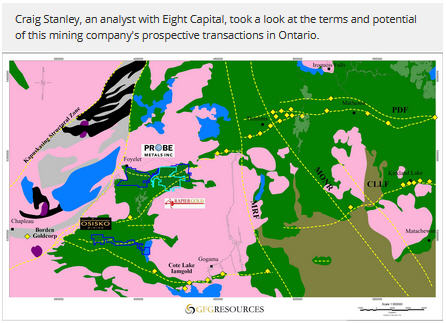

A Dec. 12 Eight Capital research note indicated that GFG Resources Inc. (GFG:TSX.V; GFGSF:OTCQB) entered into agreements to acquire three mining projects, for a total of 560 kilometers squared (560 km2) of mineral rights west of Timmins, Ontario, which analyst Craig Stanley described as "one of the most gold-endowed regions on the planet." The assets are Rapier Gold's (RPR:TSX.V) Pen, Probe Metals Inc.'s (PRB:TSX.V) West Porcupine and Osisko Mining's (OSK:TSX) Swayze.

Stanley concluded that "once the acquisitions close, GFG Resources will hold nearly 700 km2 of highly prospective, district-scale gold properties in tier one mining jurisdictions (Wyoming and Ontario)." He added that despite the projects being early stage, they are "positive for the company as they offer prospective, easily accessible ground that can be explored year-round."

As for the acquisition of Rapier Gold and its 19,000-hectare Pen project, the price is 15 million (15M) shares, or CA$0.08 per Rapier share based on GFG's price at market close on Dec. 7, 2017, Stanley noted. Thirty-four holes totaling 8,330 meters (8,330m) have been drilled at Pen, none deeper than 310m.

Regarding the West Porcupine deal, the price is 6.5M shares, or an implied ~$3.5M, reported Stanley. Twelve holes have been drilled on the property, which consists of two blocks that span about 245 km2 and flank Pen on the east and west.

In terms of Swayze, the transaction cost is 1.1M shares, or an implied ~$600,000, Stanley wrote. No drilling has been done at Swayze, but induced polarization and magnetic surveys have. The project is 40 km east of Goldcorp Inc.'s (G:TSX; GG:NYSE) Borden project.

The research note also relayed that GFG Resources announced a nonbrokered private placement to raise up to $7M. It consists of "$2M in flow-through common shares at $0.55/share and $5M at $0.50/unit (one common share and one-half of a warrant with each whole warrant exercisable at $0.75 for 24 months)," Stanley explained.

With respect to upcoming catalysts, results from 23 holes drilled at the Rattlesnake project are expected and, subsequently in H1/18, an initial resource estimate. GFG Resources hopes to commence drilling on the newly acquired properties as early as Q2/18. "Management has budgeted $2.5M for Rattlesnake Hills and $2M for the Ontario projects in 2018," the analyst added.

Eight Capital has a target price for GFG Resources of CA$1.60. The stock is currently trading at around CA$0.50.