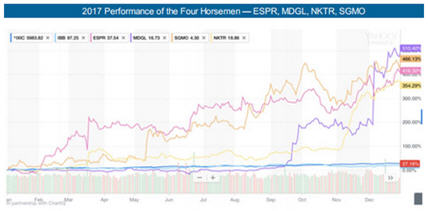

2017's Outstanding Performance Was Led by the Four Horsemen

In 2017, Medical Technology Stock Letter had four recommendations deliver outstanding returns led by Madrigal Pharmaceuticals Inc. (MDGL:NASDAQ) with a 510% move, followed by Sangamo BioSciences Inc.'s (SGMO:NASDAQ) 466% move, Esperion Therapeutics Inc. (ESPR:NASDAQ) with a 416% move, and Nektar Therapeutics (NKTR:NASDAQ) with a 354% move. In addition to the outstanding percentage moves for the year, we also provided multiple entry points as we raised the Buy and Targets for the Four Horsemen over 12 times during 2017. In 2018, we expect The Four Horsemen to continue to deliver outstanding returns for biotech investors. With the new Buy recommendation for ESPR below, all Four Horsemen are currently rated Buys.

FDA Delivers Approvals in 2017 as Gottlieb Makes a Difference

Scott Gottlieb has turned out to be everything the drug industry could hope for, as the agency has been re-invigorated under his skilled leadership in 2017. Before his start as FDA commissioner last year, new drug approvals all but screeched to a halt in 2016 with only 26 new drugs approved. In 2017 under Gottlieb, the agency cleared 53 new molecular entities, including the first two CAR-T therapies for blood cancers, Novartis AG's (NVS:NYSE) Kymriah and Gilead Sciences Inc.'s (GILD:NASDAQ) Yescarta (from KITE). The treatments remain controversial, costing $475,000 and $373,000 respectively. In our view, Ziopharm Oncology Inc.'s (ZIOP:NASDAQ) third-generation CAR-T technology may be a game-changer and cost significantly less than first generation.

Cancer drugs notched 14 approvals; most of these targeted specific subtypes of cancer. Novartis' Kisqali and Eli Lilly and Co.'s (LLY:NYSE) Verzenio, for example, were approved for patients with HR-positive, HER2-negative breast cancer, and Celgene Corp. (CELG:NASDAQ) and Agios Pharmaceuticals Inc.'s (AGIO:NASDAQ) Idhifa is for treating relapsed or refractory acute myeloid leukemia in patients with a particular mutation.

Esperion Therapeutics: Poised for Significant Catalysts in 2018

Esperion Therapeutics' lead drug development candidate is bempedoic acid (BA), an innovative, complementary, non-statin LDL cholesterol lowering therapy. The drug candidate has significant potential including its convenient, once-a-day oral dosing, an excellent safety profile, and it significantly lowers LDL by ~30%. In multiple clinical trials, the drug has been shown to be safe and well-tolerated with no serious or unexpected adverse events.

The company's second product is BA+EZ, an innovative, complementary, non-statin LDL-C lowering therapy combining bempedoic acid and Zetia (EZ). Like BA, EZ offers convenient, one-pill-a-day dosing. The BA+EZ combo has the potential to deliver up to a 50% LDL-C lowering. Similar to BA, BA+EZ has demonstrated no serious or unexpected side effects, and that compound, too, has been well tolerated in many trials.

The development focus for the BA franchise is the broad hypercholesterolemia opportunity, including patients who cannot tolerate statins, the standard of care treatment for elevated LDL-C, and as an add-on to statins in patients who remain inadequately controlled with statin monotherapy.

With the success of Amgen Inc.'s FOURIER cardiovascular outcomes study in 2017 supporting the LDL hypothesis ("lowering LDL saves lives"), Esperion was rediscovered by investors and Medical Technology Stock Letter recommended the stock at 24. In our view, Esperion is poised for significant value creating catalysts in 2018.

As a reflection of our growing belief in Esperion and management's ability to execute at a high level and deliver value creating catalysts for their shareholders we are raising our Buy to 75 (from 55) and our Target to 100 (from 70).

The first potential catalyst for ESPR in 2018 should be the 52-week safety study, which completed enrollment in early 2017 and will deliver top-line data early in 2Q. In our view, this will be a key event for the company as it will further de-risking the safety profile of BA. Safety is always paramount in treating chronic cardio disease where patients can live for decades while on LDL lowering therapies.

Following the safety study or even in parallel, we expect the first of multiple Phase 3 read outs for the company. Patient enrollment for the pivotal Phase 3 LDL-C lowering trial was completed in September of last year and we expect data in 2Q. In addition to the safety and Phase 3 data, we could see an attractive corporate partnership as the BA franchise is fully owned by Esperion and the company has been in active negotiations for some time now.

The original Esperion was sold to Pfizer for a significant premium and with the potential for M&A to explode in 2018, in our view, lighting could strike twice and Esperion could be acquired a second time. In our view, Esperion is poised to deliver value creating catalysts in 2018.

Esperion is a Buy under 75 with a Target Price of 100.

John McCamant is the editor of the Medical Technology Stock Letter, a leading investment newsletter. McCamant has spent more than 25 years on the front lines of biotechnology investing. He has established an extensive network that includes contacts throughout the investment banking and venture capital communities. His expertise in biotechnology investments is a subject of media interest. He is frequently consulted and quoted by The Washington Post, Reuters, Bloomberg, CBS and Marketwatch.

Disclosure:

1) John McCamant: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Madrigal Pharmaceuticals, Sangamo BioSciences, Esperion Therapeutics and Nektar Therapeutics. I personally am or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Disclosures from Medical Stock Technology Newsletter:

The information and opinions contained herein have been compiled or arrived at from sources believed to be reliable but no representations or warranty, express or implied, is made as to the accuracy or completeness. In no way shall this newsletter be construed as an offer to sell or solicitation of an offer to buy any securities. The publisher and its associates, directors or employees may have positions in, and may from time to time make purchases or sales of, securities mentioned herein. We cannot guarantee and you should not assume that future recommendations will equal the performance of past recommendations or be profitable.