There was a time not very long ago when hard work, honest execution, determination and honor contributed to financial security. In special cases, extraordinary application of those four practices resulted in financial windfall, as in the case of the visionary entrepreneurs from Benjamin Franklin to James Watt to Henry Ford to Bill Gates and Steve Jobs.

In the 1980–2000 era, enormous fortunes were also created by those men and women daring enough to use funds from private investors to allow them to carry out and complete geological theories resulting in massive discoveries, be it in oil and gas or minerals. The early investors in many of Murray Pezim's (a Toronto-born butcher turned Vancouver mining promoter) deals lost heavily but those that stayed with him were made ridiculously wealthy with the Hemlo and Eskay Creek gold discoveries of the 1980s. Robert Friedland's Galactic Resources filed for bankruptcy in 1992 but investors loyal to Friedland in 1994 wound up owning Diamondfields and by 1997, it was taken out by Inco for $4.3 billion after the Voisey's Bay nickel discovery.

Now, the biggest discovery I was ever involved with as a corporate finance executive was the Mountain Province discovery of 1995 where 3.76 ct/t was considered "$1,000 (per tonne) rock!" and I was rewarded by a jump from $0.39 (where we funded it) to the ultimate peak $9.75/share. Today, with zinc at $1.36/lb. after literally decades in the $0.50s and $0.60s, the value-per-tonne of a 10% grade intercept is noteworthy and similarly, with gold at $1,260/ounce versus $300–400/ounce where it resided for most of the 1990s, a 6 g/t intercept is a big deal because most of the deposits are lucky to carry sufficient scale and continuity in order to qualify as economic.

However, today, unlike the 1980–2000 period, massive intercepts are treated as "leper colony" events and are a clarion call to "SELL! SELL! SELL!" because there is absolutely no marginal buyer cognizant of the long-term accretive powers of a major discovery (which add more reserves to inventory) that will go to his/her board of directors with a scrap of Bloomberg Terminal ticker tape pitching it on the basis of being "good for our company."

To wit, look at the past thirty days where these results were reported:

June 27th: Fremont Gold Ltd. (FRE:TSX.V) Gold Drills 25.9m @ 4.66 g/t Au at Gold Bar Project, Nevada

Stock spikes to $0.22 in March on speculation and to $0.18 the day of the announcement; four trading days later the stock trades down to $0.12.

June 26th: Tinka Resources Ltd. (TK:TSX.V; TLD:FSE; TKRFF:OTCPK) drills 10.4 meters grading 44.0% zinc in new discovery of exceptional zinc grade at Ayawilca

Stock trades 2.7 million shares immediately after the announcement and then sells back down to within pennies of its recently completed $0.485/unit private placement.

June 28th: American Pacific Mining Corp. (USGD:CSE;USGDF:OTCPK) Drills 16 g/t Gold over 1.5 Meters at Tuscarora

Stock opens immediately after the NR at $0.215 then sells down to $0.18 and closes $0.19 on 670,250 volume.

This latter company is included because it is a company actively covered by Bob Moriarty of 321gold.com and it really shows you just how rotten sentiment is when even one of his sponsors can't catch a bid.

Conditions such as these are symptomatic of market bottoms where gargantuan amounts of fear have replaced smidgeons of greed in setting the tone for reactions to positive exploration news. This condition is diametrically opposite to what we encounter in the overall stock market where negative news are greeted with a persistent "Buy the dip" mentality, the product of incessant, predictable interventions by government-policy-directed trading desks of the major banks. Retail investors have been trained in a Pavlovian sequence of behavior modification resulting in well engrained neural responses to stocks and gold fed and fueled by the MSM and championed by the bank-sponsored cable networks led by CNBC.

Adding insult to injury, the new generation of investors led by the Generation X, Generation Y (echo-boomers) and Millennials, with the prior two setting the standard for and handing down the investing baton to the latter. Take the Generation Y group, born between 1970 and 1990. They are now considerably larger than their Gen X predecessors (the "baby-bust generation") but they are now between 18 and 38 and represent the vast majority of new investors AND investment managers. Furthermore, they have grown up during a period of financial entitlement, where government bailouts protect stocks at the risk of immense moral hazard, the nature of which is being felt and witnessed by subdued attitudes toward risk and elevated expectations toward reward. They forge ahead as a thundering herd of demographic chaos, buying companies with zero earnings and enormous debt (Tesla?), gravitating toward the technology sector due to their considerable familiarity with its products, and pushing prices and valuations to the absolute extreme of any and all valuation metrics with full expectations of winning. And guess what? Since the 2007–2008 GFC, that strategy has been 100% effective because by aligning themselves as a voting bloc of investment consensus, they are able to control downside reactions and manage upside probes through Twitter and Facebook, text messaging and email. And, of course, with the full support of the U.S. Fed, the BoJ, the BoC and the ECB.

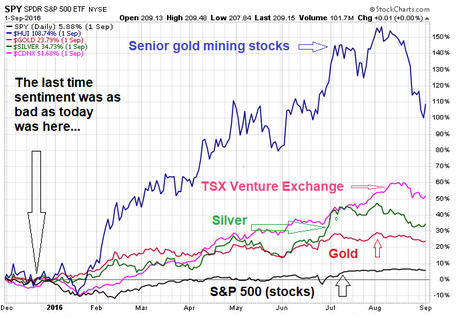

So in trying to come to grips with my dismally performing junior mining portfolio of explorers and developers, I have reached the stage where I am finally contemplating capitulation and surrender. I am a hair's breadth away from throwing in the proverbial bloodstained towel and avoiding the gold and silver sectors in the interest of capital preservation and survival. Now, having said that, I would also remind you of a similar notion communicated (with high anxiety and largely incoherent phrasing) through this publication in the fall of 2015 with gold threatening to once again move below the $1,000/ounce level. What immediately followed was a rally off the lows and the 2015–2016 returns from bottom to top were as follows:

December 1, 2015 to Sept 1 2016

Senior gold miners: up 108.74%

TSX Venture exchange: up 51.68%

Silver: up 34.73%

Gold: up 23.79%

S&P 500 (stocks): up 5.88%

Needless to say, a rip-roaring advance by all measures…

In today's missive, I began with how and why sentiment for junior exploration issues has become so jaded and I finish with an illustration of how sentiment for junior explorcos can be the ultimate buy signal when used as a contrarian indicator. In the summer of 1999 with gold at $250 and the TSX Venture under 1,000; in Oct 2008 with gold at $681 and the TSXV at 686; in 2015 with gold at $1,045 and the TSX.V at 479, sentiment was identical to where we are today. The chart posted above shows you EXACTLY what happened afterwards and for the next nine months after the lows of December 2015, gold and silver and gold and silver stocks (senior, juniors and explorcos) MASSIVELY outperformed the U.S. stock market.

Are we truly there now? Well, if the newly expanded capacity of my liquor cabinet and medicine chests are any type of indicator, then we are there, in spades. If my inability to locate my trusty Fido and my significant other since late June are any indication, then we here, at the bottom. Finally, if the number of trashed quote monitors, Larry Kudlow dartboards, and Jim Cramer voodoo dolls are any indication, welcome to the world of limitless opportunity and soon-to-become riches by investing in precious metals and their equity space counterparts.

Pass the moonshine…

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.