Dan Weir, the Executive Chairman of

DNI Metalssits down with

Proven and Probable to discuss the unique value proposition of the Graphite and in particular the virtues of DNI Metals. In this interview, we shall provide a very comprehensive review of the supply and demand fundamentals of graphite. We will also address the conclusion of the arbitration results with Cougar Metals. And the status of the environmental permit and the mobile processing plant.

VIDEO

AUDIO

TRANSCRIPT

Original Source: https://www.streetwisereports.com/article/2018/10/01/moving-ahead-with-graphite-in-madagascar.html

Moving Ahead with Graphite in Madagascar

Contributed Opinion

Source: Maurice Jackson for Streetwise Reports (10/1/18)

With graphite an in-demand metal for lithium-ion batteries and other uses, Dan Weir, executive chairman of DNI Metals, in conversation with Maurice Jackson of Proven and Probable, discusses the supply and demand situation for graphite, his company’s recent settlement with Cougar Metals, and DNI’s production plans.

Maurice Jackson: Joining us for a conversation is Dan Weir, the executive chairman of DNI Metals, which has established itself to become one of the world’s leading graphite producers.

We have some important topics to address today for current and prospective shareholders regarding Cougar Metals and production. Before we discuss that, what is graphite, where is it used, what are the global supply and demand fundamentals, and what is the unique value proposition that DNI Metals presents to the market?

Dan Weir: Thanks for asking that question, Maurice. It is good to provide an update on our view of the graphite situation around the world. I consistently talk to a lot of people in the industry. And here’s our view. Now, our view is going to be very different than many other graphite projects in the world. But I like to inform people about what’s going on in the world, specifically in the graphite space, because everybody starts jumping up and down and talking about batteries and excitement and everything else. That is very important in the graphite space. But I want to explain some other fundamentals that are happening out here in the market.

I would like to provide a brief history lesson about DNI, and what our game plan is going forward in the graphite space and why we think we can be one of the leaders in the world in the graphite space. In 2015, we came in and took over DNI Metals. It was basically a shell; it had a very large polymetallic deposit in Alberta. The capex on that was $3.9 billion. It didn’t make a lot of sense. The previous management knew that it couldn’t raise the money to do anything, and we came in and took over DNI.

DNI has been around since about 1954 and has been public for many of those years. I’m very lucky now to be the CEO and chairman of the company. The reason why we came in to DNI was to refocus the company specifically on graphite. Our group, which includes some of our directors and other people who we work, with have done a lot of work in the graphite space, built graphite mines in both Canada, Australia, Sri Lanka. One of our directors operated mines in Sri Lanka and Canada as well.

We know and understand the graphite space. We knew that in order to take advantage of the graphite space, in order to be a producer and be profitable in the graphite space, you had to go look for deposits that are in this weathered-type material called saprolite and laterite. You find it in climates that are hot and have lots of rainfall.

We first went to Brazil and searched for the right deposit. We tried to buy a couple deposits there. We realized Brazil is a very difficult place to do business; it’s extremely bureaucratic. What was exciting about Brazil was that it is the second largest producer of graphite in the world behind China. I’m going to come back to China in a minute.

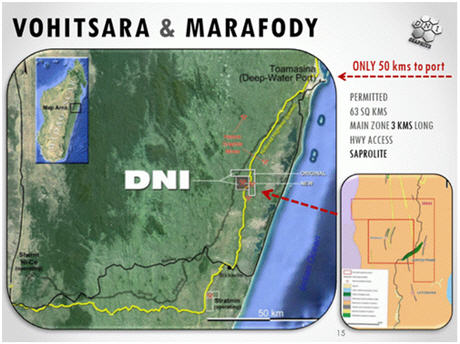

DNI decided to go from Brazil and look to other places that had that same saprolitic type of material. Certain parts of Madagascar had been producing graphite for over 100 years, and I want to emphasize that the area in which we are, 50 kilometers from the port, is an area that’s fairly close to the ocean. There is a ridge that runs along the east coast of Madagascar; it’s like a mountain range close to an ocean. So, think of Vancouver where the winds coming off the ocean, they climb up a plateau, or up a mountain, and they dropped a lot of rainfall in a certain area. That’s what we have in Madagascar.

In and around us there is a company called Ambatovy. It is owned by Sherritt International Corp., a nickel producer in Canada; Sumitomo Corporation, a very large Japanese firm; and the Korea Resources Corp. (KORES). It spent $8 billion in our area developing a nickel, cobalt deposit in these laterites, or this weathered type material. The advantage of this weathered material is you can go in with an excavator, dig it up and process it. DNI’s costs will be significantly lower as compared to hard rock deposits that you find in China, and specifically Canada, Germany, Sweden, other places in the world that would have these hard-rock type deposits.

It is critical that investors understand specifically why we’ve gone to Madagascar. We know that the costs for production are lower than what we would have found throughout the world. And this is precisely why we’ve strategically identified Madagascar for our operations.

We all know graphite is in pencils. We all know that graphite is a great lubricant. We put it on our bicycle chains. However, what most people don’t understand is that 50% of the world’s graphite is used in the steel-making industry (not batteries). It has a very high heat tolerance and you can line all the crucibles, or all the molds, to produce steel.

The other area that is growing is the lithium ion battery area. Up to 30% of a lithium ion battery is made up graphite. So, by comparison, everybody starts talking about nickel, cobalt and lithium, only 2% of a lithium ion battery is actually lithium. So, you can see here that one of the largest components of a lithium ion battery is graphite.

Audi has come out here recently talking about new electric cars. In fact, I saw a commercial on TV last night, it has got a new four wheel drive SUV that’s being launched. Porsche’s doing the same thing, Volvo’s talking by 2019 or 2020 that it will be all electric. GM has multiple models coming out. The world is becoming more and more interested, let’s say, or there’s a bigger demand for electric vehicles in the world. A lot of that revolves around the battery and demand for the battery. To put it in perspective, in the larger size Tesla, there can be 100 to 200 kilograms of graphite.

We know that’s where the growth demand is in the world. I mentioned that China is a big producer of graphite; it produces 60% to 70% of the world’s graphite. The demand in China is growing exponentially. It will produce a majority of the lithium-ion batteries going forward in the world. It is throwing billions of dollars at research, not only in batteries, but also electric cars. China is the leader in the world right now in electric cars, and I can’t see that changing anytime soon.

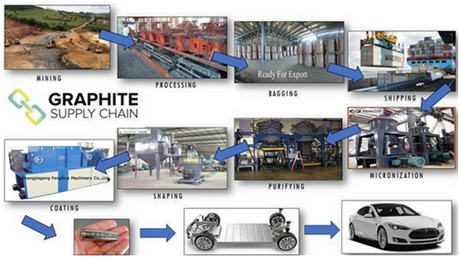

Graphite, when it’s mined out of the ground, has to be upgraded and processed. There’s a four-step process. It includes refining it, or purifying the material. Then shaping the material or curling it into a ball. Another term used for that is spherization. The next thing that they do is they code it. A lot of the coding technology is done in Japan.

So, comes out of the ground. We sell it to somebody who is going to do some of the upgrading. There are not many groups in the world that do all of those four steps: purification, micronization, spherization and coding. It tends to be different companies or different countries doing different things to the graphite before it actually goes into a lithium-ion battery. I want to emphasize this, currently in the world, over 99% or even maybe even close to 100% of the spherization or shaping of the graphite is done in China.

So, here’s our view. A lot of the Chinese graphite is going to go to the lithium-ion battery. I’ve been to Korea; I’ve met with different groups in Korea, in different places in the world. There are groups in Korea that want to do some of the spherization as well. Japan and Korea currently do over 50% of the coding. So, they’ll buy the spherized graphite, they’ll do the coding themselves. They want to do some of the spherization. But again, China still is doing the majority of that.

Our research indicates that most of the graphite produced in China will be used in the lithium-ion battery. Why is that significant? Why is that a huge opportunity for DNI? If most of the graphite now is then going to the lithium-ion battery, the Chinese graphite, where traditionally it was sold to the different steel companies around the world, that leaves a deficit that the steel companies now start scrambling trying to get material from other places.

DNI Metals could in fact try to compete with China and try and get deals and sell all of our material, grind it all up, this large-flake, high-quality material that we will produce, and sell it to the battery industry. But that wouldn’t be in the best interest of revenue and shareholders. Why? It’s because the material that’s sold to go into the battery industry is probably sold for $500 to maybe $750 a ton depending on the purity of it.

And in the best interest of our shareholders would rather sell material for $1,200, $1,300, or even the large flake, which we could sell up as much as $1,800 a ton to other industries. Whether it’s lubricants, whether it’s the steel-making industry, whether it’s different areas making foils that need the large flake graphite. You can see here where DNI Metals is so excited about the battery industry, because we know the Chinese materials are going into the batteries, and it opens up a big void that DNI Metals can fill, and we can sell material at much higher prices, mostly because our quality of our material is, I believe, far superior than the Chinese, and we can fill that void at much higher prices.

So, yes, we are very excited about the battery industry. But I want current and prospective shareholders to understand that that’s not our focus. DNI’s focus is to sell material at much higher prices to other industries around the world.

Maurice Jackson: I want to add on to that if you would. So, you’re selling the material, talk to us about offtake agreements. And for someone who’s not familiar with that, what is an offtake agreement?

Dan Weir: Okay, so let’s look at the graphite industry because there’s a lot of misnomers regarding graphite. If you’re a gold producer, zinc, copper, nickel, there are exchanges that you can sell that material into. You’ve got the LME, the London Metals Exchange, or into China, different places. There are quoted prices on that material every single day. You can sell into that. Everybody, every day looks at what the gold price is. It’s right around $1,200. I think yesterday it was up $1, $1,204 or so.

Everybody looks at that and they know that the gold producers can sell any day into that market and get that price. Graphite is not sold that way. Industrial minerals are not sold that way. The whole key to selling graphite is being able to have customers and sell to those customers. It takes some time to get those customers. They will want a one-kilogram sample, they’ll want a one-ton sample. And then they likely want a 20-ton sample, which is a 20-foot container full of graphite so that they can do the testing on their machines to fit your material.

So, good and bad, that can take some time to get those customers. But once you have those customers, they tend to be long-life customers. They’re going to modify their machinery to fit your material, and if you continue to supply that material on a consistent basis, then they will buy it from you. Also very, very critical to understand, that there are hundreds of different types of material that we will sell. It’s sold by flake size, and the purity of the material, but then they also look at things like the ash content. They’ll look at what other sorts of other impurities are in your material. And that can change. We’ve seen it on our Vohitsara property where one zone can be quite a bit different than another zone. We’ve seen the same thing over on the Marofody property where the materials can be the same in certain zones, and it can be quite a bit different within certain zones, or within certain veins that we find these in.

So, it’s very important to understand, I have been to Brazil. I’ve been to the largest processing plant in the world, which produces about 40,000 tons a year, and it has about nine small mines that it pulls material in from and then mixes and matches depending on what the customer wants. It’s very, very important to understand that. That graphite isn’t all about just getting an offtake, as you said, and I’ll explain what an offtake is here in a minute, and selling the product. Because you have hundreds of different products, and that product has got to be qualified by the end user.

So, back to what an offtake is. You will have many groups or companies around the world looking for material. They want specific material. If you can supply that specific material to them, they’ll say, “Okay, we’re going to give you an offtake agreement. We’ll buy X amount of tons per year from you if you can supply that material. It’s basically like a long-term contract if you want to think of it that way.

That’s what everybody’s looking for. Investors want to see that you have offtake and that you have customers as you’re putting the money into building plants and moving forward. So, we understand that, we have been working very hard at different offtakes over time. And you will see we have signed a few customer agreements. I think, over time, you’ll see a lot of offtakes come out of us as well.

But again, I emphasize it takes time, and it takes a lot of work, and you need material to be able to supply to those customers in order to do that. Hence the reason why we’re building this pilot plant so that we know that we can supply the material, whether it’s 20 tons, 40 tons, hundreds of tons for testing and get these long-term contracts. It’s very important to be able to do that. At the same time, you’re selling the material to them and making a little bit of money as you’re doing that.

Maurice Jackson: All right, we’ve covered the graphite fundamentals. Let’s get to company specifics. What can you share with us regarding the arbitration involving DNI Metals and Cougar Metals?

Dan Weir: I have to be very careful what I say here. We have signed confidentiality agreements that we won’t talk about each other’s companies, that we won’t go out and do postings, again, about the arbitration or anything else. I can talk about what has been publicly released. Any information that I give here will be information that you can find in press releases either from DNI or what Cougar has press released.

So, let’s start a little bit on what we did with Cougar and the settlement with Cougar so that we can move on. I think most of our investors know that we signed an agreement in March of 2017 with Cougar Metals out of Australia, which is publicly listed on the Australian Stock Exchange, where Cougar had the ability to earn into one of our properties, the Vohitsara graphite deposit in Madagascar. There were certain criteria that Cougar had to meet to earn into that. Part of that was completing a drilling contract, completing a resource study and a PEA.

We at DNI provided Cougar with extensions to do so. The timeframes weren’t met. So, what we did is we put them in default of the contract. Cougar argued that and over the last, call it nine and a half, ten months we have been working towards going to an arbitration hearing where the arbitrator would hear each other’s side of the story and make a decision on that, and award either to DNI or to Cougar the outcome of that arbitration. That hearing, and again, this is public, was to take place the week of September 24th through the 28th. After that the arbitrator would make a decision. We don’t know how long that decision would have taken. It could have taken weeks. But in all likelihood, it was going to take multiple months in order to get a decision out of the arbitrator.

DNI, within that arbitration, we looked at all the good, the bad, what advantages DNI had to complete the arbitration, or was it better to settle this arbitration and just move forward with our business. Myself, being on the board, and the Board of Directors took all of that information that we could get from our lawyers, and we had an expert team of lawyers that gave us advice on all of this. We were able to negotiate with Cougar a settlement. The terms we put in the press release that we announced on Sept. 24.

The terms are set up that it’s paid over about two and a half years. We plan to have the pilot plant up and running, hopefully very, very soon. It’s not going to hinder DNI so that we can hopefully pay a lot of that out of the cash flow. Again, that’s all in the premise that the pilot plant is up and running and going forward. I’m keeping my lawyers happy by throwing that in there as we go forward.

So, our plan is to get the pilot plan up and running. There is no other hindrances on the project, and we can move forward. The last thing that we’ve always talked about are the permits. We are working on the environmental permits. The environmental permits should be completed very quickly here now, and we’ll be moving forward getting into production and moving forward with the project.

By agreeing on a settlement we have taken the uncertainty out of our stock. Shareholders do not like uncertainty in a stock. We’ve taken that uncertainty out of the stock and we’ve done it in a way that we believe won’t hinder the operations of DNI.

Maurice Jackson: All right. Well, Dan, let me ask you a couple more questions here. You’ve addressed production and the environmental permit. In the meantime, what will DNI be working on?

Dan Weir: There are a number of announcements that we plan to make over the next little while. I know I’m being a bit of a politician and not directly answering your question. There are many things happening within the company. I think everybody’s going to be happy as we move forward with this company. I’m extremely excited. I have told everybody many, many times, I am going to get this into production. I believe that it’s one of the best graphite deposits in the world.

Last week, I had one of our investment bankers with us in Madagascar. We also brought one of our directors, Keith Minty, a mining engineer; he’s operated mines in Canada and Sri Lanka. We had our process engineer, the man who has designed the pilot plant. He came with us as well. He was very excited about the project. He’s blown away that we’re 50 kilometers to a port, that we have some of the roads that are put into the property. The material as he said, and I think I can quote them on this, at surface, he saw where we took the bulk samples that it looks fantastic seeing these large flakes at surface and everything else. He doesn’t see any issues with us moving forward and getting this done.

As I’ve said before, this plant is engineered, it’s designed. We have quotes out of China to build all of the machinery. We’re ready to go. Once we receive our permits, we’re set, we’re ready to go and we’re very excited to move this thing forward.

Especially, for me. I love being there, I love working with the local people. Actually, there’s another point here I want to make is that we were on the property, we met with the local people, our investment bankers saw all of them, the local presidents, I met with them, shook their hands. They’re eager to get going and seeing development happen on this property as well.

Everybody kept saying that we have all these issues with locals. We did not have any resistance when we’re out there on the project. People are happy and they want to see this developed. They’re looking for jobs, and they want to move forward.

Maurice Jackson: You referenced engineering there, Keith Minty, for those that are not familiar with the name. That is a name that you want to follow as one of the serially successful members in the natural resource space. Wherever Keith goes, you’re bound to find success. So, shout out there to Mr. Keith Minty. Dan, what keeps you up at night that we don’t know about?

Dan Weir: Capital markets are always the toughest thing when you’re running a junior mining company. I worked for some of the best brokerage firms as a stockbrokers for almost 13 years in Canada. I managed an institutional equity sales desk. For companies, the toughest thing is making sure you have the right amount of capital, and getting that capital as you move forward.

One of the reasons why we picked Madagascar is for its low capex, because we can get this pilot plant running, and once we do, we can start making some cash flow from that pilot plant. Remember, the main purpose of the pilot plant is to provide samples and sell samples to potential customers, but at the same time, we’re going to be selling that material and selling it at a profit. So, that is key in what we’re doing. But you’ve got to make sure that the capital that you’re raising is low enough that it makes it so that you can be profitable as you’re moving forward.

Some of the biggest problems you see, especially in the graphite area, is that guys try and make these massive projects, 50,000, 70,000 tons a year, that they want to start at. You’re not going to get the customers as you do that. You’ve got to grow with the customer. If you can have a low capex, build your customer base, grow a lot of your business, partially from cash flow, maybe from capital infusions, from offtake people, or other groups, you have a winning strategy to make this go forward.

Again, it’s always the biggest concern is, what are the markets doing? Do people care about graphite? Can you raise the money? That’s always the toughest part in any of this. I think the way we have moved this forward and our strategy moving forward and the people that we have in place to make this all happen, I think we have a winning combination, and have an opportunity here to not only get into production, but be a leader potentially in the future, in the graphite space.

Maurice Jackson: Last question, what did I forget to ask?

Dan Weir: I’m not sure. Maurice, you’ve been to the property, you’ve met the people that we’re working with at the property. You’ve met our mining engineer, Keith Minty, as you said. I think you’ve checked a lot of the boxes. You’ve been there again, firsthand and seeing how amazing this is. You’ve felt that graphite in your hand. You have seen how important it is to have this saprolitic-type deposit, and how much cheaper the production can be from the saprolite versus the hard-rock deposits that you find in North America. So, you know what, I don’t think there’s much else that you can ask at this point in time.

Maurice Jackson: I’ve actually been there twice, Dan, if you don’t recall. But I also have the graphite from the first site visit. Everything that you’ve shared regarding DNI Metals, we are proud shareholders and we look forward to growing with the company. Dan, if investors want to get more information about DNI Metals, please share the contact details.

Dan Weir: Yes, you can always get a hold of me. Email is probably the best at danweir@dnimetals.com, or can get ahold of me on my cell phone at 416-720-0754.

Maurice Jackson: DNI Metals trades on the CSE, symbol DNI. And on the OTC, symbol DMNKF. DNI Metals is a sponsor of Proven and Probable and that we are proud shareholders of DNI Metals for their virtues conveyed in today’s message. Last but not least, please visit our website www.provenandprobable.com where we interview the most respected names in the natural resource space. You may reach us at contact@provenandprobable.com.

Dan Weir of DNI Metals, thank you for joining us today on Proven and Probable.

Dan Weir: Thank you Maurice.

And last but not least, please visit our website www.provenandprobable.com where we interview the most respected names in the natural resource space. You may reach us at contact@provenandprobable.com.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

DISCLAIMER

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,250 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. YOU SHOULD NOT MAKE ANY DECISION, FINANCIAL, INVESTMENTS, TRADING OR OTHERWISE, BASED ON ANY OF THE INFORMATION PRESENTED ON THIS FORUM WITHOUT UNDERTAKING INDEPENDENT DUE DILIGENCE AND CONSULTATION WITH A PROFESSIONAL BROKER OR COMPETENT FINANCIAL ADVISOR. You understand that you are using any and all Information available on or through this forum AT YOUR OWN RISK.”

All Rights Reserved.