- Increasing lithium battery production a challenge

- Can Tesla overcome its battery bottle neck?

- The environmental Catch 22

- Is Asia (China) the answer ?

- Elcora looks to be new LIB anode supplier

The big news out of Tesla (NY:TSLA) in early October was when it announced a large shortfall on its plan to build 1,500 Model 3s (first mass market car) in the third quarter. The actual number came in at 260, or 83% less than promised. This announcement is probably a sign of challenges that Tesla and perhaps all EV makers may face as they try to build more affordable electric cars.

The feeble numbers can be traced back to the Nevada Gigafactory where Tesla builds batteries for the cars. An outside supplier responsible for part of the process of assembling batteries into modules, into packs, "dropped the ball," Tesla CEO Elon Musk said, and Tesla was forced to take the work in-house. "We had to rewrite all of the software from scratch and redo many of the mechanical and electrical elements," he says. "This is what I've spent many a late night at the gigafactory working on."

"Dropped the ball" is a pretty vague explanation of the problem, but safe to say, "the ball" is lack of battery production for whatever reasons. Building cars is not all that complicated as manufacturers around the world have been doing it for decades. The problem is—and going to continue to be—the ramping up required lithium ion battery (LIB) production. It is the same thing as building the cart before the horse. The Gigafactories are coming, but will it be soon enough, and can they source the considerable raw materials they will need? I see this as the biggest challenge to the Electric Vehicle (EV) market.

I am going to delve deeper into the battery market and make you aware of the challenges that lie ahead, what will be disrupted and suffer and what could bloom and flourish. Then you can decide if Tesla and others can overcome the battery bottle neck.

Tesla's Model 3 will use 50 kWh or 75 kWh, so we can use a 60 kWh average and to meet its1,500 production rate per quarter is 6,000 per year X 60 kWh = 0.36 gWh. Model 3 is just in production ramp up. Tesla released its delivery numbers for the first quarter 2017 and achieved both record deliveries and production during the first three months of the year: approx 13,450 were Model S and approx 11,550 were Model X. Delivery numbers for Q3 2017 were a little higher at 25,915 Model S and X. Using Q1 Model S production we can calculate 53,800 per year and the S uses a 75 kWh or 100 kWh battery, so average of 85 kWh equates to 4.573 gWh. The Model X uses a 100 kWh battery and again extrapolating to a years production would require 4.62 gWh.

At current production rates, their cars will consume almost 10 gWh per year. It is hard to get any solid figures from Tesla on Gigafactory production rates, but this article from August suggests the Nevada factory is only 30% of its planned finished size and that makes sense at a current run rate of 10 gWh and the finished factory has planned output of 35 gWh.

Now add in Powerwall 2 that stores 13.5 kWh and the Powerpack 2 stores 200 kWh. In Q3, Tesla deployed 110 MWh of energy storage systems, growing 12% from the prior quarter and increasing 138% year-over-year, driven mainly by increased Powerwall deliveries. This equates to 0.44 gWh per year, and it is no secret the constraint on this number is simply not enough battery capacity highlighted by greentech last week.

Considering Model 3 is suppose to be a massed produced car and production should eventually outpace Model S and X. By the time Tesla gets the Nevada Gigafactory to full production they will have to start building the next one.

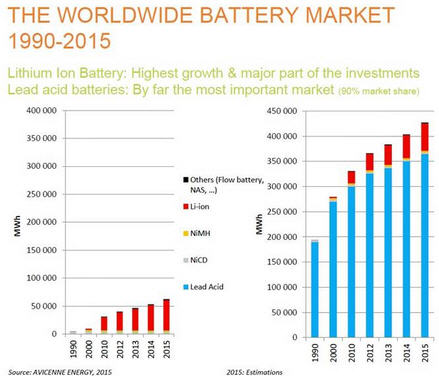

To see where the market is and where we need to go, this chart from Avicenne is an eye opener.

The LIB market is seeing strong growth, but lead acid is still 90% of the market. Considering EVs will require a lot more battery—the required production growth for LI B will be enormous.

The Tesla Model S uses and 60 kwh or 100 kwh LIB. A typical lead acid car battery may be rated for 100 amps or a 1.2 kwh rating. It is easy to see an EV will require 60 times more battery and than some. If EVs displace just 10% of the gasoline engine market it will turn this chart upside down and be the exact opposite with LIB at 90% of the market. Volkswagen is targeting 25% sales volume of EVs by 2025, a UBS report expects 30% penetration in Europe by 2015.

This next slide also from Avicenne will give you an idea of the investment and cost reductions underway. It cost $250/kwh on average for LIB production in 2012 to 2014 and just $150/kwh from 2014 to 2017. You will also notice that Tesla is investing heavily but this is somewhat dated and BYD out of China is blowing right by Tesla.

Tesla and Panasonic announced in 2014 their plans to build a "Gigafactory" capable of producing 35 Gigawatt hours (GWh) of battery cells every year, that was big news. Most of us here in North America relate to this but a lot has happened in the past few years. Led by China, battery cell manufacturing capacity has more than doubled to 125 GWh, and is projected to double again to over 250 GWh by 2020.

This Forbes article claims that total cell production capacity will need to increase tenfold from 2020 to 2037, the equivalent of adding 60 new Gigafactories, during that period. Battery technology originated in Japan; was then further developed by companies in Korea; and is now shifting strongly toward China.

Volkswagen is well aware of the problem. In Europe Auto news this July VW says it sees a huge shortage of batteries by 2025 and the industry needs 40 gigafactories. And this will just be a stepping stone. Britain is to ban all new petrol and diesel cars and vans from 2040 amid fears that rising levels of nitrogen oxide pose a major risk to public health. This follows a similar pledge in France.

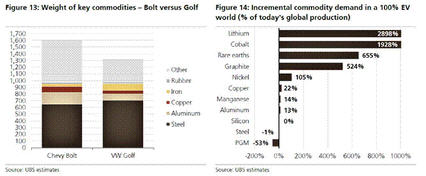

I mentioned the UBS report above and I believe it is a must read; they tore down a Chevy Bolt and analyzed all the new, the more or less used materials, and who will benefit and who might be disrupted. A few important takeaways:

- Commodities, LIB supply chain would be most disrupted, in particular lithium, cobalt and graphite.

- The Bolt is almost maintenance-free. Fewer parts to replace and no fluid changes, such as engine oil. The after-sales revenue pool could drop by ~60% or >$400 per vehicle per year.

- The Bolt has 6 to 10 times more semiconductor content than a ICE car so current OEMs could be negatively affected and semiconductor companies positively.

This graphic in the UBS report is a great summary.

Before I go further I want to address one other potential problem. Could the next generation of batteries or new technology undermine the current LIB market? Few realize how long it takes to bring a technology to the commercial stage and be reliable for long-term use for something so big and important as automotive. Engineers have been working for decades improving ICEs and already over a decade refining LIBs.

A year ago, I asked several questions with LIB expert Dr. Edward Buiel. At the time he was running Coulometric that offered an array of testing and development services for LIBs, supercapacitors and NiMH batteries. He was a colleague and worked with Jeff Dahn who is now at Tesla. In fact Dr. Buiel was a Ph.D student under Prof. Jeff Dahn where he completed his thesis on Hard Carbon Materials for LIBs.

When I asked him if he has seen any other technology on the horizon that could displace LIBs, the answer was a flat out 'No.' Volkswagen echoes the same thing. Urich Elichhor, head of R&D for the world's largest carmaker, was talking (noted article above) about advancements using lithium sulphur and lithium air chemistry but predicted it could be 15 years for that technology to become available. He is convinced the time for electric drive has arrived regardless of the comparatively low amount of cell supply.

This next graphic from UBS focuses on the commodity demand that will be asserted by LIBs. I want to point out a flaw or misleading factor in this chart. It appears there will be much more demand on lithium and cobalt compared to graphite, but the opposite is the reality.

Graphite already has a large market outside of battery storage so the percentage increase in the overall market is smaller when compared to lithium where the #1 demand usage is already from LIBs so LIB demand is already the biggest factor in lithium markets, but is just starting this influence on graphite markets. That is why lithium prices have responded ahead of graphite. Always be cautious of numbers, because they can be skewed to paint different pictures.

While on this topic, I also asked Dr. Buiel about amounts of lithium and graphite in LIBs and it boils down to a pure scientific formula as follows. The graphite used in LIBs has a capacity of about 350-360 mAh/g. An LIB has a nominal voltage of about 3.8V and so the capacity of the graphite is 355 mAh/g X 3.8V = 1.35 Wh/g of graphite. So, a 60 kWh Tesla battery will contain 60,000 / 1.35 = 44,444 g of graphite or 44.4kg of graphite. The stoichiometry of Li in graphite is LiC6. Therefore, this will give you the ratio of Li to graphite in a cell. Li is introduced into the LIB through the cathode and electrolyte.

In simple terms this mean six times more graphite in a LIB compared to lithium.

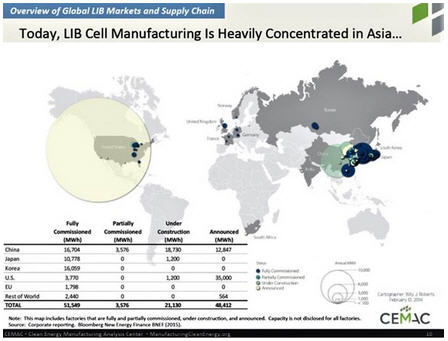

I am going to focus some on graphite but first a look at China. The country is the manufacturing basket of the world and as such has the biggest pollution issues and is at the forefront of EVs and LIB manufacturing. China is the largest auto market and in September also joined the ranks to ban vehicles powered by fossil fuels. This map gives a clear picture how important China and Asia are with EVs and LIBs.

What China has commissioned or partly plus under construction is 39,010 Mwh, which is almost eight times more than the U.S. at 4,970 Mwh. Korea and Japan are well ahead of the U.S. as well. Over here we hear lots of noise because of Tesla and it represents most of the circles in the U.S. but it is not very big in the overall scheme of things.

I believe Tesla will succeed with Jeff Dahn, as Dr. Beattie (CTO of Elcora) pointed out to me. It was very difficult before Dahn developed HPC for a cell manufacturer to do any development work or even qualify new materials because it would take years to get the longevity test results. This is largely how Panasonic and others got to the forefront of LIB technology through a very long process of slow refinement. Now with what Jeff has developed, you can get results in weeks and rapid battery development is now possible. I think the better question to ask is whether or not Tesla would have contracted Prof. Jeff Dahn and his lab at Dalhousie University if the company was not going to try to develop its own battery technology.

This is fine and dandy, but the bigger issue is the supply of graphite, lithium and cobalt/nickel. This is what I call the environmental catch 22. Many of these countries pushing EVs to improve the environment also have a very restrictive and time consuming process to get environmental approval for new mines. In many countries it can take 5 to 10 years to get environmental mining approvals.

China has been producing its own raw materials, in particular graphite, but the country is using most and no longer exporting much. Tesla has stated it prefers to source its materials in North America but this is probably not realistic.

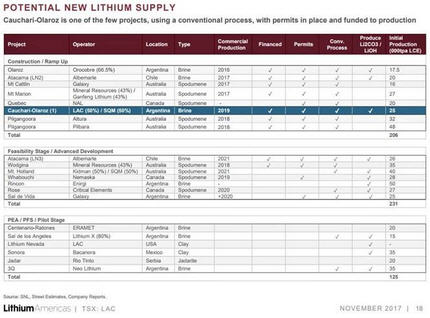

There is little hope for any big lithium mines in North America, perhaps a few smaller ones. Over half the world's lithium resources are in South America so its probably the best hope for more quantities of the white metal. Newest significant production looks to be Lithium Americas TSX:LAC, OTC:LACDF moving ahead with Stage 1 on its Cauchari-Olaroz project in Argentina with initial production in H2 2019. Also some new supply in Australia, a good summary on this slide in the Lithium Americas presentation.

To date investors have been more focused on lithium than graphite. It is easy to see with this chart of the Lithium ETF 'LIT.' Note the price rise and more so the surge in trading volume. My last pick in the lithium market, Quantum Minerals QMCQF, surged from 10 cents to $1.50, another sign of this bubbly market. LIT's holdings include two of the top lithium producers, Albemarle Corp. and FMC Corp., but the main revenue driver in these companies is actually other metals/materials. The ETF also includes Samsung, LG Chem, Panasonic and even Tesla, so it is really more a battery tech ETF than lithium.

The best way to invest directly in lithium is some of the juniors with a total focus there, but these small stocks are risky and we already have a 300% or so move up move in lithium prices, providing lots of alcohol in the punch bowl.

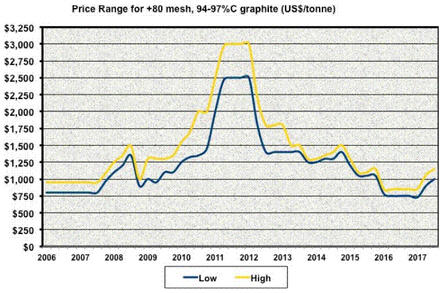

Graphite seen an initial move up in 2010/11 until China supply pushed the market down. However, the market started changing in 2016 as China has run into its own graphite supply problems for its domestic market, let alone exporting any.

In October, Benchmark Mineral reported that three graphite anode plants with an annual capacity of 100,000 tpa are being built by LuiMao Graphite in conjunction with BAIC Automotive Group Co., Ltd, ShanShan Technology and BTR New Energy Materials, with Hitachi Chem building a new facility in Japan. This will bring the total new capacity from the four anode megafactories to 360,000 tpa by 2020—a tripling of capacity on today's levels and enough to produce 300 gWh of LIBs or 6 million pure EVs the size of Tesla's Model 3. Just these factories alone will require over 800,000 tpa of mined graphite.

To give you an idea of the scale in graphite demand required, lets only consider Tesla's Gigafactory going from 10 gWh to 35 gWh in the next one or two years, so an additional 25 gWh. From the calculation of Dr. Buiel above, a 60 kWh Tesla battery will contain 44.4 kg graphite. There is 1 million kWh in a gWh so 25 gWh equates to 416,666 Tesla 60 kWh batteries or 18,500,000 kgs graphite or 20,392 tons graphite. To produce battery grade graphite (anode material) over 50% of the mined graphite is lost in the process and to simply round up, the Tesla Gigafactory expansion will require 45,000 tons per year of additional mined graphite.

Northern Graphite NGPHF has a graphite deposit with environmental permits in place and Mason Graphite MGPHF is getting close, both are in Canada, but even if these obtain financing and construction started today, it could take two to three years to see production. Northern Graphite's bankable feasibility is for 15,900 tons per year, so not enough. Mason's Preliminary Feasibility on its Lac Gueret Graphite project in Quebec envisions producing 51,900 tons/year.

Graphite companies appear to be on two different strategies, with some trying to compete with China, and others planning to complement China's plan and develop new resources for that market.

With the later, one such company is:

Elcora Advanced Material TSXV:ERA OTC:ECORF Recent Price C$0.30

Elcora Resources Corp. (ERA:TSX.V) has small production from its Ragedara mine in Sri Lanka. It is fully permitting and producing with an objective to ramp up production to 10,000 tpa. Elcora is also securing other mines in the country as well as neighboring countries that can provide close access to Asia markets.

Elcora is not really a miner but a vertically integrated company to supply anode material to the LIB market. To provide the best quality control and a superior product, Elcora belives it is an advantage to control the graphite from production to finished anode product for LIBs or graphene for the current scientific research. To that end it has built a state-of-the-art lithium ion battery research and development laboratory in Halifax, N.S., to serve a growing market.

Elcora produces world's best graphene

Led by Dr. Ian Flint, Elcora has already proven it can produce the best graphene in the world.

Dr. Flint has over 25 years of experience in graphite metallurgy, engineering and processing. He also has a strong background in equipment and circuit designs, the development of materials, physical processing, hydrometallurgy and pyrometallurgy. Prior to joining Elcora, Dr. Flint has worked at Bissett Creek, Victoria Graphite, Quinto, Crystal Graphite Corp., Integrated Carbonics, and Worldwide Graphite. Dr. Flint also has over 10 years of teaching experience at Dalhousie University on mining engineering and graphite processing. Dr. Flint's knowledge formed the funding block of Elcora's proven technologies for graphite processing and graphene production. Here is an excellent youtube video with Dr. Flint and graphene.

The Centre for Advanced 2D Materials (CA2DM) at the National University of Singapore (NUS) tested Elcora's graphene. CA2DM has been dedicated to graphene R&D since 2010 and has received over $200 million in funding. It is reported that the director of CA2DM, Dr. Antonio Castro Neto, played an important role in informing the Nobel committee regarding whether the Nobel Physics Prize should be awarded to Russians Andre Geim and Konstantin Novoselov of Manchester University in 2010. In recognition of Dr. Castro Neto's contribution to the graphene industry, Science For Brazil named him the "Graphene Godfather." CA2DM tested a large number of graphene samples from suppliers worldwide including well-known commercial producers from North America and Europe. It was concluded that Elcora's graphene is best quality in all areas tested,including the percentage of graphene content, average number of layers, and consistency in size.

Dr. Castro Neto on graphene: "It's one atom thick; it conducts electricity extremely well at room temperature; and it's completely transparent. That means the number of applications for graphene is only limited by your imagination."

Now can Elcora produce the best battery anodes?

Elcora's lab is focus on quality control and developing its EL-I-C6 graphite anode powder for lithium ion batteries. Graphite powder is routinely tested using industry-standard cells to ensure the coulombic efficiency, reversible capacity, first-cycle loss and rate capabilities of the product are within Elcora's specifications. These traceable results will give customers confidence in Elcora's materials and their reliable performance.

The research and development laboratory is testing graphite from multiple sources within the supply chain, directly from the mine, processed or refined graphite, and convert it into fully functional lithium ion batteries. The company's capabilities include: mineral processing, refining, graphite particle size reduction and sizing, spheronization, purification, electrode slurry mixing, electrode slurry coating, drying, slitting, cell fabrication, cell testing, and advanced electrochemical analysis.

Another of the Jeff Dahn/Tesla alumni is Dr. Shane Beattie as the chief technology officer for Elcora. Dr. Beattie has more than 15 years of experience in energy storage and anode development. He earned his PhD working with Jeff Dahn at Dalhousie University. His postdoctoral fellowship was with Dr. JeanMarie Tarascon at the LRCS, UPJV, Amiens, France. More recently, he was the technical director at Warwick University's battery pilot scale-up line.

Dr. Beattie will be responsible for expanding the company's existing capabilities to include testing of pouch cells, evaluating different graphite sources, supervision of the anode facility construction and related personnel, and interfacing with clients. He brings valuable experience working with several automotive companies using lithium-ion technology and with cell manufacturers.

On June 6, Elcora announced it is working closely with several lithium-ion battery manufacturers. Elcora has provided multiple kilograms of its purified, spheronized graphite anode powder to prospective customers. At that time Elcora had generated quality data from 18,650 cells using both nickel manganese cobalt (NMC) and lithium-iron-phosphate (LFP) cathodes. The data show that Elcora's graphite anode power is suitable in both high-power and high-energy density applications.

China inroads

Given the large Li-ion manufacturing base, Elcora plans to source graphite material near Asian markets. The company has operations in Sri Lanka, inroads through Singapore and has now opened an office in China to facilitate ongoing discussions with battery customers. Elcora is essentially negotiating with battery manufacturers who are looking to secure long-term contracts for graphite resources.

Elcora's graphite anode powder has been tested by numerous high-profile battery manufacturers with positive results and supply contracts are being negotiated.

In addition to graphite processing capabilities, Elcora also has internal expertise in Li-ion batteries. Elcora's Battery Technology (BT) lab is currently undertaking research and development projects for next-generation Li-ion battery technology.

A key project involves using Elcora's graphene in Li-ion battery electrodes to increase capacity and power. This successful project will result in batteries that can be fully charged in minutes rather than hours. The BT lab is also used for quality control and analysis of Elcora's graphite anode powder to ensure customers receive consistent and state-of-the-art graphite anode powder.

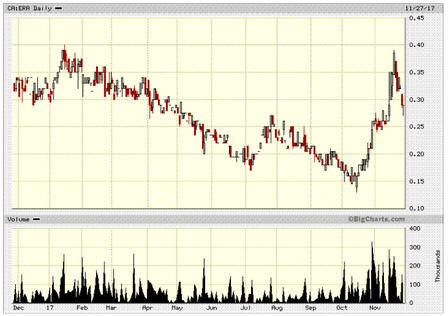

Interest has been picking up in the stock and it recently tested it's high near $0.40, the pullback from that provides a good entry point. Any progress towards supply agreements for their LIB anode material could impact the valuation very positively.

Ron Struthers founded Struthers' Resource Stock Report 23 years ago. The report covers senior and junior companies with ample trading liquidity. He started his Millennium Index of dividend stocks in 2003 - $1,000 invested then was worth over $4,000 end of 2014 and the index returned 26.8% in 2016. He retired from IBM after 30 years in customer service, systems and business analyst, also developing his own charting software. He has expertise in junior start-ups and was a co-founder of Paramount Gold and Silver.

Disclosure:

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Elcora Advanced Materials, Northern Graphite and Quantum Minerals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies referred to in this article: Quantum Minerals. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

(c) Copyright 2017, Struther's Resource Stock Report

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

Photos and graphics courtesy of the author.