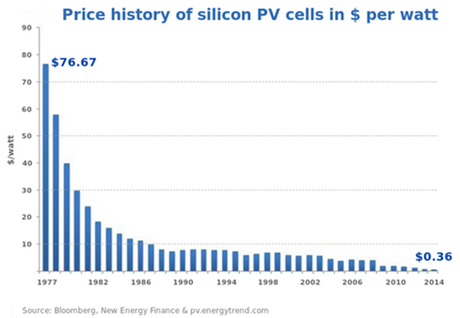

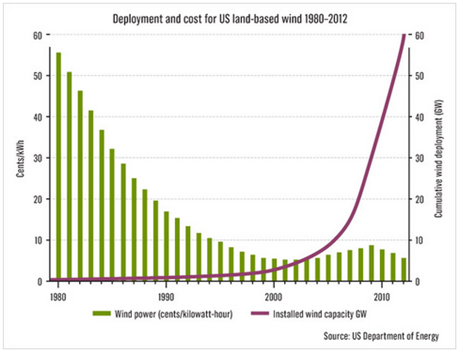

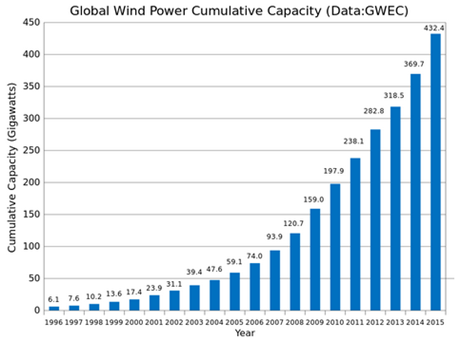

While the cost of renewable energies such as wind and solar have come down greatly in recent years, low availability continues to handicap renewable energy in certain energy markets.

In this article, I will examine the great growth opportunities in renewable energy for vanadium batteries in the $27 billion off-grid energy market.

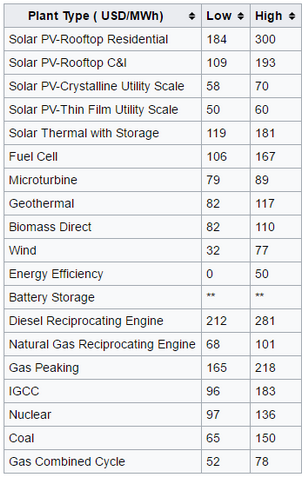

Cost of Electricity by Source (from Wikipedia)

“In November 2015, the investment bank Lazard headquartered in New York, published a study on the current electricity production costs of photovoltaics in the US compared to conventional power generators. The best large-scale photovoltaic power plants can produce electricity at 50 USD per MWh. The upper limit at 60 USD per MWh. In comparison, coal-fired plants are between 65 USD and $150 per MWh, nuclear power at 97 USD per MWh. Small photovoltaic power plants on roofs of houses are still at 184-300 USD per MWh, but which can do without electricity transport costs. Onshore wind turbines are 32-77 USD per MWh. One drawback is the intermittency of solar and wind power. The study suggests a solution in batteries as a storage, but these are still expensive so far.

Below is the complete list of LCOEs by source from the investment bank Lazard.

The levelised cost of electricity (LCOE) is a measure of a power source which attempts to compare different methods of electricity generation on a consistent basis. It is an economic assessment of the average total cost to build and operate a power-generating asset over its lifetime divided by the total energy output of the asset over that lifetime. The LCOE can also be regarded as the minimum cost at which electricity must be sold in order to break-even over the lifetime of the project.”

The LCOE for wind and solar plants have come down so quickly due to innovation and economies of scale, that they are already at or below the LCOE of traditional base load coal, nuclear and gas plants.

The issue with wind and solar energy sources is their availability factor, according to Wikipedia

“Wind capacity factors range from 20–40% and solar capacity factors in Arizona are about 19%.”

The obvious solution is to invent utility scale batteries that can store solar power during sunny days and supply that power at night. Wind power needs are often the opposite (i.e. winds blow more at night). While such battery technology exists, it was not a practical solution until recently, as previously stated, due to its high cost which has come down through innovation and growing adoption (economy of scale).

Levelized Cost of Electricity imposed by Batteries

According to a great 2015 article titleld

Why Energy Storage is About to Get Big – and Cheap

by Ramez Naam, who spent 13 years at Microsoft. He holds 19 patents related to search engines, information retrieval, web browsing, artificial intelligence, and machine learning and is also the award-winning author of five books.

“Traditional lithium ion-batteries begin to degrade after a few hundred cycles of fully charging and fully discharging, or 1,000 cycles at most. So naively we’d take the capital cost of the battery and divide it by 1,000 to find the cost per kwh round-tripped through it (the LCOE). However, we also have to factor in that some electricity is lost due to less than 100% efficiency (Li-ion is perhaps 90% efficient in round trip). This multiplies our effective cost by 11%.

So we’d estimate that at the following battery prices we’d get the following effective LCOEs:

– $300 / kwh battery : 33 cent / kwh electricity storage

– $200 / kwh battery : 22 cent / kwh electricity storage

– $150 / kwh battery : 17 cent / kwh electricity storage

– $100 / kwh battery : 11 cent / kwh electricity storage

All of those battery costs, by the way, are functions of what the ultimate buyer pays, including installation and maintenance.

For comparison, wholesale grid electricity in the US at ‘baseload’ hours in the middle of the night averages 6-7 cents / kwh. And retail electricity rates around the US average around 12 cents per kwh. You can see why, at the several hundred dollars / kwh prices of several years ago, battery storage was a non-starter…

Right now, most of the talk about energy storage is about lithium-ion, and specifically about Tesla, who appear close to announcing a new home battery product at what appears to be a price of around $300 / kwh.

But there are other technologies that may be ultimately more suitable for grid energy storage than lithium-ion.

Lithium-ion is compact and light. It’s great for mobile applications. But heavier, bulkier storage technologies that last for more cycles will be long-term cheaper.”

Flow Batteries comes to mind

“1. Flow Batteries, just starting to come to market, can theoretically operate for 5,000 charge cycles or more. In some cases they can operate for 10,000 cycles or more. In addition, the electrolyte in a flow battery is a liquid that can be replaced, refurbishing the battery at a fraction of the cost of installing a new one.

2. Compressed Air Energy Storage, like LightSail Energy’s, uses physical components that are likewise rated for 10,000+ cycles of compression and decompression.”

The downside for the Vanadium Redox Flow Battery (“VRB”) is its bulkiness and relatively lower round-trip efficiency (measured by power out over power in) of 75% compared to 85% with lithium batteries.

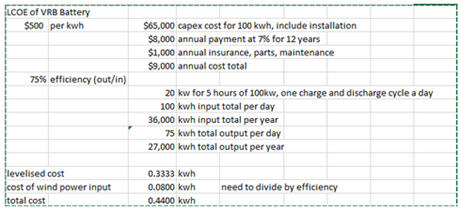

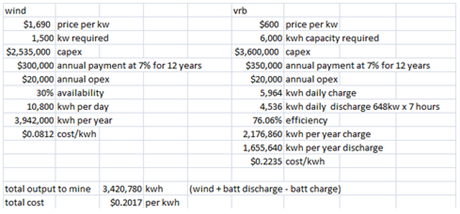

Here is my exercise to calculate the cost of running a VRB:

redT energy plc claims at its website that its Gen2 VRB machine price starts at $490/kwh

I called redT last week. They currently have about a dozen customers with a total of 2,000 kwh of deployment and I obtained general pricing information and calculated the all-in cost of their product as follows:

Thus, the LCOE of VRB and lithium batteries are similar at 33 cents per kwh. (assuming the cost of a lithium battery at $300 per kwh, VRB has a higher initial cost but more charge cycles with longer battery life). The 33 cents per kwh is the cost of storage and does not include the input cost of electricity.

On-Grid VRB Application

33 cents per kwh is more than what redT quoted me, which was 24 cents per kwh.

However, even at 24 cents per kwh, with retail electricity rates around the US average of 12 cents per kwh, VRB for the on-grid market still has some way to go, other than for specific applications such as

– Replacing natural gas peakers.

The energy grid has to be built out to support peak use. Peaker plants are reserve natural gas plants. On average, they’re active far less than 10% of the time. They sit idle, fueled, and ready to come online to respond to peaking electricity demand. Even in this state, bringing a peaker online takes a few minutes.

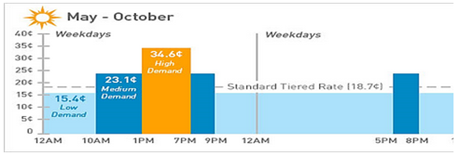

– Arbitrage on Tiered Pricing

From the same 2015 article by Ramez Naam Why Energy Storage is About to Get Big – and Cheap

“In California, one can choose the standard tiered rate of 18.7 cents per kwh. Or one can choose the the time-of-use rate. In the latter, there’s a 19.2 cent per kwh difference in electricity rates between the minimum (9pm to 10am) and the peak (1pm – 7pm).

Batteries cheaper than 19 cents / kwh LCOE (including financing, installation, etc.) can be used to arbitrage this price difference. Software fills the battery up with cheap power at night. Software preferentially uses that cheap power from the battery during the peak of demand, instead of drawing it from the grid.”

– Storage of excess renewable electricity for use when needed

This can be useful for unstable grid with low availability factor or when the grid is charging above 34 cents per kwh.

My last vanadium article talked about the largest vanadium battery, which is 60 Mwh at Hokkaido Japan, and which went live in 2016. At the current rate of innovation and adoption, the cost of grid-level energy storage batteries may approach $100 to $200/kwh – equal to approximately 10 to 15 cents per kwh LCOE within 3 to 5 years. At that rate, I believe we will see mainstream adoption on-grid.

Off-Grid Application for Batteries

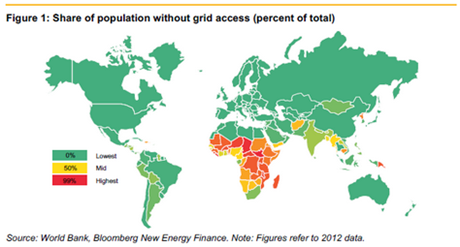

There exist great opportunities for renewable energy with the use of vanadium batteries in the $27 billion off-grid energy market.

The following is according to OFF-GRID SOLAR MARKET TRENDS REPORT 2016 published by Bloomberg New Energy Finance and Lighting Global, an innovation of the World Bank Group in cooperation with the Global Off-Grid Lighting Association:

“The 1.2 billion people living without access to power grid spend about $27 billion annually on lighting and mobile-phone charging with kerosene, battery torches, or other fossil-fuel powered stop-gap technologies.

It’s estimated that another 1 billion people are connected to the grid at present but suffer from unreliable service levels.

The off-grid population may spend an additional $5-$6 billion/year on mobile phone charging in Africa and Asia. These phones tend to be charged by small-business owners for fees reported at between $0.15-0.25 per charge. This equates to $30-$50 kWh.

Residential diesel generators are a popular solution among the wealthier people without stable grid access.”

The report went on to talk about how solar power is well suited for the off-grid energy market.

Power blackouts are frequent events in developing countries. I spend 2 to 3 months a year in Mongolia and weekly summer blackouts are common events. Blackouts last from sometimes a few minutes to entire an afternoon. Hospitals and big hotels maintain operations using back diesel powered generators.

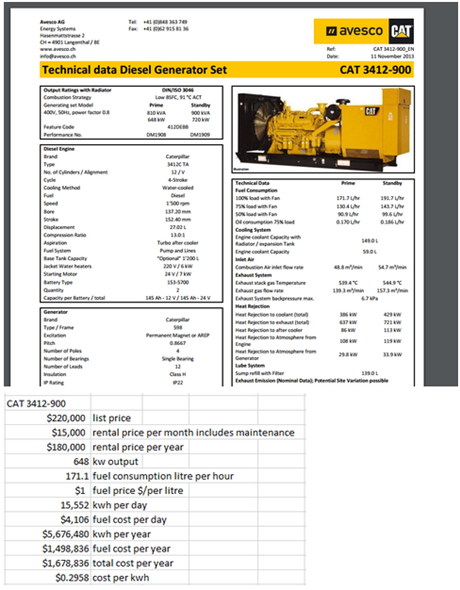

I am quite familiar with diesel generators as I managed the Ulaan Ovoo coal mine in Mongolia, that used a large, diesel powered generator that operated 24 hours a day, 7 days a week, to pump in-flowing water out of the open pit mine.

The diesel power cost is as follows:

.png)

Kindly note that average US household electricity usage is about 10,000 kwh per year, and the mine consumed 15,000 kwh per day. Thus, it’s not unreasonable to hear of diesel powered machines costing upwards of $1 per kwh in a retail set up.

If fuel goes up to $1.50 per litre from $1.00 per litre, the power cost goes up 45% to $0.4278 per kwh.

The machine overheats after running for 5 hours at 100% capacity and requires shut down for 30 minutes. It needs to be serviced every month for parts and to have a filter change.

The practical problem with using wind or solar energy for pumping water at the mine of course, will be low availability factor. I compared the cost of diesel power versus wind and VRB in the following exercise:

The wind power cost is based on the U.S. Department of Energy’s 2015 Wind Technologies Market Report that stated “In 2015, the capacity-weighted average installed project cost stood at nearly $1,690/kW, down $640/kW or 27% from the apparent peak in average reported costs in 2009 and 2010.”

Other key assumptions I have made are: 1,500 kw wind capacity, 648 kw goes to power water pump, remaining goes to charging VRB, wind availability is 7 hours per day, and VRB is deployed sequentially to continuously provide 648 kw of power for another 7 hours. Availability factor improves to 70% under this set up.

I was surprised to see LCOE under this scenario is 32% lower than LCOE with a diesel powered generator.

Granted in a real life scenario, the wind does not consistently blow for 7 hours straight, and we would still require a diesel generator to bring availability factor to above 90%. However, one can certainly optimize the set-up by installing wind and solar energy equipment to improve availability to rely less on VRB and diesel, given their higher LCOE.

The recent Financial Post article titled “Miners go green in hunt for cost efficiencies, using renewable energy sources in far-flung locations” also extolled the merits of renewable energy in the mining industry.

“Meanwhile, a dearth of new mine opportunities is driving companies into more far-flung locations that are not connected to the electricity grid — resulting in dependency on diesel — an unreliable, costly and carbon-intensive source of energy.

Some miners also see renewables as a way to maximize their social licence to operate by selling the benefits of renewables to surrounding communities: the switch can help end community-reliance on diesel generators for decades after the mine’s life ends…

Some of the world’s biggest miners, including Barrick Gold and Gold Fields, are early adopters, experimenting in locations where renewable power makes the most sense, such as in sub-Saharan Africa, where both communities and miners are all too familiar with rolling blackouts.

Miners have already realized energy savings of between 10 and 40 per cent from investing in renewables, innovative energy technologies and automating certain processes to reduce power use, according to Deloitte.”

According to Research and Markets’ Press Release dated May 26, 2016:

titled

Diesel Generator Market Update 2016-2020

“The global diesel generator market is set to grow from $14.7 billion in 2016 to $17.6 billion in 2020, representing a compound annual growth rate of 4.5%.”

Renewables with batteries will certainly play into this significant market.

Summary:

The LCOE (levelised cost of energy) for wind and solar plants have come down so quickly that they are at or below the LCOE of traditional base load coal, nuclear and gas plants.

Grid-level battery costs have also come down remarkably in recent years. While it can’t compete with coal or nuclear power, at 30 cents per kwh, grid batteries are gaining traction for certain on-grid applications such as substituting peaker plants, and tiered pricing arbitrage.

For off-grid applications, grid-level batteries can double the availability factor of renewable energy sources to above 70% and compete with diesel powered generators in this $27 billion per year off-grid energy market.

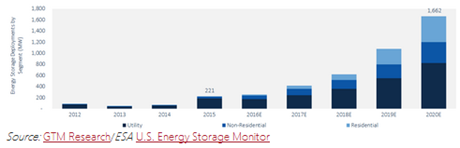

At the current rate of innovation and adoption, the LCOE for grid batteries may come down to 10 to 15 cents per kwh within 3 to 5 years to dominate the fast-growing energy storage market estimated to be $2.5 billion or 1,662 MW by 2020.

Lithium ion-batteries are not ideally suited for grid-level energy storage because they are have a short-duration discharge cycle and begin to degrade after a few hundred cycles of fully charging and fully discharging (or 1,000 cycles at most), whereas vanadium batteries can operate for 10,000 cycles.

Think of a Swatch (lithium) versus my used 1970 Rolex (vanadium) which is still going strong.

Lastly, vanadium accounts for 30% to 50% of the cost of VRB, making it essential for VRB manufacturers to secure vanadium supply. Billions of dollars have poured into VRB research and development in the past decade, with inevitable mass utility-scale VRB adoption, thus the long-term vanadium price trend looks promising, making for increased interest in miners that produce vanadium metal. One need only look at lithium exploration companies as an example:

There are currently no operating vanadium primary mines in North America and only a handful of vanadium deposits in North America. Prophecy Development Corp. (TSE: PCY) is looking to develop its 80% owned titanium-vanadium-iron deposit, “Titan” into production. Titan is an exploration stage project situated in Ontario, Canada with good infrastructure. Mine Development Associates prepared the Titan technical report dated February 26, 2010, which is compliant with National Instrument 43-101, that discloses a resource estimate prepared according to the CIM Definition Standards for Mineral Resources and Reserves, and was filed on SEDAR by Prophecy. The resource estimate by Mine Development Associates states Titan has 49 million tonnes of inferred resource using a 40% Fe2O3 cutoff, grading 0.24% vanadium (Company estimated 0.43% vanadium pentoxide). Based on this resource and grade, Prophecy estimates Titan contains 259 million pounds of vanadium metal assuming 100% recovery. The report is available at: https://www.prophecydev.com/pdf/titan_feb2010.pdf.

I manage Prophecy Development Corp. (TSX: PCY) which engages in vanadium exploration.

John Lee, CFA.

jlee@prophecydev.com

John Lee, CFA is an accredited investor with over two decades of investing experience in metals and mining equities. Mr. Lee joined the parent company of Prophecy Development Corp. (www.prophecydev.com) in 2009 as the Company’s CEO. Under John Lee’s leadership, Prophecy raised over CAD100 million through the Toronto Stock Exchange and acquired a portfolio of assets including a silver-zinc-lead asset in Bolivia, coal assets in Mongolia, and a titanium-vanadium-iron project in Canada. John Lee is a Rice University graduate with degrees in economics and engineering.

The technical content of this article was reviewed and approved by Christopher M. Kravits CPG, LPG, who is a Qualified Person within the meaning of National Instrument 43-101. Mr. Kravits is a consultant to the Company and serves as its Qualified Person and General Mining Manager.