Palisade Research February 3, 2017

Northern Vertex Mining Corp (CVE:NEE, OTCMKTS:NHVCF)

Current Price: C$0.55

Shares Outstanding: 100.7 million

Market Capitalization: C$55.4 million

52-Week Range: C$0.18-C$0.55

Cash: ~C$6 million

Total Liabilities: ~C$6.6 million

We visited Northern Vertex in Arizona back in May, and since our write-up, Chairman, President and CEO, Ken Berry, has reached every milestone set, generating significant value for his shareholders.

First, Northern Vertex consolidated its interest in Moss by acquiring the remaining 30% from Patriot Gold for $1.5 million. Second, Ken secured US$20M in project financing from Sprott Private Resource Lending.

The company just released an operational update, and we want to highlight three themes.

- Permitting – NEE just submitted a $1.4M bond for its aquifer protection permit and the final amendment is expected in March 2017. This final wait period is a formality, with key federal and state permits in hand, NEE is a fully permitted mine.

- Construction – NEE began construction in Q1 2017, and is continuing with bulk earthworks. The main crushing plant will be installed and delivered by Q2 2017. Furthermore, the company has completed two new groundwater production wells that will supply more than enough water for leaching.

- Phase III & Exploration – the Moss feasibility study was constrained by the limits of its patented property. In actuality, Moss has an additional 200,000 AuEq resource ounces on Federal lands that will be used for mine life extension. NEE has already engaged Mine Development Associates (MDA) to begin working towards phase III permitting.

NEE has enormous exploration potential, – only 5% of the property has been explored so far. The company is currently in the middle of a 3,000m drill campaign, and the first phase of a resource expansion program.

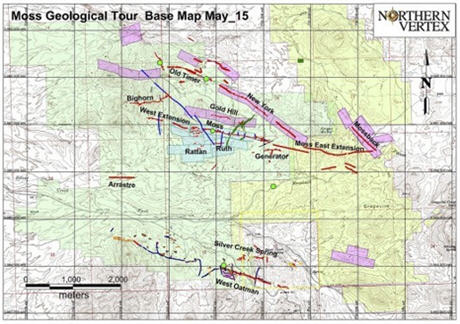

Northern Vertex has identified four high priority targets, including the West Oatman stockwork vein target, the high-grade Old Timer East and West targets, and the western extension of the main Moss mine deposit.

The company is currently drilling the West Oatman target and has completed has already completed four holes. We are very excited to see these results.

The Moss vein in the blue patent claims in the middle. Other targets include: Old Timer, New York, Bighorn, West Extension, Gold Hill, Ruth, Generator, West East Extension, and the Moss Look-Alike, West Oatman.

Moss’ geology is interesting. Its mineralized veins are harder and more resistive to weathering than its surrounding rocks. After centuries of weathering, the veins end up sticking up like a ridge, very much like the back of a stegosaurus.

This made the discovery and delineation of the main Moss vein deposit very simple. Delineating Moss was a visual process, defining Moss was simply a drilling exercise. This also makes picking out other targets just as easy.

Just like the back of a stegasourus. Uncomplicated geology: gold-silver stock-work, brecciated, low sulphidation, epithermal vein system, Outcrops at surface for 1,500 meters

Northern Vertex is poised to begin production in Q4 2017, and the Moss Mine will be a high-margin, 42,000 gold equivalent ounce producer in one of the best mining jurisdictions in the world. Moss’ after-tax NPV5 is US$60.3M or C$78.5M, with an IRR of 48%.

This company is one of the most de-risked developers we have in our portfolio, and we believe the market still has not caught onto the enormous exploration upside potential the company has.

While Northern Vertex is far along the development curve, we reiterate, only 5% of the project has been explored. During the bear market, exploration was put on the backburner, so that management could focus on preserving capital and developing its existing resources.

Through that strategic foresight, Northern Vertex emerged from the bear market with a clean share structure, and can now allocate some capital to exploration drilling while the Moss mine is being built.

According to our analysis, Northern Vertex can easily grow its resource by another 1.2 million surface ounces. While the initial exploration will be funded by cash raised through equity, the real growth and expansion will be fueled by the Moss Gold-Silver Mine. In the near-term, our one year price target for Northern Vertex is C$1.00, or a 82% gain from its current share price. We also believe NEE will be acquired by the end of the year.

Palisade Global Investments Limited holds shares of Northern Vertex. We receive either monetary or securities compensation for our services. We stand to benefit from any volume this write-up may generate. The information contained in such write-ups is not intended as individual investment advice and is not designed to meet your personal financial situation. Information contained in this report is obtained from sources we believe to be reliable, but its accuracy cannot be guaranteed. The opinions expressed in this report are those of Palisade Global Investments and are subject to change without notice. The information in this report may become outdated and there is no obligation to update any such information. Do your own due diligence.