DIAGNOS Inc. expands artificial intelligence platform into early detection of cardiovascular disease.

A few months ago Market Equities Research Group identified DIAGNOS Inc. in a research report with several potential catalysts that exist near-term with potential to result in $150 million market cap ($1 /share) for ADK. A copy of that research report may be viewed

here. We reiterate that price target as a near-term (12-month) target, on the way to substantially higher valuations from there. Look for confirmation of diabetes screening targets being met, announcements of new deals, partner developments, earnings, and further developments in platform targeting cardiovascular disease as catalysts.

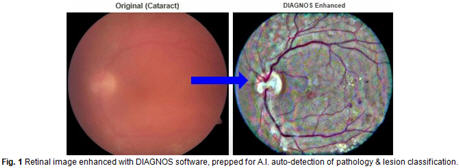

DIAGNOS Inc. (TSX VENTURE: ADK) (OTC: DGNOF) (Frankfurt: 4D4) is a Canadian-based healthcare software technology company, its 'Computer Assisted Retinal Analysis' (CARA) business has been successfully applying artificial intelligence in the diabetes market for several years via non-invasively identifying patients at risk of vision loss. The Company is active in 15 countries in total for installations of its CARA technology platform worldwide, this number and related metrics are only just getting started with the company in the early stages of a vertical growth trajectory. On September 19, 2017 the Company announced an expansion of its platform into early detection of Cardiovascular Disease; click to view release "

DIAGNOS Provides Timelines on Cardiovascular Disease (CVD) Prevention Test Development and Commercialization Plans".

DIAGNOS Inc.'s proprietary artificial intelligence algos continually learn and refine analytics from large data sets. If results from the newly announced move into cardiovascular disease (CVD) are anything similar to the success DIAGNOS has achieved with early detection of diabetes, it will affirm the Company has effectively cracked the key to early detection of heart disease via computer assisted retinal analysis, and the potential implications for shareholders of ADK.V are enormous, with dramatic upward share price appreciation being a certainty.

The newly announced calibration of the application for CVD will be done simultaneously in 4 countries (Algeria, Canada, Mexico and United States) with a minimum of 1,000 in each country with the support of 22 cardiologists. This will enable Diagnos to insure the sustainability of its solution worldwide.

Diagnos' current market cap (currently ~$20 million Canadian for ADK.V trading at 12 cents) is miniscule compared to its potential. Success in early detection of heart disease in such a non-invasive manner (for the patient), and disruptive to the marketplace, similar to that which Diagnos Inc. has already proven it is able to do for diabetes, will quickly result in the Company being a primary go-to service in a massive market place that currently spends near US$400 Billion a year in drugs and services for cardiovascular and stroke issues.

Market Equities Research Group pointed out in its June research report that DIAGNOS' foray into early detection of Cardiovascular Disease has the potential to be a MAJOR company maker. The retinal vasculature is proposed as an easily and safely measured surrogate for the coronary circulation. It is hypothesized that because retinal vessels are approximately the same magnitude as coronary microvasculature (~100250µm in diameter) they can serve as representative of processes occurring in coronary microvessels, and therefore serve as a marker for subclinical or microvascular coronary disease. Over the last 8-10 years, multiple large, prospective studies examining the relationship between retinal vascular changes and clinical endpoints of coronary disease has provided strong evidence for a positive correlation between the two. It is known that abnormalities in retinal images can potentially provide useful information about clinical and sub-clinical (not severe enough to present definite or readily observable symptoms) cerebrovascular, cardiovascular, and metabolic health of the patient. There are therefore advantages of using digital image analysis to quantify the extent of retinal pathology in vascular diseases, diabetic retinopathy (DR), age-related maculopathy and other conditions.

With or without this new foray into CVD, DIAGNOS Inc. (TSX-V: ADK) has potential to readily reach in our $1/share price target within 12 months based on DIAGNOS' current adoption rate for its CARA platform targeting diabetes alone. DIAGNOS' revenue growth curve is accelerating with monthly patient screenings up multiples year-over-year and continuing to rise. Client partners include Novartis and BAYER.

The following additional research links have been identified for further DD on DIAGNOS Inc.:

- DIAGNOS’ corporate website:

https://www.DIAGNOS.ca

- Recent Journal review:

https://www.technologymarketwatch.com/adk

- Q2 research report:

https://sectornewswire.com/MarketEquitiesResearch-ADK-June-2017.pdf

(Note: the above Q2 research report places a 12-month $1/share price target on ADK.V based on the Company’s CARA platform targeting diabetes alone).

Fredrick William, BA Ec.

Fredrick is a freelance information services professional for various media relation firms and consultant to several financial publications. He monitors and invests in the resource, technology, consumer staples, healthcare, agriculture, financial, energy, utilities, and biotechnology/pharmaceutical sectors and is the managing director of Market Equities Research Group.

***

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. The author has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. The author makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of the author only and are subject to change without notice. The author assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, the author assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report. The author does not currently own shares of DIAGNOS Inc. TSX-V:ADK however intends to accumulate.