Palisade Research March 3, 2017

ThreeD Capital – (CNSX:IDK, FRA:B5K1)

Current Price: C$0.19

Shares Outstanding: 39.3 million

Market Capitalization: C$7.5 million

52-Week Range: C$0.05 – C$0.225

Cash: ~C$0.6 million

At its peak, Sheldon Inwentash’s Pinetree Capital commanded a market cap north of $1 billion and owned 400+ names in its portfolio. Pinetree Capital revolutionized the resource investment model, and today has left its mark. Pinetree alum are spread across Toronto, churning out deals, raising hundreds of millions of dollars, and running successful funds and mining companies themselves.

Since its inception, Pinetree generated incredible shareholder value by seeding companies such as: Queenston Mining (acquired by Osisko Mining Corp. for $550 million), Aurelian Resources (acquired by Kinross for $1.2 billion), and Gold Eagle Mines (acquired by Goldcorp for $1.5 billion).

Pinetree’s share price reached a high of $24.50 (post stock split in 2007) on March 27, 2007, and according Q1 financials, had $700 million of investments spread across 393 names, sitting on a hefty consolidated gain of 60%. No other publicly-traded company has been able to replicate Sheldon’s model, and no other person has been able to put together homerun after homerun, all while raising over $1 billion dollars for his issuers.

This was achieved by having a clear mandate of scouring the markets for companies with inherent value of its resource; proven management with clearly-defined objectives and a strong technical and support team; future capital requirements to develop the full potential of its business; anticipated rate of return versus the level of risk; and exit strategies.

In May 2011, the strategic decision was made to issue $75M in convertible debt to continue acquiring undervalued securities, which at this point were plenty. Unfortunately, the market would be mired in one of the longest bears in history, and debt covenants were broken along with the bottom of the markets. Pinetree’s fall was hard and fast.

Sheldon retired from Pinetree in 2015 after 23 years at the helm, but began incubating another company almost immediately after, waiting for the markets to stabilize and emerge from the bear market.

ThreeD Capital, previously called Brownstone Energy, was the oil and gas investment focused arm of Sheldon’s empire. However, the company is now described very much like Pinetree once was, a venture capital firm focused on opportunistic investments in companies in the junior resources, technology and biotechnology markets.

While still in its infancy, ThreeD Capital is Sheldon Inwentash’s foray back into the mining sector. The company recently closed a $620,000 financing and in a corporate update, announced significant investments in Palisade Resources, a land bank focused on gold and uranium in premium jurisdictions, as well as Goldspot Discoveries, an investment company that has developed a machine learning algorithm for mineral exploration.

Before we continue, we would like to emphasize ThreeD Capital is invested in two companies Palisade Global Investments also has large stakes in, and in turn Palisade Global is an investor in ThreeD Capital.

We obviously know both Palisade Resources and Goldspot Discoveries intimately. However, being private companies, the market has no idea what ThreeD Capital should be worth. We will outline the value drivers for both companies, and demonstrate why early entrants of ThreeD Capital are poised to leverage not only the resource bull market, but also the premium someone like Sheldon brings to the table.

Palisade Resources – Building A North American Land Bank

Palisade Resources was formed in November 2015 and is led by President, Denis Laviolette, a trained geologist with more than 10 years of experience in mining and capital markets. Denis began his career working in the most prolific gold camps in Canada, including Timmins, Kirkland Lake, and Red Lake, before leaving to build and operate his own mine in Ghana.

Denis first met Sheldon on a site tour in Kirkland Lake, where Denis was leading a group of investors through the mine. During a coffee break, Denis wooed Sheldon with his knowledge about mining, geology, and stocks in general.

Circumstance had it Sheldon was in dire need of a geologist to help him vet deals and shortly after offered Denis a job at PineTree, one of the most coveted positions in capital markets at the time. Unfortunately for Sheldon, Denis declined in pursuit of his own ‘mother lode’; in this case, his very own mine in Ghana.

After several years of success but wanting to return home, Denis finally took up Sheldon’s offer and quickly rose through the ranks, eventually becoming his #2, all the while reaching prominence in Toronto finance.

Still considered very young for the mineral exploration business, he jumped at the opportunity to run his own land bank when approached by a similarly-aged group in Palisade Global Investments, led by Collin Kettell and Sean Zubick.

Both Denis’ and Palisade Global’s rolodexes were heavily leaned on. Soon after creation, an impressive board of directors and technical advisors was drafted, boasting over 200 years of experience and over $1 billion in exits.

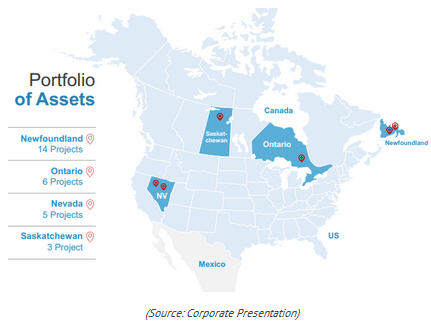

Since its inception, Palisade Resources has acquired 28 projects, with one substantial option deal completed. Palisade Resources’ strategy is to maximize returns by amassing optionality plays that will offer outsized leverage when commodity prices recover.

The company utilizes a three-stage formula to maximize returns for investors: by acquiring deeply discounted projects; unlocking value by using its own capital and expertise; and exiting projects via incubated vehicles, joint ventures, options, or outright sales. Ideally, Palisade Resources will be left with a robust portfolio of royalties and streams.

For this write-up, we will concentrate on just a couple of Palisade Resources’ ‘flagships’: the Gander Belt in Newfoundland and the Lucky Strike in Kirkland Lake.

The Gander Belt – In Canada’s Hottest Mining Jurisdiction

Believe it or not, Newfoundland underwent one of the most intense staking rushes in late 2016, largely under the radar of most of the mining community. The area was picking up steam due to the success of Marathon Gold’s drilling campaign at Valentine Lake, and Altius Minerals’ prospecting at Wilding Lake, which was optioned off to Antler Gold.

Prior to, Denis was busy consolidating the Linear area, 15 kilometers west of the town of Gander in north-central Newfoundland.

The area has been worked on since the 1980s by the likes of Noranda, Rubicon Minerals, and Paragon Minerals, drilling 94 holes totalling 8,883 meters, excavating 81 trenches, collecting 5,000 soil samples and 1,000 bedrock and float samples. Furthermore, the area was subject to intense magnetic and VLF-EM geophysical surveys, 22 kilometres of IP surveys, and numerous prospecting and geological mapping campaigns.

However, like many other projects, the claims were dropped due to the collapse of gold prices and the markets in general, and the area soon became a rag-tag collection of land owned by 16 different groups.

Clean up time. Denis painstakingly consolidated the area, first establishing relationships with the salt-of-the-Earth prospectors, and eventually negotiating contracts. A process that took well over a year, but in the end, worth the effort.

The main Linear area would be considered the crown jewel in any exploration company. Linear boasts over 450 claims and spans 11,500 hectares. The Trans-Canada runs through the south-western portion of the property, with many wood roads leading to exploration sites.

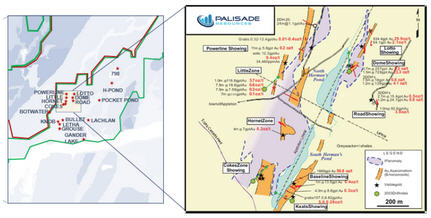

The gold showings occur around multiple parallel faults, running southwest to northwest (called “linears”), with 20 gold zones, and two newly discovered zones peppering the project. The gold is related to thrust and normal faults, which provide fluid conduits. All the zones remain open along the strike and down-dip, and no structural analysis has been carried out to evaluate controls on mineralization.

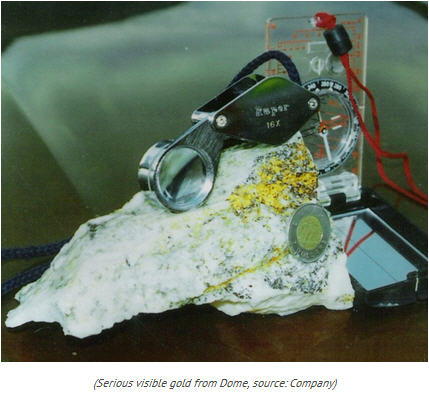

The main Linear area can be split in half by the Appleton Linear, a structural trend running southwest to northeast. East of the trend there is visible gold, while the west-side hosts disseminated gold. In this area alone there are 9 gold prospects that are all open along strike and down-dip. To the east there is Keats, Baseline, Road, Dome, Lotto, where diamond drill holes have yielded assays of 18.5 g/t over 8.6m and 304.8 g/t over 0.6m. To the west there is Cokes, Hornet, Little, and Powerline, where there is bulk-tonnage potential – a DDH assayed 24m at 1.1 g/t.

Most recent drilling occurred in 2008, when six holes over 625 meters were drilled to target the potential extension of gold zones at the Dome, Road, Keats, and Baseline prospects. All six holes were successful, including the extension of the gold-bearing quartz vein zone over a 280-metre strike length with the zone remaining open to depth and along strike at Keats and Baseline.

To the south of the main Linear lays the Bullet, Knob, Lachlan, Letha, Grouse and Gander Lake. In 2005, Rubicon found grab samples ranging from 106.3 g/t to 338.6 g/t. The area also holds several historical high-grade gold intercepts, including: 106.2 g/t over 2.3m; 102.2 g/t over 0.76m; 57.46 g/t over 4.30m; and 8.98 g/t over 14.33m. The Knob has a historical resource (non-compliant) of ~97,000 ounces at 16 g/t.

To the north of Linear lays Pocket Pond, H-Pond, 798, and the newly discovered Rainbow Zone. The area has had a total of 54 drill holes covering 9,880 meters, with surface float samples up to 798 g/t. H-Pond has 32 drill holes, including 16.27 g/t over 2.4m and 12.29 g/t over 1.05m. Pocket Pond has had 15 drill holes, and includes assays of 12.43 g/t over 3.4m and 6.63 g/t over 1.7m.

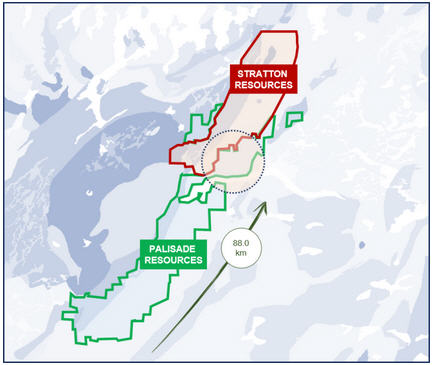

With Linear consolidated, Denis’ plan of attack was to stake the entire Gander belt, starting north before working his way down south. In late November 2016, Denis woke to a full email inbox and numerous missed calls from prospectors in Newfoundland. Legendary prospector, Shawn Ryan, had staked 4,800 claims and 120,000 hectares overnight, dropping a cool $300,000.

Shawn Ryan made his name in the Yukon, founding the multi-million ounce White Gold deposit currently owned by Kinross, and also single-handedly igniting the second Yukon Gold Rush back in 2011. Shawn had apparently been soil sampling in the Gander Zone for years leading up to this blitz, and it was apparent he was not done staking. Fortunately for Denis, Shawn had left the portion of the belt he really had his eyes on. And through a lot of research and counsel from his technical advisors, the decision was made to chase the system to the south along the Botwood Basin and Davidsville contact.

Utilizing the same strategy deployed by Shawn, Denis and his associates waited till late in the night and logged onto Newfoundland’s online staking program. Within 30 minutes, Palisade Resources claimed the south, staking 3,500 claims and 92,400 hectares, spanning over 85 kilometers. Palisade now controls the most advanced historic projects in the belt as well as the southern half.

Just a month later, Shawn Ryan optioned his acreage to Stratton Resources, a sister company to Auryn Resources and run by the same serially successful management group. Stratton Resources changed its name to Torq Resources (TSX-V:TORQ) just this past week.

Ivan Bebek and his team are looking to replicate the success of Auryn by applying the same strategy to their newly optioned acreage in Newfoundland. Auryn is best known for its 380,000 hectares in Committee Bay, located in Nunavut. A project that spans 300 kilometers, and hosts the Three Bluffs gold deposits that currently has an indicated resource of 501,000oz at 8.42 g/t and an inferred resource of 772,000oz at 7.16 g/t.

Premium acreage in mining-friendly jurisdictions is in high demand, and Auryn Resources recently secured a $35M investment from Goldcorp, who now owns 12.5% of the company and has publicly stated they are looking to invest in junior explorers that have early-stage projects with district-scale potential.

Another company who is following a similar strategy is White Gold, who optioned its acreage from none other than Shawn Ryan. White Gold now controls over 14,648 Claims across 23 properties covering 297,000 hectares in the Yukon. And similarly, to Auryn, White Gold partnered with a gold major, Agnico Eagle, who invested $14.5M for a 19.93% in the company.

The market and major companies are valuing district-scale plays in premium jurisdiction at $410 per hectare giving Palisade Resources’ Gander Belt a valuation of $35M. The company is currently planning a district-sale geochemistry program, along with VTEM along the whole belt.

Lucky Strike, Kirkland Lake, Ontario – The Upper, Upper Beaver

In addition to the Gander Belt, another project we would quickly like to mention in the Lucky Strike project in Kirkland Lake, Ontario.

The acreage is directly northeast of Canadian Malartic, and hosts the extension of its Upper Canada and Upper Beaver deposits, currently boasting 4M ounces of gold resource. The Canadian Malartic Partnership was created in 2014, after Yamana Gold and Agnico Eagle acquired Osisko. The mine is one of the largest in Canada, producing 600,000 ounces per year for the next 14 years. The Partnership is the largest holder of mineral rights in Kirkland Lake, and has stated that the Upper Beaver is a key area of exploration focus.

Lucky Strike is 5,000 hectares in the heart of the Abitibi, within the prolific Cadillac-Larder deformation zone host and is home to three past producing mines and adits. Moving forward, Palisade will be concentrating on the diorite complex to the south, originally identified by Noranda in 1988. A single drill hole yielded 100m of 0.3% copper, but since has sampled gold on the diorite as well.

Lucky Strike is home to the Walsh Mine, a quartz-hosted gold deposit that has been intermittently explored between 1908 and 2013. Notable assays include 4.15 gmt/6.45m and 6.72gm/4.85m.

The Copper King is further southwest and the showing contains a series of from 5 to 20 feet in width copper values with some gold and silver numbers. A series of veins assayed 2.25% copper over a width of 12 feet and length of 15 feet.

The Lucky Strike project is a world-class target and a fairly extensive reconnaissance program is currently being planned, which will include geophysical work as well as more mapping and sampling. Due to Yamana and Agnico Eagle’s commitment to the Upper Beaver, we will not be surprised if Palisade Resources options off this acreage in the near future.

Goldspot Discoveries – Gold At The Tips Of Your Fingers

Goldspot Discoveries was incubated in Palisade Resources.

The idea first occurred to Denis on a drive home after an exhausting weekend in Kirkland Lake, going through old data to find prospective projects for his land bank. After going through old paperwork and maps for hours upon hours, Denis was fed up with how old-fashioned everything was. Mineral exploration is very archaic, having not changed for literally hundreds of years. This was sufficient in the past; however, with all the easy targets now picked up, explorers are finding it more and more difficult to find anything.

Just a couple of weeks earlier Denis was at the Integra Gold Rush competition in Toronto, where teams made use of vast data to find the next discovery on Integra’s acreage in Val-d’Or. The second-place winners were The Data Miners, a mix of PhDs and Masters candidates, who utilized machine learning to analyse “big data” and generate 3D drill-ready targets.

Machine learning investigates the creation of algorithms that can learn from and make predictions from big data, overcoming strictly static program instructions, or giving computers the ability to learn without being explicitly programmed.

These analytical models allow users to produce reliable, repeatable decisions and results and uncover “hidden insights” through learning from historical relationships and trends in the data.

Denis’ idea was to take The Data Miner’s idea a step further, and rather than employ machine learning on one small area, the same concept was to be applied on a regional or district level.

Deposits form for a reason, and machine learning is able to link these reasons to available data to determine the relationship. In machine learning, this is called training an algorithm, and once trained, the algorithm can be queried. In this case, the question is where are new exploration camps?

Denis pursued this idea and hunted down the students, and after several meetings, they were deployed to create a prospectivity map for the prolific Abitibi Greenstone Belt in Quebec, where gold is abundant and data even more so.

The Abitibi Greenstone Belt in Quebec was chosen for several reasons. First, SIGÉOM, the GIS data management system of the Ministère des Resources Naturelles du Québec (MRNQ), has done an exceptional job collecting vast amounts of related data of the area. As the old adage goes, garbage in, garbage out, and in the case of big data and ML, this is an understatement.

This specific area was also chosen as deposits can be removed from the training set to see if the algorithm will be able to pick up the deposits regardless. This is called a blind-test: before the training process, 20% of gold deposits are removed. After running the trained algorithm to find gold deposits, the test is to see how many of these removed gold deposits pop up on their own. In this case, 80% of the removed gold deposits popped up, but also 375,000 hectares of additional targets.

The Goldspot algorithm was able to find 86% of the existing gold deposits in the Abitibi, but only needed 4% of the total surface area to do so, and found additional targets as well. So instead of searching over 10,000,000 football fields for gold, only 400,000 were needed. Definitely more digestible, and the cost and time savings offered is remarkable. Needless to say, the experiment was deemed a success.

The strategic decision was made to spin-out Goldspot from Palisade Resources, and The Data Miners were brought on full-time to continue refining the technology.

The Goldspot Algorithm is proven to mitigate investment risk and increase the efficiency and success rate of exploration in data-rich environments. Goldspot Discoveries is now positioned as an investment company that will use its machine-learning algorithm to improve mineral exploration targeting on both a regional and local scale.

Having this ‘crystal ball’, the company plans on fully levering and monetizing it by completely changing the investment decision model by: staking acreage, acquiring projects and royalties, and investing in public vehicles to ultimately create a portfolio of assets with the greatest reward to risk ratio.

The company has already staked over 6,000 hectares that yielded impressive prospectivity scores, and are in talks with groups already to option it off the land in exchange for a royalty.

Goldspot also has two contracts in place with two prolific gold producers, one in West Africa and another in Nevada, to help delineate targets. Both companies have committed to drilling out the targets, which will further prove out Goldspot’s machine learning applications. In the future, Goldspot plans on working with other companies by helping delineate targets in exchange for a success-based royalty.

Lastly, the company has already filtered out the best public companies operating in Quebec based on their prospectivity scores and market metrics to build a basket of companies. This concept was back-tested and the mock portfolio outperformed the GDXJ by 120%.

Thus, Goldspot is far more than a disruptive technology, it is a revolutionary new investment model.

Furthermore, the company has made it clear that the technology is not limited to just gold, and will be applied across the board as operations ramps up. The move to machine learning in mining is inevitable, and it appears Goldspot Discoveries will be the go-to player and brand moving forward.

ThreeD Capital, Palisade Resources, And Goldspot Discoveries

ThreeD Capital currently owns 26% of Palisade Resources and 22% of Goldspot Discoveries.

While precise valuations on each private companies is difficult, it is apparent ThreeD’s market cap of $7.3M is paltry compared to what Palisade and Goldspot have in terms of projects and intellectual capital.

As mentioned earlier, Palisade has already been able to option off a project, a cobalt-silver mine in Cobalt, Ontario, to Lico Energy (TSXV:LIC) for $850,000, 11 million common shares and a 2% NSR, giving them cash flow for the next six years. Palisade has five equally impressive cobalt assets, and as the commodity continues to rise on the green revolution, so to will the demand. Palisade has 28 high-calibre projects in its arsenal, we expect more exits and more cash flow. In addition, Palisade Resources is currently raising money at a $20.2M pre-money valuation. Assuming that valuation, ThreeD’s portion would be valued at $5,400,000.

Goldspot Discoveries is set to present at #DisruptMining, after being chosen as a top 5 finalist out of 130 submissions. Goldspot will pitch its idea in front of key players in mining and technology, and will be vying for $1,400,000 in investment funds. The cash will be nice, but the amount of exposure will solidify Goldspot as the first movers in the machine learning and mining investment model.

Lastly, let’s also not forget that during Pinetree’s peak, the company was given over a 50% premium to what it held in investments. When the bull market is in full-swing, there will be no other vehicle that will give investors the access to deal flow and investments like Sheldon Inwentash can.

ThreeD Capital is one of the most exciting opportunities on the market and we are betting on Sheldon.

Palisade Global Investments Limited holds shares of ThreeD Capital. We receive either monetary or securities compensation for our services. We stand to benefit from any volume this write-up may generate. The information contained in such write-ups is not intended as individual investment advice and is not designed to meet your personal financial situation. Information contained in this report is obtained from sources we believe to be reliable, but its accuracy cannot be guaranteed. The opinions expressed in this report are those of Palisade Global Investments and are subject to change without notice. The information in this report may become outdated and there is no obligation to update any such information. Do your own due diligence.