January 3, 2018

John Lee, CFA

- US energy storage increases 46% In 3rd quarter. Hawaii, California, Massachusetts aim to be powered by 100% renewable energy by 2045.

- Global storage market to double six times by 2030 to a total of 305 GWh. China reportedly started construction of world’s biggest 800 MWh battery (equivalent of 16,000 Tesla model 3 batteries), and it’s made in vanadium

- Lithium batteries’ parasitic load factor and scalability may hamper future growth. Vanadium batteries could start dominating the utility energy storage sector in 2018 due to their proven reliability and longer battery life.

- With fierce competition amongst vanadium battery makers without clear winner, investing in vanadium mining company may be best way to participate in the rise of vanadium usage in batteries.

- The considerable upside of vanadium mining company valuation can be seen when compared with uranium mining company valuation.

US energy storage increases 46% in 3rd Quarter. Hawaii, California, Massachusetts aim to be powered by 100% renewable energy by 2045.

The article “US Energy Storage Increases 46% in 3rd Quarter” by Joshua Hill, published on December 7, 2017, revealed latest

US Energy Storage Monitor report by GreenTechMedia (“GTM”) Research showed a total of 41.8 MW (megawatts) worth of new energy storage capacity was deployed in the third quarter of 2017, representing an increase of 46% year-over-year and 10% quarter-over-quarter.

Texas led the way in the utility-scale segment with its 30 MW project, followed by Massachusetts, California, and Hawaii. GTM Research also highlighted the increasing role that energy storage is having in utilities’ Integrated Resource Planning (IRP), with utilities across 14 states including nearly 2 GW (gigawatts) worth of storage into their IRP thinking.

Article “California To Meet 2030 Renewable Energy Targets By 2020” by Joshua Hill dated November 21, 2017 indicates California state’s major utilities have already met and should soon exceed the state’s 2020 renewable energy target of 33% and will likely meet the 2030 target of 50% by 2020.

California’s investor-owned utilities have already surpassed their interim targets and, according to the CPUC, “have sufficient resources under development to exceed the 33% by 2020 RPS requirement.”

Pacific Gas and Electric Company: 32.9%

Southern California Edison: 28.2%

San Diego Gas & Electric: 43.2%

According to the

Forbes article “California Goes All In -- 100% Renewable Energy by 2045” by

Trevor Nace (August, 2017), an

ambitious plan set forth by Senate President Kevin de León (D) would set in place a goal of producing within California's electricity grid 60% renewable energy by 2030 and 100% renewable energy by 2045.

California has the largest GDP ($2.6 trillion) of any state in the United States—roughly 14% of the entire nation's GDP. California’s GDP is larger than that of all but 5 nations. It greater than those of France and Brazil.

Similarly, a “Bill would Commit Massachusetts To 100 Percent Renewable Energy” (to quote the title of a September 19, 2017

article by Craig Lemoult). Actually, it’s two bills:

“Massachusetts would get 100 percent of its electricity from renewable sources by 2035 under a plan heard by lawmakers Tuesday. The bills would also require the state to renewably power all of its heating and transportation by 2050. The bills (

S. 1849,

H. 3395) aim to move the state beyond its current clean energy commitment, which has focused primarily on electricity generation.”

Titled “Hawaii Utility’s 100% Renewable Energy Plan Got the Green Light,” in a GreenTechMedia

article dated July 18, 2017 by Jeff John, Hawaii Public Utilities Commission approved (

PDF) the utility’s Power Supply Improvement Plan (PSIP), a sprawling document that contains the recipe for hitting the state’s 100 percent renewables mandate by 2040, five years ahead of schedule.

According to

the article by Jessica Else, “Clean energy puts Kauai, Hawaii” (November 12, 2017), more than 40 percent of electricity generated on Kauai comes from renewable resources. That’s up from 2009, when 5 percent of the island’s electricity came from renewable resources. Solar is a big contributor to power generation on the island, and on sunny days around 90 percent of daytime energy needs are met by solar, the Kauai Island Utility Cooperative says.

According to

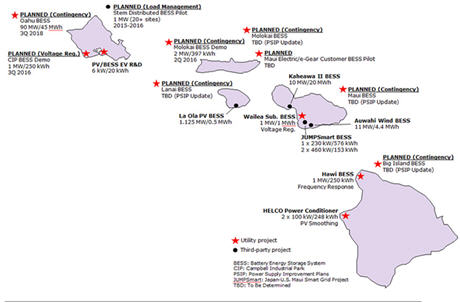

Hawaiian Electric Companies, more than 17 energy storage projects for providing grid service or exploring this technology are either underway or planned. The goal is to support the use of more renewable energy and maintain reliable service for customers.

Global storage market to double six times by 2030 to a total of 305 GWh, China reportedly started construction of world’s biggest 800 MWh battery (equivalent of 16,000 Tesla model 3 batteries), and it’s made in vanadium

Global storage market to double six times by 2030 to a total of 305 GWh, China reportedly started construction of world’s biggest 800 MWh battery (equivalent of 16,000 Tesla model 3 batteries), and it’s made in vanadium

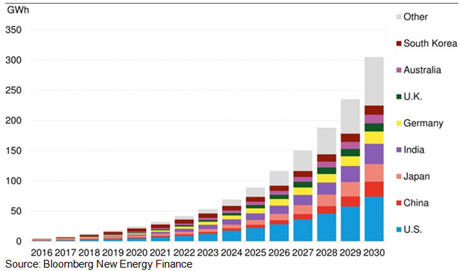

“Global Storage Market to Double Six Times by 2030,” rising to a total of 125 gigawatts/305 gigawatt-hours, according to

an article published by Bloomberg New Energy Finance (November 20, 2017).

305 gigawatt hours is equivalent in battery capacity to 6 million Tesla model 3 cars (each at 50kWh, according to

Wikipedia). Currently there are approximately 2 million electric vehicles on the road. The article forecasts one-fourth of deployments to be in the U.S. and $103 billion to be invested in energy storage over the period

Global cumulative storage deployments Chart

This is a similar trajectory to that of the remarkable expansion that the solar industry from 2000 to 2015, in which the share of photovoltaics as a percentage of total generation doubled seven times. Eight countries will lead the market, with 70 percent of capacity to be installed in the U.S., China, Japan, India, Germany, the U.K., Australia, and South Korea.

Bloomberg New Energy Finance's (BNEF)

New Energy Outlook data further reported that

“Renewable energy sources are set to represent almost three quarters of the $10.2 trillion the world will invest in new power generating technology until 2040, thanks to rapidly falling costs for solar and wind power, and a growing role for batteries, including electric vehicle batteries, in balancing supply and demand.”

Utility-scale battery systems are expected to fall from about $700 per kilowatt-hour in 2016 to less than $300 per kilowatt-hour in 2030.

Economic tipping points mean renewable energy will account for over half of electricity generation by the mid-2020s in the UK and Germany.

As early as 2030, “there will be whole weeks where wind and solar power generation exceed total demand at some point every day,” analysts state (in the actual energy report, available only by subscription). This will be a very difficult experience for base load nuclear and coal-fired power plants. But it will be an opportunity for flexible power technologies such as energy storage and gas generators, or demand response such as flexible electric-vehicle charging and variable industrial loads that can respond quickly to conditions on the grid.

A vanadium/mining industry PR firm has visited the site of an in development

200MW/800MWh vanadium flow battery (VFB) in Dalian, China and noted that site work is ongoing. They also stated that most of the product that will fill the site—the vanadium batteries—is already built in the manufacturer’s nearby factory.

This battery is currently the largest planned chemical battery in the world, and part of Chinese government investment meant to spur the technology.

The battery’s purposes are to provide power during peak hours of demand, enhance grid stability, and deliver juice during black-start conditions, in emergencies. The system is expected to peak-shave about 8% of Dalian’s load when it comes online in 2020.

The vertically-integrated

battery manufacturer has deployed almost 30 similar projects, some attached to operating wind farms in the Liaoning province of China. The Rongke Giga Factory opened in early 2017 with a phase 1 capacity of 300MW/year. Phases 2 and 3 have goals of 1 and 3 GW/year of production.

The battery is part of a push from the China National Development and Reform Commission to develop and deploy energy storage technology.

The most recent program from the commission awarded competitor Pu Neng, among others, more

vanadium battery projects.

Pu Neng, the leading provider of vanadium flow battery technology in the world, has been awarded a contract for a 3-megawatt (MW) 12-megawatt-hour (MWh) VRB as Phase 1 of the Hubei Zaoyang 10MW 40MWh Storage Integration Demonstration Project. This first phase will be installed in Zaoyang, Hubei and integrate a large solar photovoltaic system into the grid. Following this 10MW 40MWh project, there will be a larger, 100MW 500MWh, energy storage project that will be the cornerstone of a new smart-energy grid in Hubei Province.

Electrek said vanadium flow batteries already cost well below $500/kWh – and some hope to see $150/kWh by 2020. That’s a competitive product. And if utilities like it better because it scales easier and has a longer lifetime, renewables will benefit.

Indeed, grid scale vanadium battery deployment is making global inroads. Utility scaled batteries are in operation in the US (in the states of

California,

Washington,

Hawaii), China,

Singapore, and

Japan. The last of these countries has had a 60 MWh vanadium battery in operation since 2015.

Lithium batteries’ parasitic load factor and scalability may hamper future growth. Vanadium batteries could start dominating the utility energy storage sector in 2018 due to their proven reliability and longer battery life.

While lithium and vanadium grid batteries are popular choices for large-scale energy storage applications, a

GreeTechMedia article by Jason Deign (November 30, 2017) highlighted a potentially major problem for the lithium-ion battery industry.

Lazard’s latest levelized cost of

storage (LCOS)

report downgraded its estimates for lithium-ion round-trip efficiency to account for parasitic losses, GTM has discovered.

“The round-trip efficiencies for the electrical energy storage systems have been calculated as between 83 percent and 86 percent, falling to between 41 percent and 69 percent where parasitic loads are included,” the study concluded.”

Parasitic load refers to the cooling requirement for lithium batteries to operate efficiently and safely under the sun, in high temperatures.

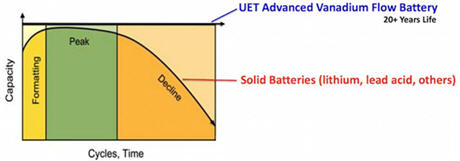

Indeed, there are problems with lithium batteries other than the parasitic load factor. Lithium-ion or lead-acid also begin degrading after a couple of years. Their life is exhausted after about 1,000 charges. Those batteries become environmental hazard with little residual value. This is hardly compatible with the lifecycle of a wind farm, which can last 10 to 20 years. Scalability is also an issue as batteries require a delicate maintenance circuitry and must be daisy chained to grow beyond 50 MWh

James Conca described vanadium battery well in a

Forbes article (December 13, 2016). The latest, greatest utility-scale battery storage technology to emerge on the commercial market is the vanadium redox battery, also known as the vanadium flow battery.

Vanadium flow batteries are nonflammable, compact, fully containerizable. They are reusable over semi-infinite cycles, discharge 100% of the stored energy, and do not degrade for more than 20 years.

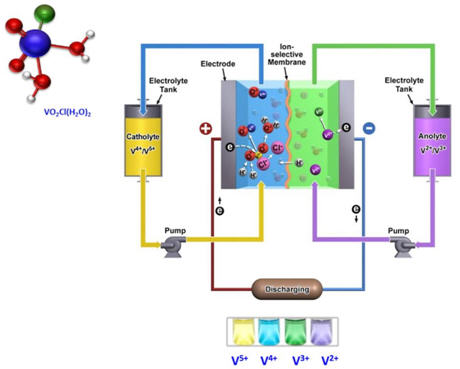

Vanadium flow batteries use the multiple valence states of vanadium to store and release charges. Energy is stored by providing electrons making V(2+,3+), and energy is released by losing electrons to form V(4+,5+). Source: UET

Flow batteries consist of two tanks of liquid, which simply sit there until needed. When pumped into a reactor, the two solutions flow adjacent to each other past a membrane and generate a charge by moving electrons back and forth during charging and discharging.

This type of battery can offer almost unlimited energy capacity simply by using larger electrolyte storage tanks. It can be left completely discharged for long periods with no ill effects, making maintenance simpler than with other batteries. Because of these unique properties, the new V-flow batteries reduce the cost of storage to about

5¢/kWh. For utility-scale applications, V-flow battery outcompetes Li-ion and any other solid battery. They’re safer, more scalable, longer-lasting, and cheaper — less than half the per kWh cost.

Unlike solid batteries, like lithium-ion or lead-acid, which begin to degrade after a couple of years, V-flow batteries are fully reusable over semi-infinite cycles and do not degrade. This gives them a very, very long life.

The specifications of the latest generation of vanadium battery electrolyte from

Pacific Northwest National Laboratory introduce

hydrochloric acid into the electrolyte solution, which almost doubles the storage capacity and makes the system work over a far greater range of temperatures, from –40°C to 50°C (–40°F to 122°F). The latter removes the large previous cost of maintaining temperature control.

With fierce competition amongst vanadium battery makers without a clear winner, investing in a vanadium mining company may be the best way to participate in the rise of vanadium use in batteries.

Today there are many vanadium battery suppliers in China (

PuNeng,

Rongke),

UK,

Europe, USA (

Vionx,

UET),

Thailand, and

Japan. Each claims its own superiority in performance, reliability, and cost. Investing in vanadium mining company may be best way to participate the rise of vanadium usage in batteries. Think of vanadium mining as bitcoin mining, which comes with relatively fixed unit cost and is unhindered upside by a rising vanadium price.

The spotlight for possibly the most advanced permitting stage vanadium project in North America is the Gibellini primary vanadium project, operated by Prophecy Development Corp (TSX: PCY, OTC: PRPCF, Frankfurt: 1P2N). Gibellini is located in mining friendly state of Nevada, where the majority of gold production in the United States takes place.

In the last 10 years, Gibellini received approximately $20 million in investment in drilling, engineering, feasibility, and permitting.

Prophecy received an independent technical report on the Gibellini project titled “Gibellini Vanadium Project Nevada, USA NI 43-101 Technical Report” with an effective date of November 10, 2017 (the

“Report,” prepared by Amec Foster Wheeler E&C Services Inc., or

AMEC). The Report disclosed an estimated for the Gibellini deposit 49.62 million pounds of vanadium pentoxide in the measured category and 79.67 million pounds of vanadium pentoxide in the indicated category. As vanadium currently trades at over $9 a pound, the resource base translates to a lot of dollar value in the ground in a mining friendly jurisdiction.

*(1) The Qualified Person for the estimate is Mr. E.J.C. Orbock III, RM SME, an Amec Foster Wheeler employee. The mineral resource estimate has an effective date of 10 November, 2017.

(2) Mineral resources are reported at various cut-off grades for oxide, transition, and reduced material.

(3) Mineral resources are reported within a conceptual pit shell that uses the following assumptions: mineral resource V

2O

5 price: $10.81/lb; mining cost: $2.21/ton mined; process cost: $13.14/ton processed; general and administrative (G&A) cost: $0.99/ton processed; metallurgical recovery assumptions of 60% for oxide material, 70% for transition material, and 52% for reduced material; tonnage factors of 16.86 ft3/ton for oxide material, 16.35 ft3/ton for transition material, and 14.18 ft3/ton for reduced material; royalty: 2.5% net smelter return (NSR); shipping and conversion costs: $0.37/lb. An overall 40º pit slope angle assumption was used.

(4) Rounding as required by reporting guidelines may result in apparent summation differences between tons, grade, and contained metal content. Tonnage and grade measurements are in US units. Grades are reported in percentages.

On December 20, 2017, the US president, Donald Trump, signed the executive order “Recognizing Strategic Importance of Minerals Mining to Domestic Economy, National Security, Infrastructure.” Among other things, he called on U.S. government agencies to identify ways to both (1) streamline the permitting processes (expediting exploration, production, processing, reprocessing, recycling, and domestic refining of critical minerals) and (2) ensure that miners and producers have electronic access to the most advanced topographic, geologic, and geophysical data within U.S. territory.

On the same day, the

U.S. Geological Survey listed vanadium as one of 23 critical mineral resources of the United States; yet there is not a primary vanadium mine currently in the country.

Prophecy’s goals are to develop Gibellini into the first primary vanadium mine in the United States and to offer the best leverage and a direct investment vehicle, one that reflects vanadium prices.

The considerable upside of vanadium mining company valuation can be seen when compared with uranium mining company valuation.

Here I have made a valuation comparison of three preproduction-stage mining companies: Prophecy (vanadium), Fission (uranium), and NextGen (uranium). I chose Fission and NextGen because most vanadium is produced in China and there are no primary vanadium mines in North America to compare Gibellini with.

https://www.nexgenenergy.ca/_resources/reports/Rook-1-Technical-Report-Sep-15-2017.pdf

https://fissionuranium.com/_resources/reports/RPA_Fission_U_Patterson_Lake_South_PEA_NI_43-101_Report_FINAL_Sept_14_20.pdf

https://www.prophecydev.com/files/Gibellini_10Nov2017_final.pdf

https://www.nexgenenergy.ca/_resources/reports/Rook-1-Technical-Report-Sep-15-2017.pdf

https://fissionuranium.com/_resources/reports/RPA_Fission_U_Patterson_Lake_South_PEA_NI_43-101_Report_FINAL_Sept_14_20.pdf

https://www.prophecydev.com/files/Gibellini_10Nov2017_final.pdf

Can we see a 1,000% increase in Prophecy valuation to catch up to Fission’s valuation?

Recall in the previous uranium bull market, Cameco went from $5 in 2003 to eventually $50.

Before you dismiss the vanadium vs uranium comparison, Consider the following

chart from

EIA

Nuclear power generation has been on the decline in the US since 2010, while renewable generation has almost doubled in the same period. The chart would not be much different on a global basis.

Energy storage is an indispensable part of renewable energy. Therefore, linking vanadium (the key ingredient in vanadium batteries) to renewables is as applicable and relevant as linking uranium to nuclear power. And unquestionably, the cheaper and cleaner renewable power holds the future.

Lastly, I leave you with quotes and sights:

“Cost-effective, reliable, and longer-lived energy storage is necessary to truly modernize the grid,” said Dr. Imre Gyuk, energy storage program manager for Department of Energy’s Office of Electricity Delivery and Energy Reliability. December 2016

If the cost savings from reducing climate change and hazardous air pollution — most importantly lower healthcare costs — are also taken into account, California would save an average of $7,395 per person by 2050, Jacobson found. About 12,500 fewer people would die each year as a result of air pollution. "It's a no-brainer," Mark Jacobson, a Stanford University engineering professor. February 20, 2017

Flow batteries scale more easily because all that's needed to grow capacity is more liquid; the hardware remains the same, Li-ion batteries require an entirely separate unit to be daisy-chained in, according toDean Frankel, an associate at Lux Research.

That means flow batteries have the potential to be less expensive than Li-ion. They also last longer, according to Frankel. At full discharge, Li-ion batteries last only four hours. To double that charge time, another complete battery unit must be added, Frankel said. March 2017

“Even U.S. utilities have announced extremely low prices for solar in relatively small quantities, and the price of storage continues to come down rapidly,” said Jon Wellinghoff, renowned energy law attorney and former chairman of the Federal Energy Regulatory Commission. “It is very clear that solar-plus-storage is now, or in the near future will be, less expensive to build than any traditional ‘baseload’ coal, nuclear or gas facilities. And we are seeing solar with advanced inverters successfully perform most of the functions of traditional power plants,” he added. November 2017

“Energy storage deployments are increasing rapidly, as more policymakers and grid planners are recognizing the many benefits of storage,” said Kelly Speakes-Backman, CEO of the Energy Storage Association. “Coupled with policies that provide a clear signal to markets, and regulatory reforms that compensate storage for the full value it offers, we see this trend continuing toward 35 gigawatts by 2025.”

December, 2017

Chairman of HubeiPingfan Xie Guangguo, said, “We selected a vanadium flow battery because they have superior safety, reliability and lifecycle economics compared to lithium-ion and other battery types.” November 1, 2017

On September 22, 2017, theChina National Development and Reform Commission (NDRC) released Document 1701, “Guidance on the Promotion of Energy Storage Technology and Industry Development.” It is aimed at accelerating the deployment of energy storage. The policy calls for the launch of pilot projects, including deploying multiple 100MW-scale vanadium flow batteries by the end of 2020, with the aim of large-scale deployment over the ensuing five years.

Robert Friedland, Chairman of Pu Neng, commented, “China has the largest and highest-grade vanadium resources in the world and is poised to use this miracle metal to fundamentally transform its electricity grid. With massive amounts of renewable energy and storage coming online, China will create the most modern, clean and efficient grid in the world.”

On the newly released NDRC policy, Mr. Friedland commented, “This new policy will result in vanadium flow batteries revolutionizing modern electricity grids in the way that lithium-ion batteries are enabling the global transition to electric vehicles.”

Qualified Persons

Qualified Persons

The resource information contained in this article was reviewed and approved by Christopher M. Kravits, CPG, LPG, who is a Qualified Person within the meaning of NI 43-101. Mr. Kravits is a consultant to Prophecy and is not independent of the Company in that most of his income is derived from the Company. Mr. Kravits serves as its Qualified Person and General Mining Manager.