Image courtesy of PLUS Products Inc. Data source: BDS Analytics GreenEdge™

Have Your Cannabis, and Eat It Too

Image courtesy of PLUS Products Inc. Data source: BDS Analytics GreenEdge™

Have Your Cannabis, and Eat It Too

In the legalized cannabis industry, where company valuations are based almost entirely on future growth prospects, the anticipated growth in commercial consumption can be expected to follow one notable trend: consumers prefer edibles. That trend so far is sharply higher. In a rapidly expanding industry, edibles outpace the overall growth rate and are still accelerating.

PLUS Products Inc (CSE: PLUS), a cannabis-infused edibles manufacturer based in California, began trading October 29th on the CSE, after an IPO at $3.25 per share raised CAD $20 million. The stock very quickly moved above $4. And by the end of the first week of trading, investors added about 70% to the IPO price.

Why the enthusiastic response? Two reasons, for starters. The first is trend-specific. The second is more company-specific.

First, let’s look at what’s trending right now -- edibles. In fact, market research data shows that dried flower sales (cannabis buds for smoking) remain the largest category by retail value in US jurisdictions with a history of legal medical or adult use.

Yet, here’s what’s interesting and noteworthy; dried flower sales are losing market share while sales of concentrates and edibles have risen to second and third place, respectively, among all market segments. This will ultimately relegate ‘bud and blunts’ to a much smaller market share, according to industry research.

This stands to reason, since most adults don’t smoke and don’t want to start in order to ingest a healthy substance. But we all have to eat and drink. And as the science of edibles continues to improve, it stands to reason that the retail market value of edibles may in time eclipse that of concentrates to become the largest single consumer category.

Second, PLUS has built an enviable track record as a start-up. It has already grown into one of California’s market leaders in the regulated medicinal and adult-use edibles space. Indeed, the company has proven its ability to innovate new products, penetrate new markets, and scale-up production in response to increasing demand.

PLUS’ THC and CBD infused products are being literally eaten up by cannabis consumers. Accordingly, sales and growth are on an upward trajectory that seems poised to continue to strengthen for years to come.

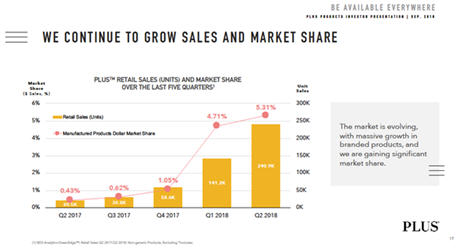

The graph below shows the ramp, launch, and upward trajectory above 5% market share (good for 4th highest statewide among manufactured products) as of June 2018, over a span of only 5 quarters. Since then the company has surpassed its competitors to achieve top position in sales performance.

Image courtesy of PLUS Products Inc. Data source: BDS Analytics GreenEdge™

Image courtesy of PLUS Products Inc. Data source: BDS Analytics GreenEdge™

The successful introduction and widespread adoption of PLUS flagship products testifies to the strength of the business model. Research and development from the beginning have focused exclusively on innovation in this high-growth, high-margin segment of the cannabis industry. The results of all the product testing and fine-tuning speak for themselves.

Image courtesy of PLUS Products Inc. Data source: BDS Analytics GreenEdge™

Image courtesy of PLUS Products Inc. Data source: BDS Analytics GreenEdge™

In perhaps the most competitive cannabis market on the planet, PLUS continues to expand its market share by continuing to be very strategic in its commitment to excellence.

By staking out the high ground as a premium brand, this should insulate PLUS against any price compression that will ensue once edible products become a hotly-contested industry sector. Constellation Brands and other food and beverage giants are sure to compete for market share at some point.

Nonetheless, PLUS appears to have a recipe for success, based on results achieved so far. And this gives PLUS an early-market entrant advantage in branding awareness -- with consumers responding enthusiastically to PLUS’s bespoken, scientifically-formulated, fast-acting edibles.

Key Ingredient #1: Ownership and Management

PLUS is headed up by CEO Jake Heimark and his father Craig Heimark (Executive Chairman and CFO) who bring together a potent leadership combination. Heimark senior brings multinational finance and investment experience from former roles as Chief Information Officer at UBS, and with Deutsche-Börse as Supervisory Board Member.

The younger Heimark was part of the core team with Facebook back in its more embryonic days, and then with Gumroad, a very popular e-commerce and community-building platform.

The PLUS management group also includes executives from some of the world’s most venerable and iconic consumer brands, including Quaker Oats and Kraft Foods.

This combination helps explain why the strategic plan for PLUS looks so strategically shrewd, disciplined and carefully calibrated.

The company is fully funded for completion of phase one of its manufacturing growth strategy. It is expanding from its current 12,000 feet of production capacity to 40,000 square feet.

This is projected to offer enough capacity to generate around $150M in annual production capacity. All told, up to 120,000 square feet of manufacturing capacity can be brought online, leading to a maximum output (at least at this one location) of as much as $450M of product.

Is global expansion of the fast-emerging California PLUS brand a long-term possibility? It sure looks like that’s where this company is headed.

Key Ingredient #2: Products and Process

Image courtesy of PLUS Products Inc

Image courtesy of PLUS Products Inc

Prohibition has for many decades severely impaired the development of cannabis biotechnology. But now, the race is on to enhance old technologies and discover new methods of deriving benefits from cannabis plants.

In this regard, PLUS has patent-pending solutions involved in overcoming the key challenges of processing cannabis oils and active ingredients into edibles. In fact, the Holy Grail to the widespread acceptance of cannabis-infused foods is consistency of dosing and ensuring fast bioavailability (the body’s uptake of the cannabinoids). PLUS asserts it has innovated proprietary technology that delivers in both regards. Consumers seem impressed.

Beyond that, there is of course sensory considerations, such as the overall food quality of the finished products. Here again, the growth PLUS has achieved in market share testifies to the company’s success in meeting customer expectations for medicinal and recreational purposes.

Given the agility and product innovation skills the company has demonstrated so far, it is unlikely to get left behind as the manufactured products category continues to evolve.

Key Ingredient #3: Product Pricing

Branded products derived from concentrates and extractions show superior long-term pricing durability compared to the concentrates themselves, even more so compared to dried flower, as the chart below shows.

Image courtesy of PLUS Products Inc. Data source: BDS Analytics GreenEdge™

Image courtesy of PLUS Products Inc. Data source: BDS Analytics GreenEdge™

In fact, the commoditization of flower and concentrate prices should help to reduce input costs for manufactured goods, which benefits PLUS’s business model. Premium pricing for appealing value-added products as well as higher margins – such as those that PLUS can benefit from – are a winning combination in any business.

This competitive advantage could also be considered a fiscal safety net offering some flexibility in pricing to respond to the competitive environment should the need or the opportunity arise.

PLUS is clearly intent on distinguishing itself from the rest of the pack. A quick look at the company’s website shows a ‘boutique’ style and tone to its elegant product line and sophisticated marketing approach.

These products speak for themselves, which is why PLUS sees no need to brag about the virtues of its fast-selling product line. Such items ultimately appeal to a much wider and diverse market, transcending both gender and generational differences.

Sweetening the Value Proposition

It’s not uncommon for a new listing like PLUS to experience a strong spike in stock price immediately following the IPO. These generally retrace soon enough and find a more realistic level. This may seem like a letdown to some investors but it is merely due to market machinations that have no real bearing on a share prices’ ultimate upside potential.

That said, PLUS does not need to continue to execute at a high level on the balance sheet to impress investors. Truth be told, it also benefits from a unique, differentiated value proposition on Canada’s capital markets. It is the only edibles company that can demonstrate a pre-existing track record of success.

This means that PLUS is unchallenged as the only “pure-play” edibles publicly-traded company in this lucrative market segment. And Canadian investors are sure to rally behind such a dynamic, ongoing success story.

In such an eventuality, investors are likely to respond well to a steady flow of upbeat news flow. When matched with a tight share structure, such developments tend to act as powerful catalysts to higher share price valuations. We clearly envision PLUS to emerge as a star performer in Canada’s capital markets.

About the Authors: Marc Davis has a deep background in the capital markets spanning 30 years, having mostly worked as an analyst and stock market commentator. He is also a longstanding financial journalist. Over the years, his articles have also appeared in dozens of digital publications worldwide. They include USA Today, CBS Money Watch, Investors’ Business Daily, the Financial Post, Reuters, National Post, Google News, Barron’s, China Daily, Huffington Post and AOL.

And Daniel Brooks is a CannabisCapitalist.ca staff writer with a long history in business writing.