A bromine extraction plant operates in Union County, Arkansas (Arkansas Industrial Development Commission; photo: Mark Morgan; source)

A bromine extraction plant operates in Union County, Arkansas (Arkansas Industrial Development Commission; photo: Mark Morgan; source)

Canada‘s largest lithium brine permit holder, MGX Minerals Inc., today announced the formation of PetroLithium Corp. of America with the mandate of acquiring oil field lithium assets (including brine, oil wells and existing oil and gas infrastructure) for the purpose of producing lithium carbonate and other valuable minerals from oilfield brine.

Staking and oil well acquisition activities in lithium brine bearing areas of Utah have commenced. Acquisition and exploration activities are expected to commence shortly in Colorado, Texas and Arkansas. All these states have significant past and current oil production associated with areas of enriched minerals including sodium, calcium, magnesium, potassium, boron, bromine and lithium.

MGX recently reported the extraction of lithium from oil wastewater in Alberta, Canada, using its patent pending process for the extraction of lithium and other valuable minerals from oil brine. It is the only patent of its kind providing for the rapid extraction of lithium and other valuable minerals from oilfield brine.

The treatment of oil wastewater offers significant revenue potential and environmental benefits in addition to mineral extraction as the processing removed all suspended solids, including 99.7% of hydrocarbons and 99.9% of silica and other scale-forming minerals.

With its engineering partner PurLucid Treatment Solutions Inc., MGX expects the deployment of a pilot plant in Alberta shortly. According to today‘s news, commercial deployment is expected in the second half of 2017 and off-take negotiations are underway.

MGX Minerals has been grabbing headlines recently (see here, here, here and here), but with the company now expanding into the US it appears that MGX is confident enough that its technology indeed works as efficiently as expected.

MGX Minerals Inc. has formed PetroLithium Corp. to enter the mineral, oil and environmental markets in the United States. Management selection for the US subsidiary has commenced. The company has filed trademark application to the United States Patent & Trademark Office for the name “Petrolithium“ for future use in commerce and, if granted, will give MGX exclusive right to its use in trade.

The oilfield technical and acquisition team will be headed by Dr. Larry Marks. who was with Royal Dutch Shell for 30 years and held Project Director positions at The Hague covering the Middle East and Africa. Dr. Marks, a Professional Geophysicist, completed his career as Vice President of Marketing and Transportation with Shell Canada in Calgary (Alberta) where his responsibilities included sale and delivery of a diverse range of oil and gas products as well as merger and acquisition activities. He currently leads the oilfield technical and acquisitions team for the company in Alberta. Dr. Marks will be primarily responsible for acquisition of lithium bearing brine and oil wells for PetroLithium Corp.

Product development and sales will be overseen by Claudio Manissero who was formerly Director of Sales for FMC Lithium and has had an extensive career with FMC Corp. spanning over 20 years.

The scientific team will be led by Dr. Preston McEachern, a leader in water management in the oil and gas industry. He has 23 years of experience in solving water challenges and holds 3 faculty appointments with Canadian Universities and was previously Vice President of Research and Development at Tervita. Dr. McEachern is the CEO of Purlucid Treatment Solutions Inc., MGX’s engineering partner.

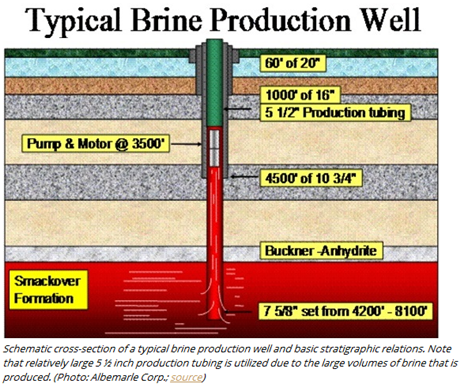

The company is active in the Mississippian and Pennsylvanian (Carboniferous) age aquifers of the Paradox Basin (Utah, Colorado) and the Jurassic Period Smackover Formation (Texas, Arkansas). Enrichment is theorized in both formations to be a result of trapped ocean water in dolomite / limestone host rock concentrated under temperature and pressure to many times ocean levels of mineralization, high temperature being a common characteristic of lithium brine from the Paradox Basin and Smackover Formations. As a result minerals are generally found in basins and directly associated with oil bearing strata of similar geological period.

According to R. Keith Evans (2008):

“Large tonnages of lithium are contained in oil field brines in North Dakota, Wyoming, Oklahoma, east Texas and Arkansas where brines grading up to 700mg/lt are known to exist. Other lithium brines exist in the Paradox Basin, Utah but the author is unaware of any global review of the potential. Collins (1978) estimated a possible reserve of 0.75 million tonnes of lithium in one tenth of the area underlain by the Smackover Formation which extends through North Dakota, Wyoming, Oklahoma, east Texas and Arkansas. Other lithium-containing brines exist in the Paradox Basin, Utah.“

Smackover Formation, Arkansas

The Smackover formation has produced almost 2 billion barrels of oil and is home to some of the country’s largest past producing oilfields, where many wells are now stripper wells producing 10 barrels a day (US EIA). Investigation is now underway to determine whether these areas of older oil production with very high brine to oil ratios may once again become viable due to the addition of value from extraction of minerals including lithium.

Increasing the value of a barrel of oil on stripper wells, which are producing only 10 barrels per day, has the potential to revolutionize the oil industry. If MGX‘s technology stands up and the company acquires properly, a quasi-monopoly would emerge. This is how Howard Hughes and J. Paul Getty were successful; they were able to drill deeper and more efficiently than anyone else but instead of selling the technology they used it to beat competition and monopolize large areas of production in the US, which is what MGX basically propose to do.

Arkansas once was the largest producer of oil in the US, so to light these fields up again could be very big.

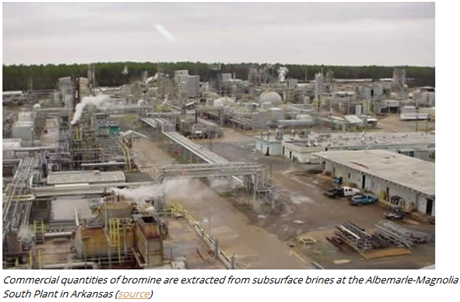

With more than 500 employees and 2 plant sites in the Magnolia area of Arkansas, Albemarle Corp. is currently the states‘ largest manufacturer of bromine and a range of chemicals.

According to Meridian International Research (2008):

“The Smackover oilfield brines are an extensive underground geothermal brine lake. On top of the brine floats crude oil, with natural gas above this. Oil production commenced in the 1920s and for decades the brine was considered to be of no value. In the 1950s it was realised that the brine contained very high levels of Bromine and commercial production of Bromine commenced. The brine contains many other minerals as well including Lithium.

Garrett states: “A few of the world’s oil field waters have a medium-high Lithium content, with limited areas of the extensive Smackover brines in the US perhaps being the highest. One zone in both Texas and Arkansas has [Li] of 50-572ppm. The Texas brine has an average of 386ppm and the Arkansas brine averages 365ppm. The brine is found at a depth of 1800m to 4800m. Brines are commercially processed to recover Bromine”. Garrett estimates that the Smackover brine contains 1MT of Lithium.

The Smackover brines are currently the largest source of Bromine in the world, accounting for 40% of world production. The largest Bromine plant in the world was established there in 1961. Some 15,000 wells pump out brine and send it via a pipeline network to two processing plants where the bromine is extracted. The spent brine is then reinjected into the underground reservoir. Peak brine flows of 352Mb were reached in 1997, falling to 300Mb in 1999, 321Mb in 2000 and 308Mb in 2001 [Rockstone Note: “Arkansas brine production for 2013 is estimated at 267,503,967 barrels according to the Arkansas Oil and Gas Commission“; source]. Bromine production in Arkansas is under growing competition from producers on the Dead Sea.

We will now estimate how much Lithium could potentially be recovered from the brine already processed for Bromine extraction.

Taking a recent average annual brine flow rate of 320Mb and assuming an average Lithium content of 365ppm, with a specific gravity of 1.2g/cc, the total Lithium content of the brine currently processed by the Bromine industry would be 22,000 tonnes. At a 50% recovery rate, some 11,000 tonnes of Lithium could be recovered per annum from the existing brine flows.

The Smackover brines have been exploited for Bromine by numerous chemical companies over the years. The current operators are Great Lakes Chemical Company and Tetra Technologies. Neither of them have yet seen fit to commence Lithium recovery operations, despite the significantly higher concentration of Lithium in this resource than at Silver Peak, Nevada. Recovery of minerals other than Bromine has been studied. If other factors do not militate against it, this resource may be one of the most promising ones to develop, given that a large scale brine extraction, processing and re-injection industry is already well established. The Mg:Li ratio is about 4 or 5 to 1. ([Mg] = 1850ppm).

• The Potential Annual Lithium Production Rate from the Smackover Bromine Brines of Arkansas would be 11,000 tonnes (55,000 tonnes LCE).

As with the Salton Sea, a solar evaporation pond system would not be viable, not least because of the need to re-inject the spent brine into the reservoir to maintain pressure. On the other hand selective adsorption technology requires a fresh water supply to flush and recharge the adsorption beds. Union County and surrounding areas in southern Arkansas where much of the brine extraction is concentrated were declared “Critical Water Use” areas some years ago due to overexploitation of the underground Sparta Aquifer. Bromine production is one of the major users of this aquifer. In the late 1990s the USGS recommended that water use from the aquifer should be reduced by 70% to prevent irreparable damage to it with serious consequences for drinking water supply. Although steps have been taken to reduce exploitation of the aquifer, water use continues to be a high priority issue in the area.

Bromine production from Smackover in 2006 was 240,000 tonnes, with a total value of approximately $360 million. At a current Lithium Carbonate price of $10,000 per tonne, 36,000 tonnes of Lithium Carbonate would produce the same revenue. Approximately 7,000 tonnes of Lithium would be required to produce this. Therefore production of even quite a limited quantity of Lithium Carbonate such as 5,000tpy would make a significant contribution to revenues from the Smackover brines. The Dead Sea could not compete with Smackover in Lithium production due to its very low Lithium content (18ppm)."

MGX Minerals CEO Jared Lazerson On Recovering Lithium From Oil Wells

By James West from MidasLetter on January 23, 2017

Listen to the podcast interview with Jared Lazerson: Audio Player

Listen to the podcast interview with Jared Lazerson: Audio Player

Transcript

James West: Jared, thanks for joining us today.

Jared Lazerson: Thank you, James.

James West: Jared, let’s talk a bit about the recent press releases outlining the recovery of lithium from some disposal water in oilfield brines. Can you give us just a quick overview and description of exactly what you got and how you got it?

Jared Lazerson: Sure. This recovery of lithium from, in this case, oilsands waste water, was a result of our patent pending process design in partnership with PurLucid Water Treatment Solutions, a highly experienced group of wastewater treatment experts. So we applied our process design in the laboratory and were able to recovery approximately 40 percent of the lithium from, in this case, oilsands wastewater.

James West: And so does the 40 percent recovery rate mesh with your longer-term plans to produce commercial volumes of lithium from hydrocarbon disposal wells?

Jared Lazerson: I will say that the recovery rate at 40 percent, we have reasonable expectation, simply based on the remaining lithium within the brine – so, after the processing testing was done, there remains approximately 20 percent in the brine – we believe this to be easily recoverable on a second pass. You have to remember, this was early stage testing of the process; we’re now in optimization phase, so the low hanging fruit in terms of recovery is the 21 percent that was remaining in the brine. In a second pass, like I said, or optimized, we expect to immediately increase to approximately 60 percent.

And then, as a result of some recent testing, we’re seeing that there’s much improved recovery for removal of loss. So essentially, there was significant loss of material in the pre-treatment or filtration phase. So the brine, because it comes from an oilfield, so in this case, oilsands, so heavy oil brine, needs to be removed so that the oil does not remain in the brine when the minerals are extracted. You can imagine that we can’t sell lithium that is coated in oil. So we need to remove the oil and in the case of the heavy oil, it caused a significant lithium loss – around 20 percent. Our recent testing with oil production water from our Sturgeon Lake project, which is regular oil, light oil, resulted in very small losses, and we expected this to crystallize in results upcoming at the end of this month or at the beginning of February.

So we’d expect to see almost doubling of that recovery, fairly shortly here.

James West: Okay. So the bulk – so you’ve got half a million acres of disposal wells in Alberta. What percentage of those are oilsands well versus conventional light oil wells?

Jared Lazerson: We do not directly own any oilsands production on mineral rights covering oilsands; all of those areas, the half million acres, the better part of 2,000 square miles, or 1.2 million standard acres, covers producing oil areas, a lot of past producing oil areas, with stripper wells and nominal current production. So very low volume oil and high volume water. So, a diverse holding covering producing wells. Oilsands is, in and of itself, often a mineral right issued by the province, so it would be a conflict to acquire mineral rights within oilsands.

Our interest and our involvement with oilsands comes primarily from our water treatment partner, PurLucid Water Treatment. They have agreements and testing agreements in place with some of the major oilsands producers, primarily from the environmental side. But what was interesting, as we began to look at these agreements and where the future of that environmental, which is a very strong business, as the government has legislated cleanup based on ongoing production, so if you’re continuing to produce in oilsands, you’d need to clean up on, I believe it’s a one to one basis for wastewater production. So a lot of wastewater, a lot of wastewater being produced, and it turns out that this wastewater, in a more concentrated form after it goes through the SAGD plants, or as an output of the SAGD plant, I should say, has high concentrations, or mid-level concentrations of lithium. Some of the higher concentrations, actually, overall in the province.

So an excellent source of environmental revenue, and a potentially large source of lithium; these are agreements that will come into place with the oilsands operators themselves, primarily through the environmental angle.

James West: Okay. So at its most basic, the recovery of lithium proves that PurLucid’s filtration process is a viable path towards creating commercial quantities of lithium from disposal wells?

Jared Lazerson: That’s correct. I wouldn’t use the term disposal wells; disposal wells, ultimately that’s where the water currently goes down the hole generally, or, I guess, even in centralized environmental locations, eventually it goes down hole. The way we really quantify it is in terms of oil wells and then the collection point would be the water batteries in front of the disposal wells, which is a fairly easy place for us to technically connect.

But the point really being yes, you’re absolutely correct: this is a dual operation, or a dual really, I think ‘sector’ might be a broad word for it, but really, there’s a dual path here. And one is the environmental path, in terms of acquisition of lithium-bearing brine and other minerals, and as well, in oilsands you have potential of significant metals: vanadium and a number of other metals that we’re looking at. And then there’s just that straight production water that is coming off the oil wells, and we’re not particular; we continue to move down both paths. But PurLucid has opened up this environmental arena to us, and it all fits quite well together. You have environmental revenue, you have mineral revenue, and it allows, just like oil water cut with oil wells, it allows flexibility in terms of the revenue stream and what actually leads to the formal deployment.

James West: Sure. So it sounds to me like you’re going to have an opportunity where oilfield operators are actually going to pay you to clean their water, which will result in a revenue stream from lithium and other valuable minerals?

Jared Lazerson: Absolutely. With oilsands 100 percent; in other areas we may use that as an offset against royalty or costs. We know at this price level of oil, the oilfield operators are highly focused on reducing cost. Pumping of large volumes of water and disposal of large volumes of water, the environmental implications as well as any onus the government puts on oilfield operators, is a major cost. So anything to offset that environmental component, I think, will significantly resonate with oilfield operators, at least at this oil price level.

James West: All right, Jared. Let’s leave it there for now. That’s another enlightening bit of information. We’ll come back to you shortly; thank you for your time today.

Jared Lazerson: Thank you so much, James.

Disclosure: MGX Minerals is a Midas Letter portfolio holding.

Source: https://www.midasletter.com/2017/01/podcast-mgx-minerals-inc-ceo-jared-lazerson-on-recovering-lithium-from-oil-wells/

Company Details

MGX Minerals Inc.

#303 - 1080 Howe Street

Vancouver, BC, Canada V6C 2T1

Phone: +1 604 681 7735

Email: jared@mgxminerals.com

www.mgxminerals.com

Shares Issued & Outstanding: 58,051,866

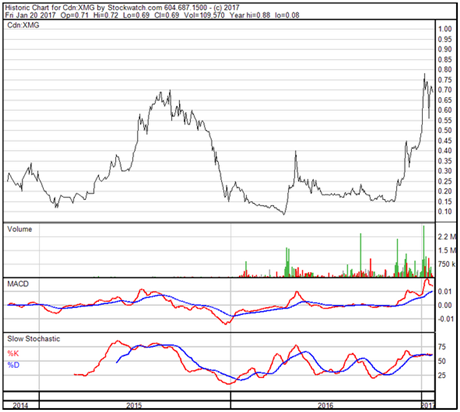

Canadian Symbol (CSE): XMG

Current Price: $0.69 CAD (01/20/2017)

Market Capitalization: $40 million CAD

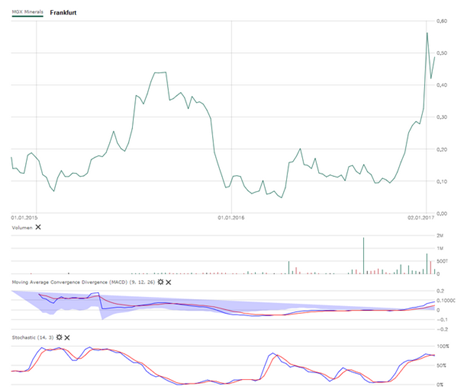

German Symbol / WKN (Frankfurt): 1MG / A12E3P

Current Price: €0.485 EUR (01/20/2017)

Market Capitalization: €28 million EUR

Previous Coverage

Report #14: “MGX Extracts Lithium from Oil Wastewater - Begins Monumental Integration with Big Oil“

Report #13 "MGX Partners with Oil Major on Lithium Brine, New Energy Industry Facing Fundamental Shift“

Report #12 "Game Changing Potential: MGX Minerals‘ Pilot Plant for Rapid Production of Lithium Nears Completion“

Report #11 "MGX assays 34 g/t gold from surface sampling in British Columbia“

Report #10 “Official: MGX owns magnesium worth multi-billions of dollars and starts pilot plant shortly“

Report #9 “One of the world‘s largest lithium resources on the horizon?“

Report #8 “Ready for significant lithium brine work in Alberta“

Report #7 “At the forefront of Alberta‘s lithium brine riches“

Report #6 “Pioneering Lithium in Alberta: MGX Minerals Teams Up“

Report #5 “Time to Put a Lithium Production Process in Place“

Report #4 “MGX Minerals Taps Into Canada‘s Potentially Largest High-Grade Lithium Resources“

Report #3 “MGX Minerals Receives Mining Lease for 20 years (in British Columbia!)“

Report #2 “MGX Minerals Accelerates Towards Production“

Report #1 “MGX Minerals Plans To Enter The Magnesium Market In 2016“

Stay Tuned!

For smartphones and tablets, an APP from Rockstone Research is available in the AppStore and in the GooglePlayStore.

Disclaimer: Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist.