Now that the summer exploration season is in full swing,

Comstock Metals Ltd. (CSL:TSX.V) is also getting ready to provide the market with new drill results. A summer drill campaign has started at the Preview SW project in Saskatchewan, while the Yukon-based QV Gold project will be drilled later this summer.

Comstock's two main projects

A) Preview SW, Saskatchewan

Drilling has already started at Preview, and it shouldn't be too difficult for Comstock Metals to add more ounces to the current 430,000-ounce (Indicated + Inferred) resource estimate.

The project is located in Saskatchewan, covers a total surface area of just over 850 hectares and is located approximately 250 kilometers north of Prince Albert and 40 kilometers northeast of La Ronge.

Although the previous operators and Comstock have discovered seven gold prospects on the property, the current resource estimate containing almost 430,000 ounces at an average grade of approximately 1.61 g/t is limited to just one part of the property, the Preview SW zone.

The gold deposit consists of several sub-parallel gold-bearing structures, which seem to trend toward the northeast. All these structures are very close to each other, and the width of the mineralized "corridor" remains limited to approximately 150 meters. While the argument could be made the relatively narrow width of this zone will result in a relatively high strip ratio, it doesn't have to be a deal breaker. Comstock will, indeed, have to deal with lower-grade mineralization in between the structures, but as the average grade of the resource estimate is relatively high for an open pit project, it does look like the project could handle a higher strip ratio as the cost to remove waste is negligible.

As mentioned before, the Preview SW resource estimate was completed on just one of the gold occurrences, and six more (known) targets remain virtually untested. The company has completed a 1,770-meter winter drill program with a specific focus on the Preview North zone, and the assay results of the past winter drill program are very encouraging, with an impressive 105 meters containing 1.01 g/t gold at Preview North and 5 meters at 10.33 g/t gold.

Needless to say, this type of drill results definitely justified a summer drill program, which is currently in full swing with the first two holes completed by now.

B) QV Gold, Yukon Territory

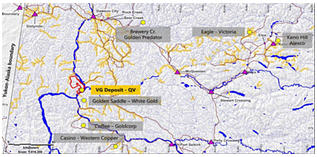

Comstock Metals' second project is the QV Gold Project in Canada's Yukon Territory. What's really intriguing here is the fact QV is located right across the river from the Golden Saddle project, which was sold by Underworld Resources to Kinross Gold Corp. (K:TSX; KGC:NYSE), only to see Kinross Gold sell the asset to White Gold (WGO.V) a little while ago.

This was an important transaction as it establishes White Gold as a dominant Yukon-focused exploration company, which really brought a lot of attention back to the region.

As the QV property is located really close to White Gold's Golden Saddle property, it would make a lot of sense to assume all options and possibilities will be thoroughly investigated farther down the road.

Over the past year, Comstock Metals has made a lot of progress to advance the property. Although it hasn't always been easy to raise money for exploration projects in the Yukon, Comstock was able to identify the VG zone and drill off an initial resource within a 350-square-meter area. The company also confirmed the rock type and style of mineralization at the VG zone is similar to what has been found at Golden Saddle.

Not only does the VG gold zone of the QV project already contain 230,000 ounces of gold, it also still remains open in all directions. This means it should also be relatively easy to add more ounces to the resource estimate, which was completed in 2014 (none of the 2014–2017 exploration results are included in the current resource).

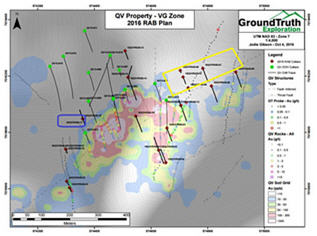

Even though last year's RAB drill program was relatively small, it was able to extend the VG zone by in excess of 50 meters toward the east after intersecting in excess of 18 meters containing in excess of 1.8 g/t gold, and 50 meters to the west with an intercept of 12.19 meters averaging 5.53 g/t gold (blue rectangle), but it also confirmed the mineralization continues approximately 200 meters toward the northeast of the Telegraph fault, the "yellow zone."

None of these holes was drilled inside the current resource, so the path to define a million ounces at QV is not unrealistic, especially considering Comstock Metals is still working on three additional "high priority" exploration targets.

There's very little doubt the current 230,000-ounce resource at QV is just the beginning, as last year's exploration program successfully extended the known mineralization, while three other high-priority mineralized zones on the wider land package also have the potential to add several hundred thousand near-surface ounces to the mix. RAB drilling is ineligible for resource calculations, and that's why Comstock is also planning to complete up to 2,000 meters in diamond drilling this year, which would indeed qualify to expand the resource base.

What's next for Comstock?

Comstock Metals is blessed with two resource-stage projects, although it's still valued as a greenfield exploration company with a market capitalization of just CA$10M (despite a cash position of approximately CA$3M). That cash position will obviously be used to complete the summer exploration programs, which will hopefully result in an increased gold resource on both projects.

While the Preview SW project hosts the largest resource, the market will very likely be more excited by the prospects of the QV project in the Yukon, as the entire region enjoys some "special attention" these days. Thanks to the renewed interest in the Yukon Territory, it will be very interesting to see the "end game" for the QV project. Unless you have in excess of 2 million ounces, it's really difficult to develop a gold project in the Yukon Territory on a standalone basis. Goldcorp will be able to build the Coffee mine, but Kinross' Golden Saddle project probably was (and is) too small to be viable on a standalone basis.

Comstock Metals isn't a one-trick pony, and both assets have a good shot at reaching the critical mass needed to start thinking about developing the projects into mines. The company's first priority will be to build ounces and cash position of approximately CA$3M; Comstock Metals is in a good shape to continue its exploration activities on both projects.

At its current market capitalization of CA$10M is trading at just US$11 per ounce of gold in the ground, and that's indeed quite cheap considering the exploration potential on both projects.

It's now up to David Terry and his team to advance both QV and Preview SW, and we expect to see a steady flow of assay results being released to the market from August on.

Thibaut Lepouttre is the editor of the Caesars Report, a newsletter and mining portal based in Belgium that covers several junior mining companies with a special focus on precious metals and base metals. Lepouttre has a Bachelor of Law degree and two economics masters degrees that have forged his analytical approach to the mining sector. Considered a number cruncher, Lepouttre focuses on the valuations of companies and is consistently on the lookout for the next undervalued mining company.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Thibaut Lepouttre: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: a long position in Comstock Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Comstock Metals. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click

here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal

disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Comstock Metals, a company mentioned in this article.