As a general rule, the most successful man in life is the man who has the best information

aheadoftheherd.com

The dizzying valuations of cryptocurrencies have sparked a frenzy of investor capital and interest in this new “wild west” that some have compared to the dawn of the Internet in the mid-1990s.

Bitcoin, the most familiar and used cryptocurrency, started 2017 at around $1,000 and finished the year just under $15,000 - a gain of 1,322%. Ethereum rose in value by over 2,500% in 2017. As crypto surged, many investors stayed on the sidelines, scared off by the volatility. When South Korea announced it was banning bitcoin trading, BTC dropped $2,000 in one morning. But hedge funds and institutional money are pouring into bitcoin, with Goldman Sachs exploring how to help clients trade digital tokens, and other companies looking at ways to bring crypto into the mainstream - by opening up regulated coin exchanges, creating futures contracts and attempting to list coin exchange-traded funds.

Many do not realize that without blockchain there would be no bitcoin. As the price of bitcoin spiked, there has been a flood of interest in blockchain technologies, which use a decentralized, public ledger of transactions that can’t be manipulated and is therefore highly resistant to hacking and fraud, while remaining public and transparent. IBM, Microsoft and Toyota have all invested in blockchain, which has practically endless applications - everything from “smart” contracts and supply chain auditing, to microgrids and stock trading.

But not all companies with the word “blockchain” attached to them offer the chance for shareholder returns. This is a space that is equally ripe for both charlatans and pioneers, and investors must therefore tread carefully. DMG Blockchain Technologies stands out as a company that Ahead of the Herd investors can get behind. Before we get into the reasons why, a bit of background is in order.

What is blockchain?

A blockchain is like a spreadsheet that is duplicated thousands of times across a network of computers. The network is designed to regularly update this spreadsheet. A great example of a simple blockchain is Google Docs, which allows a document to be shared and edited/ commented on by an infinite number of people at the same time. The advantages of such a system are that the blockchain database isn’t stored in any one location - making it virtually unhackable - while its records are public and easily identifiable.

RBC Capital Markets is much more detailed in its explanation of blockchain:

A blockchain is a distributed and decentralized database of records or public ledger of all transactions or digital events that have been executed and shared among participating parties. Each transaction in the public ledger is verified by consensus of a majority of the participants in the system. Once entered, information can never be erased. The blockchain contains a certain and verifiable record of every single transaction ever made. This is significantly different from a centralized database given that it is open for all to see (public).

In order to attack the network, one would have to attack all computers on a network that is spread around the world versus in a single data center or centralized distributed ecosystem. The value of a blockchain is that it enables a shared database without a central administrator (disintermediation). Rather than having some centralized application, blockchain transactions can have their own proof of validity and authorization to enforce the constraints.

A blockchain is a technology to efficiently record transactions, with key advantages being disintermediation, decentralized, distributed, programmable, verifiable, divisible, immutable, and with faster and lower cost to data.

Birth of bitcoin

The first blockchain was bitcoin, developed in 2008 by Satoshi Nakamoto. Nakamoto has never come forward to claim bitcoin’s birthright and his name remains shrouded in mystery. Bitcoin’s real founder(s) may have simply used the name as a pseudonym. In any event, Nakamoto published an eight-page white paper in which he described a peer-to-peer version of electronic cash, where payments could be sent directly from one party to another without going through a bank. The main argument for using bitcoin versus cash, when buying and selling good online, is that the present system relies on third parties (financial institutions) to process transactions or reverse them. This is inefficient because the third parties have to spend time and money dealing with disputes or fraud.

Nakamoto’s solution was to set up a network of interconnected computers that create a system of electronic cash by solving computational puzzles, to put it simply. Computers that solve the puzzles are awarded bitcoins, which are added to the public ledger and made available for purchases or trading.

An important element of blockchain is it solves the element of mistrust that currently exists in our financial system. Computer science professor John Doucette

explains this nicely via The Catalyst, thus exposing the faults in conventional banking:

“Blockchains are a particular technology for implementing a public ledger. A public ledger is just a place where people can read and write things, but never erase what has been written. This lets people who don’t trust each other agree on what has happened in the past. Solving that trust problem solves all sorts of other problems indirectly. For example, if you watch me write in a public ledger that I owe you $5, then you can later prove that I still owe it to you by consulting the ledger.”

“In the past, most ledgers were private. A bank might maintain a ledger, but if two people don’t trust the bank to keep the ledger correct–or the bank won’t let them write in it – there wasn’t a good way to help them trust each other about what had happened in the past. Blockchains provide a way to create public ledgers online, that anyone can write to or read from.”

The new Internet?

The advantages of blockchain compared to traditional centralized or decentralized systems (as opposed to blockchain’s new distributed paradigm) have led some to call it “the new Internet”. This is because by allowing digital information to be distributed, not copied, it forms the backbone of a new kind of shared Internet.

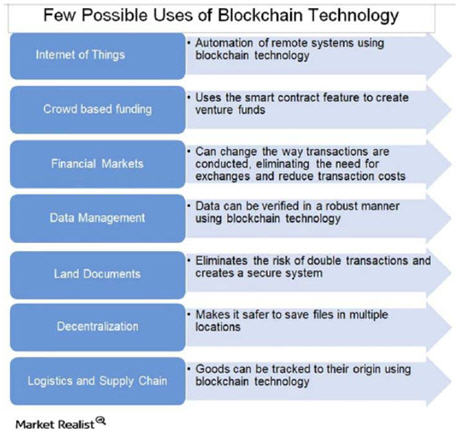

Market Realist outlines some

possible uses of blockchain technology:

An

even more comprehensive list comes via Blockgeeks.com, which describes blockchain as “the new Web 3.0”. The list names 15 possible applications, including smart contracts, stock trading, supply chain auditing, neighborhood microgrids, and know your customer (KYC) practices, adding to those mentioned by Market Realist.

The crypto spark

If all these blockchain possibilities are visualized as tinder for a campfire, the spark that ignited the flame has been cryptocurrencies.

As everyone knows, the growth in cryptocurrencies over the past year has been phenomenal. A

chart of the global coin market shows the total market cap of cryptocurrencies at under USD$20 billion from 2013 to 2017, then rising to $23 billion in April 2017. From there cryptocurrencies spike, reaching a high of $749 billion in January 2018, then retreating to the current value of around $332 billion.

While many, including Goldman Sachs, think that bitcoin is a bubble about to pop - equating it to the 17th century Dutch “tulip mania” - the reality is that blockchain technologies are here to stay. The global blockchain market is expected to grow by 42.8% (CAGR), reaching $13.96 billion by 2022.

China’s loss is Canada’s gain

While some countries including South Korea, China and Venezuela (which now throws bitcoin miners in jail) have

cracked down on bitcoin mining and trading, on concerns over electricity use and the alleged risk of fraud and money laundering Canada has been a major beneficiary.

The Great White North is an ideal environment for bitcoin mining due to its cold climate, abundance of clean, cheap power and a welcoming market for raising capital notes Bloomberg.

The news outlet adds that at least

50 firms tied to blockchain and cryptocurrencies are set to list on Canadian stock exchanges in 2018, “thanks in part to a junior market that’s more comfortable with risk than other parts of the world,” the head of securities firm GMP Capital Inc. said.

In 2017 Canada was home to some major blockchain deals and stories. These included Vancouver-based HIVE Technologies (TSXV:HIVE) going public and opening two cryptocurrency mining hubs in Sweden; Waterloo’s Kik Interactive holding an initial coin offering (ICO) that became one of the biggest in history; and large bitcoin miner Bitfury teaming up with Hut 8 to bring bitcoin mining from China to North America.

With so many companies pouring into blockchain hoping to cash in on the mania that is mostly being driven by the rise of cryptocurrencies, investors need to be careful of “pretenders” that have no substance to their claims. Within the past few months several companies have all announced plans to change their name and enter the blockchain space.

But fly-by-nighters are unlikely to deliver results for investors. Rather, investors in blockchain should look for companies that offer the safety of diversified revenue sources, along with strategic partners and a solid, experienced management team. These are the firms that can provide stable growth and legitimate exposure to the high upside potential associated with blockchain’s rapid growth.

DMG Blockchain Technologies (TSX.V:DMGI)

Vancouver-based DMG is no pretender, and while the company started out mining bitcoin in British Columbia, the soon-to-be-listed blockchain startup had greater aspirations. Over the past year DMG has evolved into a full-service blockchain company that offers superb diversification in the form of four revenue streams: bitcoin mining, “mining as a service” (MAAS), forensics & data analysis, and blockchain software management.

“DMG is a fully diversified bitcoin and blockchain company. We have large industrial bitcoin mining, we have numerous platforms being built using blockchain technologies and smart contracts, and we have a forensics division that ensures that consumers can trust our brand, and that clients can trust our brand,” CEO Dan Reitzik said in a

recent video interview.

Bitcoin mining

With DMG's new facility, accessing up to 80 MW of power and thousands of ASIC miners, DMG is setting itself up to be a major force in bitcoin mining in Canada.

The mining facilities deploy the latest computing technology, sourcing power on an industrial scale, and are designed and engineered by experienced industrial crypto-mining professionals.

DMG recently

formed a partnership with Mogo Finance Technologies, whereby Mogo has created a new subsidiary that will mine bitcoin through DMG. Mogo Blockchain Technology will initially lease 1,000 bitcoin mining machines, all operated and managed at DMG’s BC bitcoin mines. According to Mogo president Greg Feller, the subsidiary will allow Mogo to generate its own supply of the cryptocurrency as it plans to launch its own bitcoin buying and selling service later this quarter.

Mining as a Service (MAAS)

Reitzik noted that in order to mine bitcoin on an industrial scale, a company needs to bring in added sources of revenue. Enter the “mining as a service” (MAAS) model, where DMG provides hosting and management services to clients who want to become bitcoin miners. In exchange for operating and maintaining the servers, DMG receives a monthly fee, giving the company a consistent lease revenue stream regardless of whether bitcoin rises or falls.

“Our blended model of MAAS where we mine on behalf of third parties, and mining for ourselves, allow us to scale quickly without deploying that much capital,” he told Business Television, emphasizing that DMG is already providing bitcoin MAAS in Japan, the first country to regulate cryptocurrency and where more than 50% of all global cryptocurrency trading occurs.

Through its chairman Chris Filiatrault who has deep experience with bitcoin in Japan (read more below), DMG also has access to Bitmasters, a marketing group comprised of nearly 40,000 bitcoin traders and influencers.

It was in Kobe, Japan

at the annual Bitmasters conference that DMG announced its MAAS model. The group of Japan-based owners and investors placed an order for hardware purchase and setup valued at over CAD$3 million, with monthly recurring hosting revenues to flow upon completion.

MAAS is completely new, unique to DMG, and the payoff looks to be very lucrative.

“Instead of them buying bitcoin on exchanges, they can now buy their own machine, pay us a monthly hosting fee, and receive all the bitcoins every day. We’ve already received millions of dollars in orders,” Reitzik said.

Blockchain Software Platform Development

Along with bitcoin mining DMG is building a blockchain platform for the supply chain management sector. In this revenue model, DMG partners with select companies to tailor “custom-made” blockchain solutions to the client’s needs. For example on January 18th DMG signed a letter of intent (LOI) with Emerald Health Therapeutics (TSXV:EMH) to

develop a blockchain-based supply management system and e-commerce platform for cannabis, which becomes legal in Canada in July.

In December the company joined with Element Fleet Management Corp. (TSX:EFN) to

develop a blockchain for fleet management that will help Element to become more efficient and cost-effective. The deal is one of the first to address fleet inefficiencies by using blockchain to track vehicles throughout their lifecycle. It’s also notable the Element has invested a 9.9% stake in DMG. Adding that to a $28 million transaction last September which saw the amalgamation of Aim Explorations Ltd. and DMG through a private placement, means that DMG has raised over $35 million since inception in 2016.

Forensics & Data Analysis

DMG’s fourth revenue stream involves forming partnerships with blockchain analytic software companies to assist with cybercrime investigations. The company will also work with law enforcement, accounting and legal firms to provide forensic services related to bitcoin, ethereum and other cryptocurrencies.

“As fraud worldwide potentially consumes 5% of global GDP, which would equate to US$4T, assuming blockchain platforms could capture 10% of that as revenue, the total available market could ultimately be an order of magnitude larger than mining,” said Steve Eliscu, DMG’s executive vice president, corporate development, in a

recently published Q&A.

BlockSeer acquisition

A key development for DMG is the just announced acquisition of BlockSeer, a Silicon Valley-based company whose aim is to make blockchain data and applications accessible to everyone by providing valuable analysis of patterns, useful metrics, clear visualizations, and actionable intelligence. BlockSeer is essentially a tool that allows users to “follow the bitcoin” as bitcoins move through the blockchain.

Acquiring BlockSeer is big for DMG not only for the technology platform, but for the increased talent pool and brainpower it will bring to the company’s current team of seven blockchain developers.

“4 OUT OF 5 BANKS

WILL USE BLOCKCHAIN”

WORLD ECONOMIC FORUM

Blockchain pioneers

DMG formed in 2016 when CEO Dan Reitzik got in touch with blockchain pioneer Chris Filiatrault, who had been living in Japan for over 25 years. The pair teamed up with Sheldon Bennett and Steve Eliscu, who came from Bitfury, one of the world’s largest bitcoin mining and blockchain companies. Sheldon Bennett, when he was with Bitfury was instrumental in setting up a 58 megawatt facility incorporating approximately 30,000 servers making it the largest bitcoin mining operation in Canada at the time.

Board chair Chris Filiatrault has been developing Internet technology and software for the Japanese market for over 30 years. He is credited with bringing bitcoin to Japan in 2012 and is known as an authority on bitcoin, having opened the first bitcoin ATM in Tokyo in 2014 and writing a book in Japanese on bitcoin.

Steve Eliscu, EVP corporate development, was most recently head of finance at Bitfury. He was previously an equity research analyst with UBS during which he covered semiconductor companies valued over $200 billion.

Dan Reitzik’s resume includes building a teen-focused wireless community called the Digital Youth Network, a joint venture between Rogers Wireless and Universal Music, the world’s biggest record label.

Conclusion

DMG Blockchain Technologies has an ambitious goal: to become domain experts in supply chain verticals across many industries, which could include agriculture,pharmaceuticals, energy, precious metals, transportation - you name it. The way they’re going to do it is through a unique business model whose main value proposition is a diversity of revenue streams anchored by a very experienced management team capable of pulling off a multi-layered approach to blockchain.

I like DMG for its choice of four revenue platforms, and its scalability. Its “mining as a service” model provides a steady flow of cash regardless of what bitcoin is doing. And with over 80MW of power, it seems unlikely that they will run short of electricity. They’re strategically positioned in Japan, where cryptocurrency is regulated, and where DMG has an existing marketing agreement with Bitmasters, a marketing group comprised of tens of thousands of Japanese bitcoin buyers and influencers. Supply chain management, the third revenue pillar, is great because it offers seemingly endless potential for new blockchain partnerships in any number of industries. And lastly, the forensic & data analysis pillar is something that I hold especially dear, considering there are security and privacy aspects of blockchain that have yet to be proven.

Cybersecurity should be part of every blockchain.

Think about all that upside and I love the fact that their business model dictates they are earning money at both the front end, and the backend, of the deals they do.

For all of these reasons, DMGI is on my radar screen. Is it on yours?

If not, maybe it should be.

Richard (Rick) Mills

aheadoftheherd.com

Sign up for Ahead Of The Herd’s free

highly acclaimed newsletter.

***

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

DMG Blockchain Technologies (TSX.V:DMGI) is a paid sponsor of Richard’s website aheadoftheherd.com. The sole purpose of which is to raise awareness about DMG Blockchain Technologies products and services