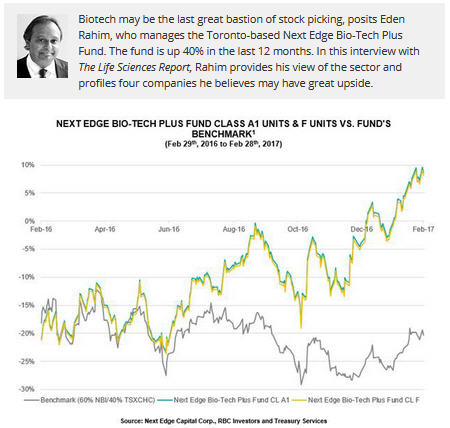

The Life Sciences Report: Eden, you manage the Next Edge Bio-Tech Plus Fund, which has seen gains of about 40% over the last 12 months. Will you talk about some of the factors that make biotech attractive right now?

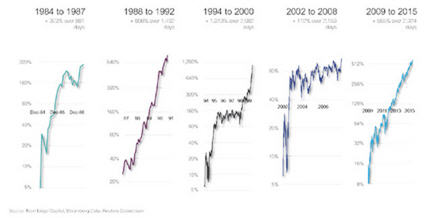

Eden Rahim: The No. 1 thing that makes biotech attractive is that we endured a 40% bear market between mid-2015 and mid-2016. That's the sixth such decline in the brief history of biotech, going back to 1980. It has restored good value to the sector.

This year we probably have the best selection of late-stage companies at the cusp of commercialization that I've seen in my career. Many of these companies are available at valuations below what they were a year ago.

Another thing that makes the sector attractive is that last year we saw a sharp plunge in the number of FDA drug approvals. The prior year, the FDA approved about 45 drugs, and last year it plunged to 22. This year it will probably normalize up toward the high 30s, which means we'll have a much better backdrop of good news for the sector.

For one of the companies I'll talk about later on, Synergy Pharmaceuticals Inc. (SGYP:NASDAQ), the FDA approved its plecanatide drug 11 days early. It's a favorable signal for what has been a beleaguered sector. It also just approved Tesaro Inc.'s (TSRO:NASDAQ) breakthrough PARP inhibitor, niraparib, two months early.

We've endured the headline risk of pricing, but that really affects large biopharma companies more than the companies that we typically invest in, which are late-stage, precommercial companies. Those headline risks actually could amplify the opportunity for large biopharma companies to acquire companies that we typically invest in.

We've seen a lot of mergers and acquisitions (M&A) in the sector. That's always been a driving force for biotech. Even though last year was a tough year for biotech, five of our companies were acquired. A good bit of M&A is probably going to continue this year because biotech has typically been more productive at research and development (R&D) than big pharma has.

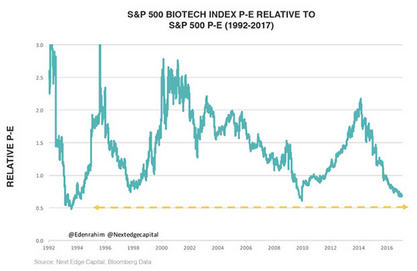

Another point that makes the sector attractive is if you look at the S&P Biotech price-earnings (P/E) multiple and compare that to the S&P 500 going back about 30 years, there only have been two or three times that we've seen the relative P/E of biotech descend to these levels. For a lot of large-cap biopharma companies that have been penalized with low P/E multiples, the future is now. They can't spend another decade and hundreds of millions of dollars only to have a drug fail. They have to spend money and acquire companies, and that's going to be a catalyst.

One final point that makes the sector attractive is the upcoming tax reform in the U.S. If corporate tax rates go down, that would encourage giant corporations to repatriate some of their offshore funds back in the U.S. Giant biopharma and biotech companies have over $125 billion ($125B) offshore right now. This would give them an incentive to bring that money back home and perhaps allocate some of it to M&A.

TLSR: Other than M&A, are there other structural fundamentals at work in the sector?

ER: This is a noncyclical sector in the sense that companies spend a decade and lots of capex developing drugs, but the drugs are not economically sensitive. Companies are fairly well insulated from the ups and downs of the economy. Access to funding affects the sector more on a short-term basis, but because we tend to play primarily in late-stage companies, they generally have access to funding. It's the earlier-stage companies that get hit more when the funding window closes.

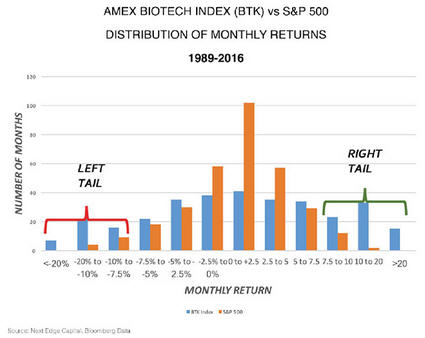

One of the other attributes that are structural about biotech is the distribution of returns. Generally, the S&P 500 returns are log-normally distributed, which means you get a big cluster of returns in the middle that are small monthly returns, and a very small number that are big up or down monthly returns.

But biotech is unlike any other sector in the sense that its distribution of monthly returns tends to have a large number of big up and big down months. What's been unique since the top in mid-2015, for 20 months or so, we've had only one plus-10% move in the biotech index. There have been five months where we've had greater than a 10% drop, including one month, in January 2016, where we had a 20% drop.

Over the past three decades, under normal conditions, we have twice as many big up months as we do down months. Just looking at a regression to the mean, we're due for some good months. That's structural to biotech.

TLSR: You said that FDA approvals were down last year. Do you see the 21st Century Cures Act changing that and changing the face of biotech investing?

ER: The spirit of the act is good, but it's going to take time for many of the proposals in the 21st Century Cures Act to get put into practice by the FDA. A lot of the burden of the work falls on the FDA and the agency is resource constrained. The intention of what the FDA is trying to do to make it easier for products, especially for rare diseases, advance to approval, to help with financing options, and so on, is good.

In 2012 the FDA enacted PDUFA V, which was a reform that brought in things like breakthrough designation, speeding up approval for therapeutics that are targeting rare diseases and making it easier for companies to get them to market. That's had a really big effect on the biotech sector and was a big catalyst for the sector between 2013 and 2015. That was easier to put into practice because the FDA just had to make adjustments and prioritize certain filings.

But the 21st Century Cures Act is a much bigger deal. It's going to take some time for it to get put into practice, and resources for the FDA are going to have to increase to make that feasible.

TLSR: You focus on companies that are late stage. Is this post Phase 2 or is it later than that?

ER: It's typically post Phase 2. I've found that it's a much better risk/reward profile to invest in a company after it has reported Phase 2 data for a well-designed, controlled trial. In preclinical and Phase 1, you can make certain claims, but they're not really backed up by data yet.

I do make an exception for central nervous system (CNS) indications and will invest in those companies at an earlier stage than post Phase 2.

When a company reports Phase 2 data, that drug has been tested against a placebo. The failure rate in Phase 2b controlled trials is about 70%, the highest failure rate along the development food chain for biotech.

For the 30% of companies that survive Phase 2, I dig a little bit deeper. If the drug is going to make a material difference to how a physician treats a patient, I'm interested. And if the trial is a large-patient, well-controlled trial, then at least we know the data are good. So that's my foundation.

I'll typically invest post Phase 2 and hold it right through the two- to three- or four-year period of Phase 3.

TLSR: What's your exit strategy?

ER: Going into the Phase 3 readout of the data, if I'm highly confident that, based on the Phase 2 data, there's a really good chance for success, I'll hold it through the Phase 3 data and I might hedge it up with put options. Or I might swap my position. If I have a large gain, I might swap it into an option like a call spread. If I have a really large gain, I might just sell it because it's just not worth holding it through the binary event.

TLSR: Do you want to tell us about a couple of companies that you're invested in right now?

ER: Each of the companies I will talk about has a different catalyst. First is Intra-Cellular Therapies Inc. (ITCI:NASDAQ), a distressed-priced company right now. It suffered a Phase 3 trial failure last September after it missed statistical significance on its second Phase 3. But the previous Phase 3 and the Phase 2 trials were all efficacious.

Intra-Cellular is developing an anti-psychotic drug, which is a serotonin receptor antagonist targeting schizophrenia and bipolar depression. Intra-Cellular has a market cap of around $700 million and cash of around $380M, so it has an enterprise value of around $320M, which is cheap for a quality, well-tested, Phase 3 CNS asset. And that's what my interest is in it. It addresses a large unmet need. We know it's pretty safe. It's been tested in controlled trials in Phase 2 and Phase 3.

Management attributed the failure of the second Phase 3 to an uncharacteristic placebo response from risperidone. Over the next week or so the company will discuss with the FDA what the requirements will be to submit a new drug application (NDA).

The market right now, based on the price, assumes that a second Phase 3 will be required. The stock is trading at around $16, the company has $9/share in cash, and the market's pretty much discounted it and said it will have to run an entirely new Phase 3.

There is, however, the possibility that the FDA may allow it to file an NDA based on available data. In that case, the upside is substantial. If the FDA decides that it has to run an additional Phase 3 trial, the stock will probably drop back to $10 or 11. If, however, the FDA decides that there are enough explanatory points for the second Phase 3, even though the treatment arm performed exactly as expected, as it did in previous trials, the upside is substantial.

To me, ITCI is reminiscent of Intermune a couple years ago, before it was subsequently acquired by Roche for $72. For a few years it traded between $10 and $50 as it also had missed a U.S. Phase 3 trial for its drug pirfenidone for idiopathic pulmonary fibrosis (IPF). It had an efficacious European Phase 3 but a missed U.S. Phase 3, before a second Phase 3 hit the mark.

There is a big unmet need for a drug like Intra-Cellular's. When you look at other antipsychotics like Seroquel, there's a huge noncompliance issue. There are cardiovascular abnormalities, weight gain, sleep issues, histamine response, all sorts of side effects associated with the standard of care.

I have built a big position in the company over the last few weeks below $14. The risk/reward is considerable. We'll know pretty soon when the company discloses the conclusions of the meeting with the FDA.

Another company I like a lot is Synergy Pharmaceuticals Inc. (SGYP:NASDAQ). I've owned it for a couple of years, so I've done a couple of roundtrips with it up and down. It is building what could be a very significant gastrointestinal (GI) franchise. Synergy has discovered, developed and succeeded through Phase 3 trials, not for one but two potentially significant drugs. It recently got approval to commercialize its drug plecanatide for chronic idiopathic constipation (CIC). It will compete with a well-established drug called Linzess from Ironwood Pharmaceuticals Inc. (IRWD:NASDAQ), which partnered with Allergan Inc. (AGN:NYSE) on that. Ironwood has grown that drug to $700M. But plecanatide—the brand name now is Trulance—has a superior side effect profile, with lower diarrhea rates, 5% versus 20% for Linzess. Linzess also has potential weight gain. I think Trulance is a superior drug. Synergy owns all the rights to it whereas Ironwood is partnered with Allergan and owns only half the economics of it.

The other competitive drug out there is Takeda Pharmaceutical Co. Ltd.'s (TKPYY:OTCMKTS; 4502:TYO) Amitiza. That is a $0.5B dollar drug. But on a clinical basis, Synergy has the superior drug.

The stock has been under pressure the last few weeks because initially, it was a slam dunk to be taken over by Takeda, but no takeover was forthcoming. Then Synergy decided to go it alone, so it has had to spend some money. It has used a contract sales force of around 200 representatives that it will detail to about 27,000 physicians. The market looked at that negatively and said maybe competitors don't really care much about the drug. But we know clinically the data are proven to be superior. So we think it represents a tremendous bargain.

Synergy also developed a drug for irritable bowel syndrome (IBS), which is also a huge market. It will be filing a supplemental NDA shortly. Synergy will have commercialized and gotten FDA approval for one drug out of its development platform, and it is about to file an NDA to commercialize a second drug. That's an amazing achievement for a company that has a market cap under $1B. So I like that one a lot. I have about a 3% weight in it right now.

TLSR: What is another company you would like to talk about?

ER: A third holding that I've built a position in over the past four to six weeks below $1.70 is a glaucoma company called Inotek Pharmaceuticals Corp. (ITEK:NASDAQ). Again, like Intra-Cellular Therapies, it's a distressed situation. It had a failed monotherapy Phase 3 trial back in January, but there's a catalyst upcoming. It has a Phase 2 trial for which it will be reporting data midyear. Its drug is trabodenoson, and it's in combo therapy with latanoprost.

The market is pricing the company for failure right now. The market cap is around $45M. It has net cash of $90M. So it has a negative enterprise value, -$45M. You're buying a company at half its enterprise value right now.

I think there's a pretty good chance of success. For the data coming out of the Phase 3 monotherapy trial for trabodenoson, out of the 55 sites, there were four anomalous sites where the outcome for the placebo response did not reflect anything of the other 51 sites. There is reason to believe that the drug performed exactly as expected in earlier trials and in Phase 3, and that it should not be written off.

I think the risk/reward is tremendous. You're buying the company as if priced for complete failure, but I think there is a pretty decent possibility of a positive outcome on a trial.

TLSR: And what is another company you want to discuss?

ER: The fourth company I like is one where I deviate from my discipline a bit. It's a little Canadian company, ProMIS Neurosciences Inc. (PMN:TSE). It's a preclinical company, but it will be going in the clinic over the next year or so.

"ProMIS Neurosciences Inc. has achieved a lot with very little, and its understanding of the mechanism of action of Alzheimer's is quite significant."

I'm in it because of some of the really important insights it has discovered into the mechanism of action of Alzheimer's disease. Drugs being developed for Alzheimer's have been an absolute graveyard. Virtually everything has failed. There has been no approved drug for Alzheimer's in 13 years, and virtually every clinical trial has failed since that time. But what ProMIS has discovered is that the ideal thing to target for Alzheimer's is soluble amyloid beta oligomers. It believes that they are the root cause of Alzheimer's, not the plaque that ultimately settles on the brain.

ProMIS predicted some of the failures that we've seen, such as solanezumab from Eli Lilly and Co. (LLY:NYSE). ProMIS was pretty comfortable that that trial was going to fail because Eli Lilly's drug, solanezumab, tended to find monomers. It believes that monomers are not the culprit and that monomers would use up a lot of the monoclonal antibody and wouldn't target the plaque. And it was correct in actually predicting that.

ProMIS has discovered that by focusing on IgG 4 isotype, you can circumvent the inflammation that often comes with monoclonal antibodies. ProMIS has identified six epitopes on protein strains of misfolded amyloid precursor proteins (APPs). APPs are the misfolded proteins that eventually lead to something called fibrils, which eventually clot and form plaques in the brain.

ProMIS has discovered that the prion strains of those misfolded proteins carry a marker, called an epitope. It's like a police car with a light on top. ProMIS has developed five murine antibodies that select for those epitopes so antibodies can find them on those misfolded proteins and bind to them. It is actually a pretty profound breakthrough at this level.

Again, it's very early stage and preclinical. But ProMIS has selected one of those five antibodies. The drug that it's going to advance, PMN-310, will be its first candidate in clinic.

A few months ago, ProMIS also got access to the cerebral spinal fluid (CSF) of 100 cadavers at the University of British Columbia of patients who had been diagnosed with Alzheimer's. The reason why that is an opportunity for it and why there is a chance for a profound breakthrough in understanding Alzheimer's is that if its antibodies can detect these prions in the CSF, then potentially it could create a diagnostic that is able to find these biomarkers at a much earlier stage.

I bought into ProMIS on a financing in the summer of 2015. I'll probably hold it for another 5 or 10 years. It's achieved a lot with very little, and its understanding of the mechanism of action of Alzheimer's is quite significant. I think we'll hear about that over the course of 2017.

TLSR: Any common threads for these companies?

ER: These four companies have below a billion-dollar market cap and have very favorable risk/reward propositions. They are either trading very cheaply or there's a catalyst to have it revalued in the future.

Biotech is genuinely the quintessential stock-picking sector. Biotech is probably the last remaining great bastion of generating excess returns.

Last year, when the fund generated the 40% return year over year through February, it didn't get any help from the sector. It was all individual company holdings doing the heavy lifting. You can pick companies in this sector that will generate returns no matter what the economy does.

TLSR: At the macro level is the fact that people are expecting President Trump to enact tax reform, lower the repatriation tax and ease regulations giving biotech any winds in its sail?

ER: A month or two back Trump met with the CEOs of a lot of biopharma companies. We all thought it was going to be the same ol' same ol', which is he's going to bash drug prices and the sector's going to get hit. The NASDAQ biotech opened down about 2% that day.

But then something really interesting came out, which was he started talking about the importance of these companies that are innovating new drugs versus those egregious companies that buy other drugs and then jack the prices up. It's the first time he actually made that distinction. He understood the importance of companies that spend hundreds of millions of dollars and risk shareholders' capital to develop new breakthrough drugs. Part of that may be because Mike Pence was Bio's congressman in 2014 for incentivizing biotech in the state of Indiana, so he may have whispered this in his ear.

The other thing, too, is that if you want to make America great again, the United States is the best in the world at R&D-based drug development. Why would you kill the goose that lays the golden eggs? Why penalize that industry when they're genuinely the leaders on planet Earth on developing therapeutics?

At the end of that day, biotech went from down 2% to up 2%. What was interesting about that day, if you take that 2% gain for the NASDAQ Biotech Index and you split it up into small caps, large caps and the midcaps where I play, the small caps were up 1%, the big caps were up 1% but the midcaps where I play were up 3%. So again it came down to the fact that those companies that were later stage, close to commercialization had a favorable risk/reward profile in this environment.

TLSR: Any parting thoughts?

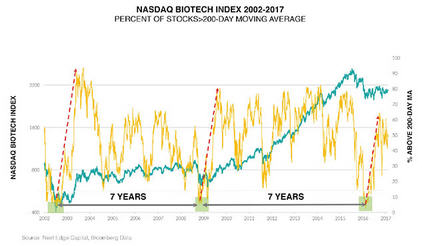

ER: We've been through a big bear market in biotech between mid-2015 and mid-2016. Every time we've gone through a decline like this the advances coming out the other side have typically run for several years, and the gains have ranged between 100% and 1,000% (see chart below). We've had nothing but flat biotech for the past year, and we've generated some good gains with that. So it would be nice to actually have a return to normal. I think there's a good chance of that.

BIOTECH MAY ONLY BE AT ITS MIDPOINT OF A SECULAR BULL MARKET THAT BEGAN IN 2010:

The 2015-2016 bear market was the sixth decline of -40% or greater in biotech since inception in 1980. After the previous five such declines, the bull market that followed ranged from +100% to +1000%.

Biotech represented by the Reuters Datastream World DS Biotechnology Index from 1980-1992 and by the Nasdaq Biotechnology Index from 1992 to present. The dates chosen were based on the research and assessment of Next Edge Capital Corp., and to a certain extent, the start and end dates of such events are subjective and different sources may suggest different date ranges, leading to different performance figures.

One of the indicators is the percentage of stocks above the 200-day moving average. It's really good at delineating cycles of extreme oversold in the sector and bear market lows. We had that in February a year ago. The pattern coming out of that is that the sector improves. A lot of bad news has been discounted, so I think the sector does OK.

TLSR: Thanks for your insights, Eden.

Eden Rahim is portfolio manager and option strategist at Next Edge Capital Corp. He manages the Next Edge Biotech Plus Fund. His experience includes two decades of portfolio and hedge fund money management, as well as work as an options strategist, derivatives and biotech analyst and portfolio manager. Rahim has managed and traded an options book spanning 250+ securities globally and four commodities, with open interest of 500,000 contracts in addition to 14 covered call ETFs (over $0.5B AUM) in Canada, the U.S. and Australia, employing his options writing discipline at Horizons Exchange-Traded Funds. Rahim possessed a top-quartile, five-year, five-star growth fund portfolio manager track record on more $1B in assets across four mandates at RBC Global Asset Management. In addition, Rahim has delivered a +26% compounded annual return across a biotechnology mandate between 1995 and 2003. He also has extensive institutional hedging experience through major crises, and experience in the structuring of notes to create specific payoff profiles.

Want to read more Life Sciences Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new interviews and articles have been published. To see recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Patrice Fusillo conducted this interview for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this interview are billboard sponsors of Streetwise Reports: ProMIS Neurosciences Inc. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor's fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Eden Rahim: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: No. I, or members of my immediate household or family, are paid by the following companies mentioned in this article: No. My company has a financial relationship with the following companies mentioned in this interview: No. Funds controlled by Next Edge Capital hold shares of the following companies mentioned in this article: Synergy Pharmaceuticals Inc., Intra-Cellular Therapies Inc., Inotek Pharmaceuticals Corp. and ProMIS Neurosciences Inc. I determined which companies would be included in this article based on my research and understanding of the sector. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.