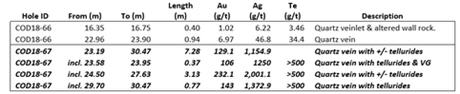

Ximen Mining reports “129 g/t gold and 1,154 g/t silver over 7.28 meter core length“

Full size / Hole COD18-67 intersected the highest gold-silver grades to date with diamond drilling at the Gold Drop Property.

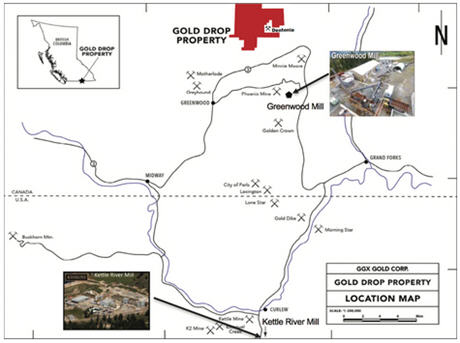

Big news for Ximen Mining Corp. as the company today announced that its option partner hit high grades at the Gold Drop Project in the historic Greenwood Mining District of southern British Columbia, Canada.

According to the news, hole COD18-67 intersected near-surface high-grade gold, silver and tellurium in the southern extension of the COD quartz vein:

"129.1 g/t Au and 1,154.9 g/t Ag over 7.28 m

incl. 232.1 g/t Au, 2,001.1 g/t Ag and >500 g/t Te over 3.13 m from 24.50 m to 27.63 m"

Although this hole was not drilled perpendicular to the strike of the vein, it still shows the exceptional high-grade nature of the vein, possibly being, or leading to, a large quantity feeder system. As Ximen keeps on reminding of the old saying “we drill for structure and we drift for grade”, this hole indicates how potential drifting may encounter the vein in case a production decision can be made in the future. Drilling along veins at slight angles helps in locating possible “ore shoots” and gaining a structural understanding of its vertical and horizontal orientations/extensions for targeted follow-up drilling.

Hole COD18-67 was drilled as part of a 11 hole program in Fall 2018, with further assays from 4 holes pending and expected to be released shortly. In December, Ximen´s option partner revealed striking drill core observations ahead of assays, e.g. hole COD18-67 intercepting a 8.51 m mineralized interval including a 7.32 m quartz vein intercept (assays announced today), as well as COD18-69 with 9.65 m of quartz separated by mineralized wall rock and COD18-71 with 12.04 m of mineralization (assays from both these holes pending).

Full size / See Ximen’s January 14, 2019 News Release for Qualified Person’s review of technical information. Note that true widths cannot be accurately determined from the information available, thus the core lengths are reported.

Full size

With approximately 400 m of the potential 1,200 m strike length (observed visually from surface with soil and rock sampling) now being drilled off, the COD Vein remains open at depth, to the south, and to the north where gold showings are present some 100 m away.

What makes the COD Vein so attractive is that it occurs near surface at a vertical depth of around 20 m. Moreover, it is just one of many known high-grade veins on the property. Last year, drilling at Gold Drop started in February/March, so another drill program may start again shortly, with other vein targets are already drill permitted.

Full size

The Gold Drop Property is surrounded by historic production stories within a few kilometers away, e.g. the adjoining Dentonia Property recorded approximately 125,000 tonnes at an average grade of 10.8 g/t gold and 64.6 g/t silver in total historic production from the Dentonia vein (Minfile 082ESE055). The veins on the Gold Drop Property have similar strike/depth ratios as the nearby Dentonia Vein.

Ximen’s team member, Alex Mcpherson, worked underground at the Dentonia Mine and thus knows the area well, and how such veins are mined. He has worked on many notable projects across Canada and the United States. In British Columbia, he was also sinking shafts for Bralorne Gold Mines. He has over 60 years of experience in mining and mineral exploration, has done extensive underground work including drifting, stoping, sinking shafts, driving raises, timbering, blasting and much more for a variety of private and public companies.

Ximen also has Peter Cooper onboard. He has been involved in 3 successful new gold mine start-ups and has overseen projects from the exploration stage right up to production. He played a significant role in the exploration, pre-production and development of Kinross Gold Corp.‘s Buckhorn Gold Mine located in northern Washington State, close to the Gold Drop Project. For many years, he served as Chief Geologist and then Manager of Operations at Kinross‘ Kettle River Mill, where the ore of the Buckhorn Gold Mine was processed.

With the recent closure of Kinross‘ Buckhorn Gold Mine (depleted), the Kettle River Mill (capacity: 1,800 tonnes/day) is currently on care and maintenance, hence Kinross could be looking for replacement feedstock to keep this large mill alive.

Full size / Freshly cut drill core from the COD Vein (hole COD18-67).

According to the NI 43-101 Technical Report on the Gold Drop Property (January 2014):

"Since custom milling opportunities exist in the district, the property does not necessarily need to support a stand-alone mine/mill operation to be viable. Even a small or modest tonnage of high grade ore could potentially be profitable to extract, given the excellent infrastructure of the region and the property itself...

The Gold Drop property covers geologically prospective ground in the well mineralized Greenwood District, and hosts 8 or more known gold-bearing veins or vein systems. On the adjoining Dentonia property, significant historic production has come from similar veins. There has been little effective modern exploration on the Gold Drop property, and in the author’s opinion, the property is unique in this respect.

Good opportunities remain untested on this property while most properties in the area that host showings of similar quality have been more thoroughly explored. Since custom milling opportunities exist in the district, the property does not necessarily need to support a stand-alone mine/mill operation to be viable. Even a small or modest tonnage of high grade ore could potentially be profitable to extract, given the excellent infrastructure of the region and the property itself...

It is reasonable to expect that veins on the Gold Drop property have similar strike/depth ratios as the nearby Dentonia vein, yet the limited drilling done on the property has generally failed to trace the veins to depth."

Option Agreement Favorable For Ximen

Since July 2016, the Gold Drop Project is under option agreement to GGX Gold Corp. which company may acquire a 100% interest by making staged cash and share payments to Ximen over a 4 year period equal to $400,000 in cash ($100,000 each year) and $600,000 in shares ($150,000 each year, subject to a minimum of 250,000 shares each year). This is in addition to the 1 million shares already issued to Ximen after TSX-V approval. GGX must also make work expenditures of at least $1 million until 2020 (minimum of $150,000 each year). Ximen will retain a 2.5% NSR (Net Smelter Royalty), of which GGX may buy back 1% by paying $1 million to Ximen.

Now it gets interesting (i.e. why this option agreement is so favorable for Ximen and its shareholders): Once GGX has obtained a 100% interest in the project after 4 years (in 2020), Ximen will have a right (for 9 months thereafter) to elect to form a joint venture with GGX by paying to the GGX the amount of money equal to 30% of the total amount expended on the property by GGX. If Ximen exercises this joint venture right, Ximen and GGX will enter into a joint venture for the exploration and development of the property. In other words: GGX is doing all the work, financing/dilution (i.e. taking the risk), and if the project becomes a success, it is Ximen who then has the decision power to get back 30% interest by paying just 30% of the costs that GGX spent. For this reason, I am a shareholder of Ximen (and not GGX). With less than 27 million shares issued and outstanding, Ximen has a tightly held share structure with less risk of future dilution as it receives annual cash payments from its optionees.

According to CanadianInsider.com, Ximen‘s CEO, Christopher R. Anderson, increased his holdings from less than 3 million shares to more than 4.3 million shares last year. As per December 28, 2018, he also held 1.2 million warrants and 0.8 million options, thus, if all exercised, controlling around 6.3 million Ximen shares. According to Ximen‘s website, insider ownership / major shareholders account for 40% of the company (as of September 2018). In other words: Management and insiders have serious “skin in the game“, i.e. they put their money where their mouth is.

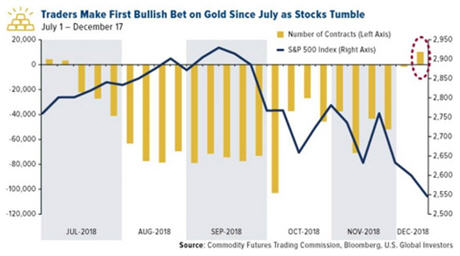

Positive Gold Price Outlook

According to the recent Bloomberg article Goldman Predicts Gold Prices to Climb to Highest Since 2013 (January 10, 2019):

Goldman Sachs Group Inc. is leading a pack of bullish voices cheering for gold. The bank’s analysts... raised their price forecast for gold, predicting that over 12 months the metal will climb to $1,425 an ounce -- a level not seen in more than five years. Bullion has benefited as rising geopolitical tensions fuel central bank purchases, while fears of a recession helped boost demand from investors seeking “defensive assets,” they said... Speculative interest in gold signals investors are not only closing bearish bets but are also adding to bullish positions... “We expect the safe-haven bid, and to a lesser extent, gold’s inflation hedge properties, to remain key drivers of the metal’s price in 2019, complemented by a resurgence of physical demand,’’ Cantor Fitzgerald analysts led by Mike Kozak said in a report. Gold and silver are ‘‘looking good in 2019,’’ underlining a potentially positive indicators that ‘‘should drive a bullish case“ for both metals “and as a result, the related equities as well.’’

Full size

Full size

Full size

Full size

Full size

Full size

Full size

Full size

Full size

Technical Perspective

Link to updated chart (15 min. delayed): https://schrts.co/DHtSzK

Link to updated chart (15 min. delayed): https://schrts.co/DHtSzK

Company Details

Ximen Mining Corp.

888 Dunsmuir Street – Suite 888

Vancouver, BC, Canada V6C 3K4

Phone: +1 604 488 3900

Email: office@ximenminingcorp.com

www.ximenminingcorp.com

Shares Issued & Outstanding: 26,751,025

Chart

Canadian Symbol (TSX.V): XIM

Current Price: $0.415 CAD (01/11/2019)

Market Capitalization: $11 Million CAD

Chart

German Symbol / WKN (Frankfurt): 1XMA / A2JBKL

Current Price: €0.20 EUR (01/11/2019)

Market Capitalization: €8 Million EUR

Previous Coverage

Report #3: “Strong drill results and appreciating precious metals prices may herald golden times for Ximen Mining“

Report #2: “Ximen Mining reveals striking drill core observations ahead of assays“

Report #1: “Ximen Mining: Hunting for Multi-Million Ounces in British Columbia“

Contact:

Rockstone Research

Stephan Bogner (Dipl. Kfm.)

8260 Stein am Rhein, Switzerland

Phone: +41-44-5862323

Email: info@rockstone-research.com

Disclaimer: This report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Ximen Mining Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the Ximen Mining Corp.´s and Zimtu Capital Corp.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through the Ximen Mining Corp.´s and Zimtu Capital Corp.´s profile on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, holds a long position in Ximen Mining Corp. and Zimtu Capital Corp. and is being paid by Zimtu Capital Corp. for the preparation, publication and distribution of this report, which company holds a long position in Ximen Mining Corp. The author currently does not hold any equity positions or other kind of interest in GGX Gold Corp. Ximen Mining Corp. has paid Zimtu Capital Corp. to provide this report and other investor awareness services.