One of the rising technology sectors is data analytics. Today, everything is tracked, measured and recorded resulting in massive data bases. The total number of data centers around the world will peak at 8.6 million in 2017, and then begin a slow decline, predicts IDC.

But this means the big will get bigger and the smaller ones disappear as growth continues. Worldwide data center space will continue to increase, growing from 1.58 billion square feet in 2013 to 1.94 billion square feet in 2018.

Data analytics refers to qualitative and quantitative techniques and processes used to enhance productivity and business gain. Data is extracted and categorized to identify and analyze behavioral data and patterns, and techniques vary according to organizational requirements.

I am very familiar with this as it was my job for a number of years at IBM as a systems and business analyst. At that time computers were not as powerful and there was fewer databases but no doubt IBM was a pioneer here. I had access to the mainframe computers, the most powerful in the world, and wrote programs to analyze data, mostly IBM's inventory data in house or customer installed. Management would request a report or analysis on some aspect of inventory management to reduce costs, improve inventory turn-around or whatever.

My masterpiece was a monthly report I created with about 5,000 to 7,000 lines of code that would report on various aspects of inventory at various locations across the country. I will not bore you with any more details of a past job, just that I have hands-on experience here.

One such company I have began to follow in this space is:

Helios and Matheson Analytics

NASDAQ:HMNY Recent Price $9.92

Shares outstanding 7.1 million

Fully diluted (1.9M RedZone note + 4M MoviePass + 6.5M convertible note) = 19.5 approximate

Helios provides:

- intuitive artificial intelligence

- predictive Big Data analytics

- data VISUALiZATION SOLUTION

It provides data analytics in many sectors that include Government, Education, Retail, Healthcare and Financial. Its goal is to be the first mover and be disruptive, especially in consumer and big-data area.

The company's focus has been crime predictive technology with its consumer RedZone map app.

What moved it into the limelight the last couple months is a majority stake acquisition in MoviePass, a company started by a co-founder of Netflix, Mitch Lowe, who commented on Fox News:

"People want to go to movies more often but price and risk of poor movie are high."

In November 2016, Helios merged with Zone Technologies, Inc., a premier global information technology company that is redefining the national predictive analytics practice. Zone was maker of the RedZone crime and navigation map, a free app for your smartphone.

RedZone Map offers one of the most sophisticated GPS-driven systems available to users today, with enhanced personal safety being the primary mission behind Zone's proprietary technology that incorporates social listening, artificial intelligence and big data.

Unlike Google Maps and Waze, RedZone Map is the first app that goes beyond navigation to address personal safety, combining GPS-driven direction with real-time crime data and social listening. The app is in the top five in the Apple App Store's U.S. navigation category, right behind Google Maps and Waze. Being the only app offering a safe route vs. risky route, RedZone Map gives its users a choice.

Covering more than 1,250 cities in the U.S., the mapping format helps consumers to be more aware of their surroundings, posting over half a million crimes committed just during the last 60 days, including crime data from the last 24 hours. It pinpoints the location of these crimes—shootings, assaults and thefts—benefiting users whether they are navigating in their own neighborhoods or traveling, and the plan is to deploy this proprietary technology globally in short order.

On June 5 Helios announced the RedZone subsidiary acquired three U.S. patents from Israel-based technology company Trendit Ltd. (TRIT.L UK Stock Exchange), among other assets. RedZone plans to integrate the patented technology with the RedZone Map™ app, in order to enable the app to track and analyze real-time crowd behavior, migration and trends. The patented technology predicts population behavior, along with population size, origin and destination, with an accuracy rate of 85–90%, and tracks demographic segmentation of a population using a population sample of 15%, together with anonymous cellular signals and demographic big data.

On July 26 the company announced Zone Intelligence™ that seeks to enhance the personal safety of its clientele using threat mapping, geospatial awareness, geofencing and alerts based on client proximity to terror, crime and other threats. Zone Intelligence™ will analyze the data collected in real-time, provide real-time threat intelligence for both domestic and international travel, and advise clients on where and when to travel and when to leave.

This year it has also added Twitter to RedZone where it will process up to 80 million tweets per day looking for criminal activity.

Helios also has advanced face-recognition technology. It basically analyzes a face and converts it to a mathematical equation and then can look for matches to that equation. If you are out and about in a major city these days it would not be uncommon for you to be photographed 1,000 times.

On April 19 the company lauched the RedZone map for London and this is planned as the start of a European roll out. In just the first week the app climbed to #3 position in all navigational categories, behind Google map #1 and Waze #2.

Based on user reviews I have seen, RedZone should gain popularity and has seen a lot of positive reviews, but it is still being refined and needs some tweaking to improve user reliability.

I believe this could eventually rival Google maps and Helios could gain millions of monthly users.

MoviePass

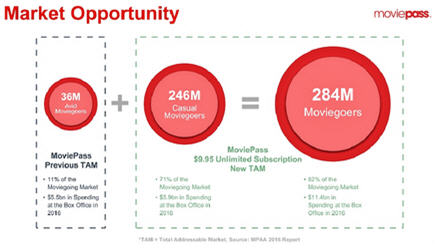

On August 15 Helios entered into a definitive agreement to acquire a majority stake of movie subscription technology company MoviePass Inc. Helios will pay $28.5 million for a 53.71% stake in MoviePass. Helios has an option to increase ownership by another 8.7% by purchasing another $20 million in MoviePass common stock.

MoviePass is available in over 91% of all theaters in the U.S. This includes AMC, Regal and Cinemark theaters, along with independent theaters. The MoviePass app enables subscribers to see unlimited movies in theaters with no blackout dates and no contracts, just a low flat $9.95 monthly fee.

MoviePass is led by Netflix co-founder and former Redbox president Mitch Lowe. Film marketing executive and producer Stacy Spikes co-founded MoviePass in 2011. Early investors include True Ventures, AOL Ventures and Chris Kelly, MoviePass' largest investor and former Chief Privacy Officer of Facebook.

"MoviePass was founded to make it easier for passionate moviegoers and casual fans to see films the way they're meant to be seen—in the theater," said Mitch Lowe, CEO of MoviePass. "Our vision has always been to make the movie going experience more affordable and enjoyable for our subscribers. We are changing the way consumers think about going to the movies by making it possible to experience a broader array of films—from the latest summer blockbuster to a critically acclaimed documentary—through a subscription model. Today's acquisition by Helios & Matheson is a huge step towards making our vision a reality by allowing us to introduce a new $9.95 nationwide subscription service that completely disrupts the movie industry in the same way that Netflix and Redbox have done in years past."

A 2016 independent report by Mather Economics found that MoviePass members showed a 100% increase in movie going. This includes a 50% increase in mid-week attendance and a 123% increase in concession revenues. In short, the subscription trumps the pay-per-view approach, reducing its high customer acquisition cost to the MoviePass risk-free, contract-free model.

Following the announcement of the new MoviePass $9.95 per month subscription price, during the six-day period from August 15, 2017 through August 20, 2017 (the "Measurement Period"), two theater chains that have partnerships with MoviePass reported outstanding attendance by MoviePass subscribers.

In one of the theater chains, during the Measurement Period, the number of theater seats filled by MoviePass increased from 206 to approximately 4,137, representing an increase in excess of 2,000% as compared to the preceding seven-day period. In the other theater chain, during the Measurement Period, the number of theater seats filled by MoviePass increased from 203 to approximately 1,795, representing an increase of approximately 884% as compared to the preceding seven-day period.

In the first 30 days after announcing the $9.95 per month plan, monthly subscribers to MoviePass surged to 400,000 from 20,000 on August 14, 2017. As of October 18, 2017, monthly subscribers has surpassed 600,000 and MoviePass is now projecting 3.1 million users by August 18, 2018.

Using the Helios and Matheson Analytics resources, MoviePass Inc. analyzes consumer trends, patterns and activities to engage subscribers with movie related merchandise, advertising and concessions relevant to their MoviePass experiences. Helios and Matheson believes its technology stack combined with the MoviePass business model will transform the movie going experience and create great value for both companies.

How it works: Moviegoers use an App on their phone to select a movie while at or near a theater and then use a MoviePass card issued to them when they sign up on the MoviePass web site and it acts as a credit card to pay for the movie ticket at the Kiosk.

Moviegoers pay $9.95 per month and can go to as many movies as they want. It is limited to only one movie per day and you cannot see the same movie twice. You cannot view IMAX or 3D movies and cannot buy advance movie tickets. No matter how you slice and dice, this is a very good deal for consumers. The key takeaway is it is now appealing to casual movie goers that are 71% of the market.

Financial

Last financials show $1.4 million in cash and revenues of $2.5 million in the first six months of the year.

The number of shares outstanding is low as the company has been financing acquisitions with Convertible notes, most of the notes used to acquire RedZone were convertible around $4.00 per share. The last of these converted in September to approximately 1.9 M shares

To acquire MoviePass, Helios Issued approx. 4.0M shares to MoviePass and raised approximately $21M with a convertible note at $3.25 per share.

Summary

The average move ticket price is about $9.00 and MoviePass pays the theater the full ticket price so it is a money-losing business. However Helios is in the business of data analytics and as MoviePass subscribers sign up it creates a new data base. As Helios CEO Farnsworth said. "We're the only company out there that can tell companies exactly who and when people are going to the movies."

If MoviePass is able to prove that it can drive incremental box office revenue to studios and cinemas, MoviePass CEO Lowe said the company can strike deals to share in the revenue from those sales, as well as from concessions. That could then lead to studios paying MoviePass to promote films to its users. MoviePass has experimented with this already and Farnsworth said 18% of users go to movies when prompted by the MoviePass app.

Farnsworth and Lowe said they want to partner with restaurants close to cinemas and possibly even with Uber to get users a ride to the theater. It's all about capitalizing on a night out at the movies, Farnsworth said. There are many areas for revenue streams.

With RedZone map the company probably has the largest crime data base in the world. As it rolls out in Europe I expect it will gain a lot of new app users. Between RedZone Map and MoviePass, Helios should gather quite huge monthly active user base. It is always tricky to value companies at this early growth stage, but I have seen market valuations from $50 up to and as high as $600 per user.

Right now with just 7.1 million shares, the market cap is only about $70 million. I believe some notes were converted adding about 1.9 million shares and if we add 4 million shares for MoviePass acquisition, plus 6.5 million for convertible note we are at 19.5 million and a $195 million market cap. I believe this is very low.

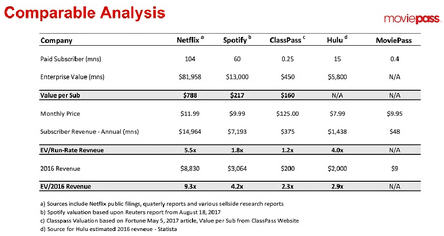

I have not seen much on numbers for RedZone users but MoviePass is planning to go public in 2018 and Helios will own about 50% at that time. MoviePass will easily have 1 million subscribers by then and a value at 1/10 of Hulu, the smallest comparison on chart previous page would mean a value of $580 million, which Helios' 50% would be $290 million, well above the current valuation.

CEO interview from August, MoviePass video

I believe the pull back from the $30 high provides a good entry point. Not a lot to go by in this chart but it does appear the stock is consolidating around $10.

Keep in mind that that this is a heavily shorted stock so I expect volatility. When a stock has only 7 million shares and is trading over 20 million per day, you know for certain there are piles of fake short volume and computer robot day trading. I checked Finra short report for Oct 11 and about 2/3 of volume was shorting. Short volume also reported on NY over half the volume.

For Oct 15, Short squeeze reports the float at 2,089,900 and an insane 83% is short. It claims 85% of the stock is owned by insiders, so a float of 2 million trading 20 million per day is more insane, but this is the type of market we have now "in the age of the computer machine."

A good strategy might be to buy half your intended position now and average down if the stock drops further.

The stock market has been booming and so has market data and stock data computer analysis. Another data analytic company I have been following in Canada is set to capitalize on this and is still very cheap and under the radar:

Analytixinsight Inc.

TSX.V:ALY

Recent Price $0.25

Shares outstanding 64 million Management/Insiders 25%

ALY has created an innovative big data analytics platform and technology engine that processes large amounts of data, rule sets, analysis models, and logical arguments to generate insights. The platform has narrative capabilities to auto generate reports for ease of consumption by end users, as well as predictive analytics capabilities. While the current application of this engine is in the financial analytics space, the platform and engine are applicable to other sectors and data sets. The company is considering opportunities to expand into the generation of social media analytics, retail sector analytics, gaming, etc.—all of which can be serviced by the backbone platform with some amount of customization.

ALY's on-line portal CapitalCube algorithmically analyzes market price data and regulatory filings to create insightful, actionable narratives and research on approximately 50,000 global companies and ETFs (exchange-traded funds), providing high-quality financial research and content for investors, information providers, finance portals and the media. AnalytixInsight holds a 49-per-cent interest in Marketwall, a mobile platform for banking and stock trading and owns Euclides,a workflow analytics systems integrator.

The company's product and technology platform is used to service both CapitalCube and Marketwall. These entities, in turn, service a variety of customers across both the individual and institutional segments. The company continues to build its individual and institutional customer bases across both its subsidiaries in the financial analytics space.

Analytixsinsight has three market segments: CapitalCube and Euclides that are contributing significant growing revenues while it has a 49% equity interest in Marketwall, a growing concern that could later been spun off or dealt in some kind of partnership. Let's look at each in more detail.

CapitalCube

CapitalCube provides analysis on stocks listed on all exchanges globally, and thus the company continues to see an expansion in the geographic spread of its customers. For the individual business segment, in the near-term, the company's efforts are focused on driving traffic and registrations for the retail online and mobile business. CapitalCube's website provides a subscription service to individual customers—primarily retail investors, financial advisers and professional financial analysts. CapitalCube's institutional partnerships with leading finance portals like Yahoo! Finance and the Wall Street Journal (www.wsj.com) have helped in increasing awareness and driving additional traffic and conversions to CapitalCube's individual customer segment. CapitalCube is working on expanding the scope of these partnerships and expects to benefit from additional traffic in the coming quarters.

CapitalCube is currently averaging approximately two million user sessions per month through various distribution channels. CapitalCube has begun custom delivery and integration of its content under its licensing partnership with Euronext, the leading stock exchange in the Eurozone. Under the terms of the partnership, the company's CapitalCube portal will deliver value added financial analysis and content, including key ratios and charts, on Euronext-listed companies to Euronext's website and mobile apps. Euronext will also market and sell CapitalCube's professional subscription licenses to various brokers, financial institutions and listed corporations in Europe.

This slide from its presentation is a good summary of CapitalCube

CapitalCube also does Predictive Analysis and forecasting:

- with a 10 point condition test to predict likelihood of dividend cuts or increases

- forecasts the probability of a share buyback

- ability of a company to make acquisitions or to be acquired

- unique performance score for fundamentals, earnings and dividends

Marketwall 49% interest is currently the other financial platform

Marketwall's customers are primarily institutional firms. Marketwall continues to benefit from the branding and marketing support it receives from the partnership with Samsung, as well as other hardware manufacturers like MiiA and Netrange. These partnerships have significantly increased the number of downloads of the Marketwall App. These download catalysts and Marketwall's partnerships with leading financial data and news providers such as Morningstar, BATS, etc. have provided the ability to pursue institutional customer opportunities.

Marketwall currently has a five-year licensing and integration project with Intesa Sanpaolo S.p.A ("Intesa Sanpaolo"), one of the leading financial institutions in the world. As part of the project, Intesa Sanpaolo will incorporate Marketwall's mobile capabilities with its existing product and service portfolios for its retail banking customers. Intesa Sanpaolo is Italy's largest retail bank with over 4,000 branches and a market capitalization of €40 billion; Marketwall is providing a custom version of the app for Intesa Sanpaolo's 8 million stock-trading clients, to be rolled out in the first half of 2018.

Marketwall derives revenues from subscription fees, licensing fees, advertising and development work. The company has also seen interest from leading financial services companies to partner on potential new business opportunities in the B2B segment—including incorporating trade execution and payments. It compares to some platforms you might be familiar with like Scotia iTrade or TD Greenline.

Marketwall's revenue for the second quarter of 2017 was $1,850,497, compared with $283,766 in the same period in the previous year. Marketwall recorded strong revenues after reaching an invoicing milestone on its contract with Intesa Sanpaolo's mobile banking division. The company and Intesa Sanpaolo expect to spin out Marketwall following the completion of Marketwall's product integration within Intesa Sanpaolo's mobile platform. The completion of this integration is expected during the second half of 2017, and is expected to result in the migration of over eight million retail banking customers of Intesa Sanpaolo to Marketwall.

Marketwall uses CapitalCube analytics within its mobile app.

Euclides Technologies

In first quarter 2017 ALY completed the previously announced acquisition of certain assets of Euclides. Euclides is an expert systems integrator and consulting partner for field service management solutions and has touch points to over 100,000 field service personnel. Euclides was founded in 2006 by three senior veterans of ClickSoftware, a premier Field Service solutions vendor. Headquartered in Cambridge, Massachusetts, Euclides operates globally, serving clients in North America, South America, Europe, Asia and Australia.

AnalytixInsight's machine learning platform and artificial intelligence capabilities are well suited to serve today's analytics and scheduling requirements within the field service management (FSM) industry. The FSM industry is being shaped by trends such as the Internet of Things, which generates data, and workflow analytics tools that can deliver predictive analytics, enhanced auto-scheduling, improved work order management and skills-based dispatching.

You would recognize many of its customers names, like Liberty Mutual, Best Buy, AltaGas, Xerox, Siemens and Pacific Gas and Electric, among others.

You can get a further idea what this does if you review the case study for Best Buy.

The order backlog continues to grow and currently stands at approximately $3 million, which is on track with expectations.

Financial

Last financials for Q2 2017 reported end of August show $549,665 cash and no long-term debt.

The company's revenue for Q2 (excluding Marketwall) was the highest in the company's history at $967,946, which is more than triple the revenue during the same period in the previous year of $302,235, and 289% over first quarter revenues of $334,418. Marketwall's revenue for the quarter was the highest in Marketwall's history at $1,850,497, a six-fold increase when compared with $283,766 in the same period in the previous year.

Revenue for the first six months was $1.3 million with $967k of that in the second quarter. The six month revenue is about 160% growth over the same period in 2016. This does not include revenue factored in with Marketwall, but with those equity gains the Q2 financials show ALY is basically break even.

Summary

ALY has been trading for just about five years and with most start ups and small tech companies it takes time to move from development, implementation and revenue growth, but ALY seems to be coming into its own now with an excellent platform of products.

Its market cap or valuation is only $16 million and using the Q2 revenue numbers and assuming no growth, its annual revenue run rate is about $3.6 million. Assuming just conservative growth we could be around $5 million at year-end, especially since Eucilides is just starting to kick in with Q2 numbers. Trading around 3 times revenue, the stock is not real cheap but not expensive.

Check these samples of CapitalCube analysis:

CapitalCube sample of analysis on Apple's Dividend

CapitalCube sample of earnings analysis Fortis Inc.: CapitalCube gave a very favorable analysis on earnings potential on September 20, since then the stock has rallied significantly, I expect in anticipation of good earnings report on November 3.

What could drive the stock price more so than revenue is user growth. There are around 2 million users sessions per month at CapitalCube and this will continue to grow.

End of August the company announced an agreement with a leading African media and financial group to jointly create and launch an online platform for African equity markets. Over the past decade, African equity markets have produced above-average returns in emerging markets, but the overwhelming concern for investors continues to be data availability, quality, logistics and liquidity. A joint product offering between AnalytixInsight and Ai, with a Pan-African reach, will enable institutional investors, high-net-worth and retail investors to increase exposure to these markets.

The joint offering platform will provide investors with data driven insights to evaluate and capitalize on opportunities offered within the African capital markets. The platform will be a premier source of financial data and analysis for 16 African exchanges, covering over 1,000 African equities, with an objective of providing domestic and offshore investors easy access to multiple African capital markets.

This should start to add growth in Q4 2017 and more so in 2018

You never know what catalyst could provide a surge in users and a much higher valuation on the stock. We saw what happened with Helios above when it moved its data platform in to aid a popular program like MoviePass. Helios went from $3 to $30, a ten-fold increase.

Another way to see the value in ALY is when compared to Helios that has US$195 million market cap. ALY is around US$13 million, a small fraction the value of Helios.

I believe a good way to have exposure to this sector is own both stocks. On the ALY chart, the stock broke out through resistance around 25 cents and has now come back to that level which should now act as support and provides a very good entry price.

This article came out as I was finishing this letter and is worth a read, the computers are taking over.

Rise of the machines: Canada's first AI-run ETF set to hit the market

Portfolio management duties are now being handed over to robots as Canada's first artificial intelligence (AI) exchange-traded fund hits the market on Nov. 1.

With the ticker MIND, Horizons ETFs Management (Canada) Inc. is set to launch the Horizons Active A.I. Global Equity ETF—an actively managed investment strategy entirely run by an AI system that extracts patterns from analyzing data.

MIND is able to evaluate and narrow down an investment base of 32 global equity ETFs to between five to 20 ETFs it will invest in. With a management fee of 0.55%, the ETF uses technology that is able to support algorithms that can gather information and analyze enormous data sets to solve problems.

Designed by Qraft Technologies, a financial technology firm based in South Korea, the initial framework of the AI programming monitors more than 50 investment metrics including money flow, six-month relative performance, 90-day volatility, beta and 80-day simple moving average.

Ron Struthers founded Struthers' Resource Stock Report 23 years ago. The report covers senior and junior companies with ample trading liquidity. He started his Millennium Index of dividend stocks in 2003 - $1,000 invested then was worth over $4,000 end of 2014 and the index returned 26.8% in 2016. He retired from IBM after 30 years in customer service, systems and business analyst, also developing his own charting software. He has expertise in junior start-ups and was a co-founder of Paramount Gold and Silver.

Disclosure:

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: I currently own 10,000 shares of ALY. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Struther's Resource Stock Report Disclaimer:

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

Copyright 2017, Struther's Resource Stock Report

Charts and images provided by the author.