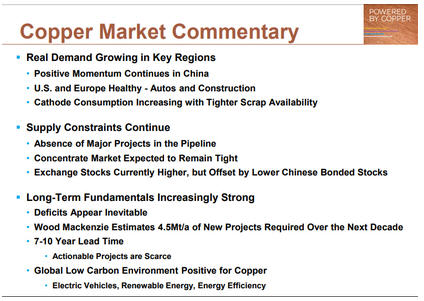

The CEO of copper mega-producer Freeport McMoran (NYSE:FCX) just stated that Freeport sees the global copper market heading for significant deficits over the coming years. A combination of supply constraints and growing real demand globally has created a situation in which “deficits appear inevitable” in the copper market:

Source: FCX presentation from BAML Global Metals, Mining and Steel Conference

Source: FCX presentation from BAML Global Metals, Mining and Steel Conference

Another aspect that will contribute to deficits over the next several years are long lead times (7-10 years) in copper projects i.e. actionable projects are scarce. Actionable projects in top tier jurisdictions are even more scarce.

Enter Kutcho Copper (TSX-V:KC) and its Kutcho Copper Project in Northern British Columbia. Kutcho is a project that is in the final phases before a feasibility study is completed – a construction decision is currently planned for 2021, which means that the mine could potentially ship its first copper/zinc concentrates less than five years from now. That is a much faster timeline to production than the vast majority of copper projects out there today.

Perhaps even more impressive is that Kutcho is a relatively high-grade copper project with an average grade of nearly 3% CuEq (copper-equivalent) across the project’s probable reserve of 10.4 million tonnes. Kutcho’s relatively high grade results in a low all-in cost (net of by-products) of C$.79/lb Cu for producing a pound of copper.

As Brent Cook of Exploration Insights so elegantly illustrated, the feasibility & development stages of a mining company’s life cyle can be especially challenging from a share price standpoint:

Cook calls this the “orphan period” in which most of the speculators have left and relatively few investors care about the story. However, it is the end of the feasibility stage and beginning of the development stage that offers investors the best risk/reward investment opportunity. Kutcho Copper shares are now in this investment sweet spot, right before a steady stream of news on project advancement brings a whole new set of eyeballs to the story.

Once Kutcho has optimized metallurgy, issued an updated resource estimate (hopefully larger and with more pounds moved into the measured and indicated category), completed its final feasibility study, and received mine permits, the stock will likely be valued at multiples of its current valuation. This leaves a brief window for investors to snap up Kutcho shares at a bargain valuation.

Kutcho Copper shares have spent the last couple of months oscillating between the high $.40s and the low $.60s as the company has been steadily making progress with advancing its high-grade Kutcho Copper project in northern British Columbia. With the ice thawing and snow melting in northern BC, Kutcho is about to embark upon its growth program at Kutcho with the objective of doubling the project size:

On

May 15th Kutcho issued a thorough NR laying out the company’s summer infill drilling and exploration drilling program, in addition to engineering & metallurgy work for the final feasibility study at Kutcho. This NR essentially tells investors that Kutcho is well on its way toward completing the feasibility stage of the mining life-cycle. It also means that there will be a steady flow of news throughout the summer and into the fall, news that could be tremendously positive in terms of upgrading the project (moving inferred pounds to M&I and/or making a new discovery at Kutcho) and, in turn, increasing shareholder value.

Between now and the end of the year, Kutcho shareholders can expect a completed exploration and resource expansion drilling program, completed metallurgy optimization studies, and an updated resource estimate. Meanwhile, at KC’s recent C$.54 share price, the market is valuing Kutcho at less than 10% of the NPV(8) laid out in the 2017 prefeasibility study (PFS) that used a US$2.75 copper price and a US$1.10 zinc price. To say that Kutcho shares are cheap right now is an understatement. The market is virtually giving this stock away and I can foresee a scenario in which the shares double from current levels, simply as a result of summer exploration results that help to prove up the resource (transfer pounds from inferred to measured & indicated) and get more eyeballs on the Kutcho story.

KC.V (Daily)

.jpg)

KC put in a higher low in mid-May, a rally above resistance near C$.64-.65 would target a move up to the C$.85-.90 area.

Disclaimer:

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Kutcho Copper Corp. is a high-risk venture stock and not suitable for most investors. Consult Kutcho Copper Corp’s SEDAR profile for important risk disclosures.

EnergyandGold has been compensated for marketing & promotional services by Kutcho Copper Corp. so some of EnergyandGold.com’s coverage could be biased. EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.