It’s an enviable position to be in.

Genesis Metals Corp. (TSX.V: GIS) already has one gold deposit in-hand at the heart of Canada’s fabled Abitibi gold fields -- where nearly 200 million ounces of gold have been mined to date.

Now the Canadian gold exploration start-up is investigating the possibility that at least two other distinct gold deposits may be waiting to be unearthed in close proximity to its core gold asset.

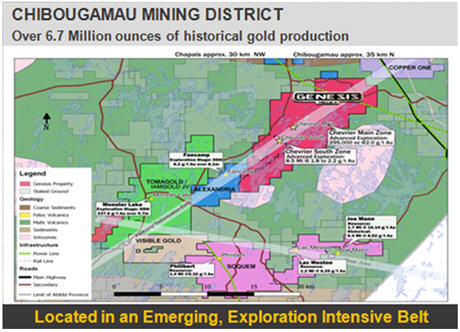

Its sprawling land package, known as the Chevrier gold project, is near Chibougamau, Quebec. Due to its size, it also has the potential for a number of important discoveries. All told, the property encompasses nearly 300 square kilometres at the heart of a geologically-fertile gold belt.

However, in the near-term Genesis is focusing on three different discovery zones (including the Chevrier Main Zone) that have all benefitted from plenty of drilling – much of which has revealed impressive gold grades. However, some of this drilling is from the 1990s, meaning it cannot be used by itself to calculate government-approved NI 43-101 compliant resource estimates.

To begin testing the theory that at least three different deposits may be within the company’s reach, Genesis has begun a 3-D modeling program. Its focus is the Main Zone (which hosts the Chevrier gold deposit), the extensively-mineralized South Zone and the comparably appealing East Zone.

Presently, close to 300,000 inferred ounces of gold averaging 1.99 grams per tonne (g/t) have already been outlined at the Chevrier deposit, aka the Main Zone. This also translates into an inferred resource of 4.6 million tonnes.

Furthermore, a total of six high priority targets dispersed over a 15-kilomere trend running the length of the company’s property have also been identified for further investigation.

Each target is sizeable, ranging from one to three kilometres in length. And each of them attests to the fact that district-scale opportunities for multiple gold discoveries may exist within Genesis’ land package.

Drilling Aims to Expand the Chevrier Deposit and Outline Gold Resources in Proximal Discovery Zones

Drilling Aims to Expand the Chevrier Deposit and Outline Gold Resources in Proximal Discovery Zones

Once the 3-D modeling of the Chevrier deposit is completed within the next few weeks, the company will have a better understanding of its structural controls.

This will help inform a Q2 step-out drill program that will probe the deposit at depth, as well as test its potential for expansion to the north. Notably, limited drilling has already encountered rich gold grades below 400 metres.

By upgrading this deposit to a larger asset, it may become an attractive takeover target considering that the deposit is within close proximity to several gold mines and mines-in-the-making.

Furthermore, encouraging gold grades were also encountered when a previous project operator drilled 19 holes into the South Zone in the 1990s.

Genesis intends to do some in-fill drilling later this year with a view to developing an updated inferred resource. That said, the NI 43-101 report for Chevrier suggested a target potential of 8.5-9.0 million tonnes grading around 1.88-2.2 g/t for the South Zone – which is around twice the size of the Main Zone.

Notably, the South Zone discovery involves a completely different style of mineralization to the Chevrier deposit or “Main Zone” – meaning it could prove to be an entirely new deposit in its own right.

Elsewhere, no less than 53 holes were drilled in the East Zone by a previous operator, Falconbridge. This prospective new gold discovery will also be drill tested in Q2. The company is encouraged by the fact that impressive gold grades were found over a large area within this zone.

Zeroing-In on Regional Scale Opportunities

It’s worth mentioning that the company’s claims span the Fancamp deformation zone. This is a structural weakness in the earth’s crust into which gold has migrated from much greater depths.

Of particular encouragement is the presence along the Fancamp gold trend of other significant discoveries. They include the proximal high-grade Monster Lake gold discovery to the southwest of the Chevrier deposit and the 6.7-million-ounce Chibougamau gold camp to the northeast.

Investment Summary

Investment Summary

The still-emerging Chevrier deposit constitutes a tangible asset that provides a solid underpinning for Genesis’ share price.

However, the prospect of more in-fill drilling and exploratory step-out drilling in the coming months promises to enlarge this deposit beyond its current inventory of 300,000 ounces of gold (4.6 million tonnes grading 1.99 g/t).

Additionally, plenty of “blue sky” potential exists on a district scale within the company’s very large but under-explored land holdings, which span 15 kilometres in length and cover nearly 95 square kilometres

(9,500 hectares).

In the near term, the well-mineralized South Zone and East Zone (both of which were extensively drilled in the 1990s) will both be drilled with a view to outlining preliminary resource estimates. In other words, each zone may prove to be an important new deposit in its own right.

It’s also worth mentioning that the company has an accomplished management team with a proven track record for success in the mineral exploration and development business. Several directors were also founders of Underworld Resources, which was acquired by Kinross Gold for $140 million dollars in 2010.

They include Rob McLeod, Chairman of Genesis, and Adrian Fleming, Executive Director. These are the same geologists who were instrumental in Underworld’s company-maker discovery.

Their decision to acquire Chevrier and other geologically prospective land holdings in one of the world’s best mining jurisdictions attests to their vision and shrewd business acumen.

On a technical note, Genesis has a relatively tight share structure with about 45.59 million shares outstanding (60.37 million fully diluted). This reality, matched with positive news flow, typically acts as a catalyst to higher share price valuations.

To this point, the advent of a steady stream of exploration and development results in the coming months, culminating in drilling, should help power the company’s share price to higher levels.

If the company demonstrates its ability to add plenty more ounces of gold to its mineral inventory, this will be a game-changer – one that promises to make 2017 a banner year for Genesis Metals.

About the Author: Marc Davis has a deep background in the capital markets spanning 25 years, which includes working as a research analyst, market commentator, and as a professional floor trader.

As a longstanding financial journalist, he has also worked for leading digital financial news agencies in North America and in London’s financial centre. Additionally, he is also a former business reporter for CBC Television. Over the years, his articles have also appeared in dozens of digital publications worldwide. They include USA Today, CBS Money Watch, Investors’ Business Daily, the Financial Post, Reuters, National Post, Google News, Barron’s, China Daily, and AOL.