China has developed tremendously in recent years. But what’s next? Is the country entering the growth recession? And how it will affect the world and the gold market?

A New Chapter in China

We have not analyzed the publications of the

World Gold Council for a while. Let’s make it up, starting with the newest edition of

Gold Investor. The report is about China and its remarkable transformation in the context of the gold market.

Indeed, at the turn of this century,

China was a minor player in this market. While today it is both the world’s largest consumer and

producer of gold, accounting for 23% of total

gold demand and 13% of total

gold supply. However, there are still opportunities for further development, as the investor base is too narrow, while the market infrastructure and regulations need to improve.

According to the publication,

Chinese investors should optimally allocate to gold about 6 percent of their portfolios. Such an allocation would reduce the volatility of the portfolio, increase the Sharpe ratio from 0.46 to 0.54 and still keep the target return of 5% The reasons for holding gold are widely known, but let’s mention them: it’s a

portfolio diversifier (it has low or negative

correlations with other asset classes), it’s an alternative currency, and it has no credit risk. Moreover, gold market is deep and liquid.

There are many concerns about the future growth of China’s economy. In particular, people worry about the country’s debt to GDP ratio is around 250 percent, clearly too high for an emerging market. Zhou Hao, Associate Dean at Tsinghua University PBC School of Finance, interviewed in the publication, dismisses these fears, pointing out that China is still growing at around 6% a year, so that ratio may be more sustainable than people think. Also, he argues that the central government has enormous foreign exchange reserves, while households are not highly leveraged.

We are more skeptical than Hao. True, the economy is still growing, but that growth is partially possible exactly thanks to incurring more debt.

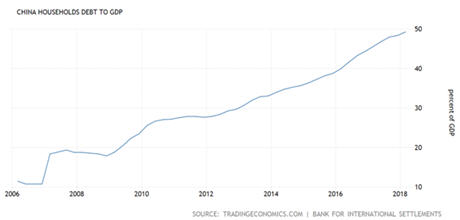

Life on credit is not stable. Especially that, contrary to Hao’s words, Chinese consumers have accumulated a lot of debt recently. Just look at the chart below. As one can see, China’s household debt-to-GDP ratio jumped from almost 40 percent in 2016 to almost 50 percent in the first quarter of 2018, reaching a record high.

Chart 1: China’s household debt-to-GDP ratio from 2006 to Q1 2018.

Gold Demand Trends and Investment Update

Gold Demand Trends and Investment Update

The WGC also published a new edition of its

quarterly report on gold demand. The highlights are that both retail investors and central banks took advantage of the price dip and increased their purchases (so they are price-takers, not price-setters). The demand for

gold bars and

coins jumped 28 percent in Q3 2018, while central bank reserves grew 22 percent year-on-year. In the December edition of the

Market Overview, we will analyze whether the central banks’ purchases create a floor for gold prices.

However,

gold ETFs saw a 116t decline when compared with inflows of 13.2t in Q3’17. It does not look encouraging – but the

trend reversed in October,

which indicates an improved sentiment towards gold compared to the third quarter of 2018.

Last but not least, let’s analyze shortly the recent WGC’s

Investment Update. It’s a short publications which points out the gold’s role as a

safe haven asset in the context of the recent stock market turmoil. Initially, the yellow metal did not response to the US

stock market sell-off. But as it became more systemic globally, gold began to

rally.

Implications for Gold

To sum up, we provided you with an update on the recent WGC’s publications. The most important report concerns China. Actually, it is one of the most important questions in our times. So far, the Chinese authorities have postponed the inevitable slowdown. But it will arrive one day. Given the economy’s massive leverage, the growth recession is likely to cause a financial crisis, which would hit the whole world. Gold should shine, then. The problem is that

nobody knows when it will happen. So be prepared, but also remember that it may take a while, so you can lose money passively waiting for the day of reckoning. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly

Market Overview reports and we provide daily

Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe.

Sign up today!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘

Gold News Monitor and

Market Overview Editor

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.