/www.streetwisereports.com/pub/htdocs/expert.html?id=14051" style="box-sizing: inherit; color: rgb(145, 0, 36); line-height: inherit; text-decoration-line: none; font-weight: bold; border: 0px none; float: left; height: 97px; margin: 5px 15px 2px 0px; overflow: hidden; width: 77px;"> Lior Gantz, founder of Wealth Research Group, explains why the gold exploration sector is worth taking a look at now.

Lior Gantz, founder of Wealth Research Group, explains why the gold exploration sector is worth taking a look at now.

For the majority of 2017, investors have been completely indifferent to external threats to their portfolios and have kept on buying U.S. equities.

Right now, it's the worst possible time to be buying stocks, but a rush of amateurs into already expensive stocks is baked in the cake.

Tech companies are incredibly loved, and throughout history when this happens, the mining companies are extremely hated.

The only sector that is worth taking a look at is gold exploration.

I honestly never thought I would see this again, and I’d prefer to avoid exploration altogether, but when you see a truly compelling situation, it's not wise to ignore it.

We had a big week for gold, and it's trading at $1,270, but the major thing to keep in mind is the big picture…

We are closely watching the gold sector. When it breaks above $1,300, the resistance is all but gone.

All this sector needs in order to spark another 2016 boom is one discovery to fuel an exploration funding cycle and gold at $1,350.

Then the industry will unleash built up energy and we will see gold, silver, and zinc stocks trade for 5-10 times today's depressed prices.

Make sure you review your portfolio today. Weed out companies that trade for multiples that are unsustainable. Cashing up now will protect gains and allow you to avoid the coming correction on the broad indexes.

It will also give us the best entry point into opportunities in the cryptocurrency, commodities and cannabis sectors that are just now starting to launch.

There's a historical risk in the Fed reducing its balance sheet, though. The central bank has embarked on this reduction six times in the past—in 1921-1922, 1928-1930, 1937, 1941, 1948-1950 and 2000—and all but one episode ended in recession.

Hedge funds are losing precious metals faith in gold as the net-long position in fell to the lowest in 17 months, prior to the metal posting its first weekly gain in six weeks.

Silver is now officially in a net-short by hedge funds, just as the 4th largest producers reported plummeting production.

The sentiment toward precious metals is bearish, and that's important.

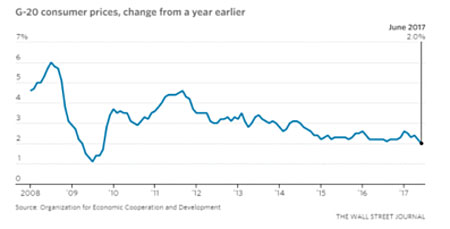

We want to be ahead of the curve, and since inflation is so low in G-20 countries, many hedge funds aren't interested, and yet the price rises, because the U.S. Dollar is tanking.

Inflation is a non-issue with most European countries today, but it will be very soon.

The time spent in Vancouver has confirmed in my mind that natural resources is an industry, where you either ride along with the best or you stay well clear of it—there's no in-between.

The last obstacle before gold stocks begin to roar higher is oil prices, and in my next article, I'll show you exactly where that industry is at.

Lior Gantz, the founder of Wealth Research Group, has built and runs numerous successful businesses and has traveled to over 30 countries in the past decade in pursuit of thrills and opportunities, gaining valuable knowledge and experience. He is an advocate of meticulous risk management, balanced asset allocation and proper position sizing. As a deep-value investor, Gantz loves researching businesses that are off the radar and completely unknown to most financial publications.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Lior Gantz and not of Streetwise Reports or its officers. Lior Gantz is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Lior Gantz was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts provided by Wealth Research Group