A gold company active in Fiji is on technical analyst Clive Maund's radar screen as a buy.

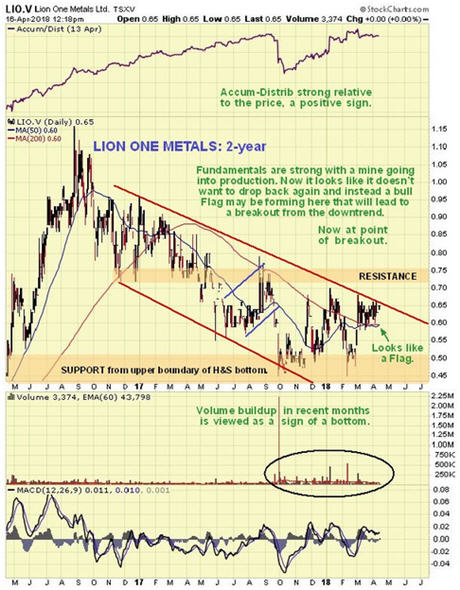

Lion One Metals Limited (LIO:TSX.V; LOMLF:OTCQX) is looking more and more positive here. It will be assumed by many traders that, having arrived at the upper boundary of the downtrend shown on the 2-year chart below, it will turn tail and drop back again as it has done in the past, but this time it doesn't look like it will. If we look carefully we can see that it is holding its ground here, so far at least, in a tight range that has the characteristics of a bull Flag, and doing so for long enough that we are on the point of seeing a bullish moving average cross.

If we now look at the suspected bull Flag in more detail on the 6-month chart, we see that volume has dwindled to a very low level, which at this juncture looks very bullish. Thus it looks likely that an upside breakout will occur soon.

A key point to note is that if Lion One does now break out from its downtrend, traders will come down off the fence and pile in, and with volume now so light it won't require many of them to drive a significant advance.

The conclusion is that Lion One looks is on the point of breakout here, so holders should of course stay long and it is again a buy at this price.

Lion One Metals website

Lion One Metals Ltd, LIO.V, LOMLF on OTC, closed at C$0.65, $0.51 on 16th April 18.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Read what other experts are saying about: