Technical analyst Clive Maund discusses two companies that have developed a process to extract minerals from E-waste.

On 15th March it was decided it was best to step aside from Enviroleach Technologies Inc. (ETI:CSE) and Mineworx Technologies Ltd. (MWX:TSX.V; MWXRF:OTCQB), because it looked like the correction that was already well underway by then would continue and result in us being able to buy them back at a better price. This has since proved to be the case, although we are "slow off the mark" with Enviroleach, which could have been bought back late in March at a very good price just above C$1.00. Nevertheless they are looking very good again now, for the reasons we will briefly look at. There is no reason to talk about the positive fundamentals of these stocks because they were discussed earlier.

Starting with Enviroleach, an 11-month chart enables us to view the entire price track from last May–June, and to delineate its strong uptrend, which is believed to remain in force for good reason—because the volume pattern continues to be strongly bullish, which is why the Accum-Distrib line continues to make new highs. This is very bullish and points to a new upleg dead ahead, and in fact it has already started, even though the price has yet to break out of the corrective downtrend channel—it started right after what is believed to be the low for the correction late in March. Other bullish factors to observe are momentum (MACD) turning higher and the bullishly aligned moving averages.

The 6-month chart for Enviroleach enables us to see recent action in more detail, and in particular that Friday's candlestick, because of its position, looks like a bull hammer, especially as most of the volume was upside volume, which is why the Accum line advanced further. This chart also makes direct comparison with the Mineworx chart lower down the page more easy, because it is for the same timeframe.

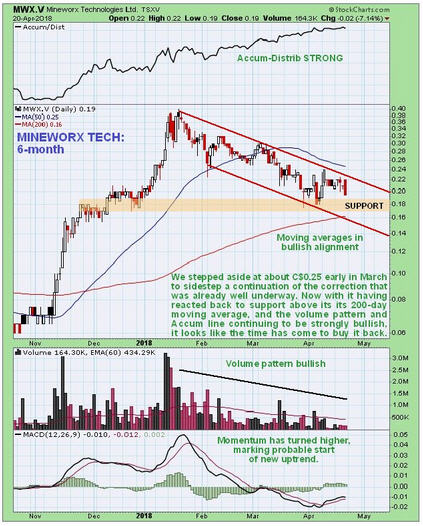

On the 6-month chart for Mineworx we see that we have a somewhat better entry point to buy back than with Enviroleach, because it is still not far above the low of its corrective downtrend. This is a good point to pick it up again, because it is just above a zone of support which itself is just above its rising 200-day moving average. Momentum (MACD) has just turned higher indicating that a new uptrend should now start, and we have a bullish volume pattern with recent light volume indicating that the correction is done and a strong Accum line making new highs, suggesting that another upleg is in the works.

Conclusion: it's a good time to buy back both Enviroleach and Mineworx in the reasonable expectation of a new upleg getting underway soon, which should be sizeable and result in good gains.

Enviroleach Technologies website.

Enviroleach Technologies Inc, ETI. CSX, EVLLF on OTC, closed at C$1.54, $1.29 on 20th April 2018.

Mineworx Technologies website.

Mineworx Technologies Ltd, MWX.V, MWXRF on OTC, closed at C$0.19, $0.166 on 20th April 2018.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.