Triumph Gold Corp. (CVE:TIG, FRA:8N61, OTCMKTS:NFRGF)

Current Price: C$0.38

Shares Outstanding: 59.7 million

Market Capitalization: C$22.7 million

52-Week Range: C$0.07 – C$0.50

Cash: ~C$6.3 million

Original Write-Up Here

Will Triumph Gold be the next Kaminak?

No. We believe it will be much larger.

As stated in our original write-up, Triumph’s flagship project, Freegold Mountain, includes Kaminak’s Coffee-like epithermal models, but also has all the signatures of Western Copper’s Casino-like porphyry. And for the record, Kaminak was acquired by Goldcorp for $520 million, and Western Copper currently has a market cap of $170 million.

This geology, accompanied by Triumph’s exploration philosophy, enticed Goldcorp to invest $6.3 million via flow-through, at a price of $0.528 per share. The share price at announcement was $0.475.

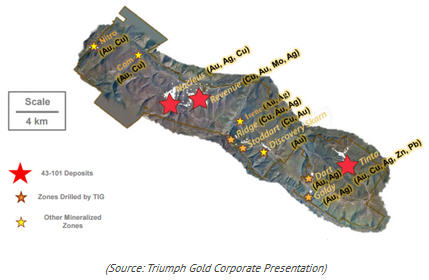

The Freegold Mountain project covers over 200 square kilometers and is already home to three deposits (Nucleus, Revenue, and Tinta) and numerous showings:

The Freegold Mountain project has already seen over $35 million spent in exploration, but its Triumph’s fresh new approach and resulting growth potential that really attracted Goldcorp.

The company recently brought on a new VP Ex in Dr. Tony Barresi, who spear-headed a geological review of Revenue and Nucleus that focused on identifying the main controls on mineralization. This led to an improved understanding of the sequence of mineral phases, and most significantly, recognition of an early stage of porphyry-style mineralization, that was not targeted during past exploration.

This work allowed Tony to produce fact-based evaluations of prospectivity, and outlined four high-priority drill targets: two at Revenue, one at Nucleus, and a newly-identified porphyry target at the Generation Zone, located north of Revenue.

With $6.3 million in flow-through cash, Triumph wants to drill. The company has allocated $4 million at Revenue and Nucleus, with $3.5 million in drilling and the other $500,000 in additional geophysics, soil sampling, and mapping. The field season will begin early June, and afterwards the company should see a steady course of news flow.

Triumph is also allocating some exploration funds to its third deposit, Tinta Hill, an intrusion hosted copper-gold enriched poly-metallic vein-type deposit. The company recently released results from a 70-line-kilometer ground magnetic and VLF-EM survey, and a 10-line-kilometer (414 samples) soil geochemical survey.

Based on geophysical patterns and coincident multi-element (gold, silver, lead and bismuth) geochemical anomalies, Triumph was able to identify four high-priority exploration targets. For 2017, the company plans on further prospecting and trenching at the target areas.

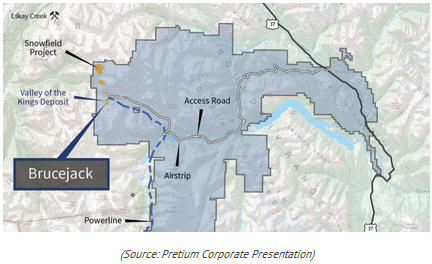

With porphyry-style gold deposits Nucleus and Revenue to the west, and vein-type deposit Tinta Hill to the east, its very easy to make the comparison to Pretium Resources’ (TSE:PVG, Mkt Cap: $2.4B) Snowfield and Brucejack.

Pretium’s Snowfield project in northern British Columbia is located 65 kilometers north of the town of Stewart and 21 kilometers southeast of Barrick’s (TSE:ABX, Mkt Cap: $28.6B) Eskay Creek Mine. Snowfield hosts a near-surface, bulk tonnage, porphyry-style gold deposit with gold and copper.

At Pretium’s Brucejack, the primary focus is at the Valley of the Kings deposit, comprised of high-grade visible gold within a lower grade gold quartz stockwork system. A FS completed in 2014 is headlined by 8.1 million ounces of gold reserves, and commercial production is slated for 2017 for the high-grade underground.

Triumph is targeting its porphyry simply because the upside is significantly more. Looking at TIG’s current valuation of $22.7 million, the company’s 3.25 million ounces of gold in the ground is still undervalued, and the vindication of Goldcorp’s entry is also ignored. Triumph Gold has the geology, jurisdiction, and infrastructure to be a home-rue. Triumph Gold remains our largest holding.

Palisade Global Investments Limited holds shares of Triumph Gold. We receive either monetary or securities compensation for our services. We stand to benefit from any volume this write-up may generate. The information contained in such write-ups is not intended as individual investment advice and is not designed to meet your personal financial situation. Information contained in this report is obtained from sources we believe to be reliable, but its accuracy cannot be guaranteed. The opinions expressed in this report are those of Palisade Global Investments and are subject to change without notice. The information in this report may become outdated and there is no obligation to update any such information. Do your own due diligence.