As a general rule, the most successful man in life is the man who has the best information

Remember the scene in that Tom Cruise movie, Jerry Maguire, when Cruise’s sports agent character gets a call from Arizona Cardinals wide receiver Rod Tidwell, played by Cuba Gooding Jr? Shirtless in his kitchen, Tidwell implores Jerry Maguire to shout “Show me the money!” loudly and with feeling, which he does, to the distress of his buttoned-down office co-workers.

The saying has become a bit of a cliche, but it’s an apt summary for an attractive lithium brine project whose stars have aligned to the point where suitors are bound to come a knockin’, and management could soon be shouting the same thing as Tom Cruise: “Show me the money!”

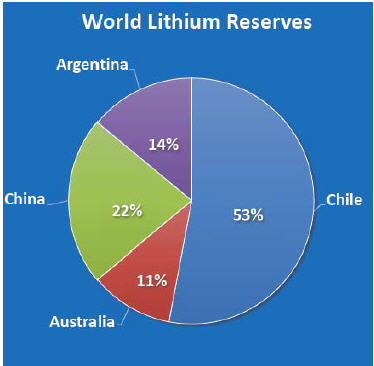

Lithium Chile (TSX-V:LITH, OTC-QB:LTMCF) has spent the last few years quietly amassing a huge collection of properties in the “lithium triangle” of Chile, Argentina and Bolivia - where about 75% of the world’s lithium comes from, given its abundance and high quality. Chile is currently the second largest producer of the main ingredient of lithium-ion batteries installed in electric vehicles, behind only Australia, home to the Greenbushes hard rock lithium and tantalum mine owned by Talison Lithium.

The small-cap lithium junior holds 152,900 hectares across 14 salars and one “laguna” (lagoon in Spanish), surrounding the world’s most important lithium reserves in the Salar de Atacama.

LITH’s land package (video) is the largest privately-owned lithium amassment in Chile.

One of the hottest, driest, windiest and most inhospitable places on Earth, the Atacama is ideal for lithium mining because the lithium-containing brine ponds evaporate quickly and the solution is concentrated into high-grade lithium products like lithium carbonate and lithium hydroxide used in EV batteries. Mining lithium in the salars of Chile and Argentina is much more cost-effective than hard-rock mining where the lithium is blasted from granite pegamite orebodies containing spodumene, apatite, lepidolite, tourmaline and amblygonite.

It’s a perfect jurisdiction to be in, with two of

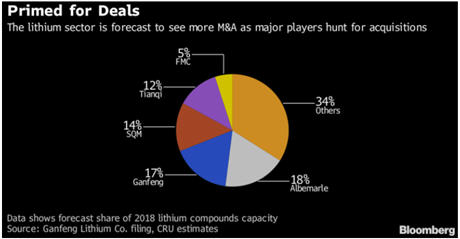

The Big Three lithium producers - US-based Albemarle and SQM, Chile’s largest lithium producer - controlling nearby ground. Moreover, Chile has become recognized as an excellent mining country, with a low risk of resource nationalism (resource nationalism is the tendency of people and governments to assert control, for strategic and economic reasons, over natural resources located on their territory), a new mining code, and clear permitting rules - all major pluses for mining and exploration companies hoping to do business there. But it wasn’t always this way.

Chile opens up to investment

Chile opens up to investment

In December 2017 Chile elected a new President, Sebastian Pinera. The billionaire businessman, who was President between 2010 and 2014, campaigned on a pro-growth, pro-mining platform. In January 2018 Pinera made good on that promise by having his right-leaning government issue the first new lithium production and export license in decades. The pro-mining mandate also meant sweeping changes to the mining code, regulation and permitting - facilitating low-cost acquisition and fast exploration. The Chilean government continues to change the rules regarding lithium production and exportation such that foreign public companies, other than the two majors, Albemarle and SQM, are being granted licenses.

Lithium Chile’s ability to acquire all the strategic properties it holds came about because of a perfect storm, brought about by a change in government. Before Pinera was back on the scene, a centre-left coalition ruled the country, and the economy was bleak. The mining, producing and exporting of lithium was restricted by an old government decree based on its use in nuclear fuels. At the same time, Argentina had eased foreign capital restrictions, elected a pro-mining, right-wing government and supported lithium exploration. Foreign investment went to Argentina, while in Chile, companies and capital stayed away.

Low-cost land acquisitions

Except for Lithium Chile. While most lithium explorers were buying up ground in Argentina, Lithium Chile turned to geologist Terry Walker. Their man in Chile had 26 years of experience in the country, not to mention a Chilean wife and children. Walker also had access to something that would prove extremely valuable: a database of the salars first done in the 1960s and updated in the 90s. The survey for the Chilean government contained information on salar chemistries and grades, and Walker used it to identify the best properties for staking. Unbelievably, Walker was able to pick up highly prospective land blocks for not much more than $3 a hectare.

By comparison, Millennial Lithium entered Argentina in 2016 and bought its first project, Pastos Grandes (PG) at $2,000 a hectare. This project had $4.5 million in previous exploration drilling. Within six months of acquisition and additional exploration, adjoining ground at PG was selling for $3,000 a hectare. Following the realization that PG contained a mineral resource that could be mined, Millennial bought adjoining ground at closer to $9,000 a hectare (2,600 hectares for USD$22.6 million).

Now, prospective lithium blocks in Chile are going for $1,000 a hectare; not only that, the low-hanging fruit is gone, along with rock-bottom prices. Any more available land is held by Chilean corporations or families, and it is not going cheap. The possibility of replicating what LITH has accomplished in assembling it’s land package would, in your authors opinion, be impossible today. The cost alone would be staggering, Lithium Chile has a land package totaling 152,900 hectares, at today’s price of $1,000.00 per hectare to assemble the same size package would cost over $150,000,000.00.

4 key prospects

With nearly 150,000 hectares under its control, Lithium Chile went exploring in 2016. Since then, the company has completed surface and near-surface brine and salt sampling programs on six salars: Coipasa, Ollague, Helados, Atacama, Turi and Talar. Geophysical surveys on five properties have also been done, with reconnaissance drilling planned for later this year.

Of the six identified salars, four have been prioritized according to three criteria: grade, size and access. All four properties - Coipasa, Ollague, Helados, and Atacama - are accessible by paved highways - so the difference really comes down to size and grade. Surface and auger sampling returned grades ranging from 580 milligrams per liter (mg/l) at Salar de Turi, to 1,410 mg/l at Salar de Coipasa. Surface and near-surface sample grades on the four above-mentioned properties were north of 1,000 mg/l.

To put that in perspective, average lithium production grades in Argentina are 600 mg/l.

In brine lithium mining, size is important because you need large evaporation ponds. Anything less than 3,000 hectares is too small. Lithium Chile’s Coipas and Helados salars size up at a respective 11,000 and 30,000 hectares - making them suitable for building a lithium production facility in the future.

A few highlights:

Helados - At over 150 square kilometers, Salar de Helados is Lithium Chile’s largest prospect. The property contains a large laguna - 6 kilometers long and 65 meters deep. The grades on the edge of the laguna are about 1,100 mg/l. On an extension of the salar and salt cap, samples brought back grades of 1,200 mg/l.

Atacama - At Salar de Atacama, the company has seen grades beyond 1,300 mg/l.

Coipasa -The Salar de Coipasa straddles the Chile-Bolivia border, meaning that a third of the salar is in Chile, and two-thirds is in Bolivia. While this could create a conflict of ownership, with Bolivia producing no lithium right now, there is nothing stopping Lithium Chile from draining the salar on both the Chilean and Bolivian sides, according to the company. LC’s highest grade sample was taken here at a meter below surface. At 1410 mg/l this is by far the best sample Lithium Chile encountered.

100% salar ownership

A company should have 100% control over the production from their salar. It’s possible an aquifer can become diluted - over-producing can impact the brine’s salt concentrations and chemical compositions - or deplete it by too many wells sucking up more brine than should be produced.

If two or more companies have straws (wells) into the same salar, legal battles might result over the sharing of the resources.

However in Lithium Chile’s case they have attempted to control the majority of the land in their most prospective targets. For example they control over 70% of the Salar de Coipasa.

Another important point about Chile is that unlike other mining jurisdictions, claims ownership does not come with a work obligation, meaning companies don’t have to worry about regular expenditures to keep their claims current. There are also no additional option payments to make, and no net smelter royalties to be paid to the government.

Low contaminants

A common industry axiom says that the ratio of magnesium to lithium in brines must be below the range of 10:1 to be economical. This is because the magnesium has to be removed by adding slaked lime to the brine. The slaked lime reacts with the magnesium salts and removes them from the water.

The higher the magnesium to lithium ratio, the costlier it is to produce a tonne of lithium.

According to Lithium Chile most of the samples they’ve taken so far are running at around a 4:1 ratio. This is significantly lower than brine-magnesium ratios in Argentina, which run between 5:1 and 10:1. Millenial Lithium, with its above-cited Pastos Grandes project in Argentina, has about a 6:1 ratio.

Shallow extraction

Most of the samples taken by Lithium Chile have been taken at or near surface. The exploration targets, judging by the conductivity, are between 20 and 300 meters deep. This is in line with most of Chile’s lithium, which is found around 30-35 meters below surface - significantly shallower than Argentina’s lithium where the lithium-bearing zones run between 300 and 500 meters. Why is this important? Because the deeper the target, the more brine needs to be pumped to the evaporation pond - adding costs and time.

Low costs

Lithium prices will fluctuate, so it’s important for a would-be lithium producer to be able to handle lower prices. In this respect, Chile is by far the safest place to weather a lithium price correction, given it’s the lowest-cost jurisdiction in the world for mining lithium. While it’s too early for Lithium Chile to publish expected production costs, a couple of examples prove the point. When Lithium Power International did a PEA on its 50%-owned Maricunga salar lithium project in Chile, the predicted cost of producing a tonne of lithium carbonate equivalent (LCE) was between $2,600 and $2,700 a tonne. Over in Argentina, Millenial Lithium has their PEA set at $3,200 per tonne. Neo Lithium, also in Argentina, is around the same, $3,300 a tonne. Chilean lithium production is therefore about 25% cheaper than Argentina’s. To put that in perspective, it costs about $6,000 per tonne to convert spodumene to lithium hydroxide - which is done in China from Talison’s Greenbushes mine in Australia. The lithium carbonate conversion is about $500 higher.

Exploration program

As mentioned one of the criteria for identifying priority targets was, obviously, grade. Steve Cochrane, president and CEO of Lithium Chile, said “the richest, lowest-cost lithium mine in the world is the SQM/Albemarle Atacama property. And their production grade right now is 1,500 milligrams per liter. So having that 1,410 on an auger sample is very encouraging.”

Cochrane, who joined Ahead of the Herd in a wide-ranging interview, also noted that lithium grades in Chile are twice those of Argentina, the chemistry of the brines is significantly better, and the magnesium content is lower.

“Even things like evaporation rates are two to three times what they are in Argentina because of precipitation, so there’s a real advantage to Chile.”

We asked Cochrane what the plan is, as far as next exploration steps. How will Lithium Chile go about delineating the LCE tonnage of what could be a high-grade lithium deposit?

“The ultimate goal is to first all prove that you have a lithium-bearing aquifer on your property and then move that discovery to a resource,” he said, noting there are four steps toward that objective.

The first two - sampling and transient electromagnetics (TEM) - have already been completed. “What that data indicated on our four properties is that we have a large conductive area over Coipasa, Ollague, Helados, and Atacama that would certainly be indicative of a liquid or a salt-rich prospect.”

Steps three and four are to identify drill targets (already done) and then to file for permits. Drilling permits have been issued but the company is waiting on land-access permits. Assuming those arrive, the next step will be to drill reconnaissance holes and perform pumping tests, to get an idea of flows.

While exploration is still early-stage, Cochrane said he likes what he sees; it’s just a matter of confirming it with the drills.

“We just really don't know, I mean the bride hasn’t been undressed,” he quipped. “We’ve got some great looking geophysics, some unbelievable surface samples, and we’ve got no competition in these salars.”

As a comparison, consider that Millenial Lithium only needed 11 holes to prove up a resource of 2.1 million tonnes measures and indicated lithium carbonate equivalent. If Lithium Chile can do something similar, the market is sure to take notice, as well as potential acquirers.

“Suffice to say, I think the targets that we’re looking at are substantial for all the properties, and as a standalone prospect, I think any company would be pleased to have one of them, let alone four,” said Cochrane.

The right project at the right time

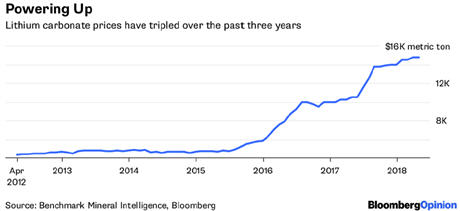

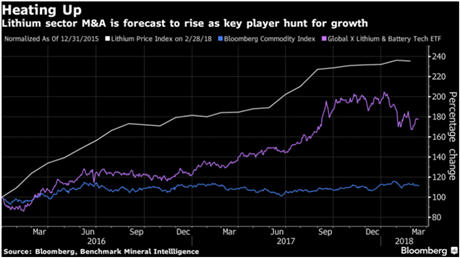

We’ve written extensively on lithium demand and supply, and most recently, how predictions of a supply glut are unlikely to come to fruition, despite the best guesses of analysts. Perhaps the most obvious evidence of the lithium bears being wrong, is that lithium prices have not budged at all since those predictions came out. What that indicates is that demand is still strong - certainly not being overwhelmed by supply.

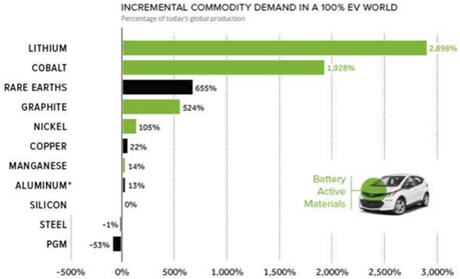

So Lithium Chile is entering the market at a great time, in terms of lithium demand. Remember, in 2016, Chinese carmakers sold 28.03 million cars. If China follows through on its promise to go 100% electric that’s a minimum 28.03 million lithium-ion battery packs for EVs per year. Add in the UK’s 2.7 million car sales in 2016 and France’s 2 million car sales in 2016. That’s 32.73 million electric vehicles all requiring lithium-ion battery packs, without counting electric buses (a big deal in China, and going to be in India as well) or annual growth rates in auto sales.

We also wrote about the take-out of Lithium X by Chinese company NextView. We calculated the value of the lithium in the ground, of that project in Argentina, to be $132 per tonne. Now, while we think that NextView overpaid for LIX, it’s intriguing to imagine what the market might pay for Lithium Chile - which has four high-grade (based on samples and geophysics) targets, in a far more attractive, and lower-cost, jurisdiction.

Then there’s the point about scale. For the first time ever, automakers are actually negotiating with mining companies, so important is the need to secure components of electric vehicles. For example

Volkswagen and Apple are both reportedly talking to major producers in order to secure cobalt - another key ingredient in EV batteries. It’s all about security of supply. These companies are looking for large deposits - of lithium, cobalt, copper - not small ones, because having to go to several suppliers for feedstock is inefficient, and expensive. That’s why Tesla is looking to source its lithium from Chile, not North America, where the mines are just too small.

We think that investors are underestimating the sea-change that is taking place from internal combustion engine vehicles to EVs. Why is that? Because it hasn’t been made necessary. But some countries are forcing people to change their mindset. China, India, France, and the UK are among countries that have promised to end the sale of gasoline and diesel vehicles. If they actually do it, by passing laws, we may be looking at

a tsunami of battery-metal demand.

A million electric cars produced in North America means 45,454,000 kg/ 100,000,000 pounds or 45,454 tonnes /50,000 tons of lithium carbonate equivalent (LCE) has to be mined just for Tesla’s North American electric vehicle production. And it's not just about the US. China is also building lithium-ion megafactories, and by 2020 these are expected to grow global production capacity by six times. Think about those global 32,730,000 lithium battery packs. If each used the same amount of lithium carbonate as Tesla’s electric vehicles, that’s 1.487 billion kilograms/ 3.273 billion pounds or 1,487,727 tonnes /1,636,500 tons of new lithium carbonate demand. Current annual production of lithium carbonate equivalent (LCE), for all purposes, stands at about 230,000 metric tonnes.

Consider; In 2014 the Benchmark Mineral Intelligence lithium battery megafactory tracker listed only three planned plants. Today 26 battery cell plants that are either in production and due to expand capacity or new operations due to be in production by 2021 are being tracked!

How on earth are we going to fill the gap between supply and demand? The answer lies in companies like Lithium Chile, that can bring on more supply, quickly.

Chile Lithium (TSX.V:LITH) Capital share structure:

Insider ownership 51%

Public ownership 49%

Total shares outstanding 101,000,000

Fully diluted 110,800,000

Treasury $8,800,000.00

“The mining industry just can’t keep up to the change that’s coming. People are trying to find fast ways to get lithium out, but that’s not going to happen. It works at bench scale, it does not work at big scale,” said Andy Bowering, a Lithium Chile director. “The tried and true approach is brine evaporation. Take any metal out of any rock, you’ve gotta reduce it to a liquid at some point, regardless of the metal. In Chile, and Argentina, and Bolivia, nature’s done it for you.”

Conclusion

A confluence of factors - the perfect storm - is meshing for Lithium Chile in what is arguably the best place in the world for mining what some have dubbed “white petroleum” for its potential to accelerate a sea-change in our global transportation system. The company has accumulated over 150,000 hectares of prospective land blocks in the Salar de Atacama of the “lithium triangle,” where the majority of the world’s lithium is produced.

Lithium Chile has four properties, each with multiple drill ready targets. The drills are expected to start turning soon. But Lithium Chile isn’t just a property owner. LITH has deep exploration and development expertise that will enable it to advance their projects to a maiden resource, PEA and beyond - giving it the option either to be a lithium miner or to hive off one or more of its projects to a major like SQM or Albemarle, a battery supplier, or even an automaker wanting to lock up a long-term lithium supply.

Demand for lithium will continue to outstrip supply, meaning prices are likely to remain strong well into 2025 and beyond. Governments are promoting a shift to EVs in a top-down approach that could eventually mean the demise of gas and diesel-powered vehicles.

For all of these reasons, I’ve got LITH on my radar screen.

Richard (Rick) Mills

aheadoftheherd.com

Just read, or participate in if you wish, our free

Investors forums.

Ahead of the Herd is now on

Twitter.

Newsletter Archives.

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard does not own shares of Lithium Chile Inc. (TSX.V:LITH). LITH is a paid sponsor of aheadoftheherd.com