NOVAGOLD Resources Inc. (NG:TSX; NG:NYSE.MKT)

NOVAGOLD Resources Inc. (NG:TSX; NG:NYSE.MKT) released its 2016 financial

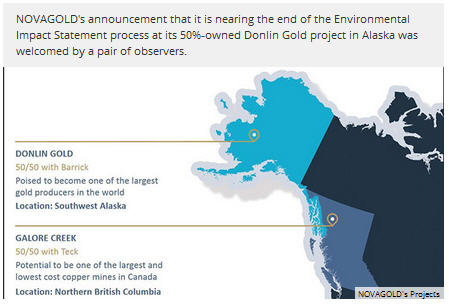

results on Jan. 25, and provided updates on the 50%-owned Donlin Gold project in Alaska and the 50%-owned Galore Creek project in British Columbia, including the news that the Environmental Impact Statement (EIS) process at the Donlin project is nearing completion. The company stated that the lead permitting agency, the U.S. Army Corps of Engineers, is working on the final EIS, and that "the Corps' schedule envisages the final EIS to be published in early 2018." The company also noted that "other permitting applications and submissions have been concurrently advanced with state and federal agencies."

Analyst Raj Ray of National Bank Financial Markets wrote in a Jan. 25 research flash that "Donlin Gold permitting enters last stretch with Final EIS expected by early 2018. . .the Donlin Gold permitting process is driven by the U.S. National Environmental Policy Act (NEPA) which requires the preparation of an EIS which is a detailed evaluation of the environmental effects of the proposed action and alternatives. . .the NEPA process drives the federal permitting timeline and state permits are anticipated to be issued once the federal process is completed."

Ray also noted that the "Alaska Native Corporations also play an important role in the NEPA process and their early involvement in the Donlin Gold project bodes well for the permitting process."

On the financial side, Ray stated that NOVAGOLD "continues to maintain a strong financial position with cash and term deposits of ~US$105 mln at the end of fiscal Q4/16 which we believe is more than sufficient to complete permitting of Donlin Gold. . .the strong cash balance provides optionality protection over the next few years."

Ray noted that he views NOVAGOLD as a "long-dated option on the gold price that offers investors long-term exposure to a large-scale and relatively high grade open-pit deposit in a stable jurisdiction which could assume significance if our forecast for industry-wide production decline play out over the next few years."

Eric Muschinski, editor of

Gold Investment Letter, wrote on Jan. 26 that "I believe the upside on this stock is enormous. . .this is a stock that you can comfortably own in size because of its mature stage of development, liquidity, and pedigree."

Read what other experts are saying about:

Want to read more

Gold Report articles like this?

Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our

Streetwise Interviews page.

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: NOVAGOLD Resources Inc. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal

disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview or article until after it publishes.

Additional Disclosures for this Content

Disclosures from National Bank Financial Markets, Novagold Resources Inc., Research Flash, Jan. 25, 2017

Research Analysts –The Research Analyst(s) who prepare these reports certify that their respective report accurately reflects his or her personal opinion and that no part of his/her compensation was, is, or will be directly or indirectly related to the specific recommendations or views as to the securities or companies.

NBF compensates its Research Analysts from a variety of sources. The Research Department is a cost centre and is funded by the business activities of NBF including, Institutional Equity Sales and Trading, Retail Sales, the correspondent clearing business, and Corporate and Investment Banking. Since the revenues from these businesses vary, the funds for research compensation vary. No one business line has a greater influence than any other for Research Analyst compensation.

Click on the following link to see the company specific disclosures

https://www.nbcn.ca/contactus/disclosures.html

Disclosures from Gold Investment Letter, Jan. 26, 2017

Eric Muschinski: I am offering ideas for your consideration and education. I am not offering financial advice. I am not a financial or investment advisor and am acting in the sole capacity of a newsletter writer. I am a fellow investor and trader sharing his thoughts for educational and informational purposes only.

This publication is a 100% subscriber supported. No compensation is received by the author from any of the companies mentioned for the recommendation of a stock in this service (if this changes or there is exception, it will be clearly disclosed to our readers).

Mr. Muschinski, Gold Investment Letter's employees and affiliates, as well as members of their families, may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.