Small cap Canadian gold exploration and development stock Alexandria Minerals Corp (OTCQB: ALXDF; TSE: AZX.V) is searching for gold discoveries in infrastructure-rich areas that allows for capitalization on smaller discoveries en route to any big discoveries.

You may think all of the gold in more easily accessible mining districts located in places like Australia, Canada and the USA have already been discovered or mined and that miners need to be looking for gold in more exotic locations, but that is not necessarily the case. For example: During previous Gold Rushes and especially during the Great Depression, its true that prospectors probably searched every possible gold-producing area throughout the USA and other major western countries know for mining. The problem is that many of these prospecting or mining activities were never fully or properly documented. Likewise, many historical mines were grab and go type operations where the gold was easy to find and extract with the technology available at the time – meaning, to paraphrase a Mark Twain character, “there’s [still] gold in them thar hills” and “there’s millions in it…”

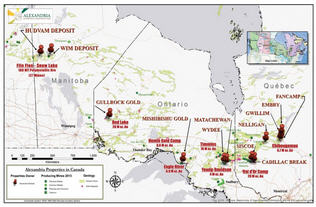

Small cap Canadian gold exploration and development stock Alexandria Minerals Corp (OTCQB: ALXDF; TSE: AZX.V) is one such company searching for gold closer to home as it has a portfolio of strategic properties located in the world-class mining districts of Val d’Or, Quebec; Red Lake, Ontario; and Snow Lake-Flin Flon, Manitoba.

These properties or their locations reflect the Company’s business model: They are located in areas with potential for multimillion ounce gold discoveries while the infrastructure-rich areas allow for capitalization on the smaller discoveries en route to any big discoveries. Remember: Not all small gold discoveries are economical to mine if they are located in extremely remote area with little to no infrastructure.

Alexandria Minerals Corp itself would be focused is on its flagship property, the 35 kilometer-long Cadillac Break Property package in Val d’Or, which hosts important (near-surface) gold resources along the prolific gold-producing Cadillac Break. The Company has been conducting diligent and continuous exploration activities since 2007 - successfully discovering resources over 2 million ounces of gold at a cost of under $18/ounce of gold discovered.

To develop Val d’Or and its other properties, Alexandria Minerals Corpispartnering with other companies who can provide added value. Last year, Alexandria Minerals Corpcompleted an Option/Joint Venture on three of its projects (in Matachewan, Ontario; Chibougamau, Quebec; and eastern Val d’Or) – this enables the Company to continue to focus on the western Cadillac Break Properties.

Earlier this month, Alexandria Minerals Corp also announced assay results from diamond drill holes at Val d’Or with the COE stating:

“These are the best results we have received to-date at Zone 4, and we are especially pleased that they have come from a previously untested area. This gives us great encouragement and confidence in the potential for growth, as we are still waiting for assay results from 22 holes, including 10 step-out holes west of the open pit.”

In March, Alexandria Minerals Corp became listed on the OTC Market Group’s OTCQB Venture Market – the middle tier of the over-the-counter (OTC) market that is intended for entrepreneurial and development stage US and international companies. While there are no financial or qualitative standards for a company to be listed on the OTCQB market, OTCQB stocks are said to be committed to both disclosure and transparency. They are also considered to be less speculative in nature than stocks that trade on the OTC Pink market (the bottom tier of the OTC market).

Jim Robertson is a paid contributor of the SmallCap Network. Jim Robertson's personal holdings should be disclosed above. You can also view SmallCap Network's complete Disclaimer and SEC Rule 17b Disclosure.