Peter Epstein, CFA Epstein.peter4@gmail.com https://EpsteinResearch.com

Cypress Development Corp. (TSX-V:

CYP) / (OTCQB:

CYDVF) / (Frankfurt:

C1Z1) is weeks away from publishing a NI 43-101 compliant maiden mineral (

lithium) resource estimate. Over the past 14 months, 23 holes

(21 of which bottomed in mineralization) were drilled on the Company’s 100% owned Dean & Glory claim blocks in Clayton Valley, Nevada. Results demonstrated good continuity across a large area. The upcoming maiden resource will likely be in the

millions of metric tonnes of Lithium Carbonate Equiv. (“

LCE“).

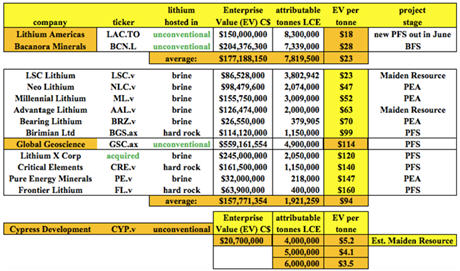

How can I say there will be millions of tonnes of LCE? Given the dimensions of the mineralized zones, average zone thickness and lithium grade — an educated guess gets one to at least

4 million tonnes LCE. I could play around with the math, but suffice it to say that whether the figure is 4 or 5 or 6 million tonnes, it would be a very large resource by global standards, {

see chart below}. NOTE: {

Lithium Americas’ Nevada clay project is shown in chart at 25% of LAC’s market cap…. its flagship asset is a JV with SQM in Argentina}

Make no mistake, Cypress is

earlier-stage than the others, and its deposit is

hosted in clay, meaning it’s unconventional

(not a brine or hard rock pegmatite deposit). So, a discount to peers is warranted. But, is the current discount, as shown by [

EV/tonne], too large?

News from Lithium Americas to Draw Attention to Nevada in June

Lithium Americas (TSX:

LAC) has a clay-hosted lithium project, also in Nevada, with a recently updated Measured, Indicated & Inferred (“

MI&I“) resource of 8.3 million tonnes LCE. An entirely new

(will replace the prior) Preliminary Feasibility Study (“

PFS“) on LAC’s clay project is expected in June. This report will contain valuable information directly applicable to Cypress’ Preliminary Economic Assessment (“

PEA“),

expected in September/October.

I believe that if LAC’s PFS is strong, they will spinout their Nevada clay project to try to attract market valuations like those of

Bacanora Minerals (London:

BCN) and Australian-listed

Global Geoscience (ASX:

GSC), which have an average market cap of

~C$400 M.

LAC has a ~

C$600 M market cap, but the majority of that valuation is attributable to the company’s Argentinian JV brine project with

SQM. A direct valuation comparison with Cypress is difficult.

To be clear, there’s no commercial-scale production anywhere in the world from clay-hosted, or unconventional lithium deposits. But, Lithium Americas & Bacanora have done a huge amount of work, including pilot plants, on their Nevada & Sonora Mexico clay projects. Standing on the shoulders of LAC & BCN, Cypress is benefiting greatly from this prior and ongoing body of work.

It’s worth noting that the Cypress’ Li grades are significantly lower than those of Bacanora’s & Lithium Americas’ clay projects. However,

what if, due to favorable geology, Cypress is sitting on a lithium resource that’s easier to extract & process? That may actually be the case, but it’s still too soon to know.

Suffice it to say that management is looking into various scenarios, and they’re excited about early findings. For one, management notes that its deposit

does not contain significant amounts of hectorite or smectite, clay minerals that require high temperature calcining to extract lithium, and have made Lithium Americas’ and Bacanora’s projects challenging to advance into production.

NOTE: {

Bacanora appears to be over the hump, production is expected in 2020}

Cypress believes its deposit contains clay minerals in which the lithium is soluble by conventional acid leaching. If true, it would eliminate significant steps in its process flow sheet.

Bottom line, there’s a decent chance that due to unique mineralogy, Cypress will be able to avoid certain steps in Bacanora’s process flow sheet. That could mean not having to do a pilot plant, potentially saving ten(s) of millions in cap-ex and 1-2 years of development time. Again, LAC & BCN led the path, having done an incredible amount of leg work on metallurgy. Therefore, Cypress could potentially reach BFS-stage faster and considerably cheaper than LAC & BCN.

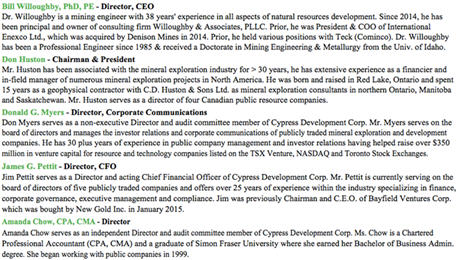

Cypress has a strong management team and Board. If the maiden mineral resource report delineates millions of tonnes of LCE, the Company should be able to attract additional high-quality execs and advisers as needed.

Cypress is fully-funded through PEA. Additional funding through delivery of a BFS

(assuming no pilot plant is necessary) would probably amount to less than

C$10 M. Conceivably, Cypress could publish a BFS in 2h 2019. I recognize that I’m getting ahead of myself with talk of a BFS next year, but it’s not a long shot, it’s a perfectly reasonable possibility.

Bacanora Minerals has Blazed a Path for Cypress

In reading Bacanora’s Sonora project (December, 2017) BFS, I noticed that the life-of-mine strip ratio is expected to be 3.4:1. That compares to virtually no waste removal for Cypress’ deposit, call it a strip ratio of 0.1:1. Offsetting this strip ratio advantage, Bacanora has a much higher lithium grade, but the combination of virtually no waste removal, favorable mineralogy, and project location represent substantial advantages for Cypress.

What if Cypress could develop a flow sheet with operating costs in the same ballpark as Bacanora’s? In my opinion, that would mean an after-tax NPV well into the hundreds of millions of CAD$. Alas, we will have to wait for Cypress’ PEA this Fall.

Cypress at

C$0.30 per share is trading at an Enterprise Value (“

EV“)

(market cap + debt – cash) of between

C$3.5 – C$5.2 per tonne of LCE

(assuming a maiden resource of 4 to 6 million tonnes). Cypress’ fully-diluted EV is ~C$21 M, with zero debt and ~

C$3 M in cash

(assumes all warrants & options are exercised). The best comp is clearly Bacanora, trading at an EV/t ratio of ~

C$28. It has a MI&I resource of 7.3 million tonnes and a strong BFS (

after-tax NPV(8%) of ~C$1 billion).

Bacanora’s BFS incorporated an

US$11,000/t price. Also in the BFS, a corporate tax rate of 30% (

vs.21% in the U.S.), a mining royalty of 7.5%

(no Federal or State royalties for Cypress), and a 3% gross revenue royalty to an investor in BCN

(no private royalties payable by Cypress). Conducting business in Nevada, (USA) has its advantages….

There are several near-term industry catalysts for unconventional lithium juniors. Bacanora expects to be in production by 2020. Lithium Americas is publishing a new PFS, in June

(replacing the old). In my opinion, LAC might spinout its clay project in 2h 2018. If it does, there would be 3 main publicly-listed, unconventional junior peers, each with market caps over

C$100 million.

Good news from LAC, BCN or GSC.ax is good news for Cypress. This lithium industry segment de-risking would arguably have the greatest impact on Cypress because it has a dramatically lower valuation to begin with.

Global Geoscience & Lithium X Corp. Suggest Possible Upside in Cypress

Global Geoscience is publishing a PFS on its unconventional asset, a lithium/boron project with economics of something like 55%/45% lithium/boron. That PFS will be big news because the company did not first generate a PEA, as is typically done. GSC.ax believes that there will be no need for roasting or calcining, which may also be the case with Cypress. As the market has come to understand that GSC.ax will reach production in 2 years, it now trades at an EV/t ratio of

C$114.

Notice on the chart above that

Lithium X Corp(PFS stage) was taken out by a Chinese group at an EV/t ratio of

C$120. Think about that for a moment, GSC.ax is trading at

C$114/t, Lithium X was acquired for

C$120/t, Bacanora is trading at

C$28/t…. should Cypress be valued at

C$3.5 – $5.2/t?

While clearly not an apples to apples comparison, the dramatic difference in valuations might be excessive. I leave it for readers to decide.

In any event, by the time the PEA comes out in Sept./Oct., readers will know considerably more about Cypress’ metallurgy and process flow sheet. There need not be additional equity raises before delivery of a PEA, especially as in-the-money-warrants get exercised. The stars seem to be aligned for

Cypress Development Corp. (TSX-V:

CYP) / (OTCQB:

CYDVF) / (Frankfurt:

C1Z1).

Readers should consider taking a closer look, here are links to additional information:

corporate presentationlatest news capital structure the projectphoto gallery

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER]

, (

together, [ER])

about Cypress Development Corp.

, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER]

is not responsible under any circumstances for investment actions taken by the reader. [ER]

has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER]

is not directly employed by any company, group, organization, party or person. The shares of Cypress Development Corp.

are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed / registered financial advisors before making investment decisions.

At the time this interview was posted, Peter Epstein owned shares and/or stock options in Cypress Development Corp.

and the Company was an advertiser on [ER]

.Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER]

is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER]

is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER]

is not an expert in any company, industry sector or investment topic.