In 2016, Klondex Mines Ltd. (KDX:TSX; KLDX:NYSE.MKT)reported that, "operations at Fire Creek and Midas produced a record 43,264 gold equivalent ounces (GEOs) during the fourth quarter, bringing the full year 2016 Nevada production total to 150,099 GEOs, slightly above the top end of the Company's guidance of 145,000 to 150,000 GEOs. Fourth quarter production benefited from planned higher grades at both Fire Creek and Midas as well as planned higher mining rates."

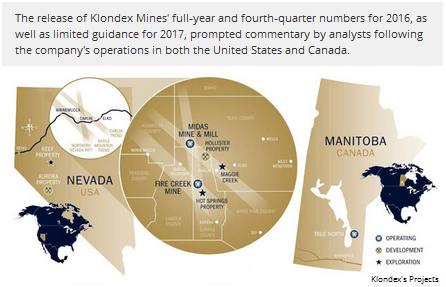

Also in its Jan. 18 announcement, Klondex stated that it "expects to produce between 210,000 and 225,000 GEOs during 2017 at an expected cash cost of $680 to $710 per GEO sold. This represents an increase in GEOs sold of approximately 37% from the prior year as the Company benefits from bulk sampling production at its Hollister project in Nevada as well as higher production from its True North mine in Canada as ramp-up continues. Fire Creek and Midas' 2017 production is expected to be in line with the prior year."

Commenting in a research report released Jan. 19, Mackie Research analyst Barry Allan observed, "KDX continues to achieve good operating results while at the same time digesting two new mines that presented prior operators with challenges. Adding value for the newly purchased Hollister mine and upgrading our forecast for 2017 and beyond, coupled with a drop in the share price, allows us to upgrade to BUY from HOLD."

"We expect 2017 to feature strong production growth," Heiko Ihle of Rodman & Renshaw wrote in a Jan. 20 research report. The analyst noted that, "In our view, operations at both Midas and Fire Creek should remain somewhat steady in 2017," and added that Rodman & Renshaw anticipates "production growth to come from two of the firm's newer assets: True North and Hollister."

In addition, Ihle wrote that his firm expects "Klondex to reach record production in 2017 and think[s] gold equivalent production could reach approximately 220,000 ounces for the year, which would represent an approximate 46% production increase YoY."

Jamie Spratt of Clarus Securities, in a Jan. 19 research report, noted that "2016 was another year of meeting guidance with full year production of +150 koz beating the high end of revised guidance of 145–150 koz. While we see production growth of +25% from True North that will be fully ramped up in 2017, we see further growth in 2018 from the Hollister mine, which could see AuEq production expand to 300 koz. Overall, we see further upside remaining in the stock given management's successful execution track record and the growth left on the table."

In addition, Spratt wrote, "Overall, we continue to believe that KDX is well positioned to deliver compelling production growth of ~100% supported by True North and Hollister mines that would boost production to ~300 koz by 2018, the best growth profile among its mid-cap producer peers. . .Our thesis continues to be that KDX offers best in class production growth, low cost production and a solid management execution track record."

PI Financial's Philip Ker, in a Jan. 19 research report, stated, "given the high-grade nature of Fire Creek and the potential of Hollister coming online sooner than anticipated, Klondex could potentially see production above its current guidance." The analyst added that PI Financial believes "further ramp-up of the True North mine and its recently acquired Hollister mine into the Company's production profile will be critical for Klondex to realize an increased production profile, help support reduced costs and help generate increased cash flow."

"The evolution of Klondex continues and 2016 was a banner year in many ways," company President and CEO Paul Huet stated in the Klondex announcement. "We are excited to enter 2017 with four mines and three mills in Nevada and Canada. Fire Creek and Midas continue to be our flagship operations. We are also pleased with the progress thus far at True North in Canada and the recently acquired Hollister project in Nevada. We are well positioned for yet another record year in 2017."

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Tracy Salcedo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Klondex Mines Ltd. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview or article until after it publishes.

Additional Disclosures for this Content

Disclosures from Mackie Research, Klondex Mines Ltd., Jan. 19, 2017

ANALYST CERTIFICATION

Each analyst of Mackie Research Capital Corporation whose name appears in this report hereby certifies that (i) the recommendations and opinions expressed in this research report accurately reflect the analyst’s personal views and (ii) no part of the research analyst’s compensation was or will be directly or indirectly related to the specific conclusions or recommendations expressed in this research report.

All MRCC Analysts are compensated based in part on the overall revenues of MRCC, a portion of which are generated by investment banking activities. MRCC may have had, or seek to have, an investment banking relationship with companies mentioned in this report. MRCC and/or its officers, directors and employees may from time to time acquire, hold or sell securities mentioned in our Research Reports as principal or agent. MRCC makes every effort possible to avoid conflicts of interest, however readers should assume that a conflict might exist, and therefore not rely solely on this report when evaluating whether or not to buy or sell the securities of subject.

Disclosures from Rodman & Renshaw, Klondex Mines Ltd., Jan. 20, 2017

Investment Banking Services include, but are not limited to, acting as a manager/co-manager in the underwriting or placement of securities, acting as financial advisor, and/or providing corporate finance or capital markets-related services to a company or one of its affiliates or subsidiaries within the past 12 months.

I, Heiko F. Ihle, CFA and Jake Sekelsky , certify that 1) all of the views expressed in this report accurately reflect my personal views about any and all subject securities or issuers discussed; and 2) no part of my compensation was, is, or will be directly or indirectly related to the specific recommendation or views expressed in this research report; and 3) neither myself nor any members of my household is an officer, director or advisory board member of these companies.

None of the research analysts or the research analyst’s household has a financial interest in the securities of (including, without limitation, any option, right, warrant, future, long or short position).

As of December 31, 2016 neither the Firm nor its affiliates beneficially own 1% or more of any class of common equity securities of Klondex Mines Ltd.

Neither the research analyst nor the Firm has any material conflict of interest in of which the research analyst knows or has reason to know at the time of publication of this research report.

The research analyst principally responsible for preparation of the report does not receive compensation that is based upon any specific investment banking services or transaction but is compensated based on factors including total revenue and profitability of the Firm, a substantial portion of which is derived from investment banking services.

The Firm or its affiliates did receive compensation from Klondex Mines Ltd. for investment banking services within twelve months before, and will seek compensation from the companies mentioned in this report for investment banking services within three months following publication of the research report.

The Firm does not make a market in Klondex Mines Ltd. as of the date of this research report.

Disclosures from Clarus Securities, Klondex Mines Ltd., Jan. 19, 2017

The analyst has visited the Company’s mining operations in Ontario. Partial payment or reimbursement was received from the issuer for the associated travel costs.

Within the last 24 months, Clarus Securities Inc. has managed or co-managed a public offering of securities of this company.

Within the last 24 months, Clarus Securities Inc. has received compensation for investment banking services with respect to the securities of this company.

The research analyst and/or associates who prepared this report are compensated based upon (among other factors) the overall profitability of Clarus Securities and its affiliate, which includes the overall profitability of investment banking and related services. In the normal course of its business, Clarus Securities or its affiliate may provide financial advisory and/or investment banking services for the issuers mentioned in this report in return for remuneration and might seek to become engaged for such services from any of such issuers in this report within the next three months. Clarus Securities or its affiliate may buy from or sell to customers the securities of issuers mentioned in this report on a principal basis. Clarus Securities, its affiliate, and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities discussed herein, or in related securities or in options, futures or other derivative instruments based thereon.

Each Clarus Securities research analyst whose name appears on the front page of this research report hereby certifies that (i) the recommendations and opinions expressed in the research report accurately reflect the research analyst’s personal views about the Company and securities that are the subject of this report and all other companies and securities mentioned in this report that are covered by such research analyst and (ii) no part of the research analyst’s compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed by such research analyst in this report.

Disclosures from PI Financial, Klondex Mines Ltd., Corporate Update, Jan. 19, 2017

I, Philip Ker, hereby certify that all of the views expressed in this report accurately reflect my personal views about the subject securities or issuers. I also certify that no part of my compensation was, is, or will be, directly or indirectly related to the specific recommendations or views expressed in this report. I am the research analyst primarily responsible for preparing this report.

1) PI Financial Corp. and its affiliates’ holdings in the subject company’s securities, in aggregate exceeds 1% of each company’s issued and outstanding securities. No

2) The analyst(s) responsible for the report or recommendation on the subject company, a member of the research analyst’s

household, and associate of the research analyst, or any individual directly involved in the preparation of this report, have a financial interest in, or exercises investment discretion or control over, securities issued by the following companies. No

3) PI Financial Corp. and/or its affiliates have received compensation for investment banking services for the subject company over the preceding 12-month period. Yes

4) PI Financial Corp. and/or its affiliates expect to receive or intend

to seek compensation for investment banking services from the subject company. Yes

5) PI Financial Corp. and/or its affiliates have managed or co-managed a public offering of securities for the subject company in the past 12 months. No

6) The following director(s), officer(s) or employee(s) of PI Financial Corp. is a director of the subject company in which PI provides research coverage. No

7) A member of the research analyst’s household serves as an officer, director or advisory board member of the subject company. No

8) PI Financial Corp. and/or its affiliates make a market in the securities of the subject company. No

9) Company has partially funded previous analyst visits to its projects. Yes

Analysts are compensated through a combined base salary and bonus payout system. The bonus payout is amongst other factors determined by revenue generated directly or indirectly from various departments including Investment Banking. Evaluation is largely on an activity-based system that includes some of the following criteria: reports generated, timeliness, performance of recommendations, knowledge of industry, quality of research and investment guidance, and client feedback. Analysts and all other Research staff are not directly compensated for specific Investment Banking transactions.