I want to encourage all my readers to go back and reread the piece I posted last week. It had some comments about Novo's Karratha conglomerate gold project that I want everyone to memorize. Foremost to understanding what Novo is doing is the first point.

- This is an unconventional deposit. It has to be explored and tested in an unconventional way.

Karratha has aspects of both a conventional placer deposit combined with a hard rock deposit. It is placer gold in a hard rock environment. There are no other deposits similar in the entire world. There may be no other deposits in the world of similar grade. We just don't know yet. Certainly the first test was extraordinary.

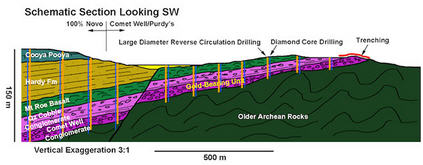

Novo has begun a core drill program strictly designed to determine the structure of the conglomerate reef containing the gold. All samples to date have been from the top of the layer. All information about thickness of the conglomerate is from looking at how the reef comes to surface and frankly guessing. The guesses for conglomerate thickness range from 5-20 meters. But we don't know and won't until core holes are drilled. Once the core comes to surface, all you have to do it look at it and measure with a tape measure and you will know how thick the conglomerate is right there.

We know the conglomerate has been covered with a basalt sheet. That is what cooked the gold and gave it the sandpaper dimple finish. More simply put, the target conglomerate was roofed with a flow of lava. If you go to Novo's website here, and scroll down to the bottom of the page, you can see the typical watermelon seed gold with the sandpaper texture. Below the picture of the gold, there is a picture of a sample with a nugget encased surrounded by small flecks of gold.

In the past Artemis and now De Grey have stated that the watermelon seed gold is similar to Witwatersrand gold. That is 100% dead wrong. Wits gold is tiny; you don't get nuggets in the Wits. The watermelon seed gold seems to be spread all over the Karratha region, I have pieces taken by people using metal detectors 110 km from Purdy's Reward in one direction and 135 km from Purdy's in another.

Among other things, I make jewelry for fun. When gold and silver harden after working by hammering or pulling, you have to heat it to a red-hot color and quench in water to soften it. When it is heated, it expands a lot. The lava cover over the conglomerate literally cooked the gold. It expanded and the halo was gold that seeped into the surrounding rock. The gold pressed into the sand and gravel and that gives it its unique texture. Again, I have never seen or heard of similar gold anywhere in the world.

Novo's sampling program will consist of three parts. They will begin by drilling a fan of short PQ size core holes on fifty-meter centers. They are drilling core right now. At Purdy's Reward there is about a 1.5 km strike of conglomerate that comes to surface that runs SW to NE. Novo plans on drilling down dip about four hundred meters farther into the basin.

The entire core program will therefore be 1500 meters by 400 meters. So a fan would be about 30 holes and there will be eight fans. They will only drill for structure. There are no plans for doing assays because we all agree that in a nuggety system core drilling will not reflect true grade.

The second phase that is also in progress is a series of trenching pits similar to the one with the results released in early August. Novo plans on doing six-ten trenches taking about 500 kg samples. Results from the trenching are expected in four to six weeks.

Last but hardly least will be to bring in a large diameter water well drill to take bulk samples of 500 kg per meter. That will begin in mid-October. The assays from the large diameter RC drill will take about six weeks to process.

I want my readers to understand something vital. Novo is not cherry picking Purdy's Reward because they expect the highest grade and best results. The only reason they are working where they are testing is because the conglomerate comes to surface. The prospectors using metal detectors proved there was some gold there and most important of all, Purdy's is permitted and has an approved Plan of Work and native approval. By no means are these results going to be the highest grade Novo expects to find. They are working at Purdy's for the same reason a dog goes into the middle of the road. Because he can.

Gauging grade of coarse gold is problematic at best. I wrote a piece that is a little complicated early this year. At Beaton's Creek Novo used RC drilling and got results, did 50-kilogram bench samples and processed a 30,000 ton bulk sample. The 30,000-ton bulk sample showed a 70% increase in grade over the 43-101 numbers from the RC drilling. As I said in my piece last week, we are never going to know the real grade until we mine. Every form of testing a nuggety system tends to underestimate grade.

For right now Novo needs to measure the conglomerate thickness and that's easy to do with the core rig. Talking to both Rob and Quinton they guess the core rig can do about 40 meters a day. The initial holes drilled at Purdy's Reward will be from the surface of the conglomerate. Further down the road, Novo will be drilling through more top cover to get to the conglomerate.

Novo estimates they can complete three holes every two days and they will be working seven days a week. The holes are easy to drill and short but moving the drill rig will take time.

I want to caution readers that right now we have no idea of the mineralization within the conglomerate layer. The only samples were from the very top. That may be the limit of the gold or the entire thing might have gold. As of today, we simply do not know.

We have just gone into spring in Australia and the days will get both longer and hotter. So it looks at first that Novo can do about ten holes a week. I would guess that the company will start releasing diagrams of the conglomerate reef every twenty or thirty holes.

At present there are no plans for doing assays of the core holes since they simply cannot accurately measure grade. That means that two to three weeks from now Novo should be releasing information about conglomerate thickness. That is going to be very important data.

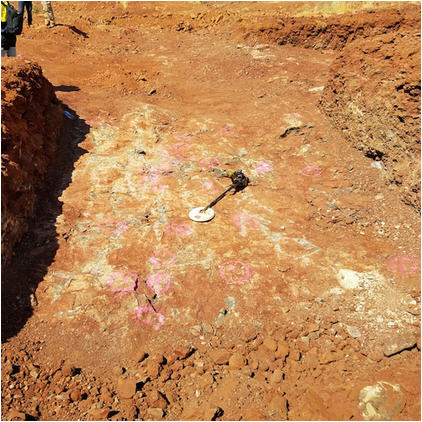

I'm going to post three pictures taken by Novo showing the trench area that starred in the live stream video at the Denver Gold Forum a week back. The viewer will have to look closely for the spray paint on the surface showing the targets but I am told Novo's guys found 356 signals with a metal detector in a ten-meter by thirty-meter patch cleared by the excavator. Each blob of paint meant some gold and for all practical purposes the gold was either at surface or within 3-4 inches of the surface of the conglomerate layer. I'm going to point something important out that hasn't occurred to anyone else yet.

Lest the reader suspect that I am some Johnny come lately who wants to jump on the Novo bandwagon now that they have made a big find, actually Quinton started briefing me on his theory in October of 2008. We made our first visit together to Western Australia in June of 2009. I've been to see various parts of the project four different times since then. I know as much about both the theory and the project as anyone writing about it.

Here are the pictures of the trench.

I going to share something with my readers that no one has ever mentioned that you really want to think about. Pretend for a moment that the lava never covered the sand and gravel and turned it into hard rock. Instead of this being a 5-20 meter thick hard rock conglomerate, it's a simple 5-20 meter thick sand and gravel bed with gold nuggets in it.

It's a placer deposit. We don't know how the gold get there or where it came from: it's a standard but very rich placer deposit.

Where is the richest gold?

Right! It's at the very bottom of the gravel right on and in the bedrock.

The richest gold is not at the top of the sand and gravel unless you can think of some way of making gold nuggets float. Nobody's mentioned that yet. The deep large diameter RC bulk samples taken from the lower parts of the conglomerate are going to be very very interesting.

As I said in my first piece on Novo in August of 2012, this is the big one. I got it then and I get it now. Fireworks will resume in 4-6 weeks and I believe will continue for the next fifty years.

Novo has been my biggest position since the company began in October of 2009. I think I paid $0.25 for my first shares. I could not possibly be more biased. Novo is an advertiser.

Please take some responsibility for your own decisions and do your own due diligence.

Novo Resources

NVO-V $6.33 (Sep 29, 2017)

NSRPF OTCQX 142 million shares

Novo Resources website

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Novo Resources. Novo Resources is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Photos and graphic courtesy of Bob Moriarty