Was 2018 good or bad for the previous metals market? We invite you to read our today’s article and learn more about the most important drivers of the gold prices in 2018. This analysis should help investors better understand the gold market, and draw

investment conclusions for the new year.

The Gold Market in 2018

“Hence, we are neutral to slightly bearish for the gold market in 2018.” – this is what we wrote in the December 2017 edition of the

Market Overview. Fast forward one year (oh my God – when has it passed?) and it

turned out that we were right.

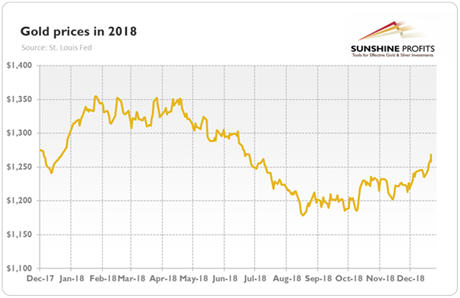

Just look at the chart below. It paints the gold prices over the last year. The yellow metal entered 2018 with a quote of $1312.05, while ended the year at $1268 (as of December 27). So, gold dropped 3.4 percent last year,

which was exactly in line with our expectations.

Chart 1: Gold prices (London P.M Fix, in $) from December 2017 to December 2018.

Please note that bullion jumped in the aftermath of the December 2017

FOMC meeting. If we compare today’s gold prices to the pre-meeting level (around $1,260) or just to the average of 2017 ($1257.12), it will be even more clear that

our “neutral to slightly bearish” call was accurate.

Is the 3-percent drop a big or a small change? Well, it depends on your perspective. If one assumes that gold prices can only rise, they might be disappointed. If one dwells on price around $1.900 and waits for a triumphant comeback, they also might be frustrated. But gold performed poorly not only compared to the glorious 2011, but also to 2017, when it gained more than 10 percent, as one can see in the chart below.

Chart 2: Gold prices (London P.M. Fix, in $) from 2013 to 2018.

On the other hand, the chart above shows that the drop of 3 percent is actually not unusual for the period starting in 2013. Investors should remember that

2018 was fundamentally very challenging for the precious metals. The Fed

tightened its

monetary policy further, hiking

interest rates four times. The US economy accelerated, while

inflation remained subdued.

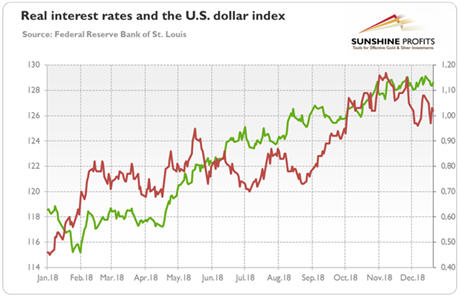

Please take a look at the chart below. It shows the performance of the

greenback and the US

real interest rates –

two of the most important drivers of the gold prices. As one can see, the dollar index, which measures the strength of the American currency against its peers, rose from 120 to 128, or 6.66 percent, while the yields on inflation-indexed 10-year Treasuries climbed from 0.5 to above 1.0 percent (so they more than doubled).

Chart 3: The U.S. real interest rates (red line, right axis, yields on 10-year Treasury Inflation-Indexed Security) and the U.S. dollar index (green line, left axis, Trade Weighted Broad U.S. Dollar Index) in 2018.

The Fed’s tightening cycle increased the

divergence in monetary policies between the US and other countries. The dollar-denominated assets became more attractive, so investors shifted their funds into America, making the greenback strong again

– and exerting downward pressure on the gold prices.

That process was supported by the negative impact of higher interest rates on the

emerging markets and the healthy economic expansion in the US – thus, investors had additional motivation to re-allocate their fund into dollar-denominated assets. Hence,

gold’s performance in 2018 was actually reasonable given the unfavorable macroeconomic environment.

And what about 2019 – will gold finally break out the chains of its sideways

trend? Unlike other analysts, we will be honest with you – we don’t know, as we don’t have a crystal ball.

But we know that the macroeconomic factors should be more favorable towards precious metals.

The US policy mix is likely to change. The accommodative effects of the

fiscal policy should dissipate, while the contractionary effects of the monetary policy could finally reach the economy. The higher interest rates tightened financial conditions and widened the

credit spreads, as one can see in the chart below.

Chart 4: The CBOE Volatily Index (green line, right axis) and BofA Merrill Lynch US Corporate BBB Option-Adjusted Spread (red line, left axis) in 2018.

The widened credit spreads (as well as increased volatility) imply weaker economic confidence, which should support the gold market. Indeed, investors entered 2018 with very optimistic views about the synchronous and accelerating global growth, but the current moods are much more pessimistic.

Rising fears make investors more risk-averse and more prone to buy safe-haven assets, such as gold.

Another reason is that no matter whether we will see three or fewer Fed hikes in 2019, the pace of tightening will be slower than last year. Forward-looking investors could sense the end of monetary policy normalization, selling the US dollar and buying gold today.

All these factors make us to believe that2019 fundamental outlook for the gold market is better than one year ago.

If you enjoyed the above analysis and would you like to know more about the fundamental outlook for the gold market, we invite you to read the January

Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our

Gold & Silver Trading Alerts. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe.

Sign up today!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘

Gold News Monitor and

Market Overview Editor

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.