Opinions can vary, but charts made from hard data don’t lie.

And what these charts are showing is that gold is about to break out into a new multi-year bull market. . .

Take a look for yourself. . .

Number 1.

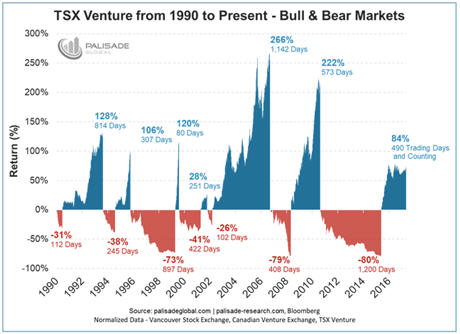

This critical chart of the TSX Venture shows you the extreme gains that come after each bear market.

But – what is the TSX Venture?

It’s basically a Canadian mining stock index – like the NASDAQ is for technology stocks.

“The TSX Venture Exchange serves as a public venture capital marketplace for emerging companies, particularly in Canada’s rich natural resource sectors [gold and mining stocks].”

As the above chart shows, every time when the TSX broke out of a bear market, the rise was rapid and extreme.

For example, it gained over 50% in six months before trading fairly stagnant.

And since the New Year began, things are looking great.

The TSX Venture is at its highest for this current cycle, sitting at an 84% gain.

And compared to past gold bull markets, there is still plenty of steam left as we show below.

Number 2.

This is one of my favorite charts and it should be one of yours also. . .

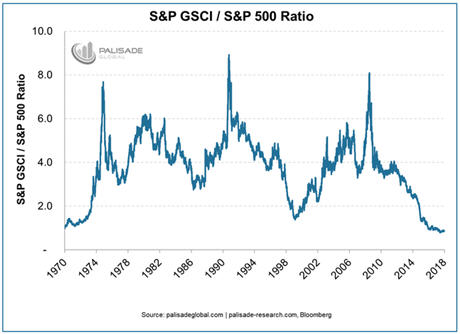

The S&P GSCI is a benchmark for investments in the commodity markets and serves as a measure of commodity performance over time.

And according to the chart above, when you measure the S&P GSCI compared to the S&P 500, it is apparent that commodities are dirt cheap and equities are overvalued. . .

Actually – commodities compared to the S&P 500 are at their cheapest they have been in the last 40 years.

Even the inflated valuations leading up to the dot-com bubble did not yield a ratio this low.

That’s why investors finally took notice, and since 2017 commodity prices have been rising – as we expected.

But don’t worry. . .

As the chart shows – there is still significant gains to come.

Number 3.

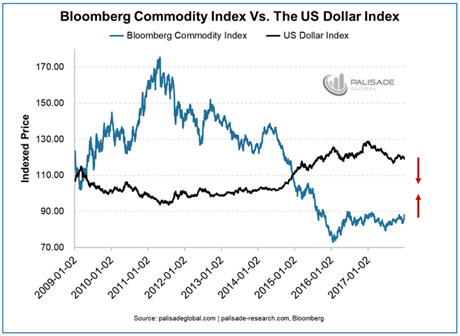

After hitting a 16 year high in January 2017 – exactly one year ago – the US dollar has since dropped over 11%.

And in 2018 it looks like it will fall even further. . .

The majority consensus now is that the US dollar will weaken.

Economic laws tell us that when currencies depreciate, it causes inflation – also known as rising prices.

That’s why the above chart is so important. . .

As the dollar keeps falling, commodities – especially gold and silver – will soar.

Number 4.

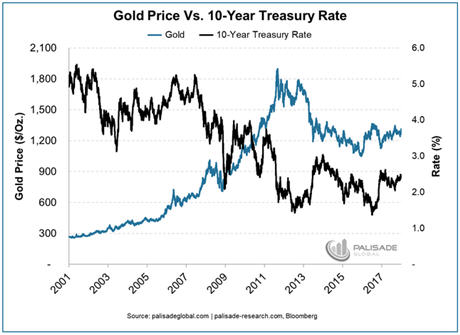

Since 2001, gold and treasury rates have had a negative correlation of 86%.

This means when rates go lower – gold goes higher, and vice versa. . .

Throughout 2017 the bond market has seen a tightening spread between shorter and longer-term yields.

When this happens, it almost always indicates that a recession is on the horizon. . .

That’s why there is such extreme unease about the flattening of the Treasury curve – when short term interest rates are the same as long term interest rates.

While the Federal Reserve has signalled more rate hikes in 2018 and 2019, we believe this is unlikely.

And even a single dovish indication or surprise interest rate cut from the Fed would shatter the markets “everything is okay” expectations and could be the catalyst that causes gold to hit new record highs. . .

Number 5.

The reality is that we are already in the midst of an ongoing gold recovery.

That’s right – it’s going on right now as you’re reading this.

And looking back at previous gold bull markets in history, every initial rise in the price has been met with drops in the price.

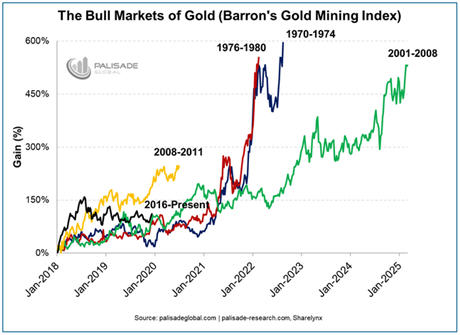

Just look at the above chart. . .

The 2016-ongoing gold bull market (black line) has an almost identical beginning to the last 4 major gold bull markets.

While gold is currently trading sideways, we believe it is setting up for the longest and most lucrative bull market since the 1970’s.