The following interview of CEO Bill Willoughby, Phd, PE of

Cypress Development Corp. (CYP:TSX.V; CYDVF:OTCQB; C1Z1:FSE) was conducted by phone and email over about a one week period ended July 11th. I've written several articles about this

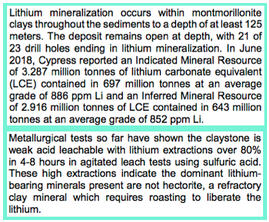

Epstein Research website sponsor—so far management has delivered on promises. In June, the company delivered a maiden lithium resource estimate of 3.3 Million tonnes (Mt) Lithium Carbonate Equivalent (LCE) in the NI 43-101 Indicated category, plus 2.9 Mt LCE Inferred.

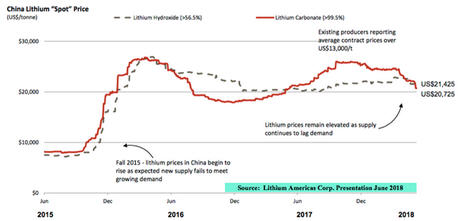

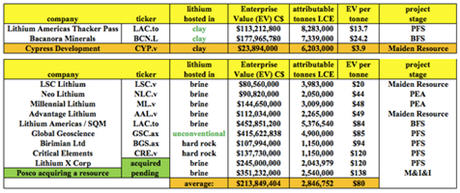

Cypress has the third largest lithium resource in North America, but the lithium is hosted in clay, and no clay-hosted lithium projects have reached commercial production. However, that's very likely to change as Bacanora Minerals' (BFS-stage) Sonora, Mexico, clay project is expected to start production in about two years and unconventional/clay projects owned by Global Geoscience and Lithium Americas, (both at PFS stage, both in Nevada), could commence production within three to four years.

Cypress is just weeks away from reporting key metrics of a PEA. Lithium Americas recently delivered key PFS metrics on its Thacker Pass clay project, including an after-tax NPV(8%) of ~C$3.4 billion and IRR of 29.3%. That's based on a two-stage production ramp up reaching 60,000 tonnes per year LCE in 2026.

Cypress is contemplating less than 60,000 tonnes/year in its upcoming PEA, but if it can demonstrate attractive op-ex with relatively moderate cap-ex needs, a NPV well into the hundreds of millions of Canadian dollars seems likely. Compare that to Cypress Development's market cap of ~C$22 million.

Without further preamble, here's the exclusive interview with CEO Bill Willoughby.

There's been a lot of good news at Cypress Development Corp., a maiden lithium resource estimate and rapid progress on a PEA (expected in next several weeks). Let's start with the maiden resource; what are the key takeaways?

We have a very significant resource. It's been a little over a year since Cypress started drilling and we have an NI 43-101 compliant Indicated resource of 697 Mt at 886 ppm lithium. This alone equates to 3.3 Mt Lithium Carbonate Equivalent (LCE). And, we have another 2.9 Mt LCE in the Inferred category, making our overall project (we believe) the third largest lithium resource in North America.

Most drill holes ended in mineralization, so additional drilling could grow the resource, and well placed holes could increase overall grade and improve the proportion of Indicated vs. Inferred tonnes.

The technical report shows what we're calling a "preliminary pit," where our consultants at GRE outlined nearly 200 Mt of clay around some of the higher-grade holes. So, it looks like there will be room in the PEA to optimize grade by selective mining.

In the chart below, a cut-off of 900 ppm Li generates an average Li grade of 1,126 ppm and ~36 years of production at 20,000 tonnes/yr. from the Indicated category only (i.e., not including Inferred). This gives us substantial tonnage as a starting point for our PEA.

A resource estimate by itself is not an economic study, but it does contain an economic basis in the form of a third-party (GRE) selected cut-off grade. The economic premise for our project depends upon metallurgy, and specifically that the lithium is in an acid-leachable clay. So far, we've done metallurgical bench tests on material from three drill holes, two of which are within the preliminary pit shell.

Tests show that lithium can be leached rapidly with relatively low acid consumption. If this were not the case, it's doubtful we would be moving ahead at the pace we are.

While it's exciting that a PEA is expected within weeks, what's the rush to get it out? Aren't there a number of open questions on metallurgy and the process flow sheet that need to be answered?

We see a good project and the steps ahead include more drilling and environmental studies. While we don't need these steps to complete the PEA, we need the PEA to define the scope of the project so that we can keep it moving in these other areas.

As for metallurgy, we already have enough information in hand for the PEA. We know our flow sheet, which includes agitated tank leaching using sulfuric acid. We know our options on how to treat leach solutions and arrive at an end product, whether lithium carbonate or hydroxide. We know we have more work to do and questions to answer.

Cypress is sitting on a "clay-hosted lithium" project. There's no meaningful lithium production anywhere in the world from clay. Why have clay-hosted projects been so difficult?

The process we are planning—agitated tank leaching—is quite conventional. We're talking about lithium, which doesn't have a long history in mining. The world's very first lithium brine operation started just 50 years ago, and that was next to us in Clayton Valley, Nevada, at Albemarle Corp.'s Silver Peak.

It's very true that clay-hosted deposits have been very difficult to exploit. The deposit you're probably thinking about is Kings Valley, in northern Nevada. That deposit is very good grade but contains the clay mineral hectorite, which requires heating to high temperatures to leach the lithium. Until the recent rise in prices, the economics for a hectorite project weren't there.

Lithium Americas, owner of Kings Valley, just in the last year announced a very large resource at Thacker Pass that is not hectorite and is acid leachable. A company working west of Silver Peak, Global Geoscience, is also pursuing acid leachable lithium at its unconventional deposit, Rhyolite Ridge.

As far as processing goes, the idea of acid leaching clay is quite common. For Clayton Valley we are looking at a standard crusher followed by agitated leaching, purification and recovery of lithium from the leachate. The flow sheet is what you might see on the hydro-metallurgical end of hard rock lithium projects, quite similar in concept to agitated leaching of gold or copper oxide resources.

How is Cypress' clay project different?

You touched upon our extremely low strip ratio. The clays are soft and won't require drilling/blasting, so mining costs should be "dirt cheap," excuse the pun. As mentioned, the lithium appears to leach quickly with low acid consumption at relatively mild temperatures. This suggests a plant that could potentially have high throughput and low operating costs.

When you talk about a hard rock operation, you have drilling and blasting and overburden removal involved. You've got to crush and grind to the appropriate size faction, then do gravity and flotation to make a spodumene concentrate, followed by pyrometallurgy and leaching. If you look at our flow sheet, we're virtually just scooping the material out, putting it in the mill, then jumping straight into the hydro-met section. So you can see there's a whole series of events that we're bypassing.

What's the current status of metallurgical testing, what further testing needs to be done for the PEA?

We have the information for the PEA as far as testing goes. We are, however, still doing work to improve our knowledge and obtain information for what will come after the PEA. As mentioned, we have five clay units defined in the resource estimate. So far, we have worked in the labs with two composite samples from three holes.

In the next stage of testing, which we are working on now, we will look for differences between the clay units and by location across the property. We are also looking into ways to purify leach solutions and recover lithium to end product.

Are there noteworthy read-throughs from Lithium Americas' press release describing its Prefeasibility Study on the Thacker Pass clay project (in Nevada)?

Overall, there are similarities that feed the tendency to compare our projects. Thacker Pass is located in northern Nevada in the McDermitt Caldera. Historically, the deposits there have been known for difficult metallurgy due to the presence of the clay mineral hectorite. With Thacker Pass, Lithium Americas has identified a new resource area that is acid leachable. The grades are higher, averaging around 3,000 ppm lithium, and the PFS shows positive economics, producing 30,000 to 60,000 tpy of lithium carbonate.

However, there are significant differences, most notably in mining cost and acid consumption, that could offset the difference in grade. We might be able to say more when our PEA is done.

What have been the biggest positive or negative surprises with regard to the metallurgy?

The most positive finding, of course, is that we have acid leachable clay. We are able to leach a high percentage of the lithium in a short period of time, in mild leach conditions and with low acid consumption. To be clear, we still have room for improvement, and we have found a few steps in the leaching and treatment of the solutions that are encouraging, possibly unique or proprietary to our deposit.

What's the latest on how much water might be needed, can water be recycled, can the company obtain water rights in Clayton Valley?

We have estimated what we need for water, which will be in the PEA, and have identified options regarding how to get it. Water is a concern, but until we have the PEA in hand and additional funds to pursue our options, we aren't actively looking to acquire water rights at this time. Instead, we're identifying ways to minimize use, including reclaiming process water and opting for dry-stack tailings as opposed to a tailings pond.

Given talk about the Trump Administration's proposed fast-tracking of natural resource projects (for select minerals/metals deemed to be of high strategic importance), is there any evidence of this with regard to the BLM and Cypress' Nevada project?

That's a good question. We haven't progressed that far into permitting yet, but we have heard that other natural resource companies are seeing some changes. We're hopeful that when people see our PEA and the scale of our project, they will put it together with the importance of lithium as an energy metal and our project being a significant potential source of domestic supply.

Nevada is a world-class location due to its infrastructure, rule of law, skilled mining labor force and mining equipment/services availability. The newly enacted tax law, a federal tax rate of just 21%, with no federal or state royalties, is a big deal. In Chile the only producers in the country—SQM and Albemarle—are paying a sliding scale royalty on lithium sales currently equal to about 20%.

Thank you so much, Bill, for your time and detailed answers to my questions. The world awaits your PEA.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis, and he is a Chartered Financial Analyst (CFA). He holds an MBA degree in financial analysis from New York University's Stern School of Business.

Disclosures: The content of this interview is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Cypress Development Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Cypress Development Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed / registered financial advisors before making investment decisions.

At the time this interview was posted, Peter Epstein owned shares and/or stock options in Cypress Development Corp. and the Company was an advertiser on [ER]. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: Cypress Development Corp. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts and graphics provided by author.