After several attempts in vain, it seems like Tinka Resources Ltd. (TK:TSX.V; TLD:FSE; TKRFF:OTCPK) has finally found what it was looking for: mineralization on the highly anticipated target Zone 3. Drilling in Zone 3 isn't easy as the terrain in this area is steep, and the drilling itself took longer than usual, causing earlier hole 091 to be abandoned after no less than six weeks of drilling it. The rig was also badly needed for resource drilling at the time, so it was of better use elsewhere (South Ayawilca). Notwithstanding this, CEO Graham Carman didn't forget the significant green alteration appearing at the very end of the drill core of another abandoned drill hole in Zone 3, hole 081, caused by chlorite, which is a strong indicator mineral for zinc. He needed a definitive answer from Zone 3, and deepened hole 091 another 145 meters. This time he and his crew had more luck and finally hit economic grade mineralization. What this could mean for the resource will be explained in this update.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in U.S. dollars, unless stated otherwise.

Please note: the views, opinions, estimates or forecasts regarding Tinka's performance are those of the author alone and do not represent opinions, forecasts or predictions of Tinka or Tinka's management. Tinka has not in any way endorsed the information, conclusions or recommendations provided by the author.

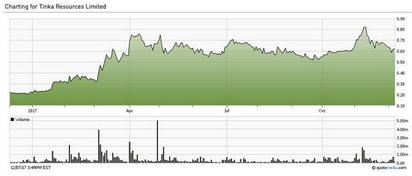

Things are getting interesting again for Tinka on the exploration front, after the company outlined the resource on South Ayawilca and updated the total Ayawilca resource estimate to 42.7Mt @7.3% ZnEq on a US$55/t cut-off (about 3.6% ZnEq cut-off grade). As Zone 3 is a large target, and mineralization is abundantly found at Ayawilca, I wasn't too concerned about the first misses. The current resource already indicates a pretty economic and sizable project, but investors (and management) were hoping for more, which might have been one of the reasons the share price didn't hold on to higher levels as much as anticipated after the resource update on November 8:

Base metal sentiment in general has been lower as well during the last few weeks, although zinc prices are slightly above $1.40/lb, which is well above long-term forecasts. LME zinc inventories are sinking close to 10-day supply levels now, which is deemed to be critical by experts, and could cause a spike in prices, as happened in 2007. Besides this, although I was attending a mining conference in London (Mines&Money) a week ago, a lot of conversations involved things like the inevitable blockchain technologies, cryptocurrencies and electric vehicles (EV), and the general feeling was that these developments are draining capital from junior mining stocks at the moment, which could also be a factor. I am not too worried about the prospects for Tinka though, as it already is one of the best zinc deposits on the market, with likely excellent economics, and markets usually tend to reward quality sooner or later.

The latest exploration news could improve these prospects even further in my view, and management is eager to do a lot more drilling. With the warrant conversion executed by Sentient and IFC, the treasury is estimated to be C$8M at the moment, and this is enough cash to do a lot of drilling in the first half of 2018, update the resource again and complete the PEA most likely in Q2 2018. For now there is a "rain" slow down, so just one rig is at work until February–March, with one idle rig located on site, which considerably shortens the period to activate it. When the rainy period ends in March/April, the plan is to increase drill production again.

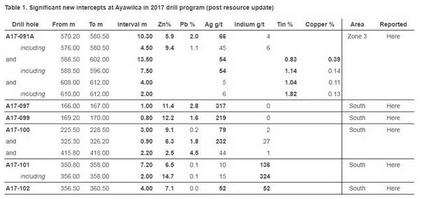

Eyecatcher of the latest batch was, of course, drill hole A17-091A (previously A17-091, which was deepened from 480 meters to 625 meters depth), which was drilled in Zone 3, the most anticipated target after South Ayawilca. A map with drill collar locations can be found a bit later in this article.

It was a very interesting hole with lots of different kinds of mineralization, but on first glance the 10.3m @10.5% ZnEq with 5.9% Zn stood out. More on this later. In addition, drill hole A17-100 has extended the known South Ayawilca zinc mineralization by about 200 meters eastward, with mineralization still open. The intercept of just 3m with a true width being at least 85% of this is at the edge of economic mining methods as it is near horizontal. The full table of results can be seen here:

CEO Graham Carman was very pleased with the results from A17-091A, and disclosed some of his plans as well in his comments which can be found in the news release:

"We believe the new intercepts in drill hole A17-091A are very significant, as they open up the Zone 3 area for potential resource expansion in an area that has seen little drilling. The same magnetic anomaly that outlines the Ayawilca Zinc and Tin Zones continues into Zone 3, extending the prospective zone by hundreds of metres to the northeast. A drill rig will continue to operate in the Zone 3 area following-up on this exciting discovery. Drilling is now expected to continue well into 2018 without a break, other than for the Christmas period."

"These holes are the first to be released following our zinc and tin resource update (see Press Release Nov 8, 2017). Already, new results are indicating that the project is likely to continue to grow with additional drilling. Drill hole A17-100 intersected 3 metres grading 9.1 % zinc in a 200-metre step-out hole from the resource at South Ayawilca. A large 750-metre gap remains undrilled between significant zinc intersections at South Ayawilca and Zone 3. While exploration drilling continues with the goal of expanding the project resources, we are concurrently working on de-risking the project through metallurgical tests of the two main styles of mineralization as well as beginning preliminary desktop mining studies. We look forward to providing updates on these programs as they progress."

I believe he could be on to something as well. Four things stood out for me about hole A17-091A:

- mineralization was at a greater depth of >500m

- zinc intercept wasn't wide but occurred in a much wider zone of massive sulphide

- nearby drill hole A14-031 had also comparable mineralization

- the hole also contained a tin and copper intercept

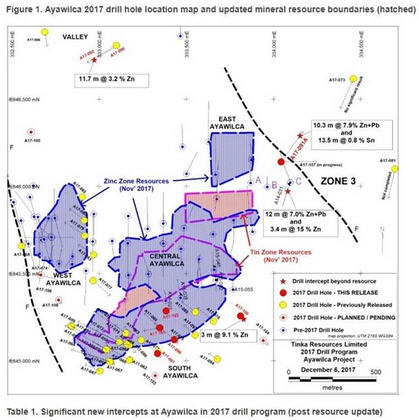

To get the picture, the locations of the drill holes can be seen here. Note the earlier mentioned A17-081 to the far right, and also A17-073, which didn't return significant results, indicating a potential upper boundary for mineralization:

Please note the earlier holes that I labelled A, B and C. C is A14-031 with economic grade zinc mineralization, as shown in the figure, and hole A14-028, containing 63m @0.26%tin and 0.2% copper. Hole B (A15-050) had 8m @2% zinc. Hole A, which is hole A14-24, intercepted 40 m @4.1% zinc with some silver/indium and 5m @0.9% tin and 0.4% copper at the edge of East Ayawilca from 320 m depth. So clearly, mineralization is wide open to the east, and may even connect with hole A14-031 and A17-091A on both sides of the fault (dotted line F trending SE-NW), but time will tell. This connection isn't too far-fetched, as both holes drilled into limestone, which is the principal carrier of mineralization (limestone in blue):

This is actually a pre-drilling cross section, but the basic concept behind it still seems to hold up very well. The upwards folded limestone structure is called a "syncline" in geology. As the thickness of the limestone at Zone 3 is at least double the thickness of other mineralized zones at Ayawilca, the massive sulphides in this thicker limestone could be more extensive as well. The airborne magnetics show strong anomalies as well at Zone 3 (see map further below).

Because of the copper and tin mineralization at Ayawilca as well as the zinc, the porphyry intrusive (red zone in the cross section) about 3km to the east that outcrops at Los Pinos could be the source of the mineralization overall. The zinc mantos (horizontal mineralized envelopes) themselves (which have to be fed by faults as well of course, probably coming through the basement rock below) could have been the feeders for the thicker "chimney" style mineralization at West and South Ayawilca. The thick chimney mineralization could have been caused by the manto mineralization being trapped near fault structures, and had nowhere to go but up.

Another subject is that zinc and copper often appear on the same location, with zinc settling on the outer edges of copper mineralization. This could be the case here. When I asked Carman about plans/drill permits to look into the intrusive to find this possible main feeder it appeared this was a bit too farfetched for now, as he indicated the intrusive itself was probably not a target for now. The magnetics do support ongoing sulphides to the east so who knows:

It is also interesting that the highest magnetic intensity is not always being located at the center of mineralization, like at South and West. This seems to be consistent with the current mineralization being positioned around the edges of the strongest magnetics. Therefore, magnetics aren't a direct indicator of mineralization.

What could these new results imply for Tinka? The area east of Central to the northeast where A17-091A is drilled is virtually unexplored and could contain connecting mantos, or chimneys. If I would assume a 500m long, 200m wide and 10m thick mineralized envelope there, this could result in another hypothetical 3Mt. If A17-100, which indicates a thinning out manto to the east, could materialize into a 500m long, 200m wide and 3m thick envelope, this could also add a hypothetical 1Mt. As a number of thin mantos more to the surface (depth of 200-250m) could connect West, East, South and Central, this could add another hypothetical 2–5Mt at most I believe.

If A17-081 can be deepened (which may not be possible) or redrilled, and generates the same results like A17-091A, things could get interesting, as for example a 500m x 300m x10m envelope could add a hypothetical 4.5Mt. When mineralization continues along the fault to the north and south, and/or to the east, much more is possible of course. An area of roughly 300m x 100m x 10m could add a hypothetical 1Mt, and Zone 3 is a large target. All in all, I do believe Tinka is on its way to a potential 50Mt plus. Depending on how things unfold at Zone 3, this number could get considerably bigger, of course.

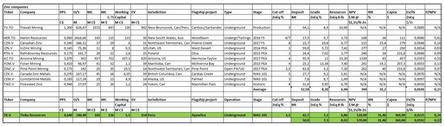

In order to see how Tinka ranks among its peers, I updated the comparison table, added the 50Mt target and applied a longer minelife in my DCF model, adding to the NPV:

See Full Size Image

As I have indicated before, Tinka isn't cheap but the stock deserves a premium in my view because of the quality and size of the project and people, and the takeover potential with several producers nearby looking for new zinc assets. The upcoming PEA (probably in Q2 2018) could potentially initiate a re-rating to C$1.00–1.25 levels if zinc prices could hold $1.40–1.50/lb levels, as a market cap of about 30–35% of NPV for a premium project isn't anything out of the ordinary, as for example Arizona Mining traded at 36–60% of NPV since the PEA came out.

The company will most likely announce the upcoming drill hole results (holes 103 - 108) early next year. Most important assays for me will be A17-107, which is being drilled from the same platform as 091A, but angled to the east. Tinka is also planning more holes from this same platform, to get a better understanding of geology/mineralization around the rather complex fault/syncline situation, interpreting the data, refine the concept and go from there. The company is also looking for deeper mineralized structures below South, and this will be explored next year.

Conclusion

Tinka delivered a very interesting intercept in hole A17-091A, creating the possibility for extended mineralization to the east in Zone 3. I see a real opportunity to take the resource to a potential 50Mt for now. Who knows what else Tinka might find in 2018, when it will increase drilling at Zone 3, besides stepping out of the current resource. As there is so much mineralization on the property, management is hoping Ayawilca could grow into something really substantial. They are hopefully on their way to solve a complex puzzle, and the first big pieces are put in place now. The discovery journey is fascinating and educational for me so far, and let's see how big Ayawilca can get.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and has a long position in this stock. Tinka Resources is a sponsoring company. The views, opinions, estimates or forecasts regarding Tinka's performance are those of the author alone and do not represent opinions, forecasts or predictions of Tinka or Tinka's management. Tinka has not in any way endorsed the information, conclusions or recommendations provided by the author.

All facts are to be checked by the reader. For more information go to www.tinkaresources.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: Trevali Mining. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.