Being a teenager in the 1960s, my early formative years were all about the Beatles, JFK's assassination, sex, drugs, rock and roll, and hockey, but when it came to entertaining myself, thanks to my mother, who was a voracious reader, I learned to love to read books. I remember the day that Mum handed me Ian Fleming"s "To Russia with Love" and since I was barely into my teens, I think it was the first time I was ever introduced to soft "porn" (which was predominant in all of the Bond books), which may have been Mum's way of quietly giving me a Sex Ed lesson. As I grew older and moved away at 16 to play junior hockey with and against men in their 20s, I would ride the buses between St. Catharines and Ottawa with two or three paperbacks tucked into the zipper compartment of my carry-on bag.

"'Whoever wins becomes so immensely powerful, like Nixon is now, that when you vote for President today you're talking about giving a man dictatorial power for four years.'"

Later in university, the road trips were usually on airplanes and buses where my preferred reading topics included J.R.R. Tolkien's "The Hobbit" and Ken Kesey's "One Flew Over the Cuckoo’s Nest," but nothing captured my heightened appreciation of depravity in humor and journalism more than Hunter S. Thompson's many works ranging from his anecdotal account of life with the Hells's Angels (1967) to the 1972 Nixon-bashing "Fear and Loathing on the Campaign Trail '72." Hunter S. Thompson was to the 1960s and 1970s what Matt Taibbi is to the current Western "narrative." While Matt Taibbi coined that marvelous description of Goldman Sacks as "a great vampire squid wrapped around the face of humanity, relentlessly jabbing its blood funnel into anything that smells like money," Hunter S. Thompson would lob invectives like "In a nation run by swine, all pigs are upward-mobile and the rest of us are f***d until we can put our acts together. . ."

In every generation, there are always those journalists that capture the national collective in print such that you need only read one of their books and you are immediately transported back in time whether it is James A. Michener's "Hawaii" or Steinbeck's "The Grapes of Wrath," but Hunter Thompson's works include passages that are literally timeless; the people he describes are found in every era and in every part of the globe since the dawn of creation. In light of the rise of the name "Donald Trump" to the point of total global dominance of the airwaves and the blogosphere, you really do have to appreciate the following passage written in the 1970s near to the end of the presidency of Richard Nixon:

"We've come to a point where every four years this national fever rises up — this hunger for the Saviour, the White Knight, the Man on Horseback — and whoever wins becomes so immensely powerful, like Nixon is now, that when you vote for President today you’re talking about giving a man dictatorial power for four years. I think it might be better to have the President sort of like the King of England — or the Queen — and have the real business of the presidency conducted by. . . a City Manager-type, a Prime Minister, somebody who"s directly answerable to Congress, rather than a person who moves all his friends into the White House and does whatever he wants for four years. The whole framework of the presidency is getting out of hand. It's come to the point where you almost can't run unless you can cause people to salivate and whip each other with big sticks. You almost have to be a rock star to get the kind of fever you need to survive in American politics."

"I miss maniacs like Hunter Thompson tearing apart the public consciousness with his blistering attacks on the status quo."

After I re-read that for the first time a few hours ago, I immediately thought of this Gong Show currently transpiring in the United States and wondered how, if he were alive today, Hunter S. Thompson would react to the Trump Phenomena and concluded that the timelessness of the above quote allows one to substitute "Trump" for "Nixon" and it would be pretty much relevant to 2017 and the myriad of issues we all face.

You know what I miss about the current state of the political narrative? I miss maniacs like Hunter Thompson tearing apart the public consciousness with his blistering attacks on the status quo which, here in 2017, would most certainly include the elitists that run the show – the banks, the two-party system, the Koch Brothers and their John Birch Society support of "free market capitalism" (where the definition thereof is "any business they are in"). Today, the younger generation would not allow a Hunter S. Thompson to invade their "safe space" with his psyche-bludgeoning sarcasm, his façade-melting insults, or his inane gift for telling us how "blotter acid with room-temperature Jack Daniels" would improve one's perception of a particular political point of view or clarify an argument made against impeaching a president. Today, we have far too many wimps out there trying to be politically correct and perpetually non-invasive so as to keep everyone comforted in their own persuasions and preferences.

I blasted Bill Maher a few weeks back and now I'm looking to blast Jimmy Fallon whose "I'm too cool for words" persona gives me a total pain in the ass. However, since as a Canadian I have no real right to obsess over strictly American public figures of prominence, I'll give you a Canadian megalomaniac, KEVIN O'LEARY, who now thinks that his ill-fated 1999 sale of Softkey to Mattel qualified him as a "business genius" such that the only businesses he is now involved with are those that utilize his self-engineered "star power" to promote the brand. What the world forgets is that as a salesman, O'Leary is unparalleled because only four years after selling Softkey to Mattel, Mattel had to settle a class-action lawsuit for $122 million after the projected $50 million of accreted profit wound up being a $105 million loss.

"Silver is now well on its way to $25/ounce by mid-year."

Now, O'Leary is running to head up the Canadian Conservative Party and vows to displace Justin Trudeau as Prime Minister of Canada. As much as I would love to see anyone remove our current prime minister, a trust fund baby that has never graduated from university and never met a payroll and most-certainly qualifies as a card-carrying member of the 1% elite, I pray that his vanquisher is anyone but Kevin "Look at me!" O'Leary. We need a Canuck Hunter S. Thompson to smack sense into these frozen northern brains that are all tweeting their "selfies with Justin" and plastering them all over their Facebook pages as O'Leary does photo-ops with air-brushing as a prerequisite for inclusion.

I usually try to capsulize the trading week in gold and silver by doing a breakdown of the COT report but this week was a non-sequitur because with only a modest rise in open interest and the aggregate commercial short interest, there isn't much to talk about. What IS significant in the precious metals arena for me is the terrific action in silver last week with the GTSR (gold-to-silver-ratio) going out for the week at 68.74 which means to me that, despite the fact that a pseudo-anonymous Peruvian "tout sheet" (featuring a failed Bay St. mining analyst) thinks silver is in over-supply, it is now well on its way to $25/ounce by mid-year. The evidence for me is the terrific action in copper and zinc (both highlighted in this publication for years) with the late-week explosion in copper through $2.75 paving the way for the copper-silver correlation to kick in.

Especially exciting is the fact that my number one holding for 2017 is a little Mexican silver project called Santa Rosa Silver Mining Corp. that is finally merging with Canuc Resources Corp. (CDA:TSX.V) with the $2.0 million financing about to close this week. In my watershed issue from a year ago entitled "Patiently Climbing Aboard the New Golden Bull," I provided a rationale for a $1,450 gold price by the end of 2016 (which was wrong) such that with a GTSR of 50, silver could trade up through $72.50 (which was ALSO wrong).

Now, since the Crimex criminals were as usual allowed to cap the precious metals rally in the late summer by flooding the paper market with over 36.6 MILLION ounces of phony, synthetic, paper "gold," which completely usurped any and all momo from the breathtaking rally from the prior January, it in no way denies me from re-stating my 2017 target for the GTSR at 50 and a gold price at $1,450. Should that be the case and should the base metals continue to scream higher led by copper, silver is going to dominate the precious metals landscape.

On the topic of silver, I read a piece over the weekend written by my GATA pal Mike Kachanovsky who goes by the moniker of "Mexico Mike" who has graciously allowed me to re-post. You all know that in addition to being a guest contributor to the website lemetropolecafe.com I am also a subscriber to the website because of one simple reason: GATA has the most informed precious metals content of any newsletter on the web. To wit, here is a great example of a concise analysis of the current silver market by a gentleman far more cynical than even yours truly:

"Silver launched out of the gate this morning like a scalded cat, after testing lows of $17.50 in Asian trading, the metal surged in NA trading and actually rose above $18 an ounce for a few minutes before the bankers slammed the door shut on that move. Nonetheless, the GSR is now back below 69 and silver is holding most of its gains, on a day when the dollar is well in the green.

The only fundamental driver for this move that I can think of is the closure of Escondida due to the strike. About half a million ounces of silver production a month comes from this mine, and since its owned by BHP you can be assured that silver by-product was forward sold in a hedging deal. I do not think this strike will drag on more than a few weeks, and so the net removal of silver bullion from the bankers will not amount to a big deal.

The banks buy silver at a discount in these forward contracts, and then use that silver as part of the rigging game to depress silver spot prices, which then enable them to buy the next round of mine production contracts even cheaper. See how this little game is played? Since most silver output is produced as a by-product from base metals mines, the operators are happy to lock in a price even if it's below the cost of production for primary miners. And the regulators look the other way as many multiples of world silver output are then dumped in the paper silver market to fleece specs.

Silver has been driven below the $18 range since Trump was elected. Somehow the market is able to cheer on industrial stocks due to economic recovery hopes, and yet the industrial metal silver, which is in a long term supply deficit, is driven lower. To keep the spot price in this price range, a huge new layer of paper shorts has been dumped in daily trading, such that the open interest for silver is now approaching record levels again.

Any unexpected breakout for silver will put these contracts in danger. There is not enough silver on the planet to make good on a delivery demand for even a portion of the outstanding contracts. COMEX is a fraud because the 'contracts' are not legitimate and there is no remedy for a failure to deliver. In fact, the crooks that run this rigged little casino frequently change the rules to ensure contract holders are screwed, and that a cash settlement option is available to deal with spec longs in the event the banks cannot effectively destroy spot prices ahead of an option expiry window.

The best possible upside for silver involves having a frenzy develop such that the market is not contained with further paper. At the end of the day, industrial demand will drive the silver market. Price is what it is, but for critical components that MUST have silver to function, demand will compete for bullion no matter what the rigged price may do. Adding in investment demand from speculators will put a further crimp in bullion supply. If the bullion inventory is insufficient to meet this demand, all of the paper contracts in the world will just dig a bigger hole for the banks.

Not a goddamn word of this commentary is anything new to this sector. I do not suggest that the day of a supply squeeze is at hand. I do believe the rigged markets will continue to fleece idiot spec longs that want to gamble against bankers with unlimited leverage. But I also believe the drawdown of physical silver bullion is approaching critical levels and at some point the scam breaks down.

We have seen silver under a constant intervention lockdown since 2011. Meanwhile rising imports from China and India, plus the rising incremental demand for industrial consumption, plus several years of record bullion sales from worldwide mints, are having an effect.

The GSR was hovering around 70 for most of the last year or two. The total silver production worldwide is about 9 times the amount of gold. Does this GSR seem reasonable or sustainable to you?"

"'The drawdown of physical silver bullion is approaching critical levels'"

This is the kind of commentary that remains priceless. Of course we all know that “not a goddamn word of this commentary is anything new to the sector” but I, for one, simply enjoy being reminded of a) the incredibly-bullish fundamentals for silver and b) the outrageousness of the bullion bank interference in that market. Thanks to GATA and Mike for a wonderful refresher.

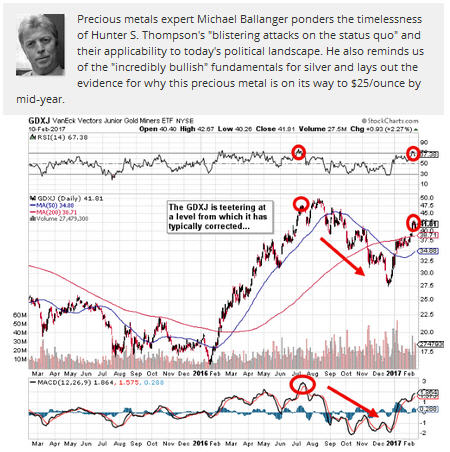

As for the miners and, in particular, the GDXJ, I am long the ETF (unleveraged) and flat the call options going into the new week and looking for a near-term correction in order to attempt to re-enter the option trade designed to add some torque to the position. To clarify, I am NEVER out of the precious metals markets; I am ALWAYS in possession of a multitude of shares in some "penny dreadful" junior ExploreCo that is going to become the next Newmont or the next Barrick on the basis of a brand new discovery. I also will never attempt to trade the physical metals that are strewn around the world in safety deposit boxes and vaults the location of which is kept under lock and key in the fire-proof safe in my home right next to the Remington Sparton 100 guarding it.

Of course, my partner disallows me from keeping the shells anywhere near it so as a backup, I have the same "personal protection device" I carried around in the middle of the Saint Louis going to attend a Richard Prior concert in 1974. She is a 1957 model and the same one used by Hank Aaron – superb for hitting home runs and errant thugs.

I end this week's missive with a final quote from my dear, departed friend/mentor/hero, Hunter S. Thompson, who actually does make a rather timeless commentary on the mainstream media's inability to report anything vaguely resembling accuracy in either politics or finance:

"As far as I'm concerned, it's a damned shame that a field as potentially dynamic and vital as journalism should be overrun with dullards, bums, and hacks, hag-ridden with myopia, apathy, and complacency, and generally stuck in a bog of stagnant mediocrity."

…and that just about sums up the genius of Hunter Thompson.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Michael Ballanger: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company, Bonaventure Explorations Limited, has a financial relationship with the following companies mentioned in this article: Santa Rosa Silver Mining Co./Canuc Resources Ltd. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

All charts and images courtesy of Michael Ballanger.