As a general rule, the most successful man in life is the man who has the best information

aheadoftheherd.com

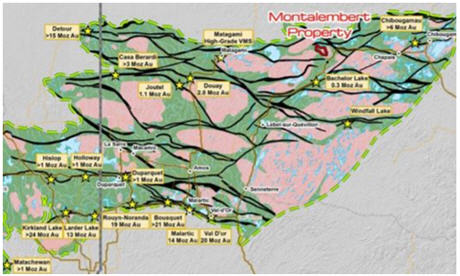

Canada's Abitibi Greenstone Belt is one of the most important gold mining regions in the world. On par with the Carlin Trend in Nevada and the Witwatersrand Basin of South Africa, the Abitibi, which straddles Ontario and Quebec, has yielded over 180 million ounces since the first mining camps were established there in the early 1900s.

It may seem surprising that after over a century of mining and exploration, there is still room for new discoveries there. To make the assumption that the Abitibi is mined out would be a serious mistake, however, as the story of Enforcer Gold Corp. (TSX.V:VEIN) and its aptly-named stock symbol demonstrates.

The Toronto-based company actually started off as a lithium play, focusing on the

Duval lithium property about 300 kilometres north of Chibougamau, Quebec, but about a year ago management switched their focus to gold exploration and started looking around for interesting projects and someone to head up the new enterprise.

Steve Roebuck, a veteran geologist with over 25 years experience, was invited to lead the search. The former president of Scorpio Gold (TSX.V:SGN), a 40,000-ounce producer with assets in Nevada, became President/CEO and renamed the company Enforcer Gold. After sorting through a few gold plays the team singled out the Montalembert gold project in Quebec.

Recalling the company origins, Roebuck says the high-grade gold on the property, which features two gold-bearing vein structures, immediately captured his attention.

“I said that one's high-grade. You can never, ever go wrong with high-grade. It covers up a lot of fatal flaws in a lot of projects if you can mine it efficiently,” he told Ahead of the Herd in a recent interview.

But it was when the property's owner, Jack Stoch of Globex Enterprises (TSX:GMX), came to Roebuck's office in Toronto with a “pretty snappy-looking piece of channel sample” that Roebuck decided to investigate further. He drove up to Chibougamau to do a due diligence visit. The first sample he took was 510 grams per tonne. The second, a channel sample on the Galena vein, was 118.9 grams per tonne gold and 14.5 g/t silver over a meter.

“I knew right away this was a special project, it was high-grade. So I said, Okay, let's go for it and look at it, and take the option,” Roebuck recounted.

Located 125 kilometers west of Chibougamau, the 7,293-hectare Montalembert project is not close to a mine. The nearest would be the relatively small Bachelor Lake mine, which produces about 30,000 ounces annually.

But according to Enforcer Gold the geological setting is outstanding, with geology similar to the 6-million ounce Chibougamau mining camp to the east, between a major anticline (a ridge-shaped fold of stratified rock) to the south and a syncline (a fold of stratified rock) to the north. The company believes that the placement of the plutons – intrusive igneous rock crystallized from slowly cooling magma – deformed the rocks and caused shear deformation. Most of the gold in the Abitibi is found in shear-hosted quartz veins.

The geology is good, but the really interesting, maybe even shocking, facet of Enforcer Gold that is of most interest to investors, is the company appears to have hit upon a property that has seen limited exploration despite showing promise on multiple occasions by different companies throughout the last 68 years.

Five gold veins were discovered in 1949 by N.A. Timmins Inc., which the next year drilled 31 small-diameter holes including seven under the Galena vein and three under the No. 2 vein. But despite over 200 occurrences of mineralization, only 10 core samples were taken, and no assays exist. Fast forward to 1973, when Rochelom Mines drilled and blasted about five tonnes of material out of the Galena vein, coming back with 13 grams per tonne along a 123-metre-long strike.

“When I read that, I said, Okay, this is definitive, it's not just a one-hit wonder, that there is some gold there,” says Roebuck. A bulk sample from the Quebec government showed 12.69 g/t over 108.2m.

Inexplicably, however, no follow-up exploration was done on the veins, or anything in their vicinity, until 2015. Base metal exploration in the 1980s included the discovery of two gold-bearing veins just north of the Galena vein, and in 1997, a hydrothermal breccia - rock containing fine gold fragments - with 20% sulphides and visible gold was discovered in a hole located about four kilometers north of the Galena vein, but assays were inconclusive and no further exploration was done.

The claims expired and in 2015 the property was acquired by Globex, which did some channel sampling (samples are collected using a diamond-blade power saw typically five centimeters wide and five centimeters deep, cut perpendicular to the strike) on the Galena and No. 2 veins, before it was optioned to Enforcer Gold in 2016. Highlights from 122 samples collected last October from 25 channels 3m apart included 39.35 g/t at 1.1m and 5.07 g/t at 0.95m.

The Galena and No. 2 veins are parallel, mineralized shear zones separated by ~80 m. High-grade pockets of gold mineralization occur along the currently exposed 183m and 189m lengths of both veins.

Since acquiring the project, Enforcer Gold has launched a $2.2 million exploration program that started in March, including a geophysical survey, additional channel sampling and diamond drilling.

Up to 8,000 meters of drilling will focus on testing the strike continuity and depth of the Galena and No. 2 veins, and also the hydrothermal breccia described above. Between 50 and 100 holes will test the veins down to a depth of about 200 meters, employing larger diameter coring equipment than previous drilling in order to get more representative samples.

Roebuck said the main goal of the program is to find a discovery hole, and to better understand the underlying gold structures, which could point to a deposit:

“What I'm saying is that I think that these two veins are indicative of a larger system at play. Does gold come in from the plutons to the southwest and to the northeast? Or was it remobilized from the volcanic package itself? Are they vertical veins? Or are they heavily faulted and folded as we go down? We're just starting to get indications that the plumbing system beneath the surface is fairly complex.”

He noted that the structure appears to form a fold or hinge, about 50 meters below surface.

“These folds tend to act as traps. And this is where you actually get your dilation in the nose fold... typically, this is where you get your pooling of these gold-bearing fluids.”

Roebuck added that the plan is to map out the structure by drilling shallow holes at surface before seeing what's happening at depth.

“We're doing a little bit of trenching. We're exposing the vein to the north and to the south. We're power washing, we're channel sampling. We continue to impress ourselves, actually, in certain areas where we're getting really meaty thickness of the vein up to a meter, meter and a half in width; that's really encouraging.”

As an example of that work, Enforcer recently

released the results of channel sampling on the No. 2 vein which yielded an impressive result: 3,310 grams per tonne over a meter, and 1.93 g/t over a meter 20 meters away to the north. The results followed the

discovery of visible gold 51m north along the No. 2 vein two weeks earlier.

“It tells you that this is outrageously high-grade material, the system is very well-endowed with gold,” says Roebuck, punctuating with enthusiasm:

“All of a sudden it was like, wow look at the gold coming out of here. I don't know what gold smells like, but I bet those guys who were cutting that stuff smelt the gold. I mean, it's outrageous how much. That was 3.3 kilograms per tonne.”

It's not just Roebuck and his team that have seen the potential in Montalembert, despite being passed over by some of the biggest names in the business, including Falconbridge in the 80s. The company has raised $8.9 million through two financings, one last November and one in April 2017. It has a balanced share structure, with management and insiders holding 15% of the shares, institutional investors 37%, and the retail float at 48%.

Institutional investors include Alpha North Asset Management and US Global Investors. In April Osisko Mining (TSX:OSK) participated in a private placement worth $2 million.

Conclusion

Enforcer Gold is a well managed exploration company backed by deep pockets that is drilling for gold in one of the most well-endowed gold districts in the world: the Abitibi Greenstone Belt.

The company has an experienced geologist at the helm, has reams of geological data on the Montalembert property that goes back six decades, has brought in seriously qualified individuals to help figure out the puzzle presented and

already has shown the market much success without yet coming out with the assays from its 2017 drill program. This means to your author the upside for investors could still be in front of them, especially if Enforcer Gold hits its coveted discovery hole.

For these reasons, Enforcer Gold should be on all Ahead of the Herd radar screens. Enforcer Gold is definitely on my screen. Is it on yours?

If not, it should be.

Richard (Rick) Mills

aheadoftheherd.com

Sign up for Ahead Of The Herd’s free

highly acclaimed newsletter.

***

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard does not own shares of Enforcer Gold Corp (TSX.V:VEIN). VEIN is an advertiser on his site.