What’s the most reliable way to profit from mining stocks?

Just follow the “smart money”.

Big-league investors in the stock market tend to be far more successful than small retail speculators. This is because they have the competitive advantage of amassing expert knowledge about the industries that they invest in.

With this mind,

Genesis Metals Corp. (TSX.V: GIS) just got the best kind of validation that a start-up gold explorer dreams of.

The company recently raised in excess of $4 million in two equity financings — some of which will be used for a summer drill program. And it was able to attract hard dollars from a legendary billionaire mining investor, a top-flight mining company, and even the Quebec government.

Genesis can now boast Eric Sprott as a significant shareholder (7.2%). He made his fortune buying undervalued mining stocks. High-flying gold producer Osisko Mining is also on-board (6.4%).

Two Quebec government-sponsored investment funds, SIDEX Limited Partnership (SIDEX) and La Société de Développement de la Baie-James (SDBJ), also took part in the financing. And several high-profile mining investment funds — namely, Gold 2000, US Global Investors, Medalist Capital and Delbrook Capital — also got a piece of the action.

Obviously, the smart money sees Genesis’ prospects for a one-million-ounce-plus gold discovery to be pretty good.

Now with drilling underway at the heart of Quebec’s fabled gold fields, Genesis believes it is on-track to significantly expand upon its existing 300,000-ounce gold resource, which is known as the Main Zone.

Amassing More Gold in “Elephant Country”

So what’s so special about the company’s summer drill program that all these deep-pocketed mining investment specialists want skin-in-the-game?

First, let’s look at the big picture.

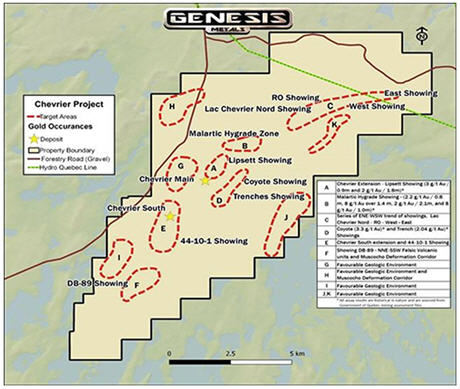

Genesis’ sprawling land package, known as the Chevrier gold project, is near Chibougamau, Quebec—a mining camp that has produced over 6.7 million ounces of gold to date. It Due to its size, it also has the potential for a number of important discoveries. All told, the property encompasses nearly 95 square kilometres at the heart of a geologically-fertile gold belt.

Furthermore, the company’s claims span the Fancamp deformation zone. This is a structural weakness in the earth’s crust into which gold has migrated from much greater depths.

Of particular encouragement is the presence along the Fancamp gold trend of other significant discoveries. They include the proximal high-grade Monster Lake gold discovery to the southwest of the Chevrier deposits. Additionally, the past-producing, high-grade Joe Mann mine is nearby.

The prospect of one or more sizeable gold deposits emerging on Genesis’ property is significantly boosted by the close proximity of these other gold deposits. In fact, they are clear evidence of how geologically-fertile this gold trend really is.

In the near-term Genesis is focusing on Chevrier’s Main Zone and South Zone deposits, as well as the East Zone discovery. All of them have benefitted from plenty of drilling — much of which has revealed impressive gold grades.

Presently, close to 300,000 inferred ounces of gold, averaging 1.99 grams per tonne (g/t), have already been outlined at the Main Zone. This also translates into an inferred resource of 4.6 million tonnes.

Now Genesis is looking to update and expand upon this mineral resource. This will happen by way of definition drilling, exploration drilling and the twinning of some of the 40 or so historic drill holes that encountered impressive gold grades but have not been used for the current resource estimate.

In fact, if results from the historic drill holes in the Main Zone can be duplicated — which appears likely — the Main Zone may easily double in size.

This does not even factor-in the prospect of additional gold mineralization being revealed via step-out exploratory drilling. To this point, recent trenching surrounding the Main Zone has encountered grades as much as three times higher than the average 2 grams per tonne (g/t) grade of the known 300,000 inferred ounces of gold.

Capitalizing on a District-Scale Opportunity

Elsewhere on the property, Genesis is investigating the possibility that at least two other distinct gold deposits may be waiting to be unearthed in close proximity to its core gold asset.

They include the extensively-mineralized South Zone deposit, where a previous project operator drilled 19 holes in the 1990s.

In fact, the NI 43-101 report for Chevrier suggested a target potential of 8.5-9.0 million tonnes grading around 1.88-2.2 g/t for the South Zone. This amounts to as much as 600,000 ounces, based on the report, which was published in 2010.

Notably, the South Zone deposit involves a completely different style of mineralization to the Main Zone — meaning it could prove to be an entirely new deposit in its own right.

In addition, no less than 53 holes were drilled in the East Zone by a previous operator, Falconbridge. This prospective new gold discovery will also be drill tested in Q2. The company is encouraged by the fact that impressive gold grades were found over a large area within this zone.

There is also a total of 10 new high-priority targets dispersed over a 15-kilomere trend running the length of the company’s property have also been identified for further exploration.

Each target is sizeable, ranging from one to three kilometres in length. And each of them attests to the fact that district-scale opportunities for multiple gold discoveries may exist within Genesis’ land package.

Investment Synopsis

The company’s focus on upgrading the Chevrier’s Main Zone to a larger asset is smart.

The prospect of at least doubling the size of the Main Zone in the near-term promises to become a springboard to eventual success on a much larger scale.

After the proving-up of the South Zone by way of additional drilling, these two deposits should become integral towards the quest of outlining an initial million-ounce-plus gold inventory.

Furthermore, the deposit’s gold mineralization is not just “open” (continuous) along a lateral plane. It is also open at depth. This means that it offers additional scope for expansion below the 300-metre mark, where limited drilling has already encountered rich gold grades.

Additionally, there is plenty of “blue sky” exploration potential at the South Zone and East Zone, as well as at least 10 other gold prospects — all of which sit within almost 95 square kilometres (9,500 hectares) of land holdings at the heart of a richly-mineralized gold belt.

In fact, the likely eventuality that considerably more gold will be found helps explain why Genesis has acquired so many well-informed, mining-savvy investors lately.

It’s also worth mentioning that the company has an accomplished management team with a proven track record for success in the mineral exploration and development business. Several directors were also founders of Underworld Resources, which was acquired by Kinross Gold for $140 million dollars in 2010.

All told, it’s not hard to see how the still-emerging Chevrier deposits and satellite discoveries have the potential to grow big enough to eventually get acquired by a major gold producer.

The odds in favour of Genesis becoming an attractive takeover target are further strengthened by the company’s ideal location. Its property is in close proximity to several gold mines and mines-in-the-making, as well as the necessary infrastructure for commercializing mines.

Add to this the fact that Quebec is a pro-mining, politically-stable jurisdiction with a long mining history, and it sure seems like Genesis is a success story in-the-making.

About the Author: Marc Davis has a deep background in the capital markets spanning 25 years. He is also a longstanding financial journalist, having worked for leading digital financial news agencies in North America and in London’s financial centre. He is also a former business reporter for CBC Television.

Over the years, his articles have also appeared in dozens of digital publications worldwide. They include USA Today, CBS Money Watch, Investors’ Business Daily, the Financial Post, Reuters, National Post, Google News, Barron’s, China Daily, Huffington Post and AOL.