPI and its nominal GDP, according to Evercore ISI, so growth in the world’s second-largest economy should pick up some steam this year.

“Based on history, the PPI’s increase of +3.3 percent year-over-year (y/y) in the fourth quarter suggests +15 percent y/y nominal GDP growth,” the firm wrote. It estimates fourth-quarter growth to be more than 8.8 percent and more than 9.6 percent in the first quarter of this year.

Meanwhile, the country’s purchasing managers’ index (PMI) has remained at or above 50—indicating manufacturing expansion—for the past six months, which is bullish for commodity prices.

Chinese demand for commodities, which were

up 25 percent in 2016, is indeed skyrocketing, with imports of oil, iron ore, copper and soybeans reaching all-time highs last year. This helped solidify the country’s role as the world’s top engine of economic growth once again, contributing an estimated 33.2 percent to global economic expansion, according to China’s National Bureau of Statistics.

It’s expected we’ll see a repeat of outsize commodity demand this year, which should support prices.

Explore investment opportunities in China!

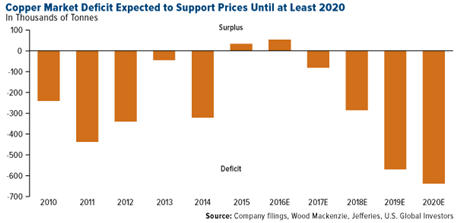

Looking at copper, further support should come in the form of market deficits, which are expected to widen until at least 2020. As investment bank Jefferies explained in a note, “unexpected disruptions”—including undercapitalization of mines and the risk of labor strikes at Chile’s Escondida, the world’s largest copper mine—will likely add to supply constraints.

“From a supply perspective, the outlook for mined commodities is very bullish,” Jefferies added.

That includes gold. As a friend recently reminded me, China’s official gold holdings account for only 2 percent of its foreign reserves. Two percent! That’s remarkably low, far lower than most large economies. (In the U.S., it’s around 75 percent, according to the

World Gold Council.) China is obviously interested in supporting its currency, and since it sold off quite a lot of U.S. Treasuries in the past year—Japan is now the

top holder of U.S. government debt—it will likely need to substantially build up its gold reserves.

The People’s Bank of China (PBoC)

has been accumulating gold, even if the rate has slowed recently, but imagine if it decided to boost holdings up from 2 percent of foreign reserves to 10 percent, which is more in line with other countries. That would have a monumental impact on the price of the yellow metal.

At this point, there’s no evidence the PBoC plans to follow such a route, but the possibility is there, with huge implications for gold.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The Small Business Optimism Index is compiled from a survey that is conducted each month by the National Federation of Independent Business (NFIB) of its members.

The Producer Price Index (PPI) measures prices received by producers at the first commercial sale. The index measures goods at three stages of production: finished, intermediate and crude. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 09/30/2016: Ford Motor Co.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.