Andrew O'Donnell of

Supercharged Stocks discusses a gold exploration company that should start receiving summer drill results shortly.

Juggernaut Exploration Ltd.'s (JUGR:TSX.V) stock has been getting a lot of attention from many industry heavyweights, newsletter writers and senior mining analysts who are considered experts in the mining sector. Quiet enthusiasm has been growing and this is being reflected in the price and volume of the stock traded. Subscribers who got in at around $0.20, when I started covering Juggernaut (February 28, 2018) are asking if it is time to add to their positions as drilling is about to commence. Now, I cannot answer that for each individual, but what I can say is this: I am not in this just to double my money. I am in this stock for a major discovery and right now Juggernaut is in a "data accumulation phase": drilling and amassing information to further its conclusion that it is sitting on a world-class discovery. My fear is missing out on the potential upside when it starts releasing the data shortly.

Every other day there are new emails, inquiries and phone calls asking about this company from strangers, new subscribers and the new investors into this market. Their first question is always "What is going on?!" Followed quickly by the question: "Am I too late for Juggernaut?" The answer is no. We are standing in ahead of the curve on this and even at $0.60 you are well positioned. This is a stock for holding and waiting for the data. Sure, you could have made incredible short-term gains on this stock just because more and more people are coming into the opportunity, but the bigger question is why? Why would you risk the potential to capitalize on the opportunity that many feel is unfolding before us? The indicators are there that this could be the deposit that sparks a sector boom. I am in this one for the big gain, a ten-bagger (10 times return on investment). That speaks to my level of risk tolerance, as well as my understanding of the data. A lot of time, effort, research and data have been put into this region by many smart people. This sector, this region in morthwest British Columbia, the syndicates and this management in particular are going to deliver results.

I had mentioned that this was a hold stock for me, but that does not mean there is not a market to trade. In fact, it is quite the opposite. The volume, market and retail growth coupled with the two consecutive oversubscribed financings totaling $4,253,000 has now fully funded the highly anticipated and extensive inaugural drilling campaigns for both of Juggernaut's 100%-controlled Empire and Midas properties. Juggernaut continues to receive strong support from senior miners, institutions and strategic accredited investors alike, making this a versatile stock for both short-term and long-term players. There are wonderful technical stock analysts out there who can give you the edge in trading this stock, but for me, I am a believer and I look forward to the release of data.

The latest news from Juggernaut has been exciting and the story is getting out; the right people are looking at the story. Recent financings have allowed the company to get strategic partners involved. Juggernaut's recent financing was wildly successful (in an otherwise barren market) and included key industry players to get this story in front of the most sophisticated investors and institutions. With that in mind, Juggernaut is an incredible opportunity to invest risk capital, or better yet take it to your broker—and show them what is happening with this company.

So what has happened?

In the past few weeks, small victories built upon each other. This began with Jay Taylor, owner of Miningstocks.com and Taylor HardMoney Advisors. Jay is one of the most highly respected and stoic investors in this space. He said in his June 1, 2018, publication: "It is my view that Juggernaut is one of the most exciting high probability early exploration stories I have covered in this newsletter since its inception in 1981."Coming from Jay Taylor, this is high praise indeed. Furthermore, Mr. Taylor finished off his statement about Juggernaut by concluding:

"Last but not least, the quality of management with its proven track record provides added confidence in the likelihood of success. All in all, this is a stock I felt compelled to own and to pass what I know along to you."

Getting that type of endorsement from a man with his reputation certainly brought the right type of attention to the opportunity. Canada's largest and most respected independent national brokerage firm, Haywood Securities, heeded the call and included Juggernaut in its highly respected publication "Haywood's Junior Exploration Q2/18 Report."

The news Juggernaut has created in this space is growing, but I want to reach out again and let people know about this opportunity. I want to inspire people to take action and enter into an undervalued sector that has massive historical data in a world-class region with global demand.

Let's look at the fundamentals of this company and revisit my last analysis from late February 2018 when the stock was trading around $0.20.

The junior mining market is small. This is not a disparaging comment, but on the global financial scale, junior miners raise smaller amounts of funds to do the heavily lifting of finding, prepping and making projects feasible for producing companies. This historical curve is supported by evidence. Juggernaut could truly be only one drill hole away from a paradigm shift. As one P.Geo put it to me recently, "the opportunity in Juggernaut is geologically irrefutable, truly elephant targets in elephant country." This is the type of opportunity we all are looking for to get in on, ahead of the curve. It could be any week that results start trickling in, or we start to hear some camp chatter about results. Take some profits out of the overplayed weed stocks, social media companies and cryptocurrencies and put some money in a sector that is incredibly undervalued. This sector is primed for some good results and when that happens this stock can take off.

The Opportunity

We cannot talk about Juggernaut without first touching on the technical team, which is led by a world-class project generator, Bill Chornobay. He is the one that had the vision to assemble the projects and utilize the same business model that he has had great success within the past. His track record includes discovering the Golden Mile in Ontario, which was rolled into Prodigy and bought out by Argonaut for about $320 million just a few short years ago. Bill originally staked the Coffee Creek assets in the Yukon, specifically the "Supremo Zone," which became the base asset for Kaminak, which Goldcorp recently bought for about $520 million. More recently, Bill generated and discovered the Plateau South project, in the Yukon, which is owned by GoldStrike Resources. He recently inked a $53 million joint venture with Newmont Mining Corp. The depth of Bill's exploration team is immense, and they clearly know how to find robust mineralization when they're out in the field.

MIDAS PROPERTY

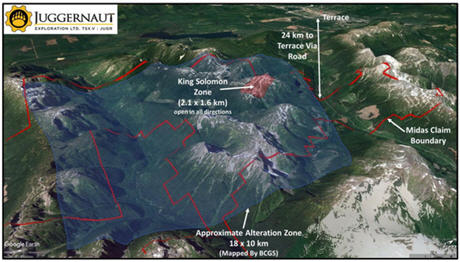

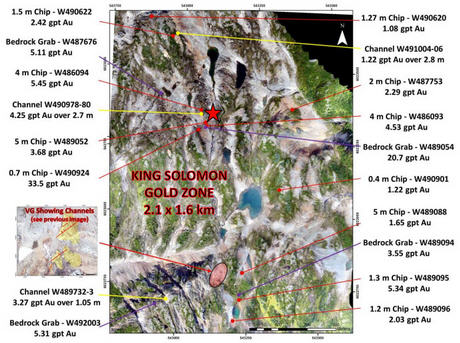

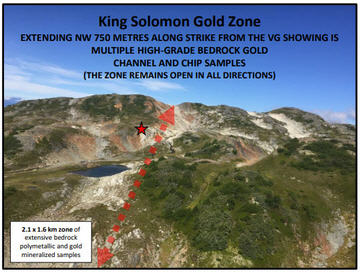

Midas is situated in a world-class geological setting within which Juggernaut discovered a 2.1 x 1.6 km gold in bedrock discovery that is 100% controlled. Midas is only 14 km to major power, CN rail, with direct road access, and is drill ready. This discovery was made as a result of rapid permanent snow-pack abatement in the region due to global warming. I was able to sit down with Dr. Ewan Webster and speak to him about what a "world-class geological setting" looks like, and I urge you to make sure you watch this video. Multiple high-grade gold mineralized chip, grab and channel samples have defined a 2.1 x 1.6 km zone of surface gold mineralization known as the King Solomon Zone, which remains open. Channel samples contain grades up to 10.28 grams per tonne gold over 4.34 meters. The extent of the gold mineralization indicates a large feeder source at depth.

Figure 1: King Solomon Gold Zone

The Midas property is within an 18 x 10 km alteration zone that was identified by the BCGS (British Columbia Geological Survey), which also stated this is one of the last large under-explored alteration systems in BC with very strong potential for both Eskay Creek-style VMS and structurally controlled gold mineralization. Widespread polymetallic and gold mineralization is seen on surface, coupled with an extensive gold in soil anomaly that measures 1100 by 800 meters, provides strong evidence of a large gold system that is drill ready.

Figure 2: Aerial View of King Solomon Gold Zone Looking NW

I liken this project to a modern-day gold rush. What the market has been waiting for is major news of a discovery and in a safe jurisdiction. On top of this, Juggernaut's projects have road access and are positioned close to excellent infrastructure in Terrace, BC, including an ALS Chemex prep lab. According to Dan Stuart, president and CEO of Juggernaut: "I was able to arrive in Terrace and head over to Tim Horton's for a coffee and within 20 minutes I was on the property with a still warm coffee in hand!" From double-double to being on the property in double-quick time—now that is truly close to infrastructure!

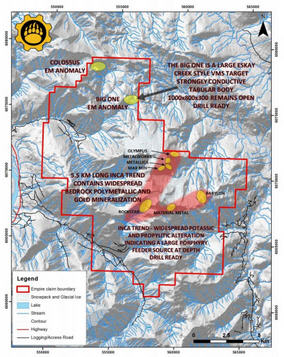

EMPIRE

The newly discovered 5.5 km long Inca Trend is located on the Empire property (Figure 3), which is only 8 km to major power, CN rail, and has road access. Like Midas, it is hosted in the same world-class geological terrane of northwestern British Columbia. This discovery was also made as a result of rapid glacial and snow-pack recession in the region. One of many discovered zones is RockStar; it measures 1000 x 550 meters with 450 meters of mineralized vertical relief, and remains open in all directions. Rockstar is located along the newly discovered 5.5 KM long Inca Trend that contains widespread polymetallic mineralization in bedrock and potassic and propylitic alteration, indicating a large porphyry feeder source at depth. Inca provides for multiple strong drill targets for the upcoming inaugural 2018 drill program.

Figure 3: Empire Property Highlighting the Inca Trend and Big One and Colossus EM anomalies

Figure 4: Inca Trend Overview

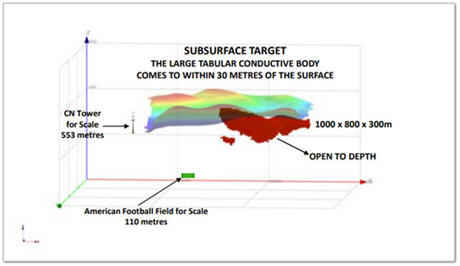

The second drill-ready area to be targeted on Empire for 2018 is the Big One anomaly (Figure 5). It is located ~3.5 km north of the Inca Trend and is a large geophysically indicated, strongly conductive tabular body measuring 1000 X 800 meters that extends to a depth of 300 meters and remains open (See 3D Model Video). This subsurface conductive body is hosted in a layered sequence of volcanics and comes to within 30 meters of the surface. The tabular shape of the conductive body, the presence of sulphides including chalcopyrite on surface, and the presence of marine fossils in the area are all strong indicators of being in close proximity to what was a hydrothermal vent system, a black smoker. These results demonstrate Big One has strong potential to be an Eskay Creek-style VMS at depth.

Juggernaut has only begun to scratch the surface of these two properties and it is theorized we are seeing just the tip of the iceberg. This is no small play on words, the ice abetment is revealing potential that could be startling. The company could be just one drill hole away from a major new discovery in a world-class geologic setting, proven capable of hosting world-class deposits. This is a very rare opportunity to be in ahead of the curve.

As Dan Stuart explained in his interview with me at the recent Vancouver Resource Investment Conference, the "Rockstar Zone, for instance, is currently 1 kilometer by 530 meters and it remains open. 100% of the channel samples contained significant gold, copper, zinc, and lead mineralization. 92% of all the grab samples ran with gold, copper, zinc and lead."

Figure 5: 3-D model of the Big One anomaly

Dr. Stefan Kruse. P.Geo, chief consulting geologist, stated, "We're going to get in there as early as possible this year and run an IP survey to trace the extent of the surface mineralization to depth, prior to drilling, we are targeting elephants. The discovery of a new extensive zone of gold and copper rich massive sulphides at surface on Rockstar is very exciting and we look forward to outlining the full extent of this discovery both along strike and at depth. We have strongly recommended a comprehensive exploration and inaugural drill program in 2018 targeting this and the other exciting new discoveries made on both Midas and Empire."

Another exploration geologist on the team recounted a memorable day on the Empire property: "It was a foggy morning and we were all standing on an extensive newly exposed mineralized outcrop which had not yet oxidized, and when the fog lifted and the sun shone through the ground literally started sparkling everywhere." The geologists could not believe what they were witnessing a truly spectacular sight.

We cannot talk about Juggernaut without touching on the DSM Syndicate. Following the story of this team is exciting because you learn that the process of making these discoveries has many phases. Getting these grab samples is one of the first stages in ground truthing a generated target. This speed prospecting program covered over 1500 km of terrane and returned many multi-ounce gold samples that culminated in the staking of six new properties. Juggernaut owns 20% of this syndicate. This is a unique opportunity all on its own. To have a relationship with this syndicate as well as 20% stake in its finds tells me that JUGR might have a front row seat at the table with this group, or at least could provide for a stream of income and additional news flow if another qualified partner comes along and develops any of these syndicate properties.

There is a lot of media coming out in North America about this undervalued sector. It will not stay cheap for long and Juggernaut is moments away from drilling. If there was ever a time to get involved in an undervalued market with excellent management teams and potential then now is that time.

I firmly believe Juggernaut's chart could be one of the most dramatic charts you are going to see in 2018. The company checks all the boxes in a sector prepared to boom, in a safe region that is known to host world class deposits. As the age-old adage in the exploration business goes, "we are one drill hole away from a major discovery." Anyone can say that, but what matters is who is saying that and what do they have to back it up. Now you are all duly informed and are in the know ahead of the curve. This has nothing to do with the luck of the Irish as the O'Donnell clan elders preached the harder we work the luckier we get.

Further information can be sourced online at: JuggernautExploration.com

Do not miss out on getting In Ahead of the Curve. This is the time, this is the second pick and get ready to hear more about this amazing opportunity.

Don't forget to follow us @SuperChargedStocks (Ahead of the Curve) for real-time news updates! And check out our website sections Camp Chatter, Drill Bits, Prospectors Corner and Made the Grade.

Andrew O'Donnell is president and CEO of Supercharged Stocks.com. He was born into a family that lived and breathed the financial industry. Many a family meal was spent discussing markets, wealth accumulation, estate planning, tax strategies and new products and services for companies and families. A graduate of Ridley College, O'Donnell obtained his Bachelor of Arts from the University of Western Ontario. He began his career in Calgary as an advisor with Standard Life but branched out to include stocks, bonds and derivatives products when he took his book to Merrill Lynch. The focus was on providing thoughtful planning, high performance and structured strategies. Throughout his career O'Donnell has worked at various levels of the financial service industry culminating as a Managing Director of an offshore "captive insurance company" in Barbados, which he created with Willis Canada for a land banking company. He has created structured products and is always looking for innovative, interesting market advantages.

Disclosure:

1) Andrew O'Donnell: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Juggernaut Exploration. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Supercharged Stocks disclosures are listed below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Juggernaut Exploration, a company mentioned in this article.

Supercharged Stocks General Disclaimer: I am not a certified financial analyst, licensed broker, fund dealer, Exempt Market dealer nor hold a professional license to offer investment advice. We provide no legal opinion in regard to accounting, tax or law. Nothing in an article, report, commentary, interview, and other content constitutes or can be construed as investment advice or an offer or solicitation to buy or sell stock or commodity. These are all expressed opinions of the author. Information is obtained from research of public media, news, original source documents and content available on the company's website, regulatory filings, various stock exchange websites, and stock information services, through discussions with company representatives, agents, other professionals and investors, and field visits. While the information is believed to be accurate and reliable, it is not guaranteed or implied to be so. The material on this site may contain technical or inaccuracies, omissions, or typographical errors, we assume no responsibility. SuperChargedStock.com does not warrant or make any representations regarding the use, validity, accuracy, completeness or reliability of any claims, statements or information on this site. It is provided in good faith but without any legal responsibility or obligation to provide future updates. I accept no responsibility, or assume any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information. All information is subject to change without notice, may become outdated, and will not be updated. A report, commentary, this website, interview, and other content reflect my personal opinions and views and nothing more. All content of this website is subject to international copyright protection and no part or portion of this website, report, commentary, interview, and other content may be altered, reproduced, copied, emailed, faxed, or distributed in any form without the express written consent of Andrew O'Donnell.