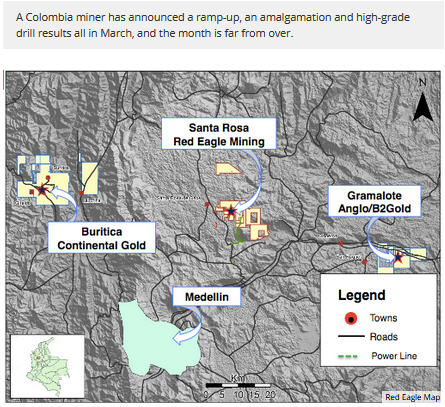

It's been a busy time for Red Eagle Mining Corp. (R:TSX; RDEMF:OTCQX; R:BVL). The company been ramping up operations at its Santa Rosa project in Colombia, and drilling has revealed high-grade mineralization below the existing gold deposit. On top of that, the company announced a merger early this month with Red Eagle Exploration Ltd. (XR:TSX.V).

On March 2, Red Eagle Mining announced the amalgamation with Red Eagle Exploration, which holds the Vetas Gold, California Gold and Santa Ana Silver properties, all located in Colombia. The two companies already share the same management.

"This amalgamation will result in a combined company with bigger scope and more properties and will reduce costs." - Clive Maund

Red Eagle Mining already holds 76.43% of all outstanding shares of Red Eagle Exploration. Under the terms of the agreement, "XR shareholders will receive one (1) common share of Red Eagle Mining (Red Eagle Share) for every two (2) XR common shares ("XR Share”) held (Exchange Ratio). The Exchange Ratio represents the equivalent of $0.135 per XR Share based on the closing price of the Red Eagle Shares on the TSX as of March 1, 2018 and represents the equivalent of $0.139 per XR Share based on the 20-day volume weighted average price of the Red Eagle Shares on the TSX as of the same date."

Red Eagle Mining noted that "the combination of Red Eagle Mining and XR will create a strong exploration, development and operating company with four 100% owned high grade gold and silver projects in Colombia."

The amalgamation is "subject to the approval of at least 66 2/3% of the votes cast by holders of XR Shares and by a majority of the minority XR Shareholders, all at a special meeting of XR Shareholders scheduled to be held on April 5, 2018."

Red Eagle Mining currently operates the Santa Rosa project, and on March 19 the company provided a drilling update, noting that drilling at the San Ramon Gold Mine, part of the Santa Rosa Gold Project in Colombia, has returned 4.75 meters at 20.3 grams gold per tonne.

This drilling was below the already delineated resource and is "extending the vertical extent of known gold mineralization."

Red Eagle noted that "mineralization is open to depth in an area with no previous drilling and outside of the mineral resource and mineral reserve. Results continue to return intercepts with grades significantly higher than the reserve grade of 5.2 g/t Au."

An earlier update Red Eagle Mining released on March 6 noted that the company is continuing to ramp up the Santa Rosa Gold Project.

According to the company, the mill "continued to ramp up according to plan processing 17,008 tonnes at 2.12 grams per tonne gold producing 1,100 ounces of gold in January and 21,138 tonnes at 3.19 grams per tonne gold producing 1,974 ounces of gold in February. Gold recovery was 91%. The mill operated slightly above plan of 750 tonnes per day and production was at the high end of guidance for February of 1,500–2,000 ounces of gold."

The company explained that the San Ramon mine currently has "24 attack ramps with 16 in production (which provided 39 active production faces in February) and the remaining attack ramps in breasting, backfill or development." It noted that "stope mining operations continued to ramp up with 17,092 tonnes mined in February."

Red Eagle Mining received new equipment the end of January, which made possible the increase in February production. Additional equipment that has been delayed due to supplier manufacturing is expected to arrive in April, "which will enable production to be significantly increased in April," the company noted.

Technical analyst Clive Maund of CliveMaund.com commented on March 4 on the amalgamation: "although this is as much a merger as a takeover, and it is noteworthy that Red Eagle Mining already owned 76% of the shares of Red Eagle Exploration prior to this announcement. This amalgamation will result in a combined company with bigger scope and more properties and will reduce costs, and is not seen as negative in any way for the shareholders of either company."