In this issue an update of significant developments on some of my green tech and tech companies I follow. A lot of new developments in the past week.

Greenbriar TSXV:GRB OTC : GEBRF Recent Price C$1.15

Things are picking up speed with Greenbriar Capital Corp. (GRB:TSX.V; GEBRF:OTC) as the company executed a $50-million (U.S.) mandate arrangement with a major U.S. investment fund to provide the essential project equity portion of the proposed $305-million (U.S.) Montalva project financing package. This occurred in early May and this $50-million (U.S.) equity financing will not dilute the issued common shares as this is a structured product at the project level.

Last week, Greenbriar executed an additional $265-million (U.S.) mandate with Pegasus Renewable Energy and Sustainable Infrastructure Credit Advisors LP (RESIC) for the company's 100-megawatt AC Montalva solar project. Together with the previously disclosed $50-million mandate with Pegasus, the total under letter of intent is now $315 million, which covers the entire forecasted project cost.

RESIC specializes in key mezzanine capital investments and is an affiliate of Pegasus Capital Advisors LP, an alternative asset management firm with approximately $1.9 billion in assets under management. Pegasus invests in companies within the sustainability and wellness sectors that are seeking strategic growth capital.

As an incentive to RESIC, the company will issue upon certain conditions, two million common share purchase warrants exercisable for a period of five years at a price of $1 per share. The RESIC finance team for this $265-million LOI is led by Thomas Emmons. Mr. Emmons is an experienced financier in the U.S. renewable energy business and has been involved in financing over $20 billion in wind and solar projects in the United States since 2008.

One of the toughest hurdles to develop any resource or energy project is obtaining the financing for build out and Greenbriar now has this all wrapped up, so a major risk factor has been removed.

The project is on fast track as a critical energy and infrastructure project for Puerto Rico under the U.S. Financial Management and Oversight Board. I believe we are not far off from the day that this gets the green light to start construction. Not to repeat myself, but is important to remember that Montalva once built will generate revenue of US$58 million per year for 35 years to Greenbriar. That is over three times Greenbriar's current market cap.

What is more, Greenbriar released news today on further developments of its 132-acre land tract in southern California. The company has engaged Co-Create Living; it's founder Stuart Nacht has over 40 years of experience in real estate construction and development. Greenbriar's plan is to develop and sell over 1,000 residential town home units. The property had already received approval for a previous 688 unit plan so this will be revised by Co-Create Living.

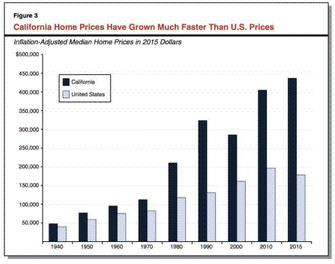

California is facing a severe housing shortage with median home prices about double the national average and rents about 50% higher. Greenbriar will be part of the solution and as per the new California law will equip their homes with solar panels from its solar division.

Once fully built out, the property will yield over US$260 million in gross sales, more than 15 times Greenbriar's current market valuation. I believe this in one of the most undervalued and unknown stocks listed in Canada.

There are some interesting observations on the chart. I see a rising up trend with higher lows and the 200 Day MA still moving up, although flat the past month. The top or resistance is around $1.55. The trading volume on this stock is light but you can see an increase since last November. It reminds me of a pot on slow boil with the lid on tight and you know it will eventually blow off. I believe this is what we will see here, a pop and quick sharp move through $1.55 and it really there is no resistance above that so it will launch into some higher trading range.

I would be using the current market weakness to accumulate stock

Smartcool TSXV:SSC OTC:SSCFF Recent Price C$0.055

Smartcool Systems Inc. (SSC:TSX.; SSCFF:OTC; R3W:Frankfurt) released Q1 2018 results on Friday with revenue of $314,363 up 265% over Q1 2017. This is good news, although the revenue growth has been slower to gain momentum than I expected. In 2017 revenue came in at $774,279 for the year and by Q1 2018 I was expecting a revenue run rate of several million and at the current pace we are only around $1.2 million.

I believe they have some momentum to continue to grow revenue but there are two short-term factors we need to watch that could make a big impact for 2018.

Early March SSC announced and LOI to acquire Total Energy Concepts (TEC), based in the U.S. state of Minnesota.TEC is a distributor of Smartcool products but more importantly has its own line of energy efficient products and has been in business since 2003. SSC needs to close on this acquisition and then we could see the stock react better as it would add significantly to revenues.

The second catalyst will be Smartcool's agreement with Mike Holmes and The Holmes Group to partner and promote the company's ECOHome products internationally. They are first focused in the southern U.S. states and if sales get traction for this new home product, it could add significantly to revenues.

I don't believe the stock is going to take off at least until they close a $800,000 financing at 5 cents.

The stock remains in the wedge pattern I pointed out a couple months back and the 200 Day MA is still in an uptrend but leveling off. The range has been tight between 5 and 6 cents. A close at 7 cents or higher would likely signal a new rally under way with 10 cents the upper resistance.

Drone Delivery TSX:FLT OTC:TAKOF Recent price $1.73

Entry Price $0.43

Last week, Drone Delivery Canada Corp. (FLT:TSX.V; TAKOF:OTCQB) and Toyota Tsusho Canada Inc. (TTCI) signed an agreement to collaborate on a drone delivery logistics platform. TTCI is a wholly owned subsidiary of Toyota Tsusho America Inc. The ultimate parent company of TTCI is Toyota Tsusho Corp., the trading affiliate of the Toyota group of companies. Under the agreement, TTCI will participate in Drone Delivery Canada's commercial pilot program in Canada as an initial stage. Collectively, the two groups will look to commence flight testing and identify other international markets to deploy Drone Delivery's proprietary drone delivery platform as a transportation solution.

"This agreement with TTCI is expected to open international markets for us as a company," commented Tony Di Benedetto, chief executive officer of Drone Delivery Canada. "Working alongside a global industrial leader such as Toyota Tsusho also provides us quick access to a very extensive international global network and a breadth of commercial skills."

"We are confident drone delivery services are the way of the future. This agreement with DDC will enable us to participate in this cutting-edge technology," commented Hidetoshi Tada, president TTCI.

On Friday it was revealed that Transport Canada has selected FLT to participate in the department's beyond visual line of sight (BVLOS) pilot project. The pilot project in Moosonee and Moose Cree First Nations communities will advance FLT's BVLOS capabilities and will further FLT's capabilities in the pilot project communities in northern Ontario, commencing in the summer of 2018.

The pilot project will utilize FLT's drone delivery platform, which includes its Flyte management system, DroneSpot technology and its Sparrow X1000 delivery drone, which was deemed compliant by Transport Canada in late 2017. FLT's pilot project with unmanned aircraft deliveries will include letters, packages and medical deliveries from a large group of FLT's existing customer base, including FLT's recently announced partnership with Toyota Tsusho Canada Inc. on May 28, 2018.

This is a huge vote of confidence by Toyota and Transport Canada. I have no doubt FLT will be the first and probably leader in drone deliveries in Canada. Its expansion of testing in the U.S. and the agreement with Toyota will probably expand FLT into other countries as well. The stock remains in a long-term up trend. After the first run to $2.20 we seen a nice consolidation and a new rally has begun. There is resistance in the $1.90 to $2.20 area and I am betting the approval from Transport Canada for BVLOS deliveries is what is needed to break out into a higher trading range.

Patriot One Technologies TSXV:PAT OTC:PTOTF Recent Price C$1.56

Entry Price $0.95

It has been a while since I updated Patriot One Technologies Inc. (PAT:TSX.V) and for new readers you may want to watch this video to get a good idea what their weapons detection system does. https://patriot1tech.com/news/videos/

I am convinced this will sell big time once the company finalizes the product for full commercial launch and that has taken longer than expected. All the FCC approvals are in place since Q3 2017 and it began commercial production, but it was discovered some fine tuning was required in live environments compared to the lab.

Currently engineering teams are focused on developing and honing the Patscan CMR antenna system. During the past three months it has been fine tuning and managing minute background anomalies found in real-world environments that were not readily identifiable in previous laboratory studies. As a result, the company instituted an antenna update program, which requires additional testing.

Patriot One has been working with the Westgate Las Vegas Casino & Resort that has provided in-depth and practical field study results at this key juncture. The company believes this has saved significant capital and amassed strategically important data that it would not have otherwise collected as quickly. It has begun preparations to roll out two additional development centers, one at a major Midwestern United States university and another in a southeastern U.S. school district. Working in these additional real-world environments, including applying recent advances in the antenna design, will further propel the hardware and software development, and move the Patscan CMR solution further toward commercialization.

The company highlighted in a press release, "Given that our product, when released commercially, will play a front-line defensive role in potential life and death situations, there is a fundamental need to ensure the technology works effectively. There is no second best or excuse for releasing a product until we are satisfied with its performance."

We are still sitting on a 70% gain but the stock has been languishing, probably because of commercial launch delays. There is support around $1.50 which is also the area of the 200 Day MA. I would try to buy on dips below $1.50.

For 27 years, Ron Struthers, founder and editor of Struthers' Resource Stock Report and Playstocks.net, has consistently beat the comparable benchmarks selecting stocks in the precious metals, oil and gas, clean-tech and disruptive technology sectors. In 2017, 35 stocks in the precious metals sector saw an average gain of 62% and energy clean-tech an average gain of 65%. In disruptive technology, 16 picks saw an average gain of 55%. Past performance is no guarantee of future gains. Struthers leverages his vast network of contacts, approaches investments from a value perspective seeking several 100% gain potential and uses technical analysis to aid in buy and sell levels.