October 24, 2018. Early this month I attended a 2-day conference in New York City — the

121 Mining Investment conference, featuring nearly 60 metals / mining / minerals companies. I had 30-minute 1×1 meetings with about 20 of them, mostly gold / silver / copper & lithium juniors. Interest at the event was surprisingly high given that the underlying share price performance of junior miners this year has been terrible.

I offer a few key takeaways, industry-wide trends stretching across multiple commodities & jurisdictions. First, getting projects into production is becoming much harder, taking longer and costing more. Permitting time is extending and discussions with local communities are becoming more timely and complex.

Second, access to water is a global challenge. Some CEOs fear that local communities might be overreacting to threats of water shortages, but the concerns are real and they are growing. Third, there’s an emerging market crisis (

perhaps crisis is too strong a word?), in many countries across several continents. High inflation and weak local currencies are causing serious problems in places like Argentina, Turkey & Brazil. President Trump’s trading policies are seen as a big factor, as are rising U.S. interest rates.

Fourth, in the gold & copper sectors there’s been chronic underinvestment in exploration & development over the past 5-6 years. This virtually assures higher prices down the road. And, many CEOs are talking about anemic new project pipelines among gold Majors and larger mid-tier players.

I believe that gold juniors are poised for a rebound, perhaps a big one. To be fair, we probably need a modest to moderate recovery in the gold price to foster this move, but prices returning to

US$1,300/oz. is no tall order, that would be up just 6% from today’s level. A return to

US$1,350/oz. would be a 10% gain, and

US$1,400/oz. a 14% gain.

US$1,350/oz. has been approached and/or surpassed numerous times this year. With this in mind, I’ve notice increased trading activity in tiny Canadian gold junior

Genesis Metals (TSX-V:

GIS) / (OTCQB:

GGISF)

Genesis Metals is a promising exploration-stage

Gold (“Au”) junior in northern Quebec, near Chibougamau. It has seen a notable increase in trading volume. Over the past month, the share price increased from C$ 6c-7c to as high as 12c, before closing at 11c on October 19th. Investors seem to be stepping up, buying with increased conviction. This renewed interest

(Genesis Metal’s 52-week high is 17.5c), encouraged me to talk once again with

President & DirectorJeff Sundar. {

see new corp. presentation}

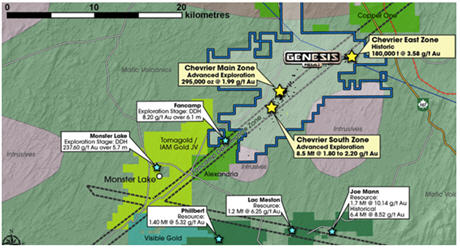

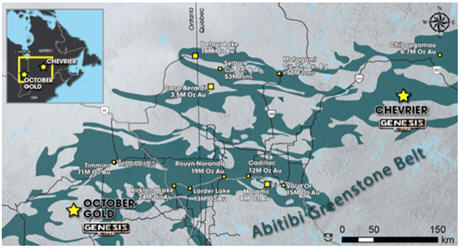

Genesis holds 100% of a large land package of 130 sq. km in the Abitibi Greenstone Belt…. which is 150 km wide and stretches 650 km from roughly Wawa, Ontario to Val d’Or, Quebec. Genesis’ property straddles the Fancamp Deformation Zone (“

FDZ“) which seems to be one of the major structural breaks found in eastern Canada, much like the Cadillac break and the Timmins-Porcupine area in northern Ontario. The FDZ looks like a major conduit that controls meaningful gold deposits.

One of the most notable nearby resources is the Monster Lake project, being explored by

IamGold and

TomaGold. It boasts a 433,000 ounce maiden mineral resource estimate announced in February at an avg. grade of 12.1 g/t Au. This resource is thought to be just the tip of the iceberg as more recent drill hole intercepts

(from 4 holes included; 3.8 m @ 24 g/t Au, 3.8 m @ 39.2 g/t, 5.3 m @ 40.9 g/t & 2.6 m @ 72.2 g/t).

To reiterate, those are holes from nearby Monster Lake, about 15 km from Genesis Metals’ flagship

Chevrier project. The main portion of Chevrier hosts a smaller Inferred resource, compiled in 2010, of ~295,000 ounces, and at a lower grade of @ ~2 g/t Au. However, like Monster Lake, more recent drill results are fairly exciting, such as an interval of

8.7 g/t Au over 21.4 m, including 38 g/t over 3 m.

Like many small cap junior mining plays, management had trouble raising meaningful capital over the Summer for a drill program. Instead the Company raised a smaller amount and embarked on a field exploration campaign consisting of surface work on 5 priority targets. Although not drilling at this time, the field work done is important and should generate valuable information.

This season’s field work will go a long way towards choosing the next areas in which to drill. Genesis has at least 10 target zones to choose from.

Brian Leni of

Junior Stock Review recently published this

excellent review of Genesis Metals. I urge readers to check out Brain’s article and I will reiterate these key highlights:

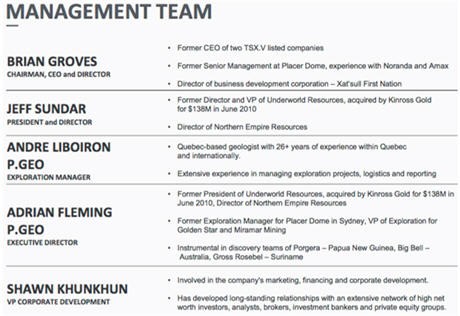

++ strength of the mgmt. team, Board & technical/strategic advisors….

++ cheap valuation: at

C$0.08/shr. = C$6.9 M (US$ 5.3 M), at

C$0.09/shr. = C$8.8 M (US$ 6.0 M), at

C$0.10/shr. =

C$8.7 M (US$ 6.7 M)…. If interest in gold juniors returns, companies like Genesis Metals could stand to benefit nicely.

++ high-grade drill results earlier this year seem long forgotten….

8.7 g/t Au over 21.4 m, including 38 g/t over 3 m

++ considerable expansion potential in multiple zones

As mentioned, Genesis has an Inferred resource from 2010 at its Main Zone of

295k ounces @ 2 g/t Au. In late November management expects to deliver a NI 43-101 compliant mineral resource estimate. Management is not able to say how large the resource might be, but I’m hoping that it will come in around 500k ounces.

In addition to the Main zone, there’s a South zone that has a conceptual “

exploration target” of 8.5 – 9.0 M tonnes at 1.8 – 2.2 g/t Au. That equates to a mid-point “

exploration target” of 562k ounces. However, it will take additional drilling at the South zone to begin unearthing that potential. The focus for now is the Main zone and new discoveries on one or more of the Company’s 10 target zones.

How much might a company like Genesis be worth? I think the question boils down to; at what point might a larger player want get involved or acquire it.

Prospective suitors would not only be buying the existing ounces

(new resource estimate expected next month), they would be after the upside at the Main Zone, the opportunity in the South zone, plus the blue-sky potential on 10 untested zones. That’s 130 sq. km in a very well-known, prolific Gold basin. Suitors would not just be getting a potential open-pittable project, but one with good grade at a fairly shallow depth — recall the headline grabbing intercept of

8.7 g/t Au over 21.4 m, including 38 g/t over 3 m was from 110 meters depth).

Interested parties from around the world could hardly do better than to pick up a large land package in a top 10 global jurisdiction. Quebec is ranked # 6 in the latest annual Fraser Institute Mining Survey. There are hundreds of open pit prospects — Au deposits in far less hospitable locations, at significantly less than 2 g/t, and/or deeper than 110 m. Assuming (just a guesstimate) 500k ounces, Genesis Metals is trading at about

US$12/oz. on mineralization found on a small portion of its considerable land package.

Most junior miners with market caps under

C$10 M have 1 management or Board member of note, a person with direct experience in the commodity and/or jurisdiction — plus a favorable track record. Genesis Metals has at least 3 top-tier mining executives

(not even including industry veteran, Genesis co-Founder, Rob McLeodwho’s an advisor to the Company). I honestly believe that to find a management team, Board & technical Advisors of this caliber, one would have to look at companies with market caps starting at

C$50 M or even

C$100 M.

Investors are stepping up, buying with increased conviction into what was an oversold situation. This renewed interest

(Genesis Metal’s 52-week hi is 17.5c), encouraged me to talk again with

President & DirectorJeff Sundar. {

see new corp. presentation}

Like many small cap junior Au plays, Genesis had trouble raising capital over the Summer for a drill program, so instead management raised a small amount and embarked on a field exploration campaign consisting of surface work on 5 priority targets. Although not drilling at this time, the field work is important and should generate valuable information.

Recall that Genesis is much more than just its Main Zone, an area with an Inferred resource of 295,000 ounces at 2 g/t Au (2010 report). This season’s field work will go a long way towards choosing the next zones to drill. Genesis has at least 10 target zones to choose from.

Next month’s resource estimate could go a long way towards refocusing investor eyes on the Genesis Metals story. Increased buying of shares has driven the price up somewhat, but the market cap remains below

C$8 M. This article is not investment advice. All I’m saying is that I’m noticing increased interest (

higher trading volumes at higher share prices) over the past 2 months.

If gold prices were to move higher and the expected resource estimate in November is viewed favorably, readers will have benefited from investigating the investment merits of Genesis Metals ahead time by reading this article and conducting further investment research. As a reminder, please see the Company’s new

corp. presentation and

Brian Leni’s more detailed piece.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein or Epstein Research, (

together, [ER])

about Genesis Metals

, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER]

is not responsible under any circumstances for investment actions taken by the reader. [ER]

has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER]

is not directly employed by any company, group, organization, party or person. The shares of Genesis Metals

are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned shares and/or stock options in Genesis Metals

and the Company was a paid advertiser on [ER]

.Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER]

is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER]

is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER]

is not an expert in any company, industry sector or investment topic.