Technical analyst Clive Maund charts an agritech company that he believes is set to break out.

Verde AgriTech Plc (NPK:TSX; AMHPF:OTCQB) continues to move forward with its projects, including its proprietary product for farmers called Super Greensand, which is a potash based nutrient mix, and a few days back the company was awarded a permit to produce 50,000 tons of the stuff, and it has plans to go well beyond that. The market yawned at this news.

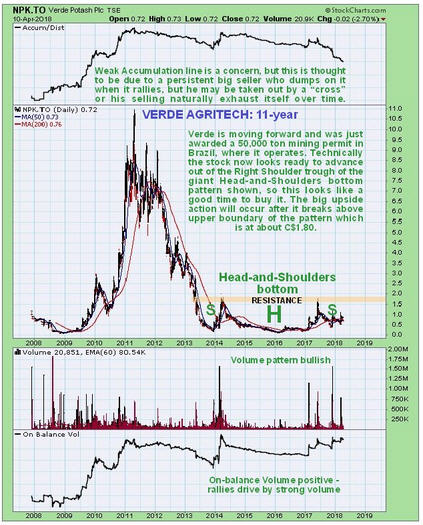

Technically, the stock appears to be getting ready to break out of a giant Head-and-Shoulders bottom as we can see on its latest 11-year chart shown below. From a price/time perspective we appear to be close to an optimum entry point here, as the price is still not far above the Right Shoulder low of this pattern. Breakout from this base pattern will be signaled by the price breaking above the resistance at its upper boundary, which is at about C$1.80, so clearly, just getting to this breakout point will result in a big percentage gain from the current price. Once it breaks above C$1.80 its rate of rise should accelerate.

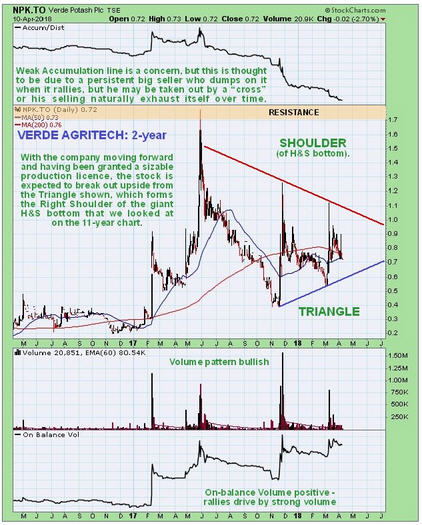

On the 2-year chart we can look at price/volume action in the Right Shoulder of the H&S bottom pattern in detail. On this chart we see that the Right Shoulder is taking the form of a Symmetrical Triangle. The sudden spikes on big volume within this pattern (and before it) are bullish and this high upside volume has driven the On-balance Volume higher and it is still close to making new highs, a positive sign. However, a strange and potentially concerning anomaly is the weak Accumulation line. What appears to be going on here is that whenever the price spikes a big seller comes out of hiding and dumps onto the rally, driving the price back down (and the Accum line). What will probably happen is that the company will arrange a "cross" trade to take him out, or his selling will naturally exhaust itself over time, but in any event it is not thought to constitute a formidable obstacle. Observe how the Triangle is closing up, so an upside breakout should occur quite soon.

On the 6-month chart we can review recent action in more detail. On this chart we can see 2 spikes—the one last November, that arose from the Right Shoulder low of the Head-and-Shoulders bottom, which was followed by a long and tedious reaction, and the one early last month, which has been followed by another reaction, that is thought less likely to be so deep, because the Triangle is now closing up, making it more likely that it will "get on with it" and break out of it.

Conclusion: Verde Agritech is rated a buy here, for a breakout from its Triangle leading initially to a challenge of the resistance at the upper boundary of the H&S bottom pattern at about C$1.80. Buyers should be aware that there is some (lesser) chance that it will first drop back to the support at the lower boundary of the Triangle now at about C$0.60. Long-term, once it has broken out of the base pattern, a major bull market will be in prospect. Verde Agritech trades in light volumes on the US OTC market, where for this reason it should be avoided for now. There are 37.3 million shares in issue, which is modest.

Verde Agritech website.

Verde Agritech Plc, NPK.TSX, AMHPF on OTC, closed at C$0.72, $0.567 on 10th April 2018.

Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Verde Agritech.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Verde Agritech, a company mentioned in this article.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stockmarket analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.