Kevin Jackson

LinkedIN

Summary

- California’s legalization of cannabis on January 1st, 2018, started off with a global bang.

- Sunniva’s stock began trading a few days after legalization and rocketed higher as investors salivated at the prospect of an operator that could dominate the world’s two biggest cannabis markets.

- As the euphoria of legalization dissipated and Sunniva’s roadmap took a detour, its stock price plummeted and ended 2018 near an all-time low.

- Let's fast forward to 2019 where Sunniva's facility at Cathedral City, California, is expected to reap its first harvest in Q2 19.

- We believe the pendulum will reverse course yet again in 2019, and the stock will comfortably trade in a range of $10-20 USD by year's end.

Source: Sunniva.com

On January 10th, 2018, Sunniva (

OTCQB:SNNVF) shares began trading on the OTC under the ticker SNNVF around $8 and, within 10 days, touched a high of $16. Investors clearly saw value in an operator that had the potential to be a market leader in the two biggest cannabis markets on the planet. Sunniva's all-star management team is led by Dr. Anthony Holler, the former CEO of ID Biomedical that was acquired by GlaxoSmithKline back in 2005 for

$1.7 billion.

Sunniva's stock price in 2018 has plummeted, however, from its peak of $16 to nearly $2. What happened? The purpose of this article is to provide a comprehensive answer to this question and prove that the current Sunniva share price offers investors a compelling risk/reward investment opportunity in 2019 and beyond.

Source:

Bureau of Cannabis Control

California Cannabis Compliance

In order to truly understand Sunniva's golden opportunity in California, it is important to understand what cannabis compliance entails. According to the

Bureau of Cannabis Control (BCC), the three phases for the laboratory testing of legal cannabis are the following:

Phase 1 (effective 1/1/2018):

- Cannabinoids

- Category I Pesticides

- Category II Solvents

- Microbial Impurities

- Moisture Content

Phase 2 (effective 6/1/2018):

- Phase 1 Items Plus

- Category I Solvents

- Category II Pesticides

- Foreign Material

Phase 3 (effective 1/1/2019):

- Phase 2 Items Plus

- Terpenoids

- Mycotoxins

- Heavy Metals

- Water Activity (Edibles)

Operating as a compliant cannabis cultivator in California is no easy task and requires substantial capital resources, connections, and expertise. In the days leading up to Phase 2 on July 1st, 2018, cannabis companies slashed the prices of all their products that failed to meet the new testing and packaging standards. Wired Magazine covered the Phase 2 transition with a provocative article entitled "

Why (And How) California Is Destroying Mountains of Weed".

Let's fast forward to the present day and the implementation of Phase 3 in 2019 where compliance concerns are once again on high alert. According to a recent

L.A. Cannabis Times article, the new test for heavy metals could potentially pose a significant threat to growers and "plated rather than metal THC oil cartridges are at risk for leaking heavy metals into oils. That could cause a higher fail rate for cartridge products."

Starting on January 10th,

medical marijuana collectives and cooperatives must have a state license or else face criminal charges or civil fines. "It's significant because, at this point, if you don't have a license, whatever legal protection you have goes away," said Los Angeles cannabis attorney Michael Chernis.

These facts make a very strong case for a cannabis operator that is able to create an efficient, scalable facility capable of consistently producing a wide range of compliant cannabis products in a massive market that is starving for it. Sunniva is among the very few companies that can meet these criteria.

The State of California

Despite the fact that California is the

world's 5th largest economy, it is perpetually in search of more tax revenues. Cannabis was expected to rake in $630 million in 2018, but the actual figure was only

$471 million. This is a far cry from the forecasts of $1 billion in tax revenues that many "potimists" were previously touting.

Regulations are certainly a driving factor, which includes licensing challenges in addition to testing requirements. In a recent

L.A. Times article, it was reported that:

"Less than 20% of cities in California - 89 of 482 - allow retail shops to sell cannabis for recreational use, according to the California Cannabis Industry Assn. Cities that allow cannabis sales include Los Angeles, Oakland, San Francisco and San Diego."

High taxes are the cherry on top of this cannabis sundae as California levies a statewide 15% excise tax along with sales and municipality taxes that can pile on an additional 20 percent.

The delivery platform Eaze did a recent survey and found that:

"one in five Californians still purchase cannabis from the black market. The survey also found that a 5 percent reduction in the tax rate could convert 23 percent of consumers from the black market to the legal market."

Finally, the legalization process has hit numerous brick walls in cities and towns that are adamantly opposed to having cannabis businesses visible in their communities. The flipside of this broken record is that the black market is thriving, dangerous, and the shocking subject of a new Netflix documentary series called "

Murder Mountain."

Is Green the New Black?

In a recent New York Times article entitled

"Now for the Hard Part: Getting Californians to Buy Legal Weed", it was reported that:

"California was the sixth state to introduce the sale of recreational marijuana - Alaska,Colorado, Nevada, Oregon and Washington paved the way - but the enormous size of the market led to predictions of soaring legal cannabis sales.

Instead, sales fell. Around $2.5 billion of legal cannabis was sold in California in 2018, half a billion dollars less than in 2017 when only medical marijuana was legal, according to GreenEdge, a sales tracking company."

We believe this startling statistic represents "ground zero" for the California legal cannabis market, and despite all of the challenges that California faces regarding implementing cannabis legalization, it still remains the best cannabis market on the planet.

Long-time

cannabis crusader, Gavin Newsom, has officially taken the helm as the Governor of California and has openly identified cannabis as a key national issue for generations to come. We believe that Newsom has a big incentive to step in and oversee (and take credit for) the spectacular growth of the legal California cannabis market as the soft whispers of a

2024 presidential bidbecome increasingly louder. Governor Newsom has gone on record as recognizing California's significant role in illegal cannabis trafficking in the United States and has pledged on numerous occasions that he will be tough on the black market. He is already delivering on this promise by proposing that

$200 million be earmarked for the enforcement of marijuana regulatory programs starting on July 1st.

It is also true that Newsom's recent campaign

received $500,000 from the legal cannabis industry, and there is a lot more where that came from. The bottom line is that there are very legitimate reasons to believe that the legal cannabis market in California will significantly improve in 2019 and beyond and that Governor Newsom will swing a bigger stick. This bodes well for Sunniva.

Source:

California Dept. of Public Health

Sunniva Risks and Concerns

Before we make the case for Sunniva as a highly attractive investment opportunity for 2019 and beyond, we believe it is critical for investors to clearly understand the risks and concerns displayed in this timeline of events.

- Canopy Supply Deal Announcement: On February 21st, 2018, Canopy Growth (OTC:CGC) and Sunniva announced a two-year supply deal that would enable Canopy to purchase up to 45,000 kilograms of dried cannabis on an annual basis. The commencement of this deal was scheduled for Q1 of 2019. The Canopy deal is a "big deal" and largely legitimized the build-out of a 759,000 sq. foot cGMP greenhouse facility in Okanagan Falls, Canada.

- The Spin-Out: Sunniva announced on July 10th, 2018, that it will spin out its Canadian assets and pursue listings on the TSX and the NASDAQ. While this move received early praise from analysts, it did nothing to stop the rapid decline of its share price. Many of us investors believe that this move was both confusing and poorly communicated. Sunniva has retained KCSA Strategic Communications on October 10th, 2018 to help fill this important gap, and we view this as a step in the right direction.

- Canopy Supply Deal Update: In the Q3 conference call, Dr. Holler's comments were the following:

"We obviously can't meet that deadline. There were a number of reasons or thatfacility not being able to meet the deadline including our vendors in Europe, notbeing able to deliver products to complete that facility. Some of the vendors aresix months late at being able to deliver products. We clearly aren't meeting thatdeadline and we are in discussions with Canopy about extending the date ofdelivery to the actual date the facility is up and running."

This was not welcome news by the market that largely viewed the Canopy deal as the floor supporting Sunniva's Canadian operation.

- Sunniva Canada Campus (Okanagan Falls): The original plan was to create a 759,000 sq. foot cGMP greenhouse facility (100,000-kilogram capacity) that would become operational in Q1 2019. In its Q3 reporting, however, management retained Canaccord to assess strategic options for its Canadian assets. After carefully considering all viable options, management decided to pursue a much smaller modular footprint that will support their existing NHS clinics and tap into the higher margin medical cannabis consumers. This facility is due to be operational in Q3 19 (more on this later) as management attempts to restructure their deal with Canopy.

- Cathedral City Delays: After Sunniva's Q2 reporting, it was reported that "Construction continues at the Sunniva California Campus. Phase one (50,000 kg per year) is expected to commence operations in Q4 2018, with the first harvest expected in Q1 2019." We can now expect initial planting in Q1 and the first harvest in Q2.

- Sunniva's Q3 Financials: Their third-quarter results did show revenue declines in its Canadian based Natural Health Services (NHS), and California-based Full Scale Distributors (FSD) subsidiaries. It should be noted, however, that the year-over-year revenue did increase by 30%.

- Liquidity Concerns: For the 9 months ended Sept. 30th, the company spent $5.1 million on the California campus buildout and $24.9 million on the Canadian campus buildout. The 3rd quarter alone, the company invested $10.3 million and $1.9 million, respectively, to advance the Canada and California Campuses.The company also had a $6.5 million working capital deficit for that 9-month period. We will explain later how Sunniva is dealing with these concerns.

Source:

Orbis Bioscience

Sunniva: The Road to 2020

These are all legitimate risks and concerns, and many Sunniva shareholders have experienced significant share price compression. So, why would anyone want to invest in this company in light of this information?

Here are the facts and analysis regarding why we believe Sunniva stock at its current levels has the potential to yield outstanding returns to patient investors.

Source:

svcnna

Sunniva California Campus

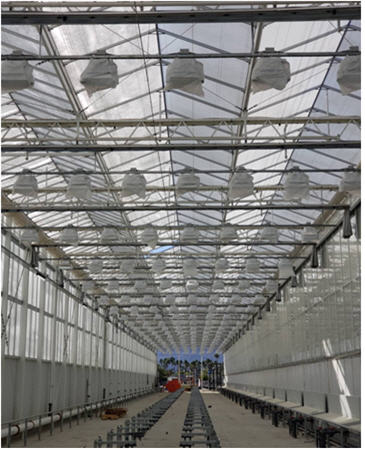

The Sunniva facility in Cathedral City has been many years in the making and is now nearing completion. Here are some key attributes that demonstrate the uniqueness of this facility.

Location

Cathedral City is located about 104 miles (167 kilometers) to the east of Los Angeles and about 84 miles (135 kilometers) from San Diego.

Weather

On average, there are

271 sunny days per year in Cathedral City. The US average is 205 sunny days. This sunshine offers a clear advantage over other growers that pay

huge energy bills (Nick Kovacevich from Kush Co. covers this well) for their indoor and/or greenhouse cannabis cultivation.

cGMP standard

For those who may be unfamiliar, the Sunniva facility in Cathedral City is no ordinary greenhouse. It utilizes the latest modern agri-technology and that adheres to a

cGMP level standard for cannabis. This level is comprehensive and covers the following key aspects:

- Materials

- Premises

- Equipment

- Storage

- Record Keeping

- Staff Training

- Hygiene

- How Complaints Are Handled

- Product Development

The difference between

GMP and cGMP is that the "c" stands for current and reflects the need to constantly keep all systems and technologies up to date and compliant with regulations.

Barker Pacific Group (BPG)

The California campus is being built in cooperation with the Barker Pacific Group (BPG), a well-established real estate developer. The beauty of this arrangement is that BPG is building and leasing the facility to Sunniva so that capital early on can be focused on business growth. In other words, the cornerstone of this agreement is that Sunniva does not begin to make lease payments for the facility until it is completed and generating revenue. It is clear that BPG has a lot of confidence in management's ability to execute their business plan and this plan rewards shareholders with minimal dilution.

Source:

Sunniva

The Facility

According to Sunniva's recent

Q3 2019 financial report, Phase I (325,000 square feet) will be completed in Q1 2019 and create an annual capacity of 50,000 kilograms plus 10,000 kilograms of trim. The first harvest will be in Q2 2019 and the real fun will begin. This facility is scheduled to reach full capacity during Phase II (489,000 square feet total) in 2020 boosting its annual capacity to 72,500 kilograms plus 15,000 kilograms of trim (used for

Trim Runs).

Sunniva also stated in this report that:

"A total of 100,000 plants from the Oakland Facility are being prepared for onboarding for the initial planting cycle in Q1 2019. Automation will move the plants through their life cycle and when operating at full capacity, the Sunniva California Campus is expected to deliver a continuous daily harvest of approximately 210 kg (2.1 million grams) of dried flower."

Sunniva is serious about

sustainability. This greenhouse will be more energy efficient and produce less waste than indoor cultivation facilities. The system not only helps maximize plant yield but also provides thorough root aeration and precise nutrient delivery to the plants. Their Integrated Pest Management System is expected to ensure that every plant they grow is certified clean and free of all contaminants and pesticides. Furthermore, the air for the facility is treated via a multi-layer carbon filtering system to ensure minimal odor to the outdoors.

As we have previously discussed, the ability to produce compliant cannabis in California is paramount to success. Sunniva is among the few that achieves this with significant scale.

Oakland Vision Project

On October 17th,

Sunniva announced the acquisition of the Oakland Vision Project that includes their licensed cultivation facility located in Irvine, California. This facility offers a production capacity of 725 kg per year, development plans to scale production to 3,625 kg per year in 2019 and estimated production costs below $1.00 per gram.

The crown jewel of this acquisition, however, is the onboarding of Vison's seasoned group of cultivation professionals who have extensive experience in both small and large-scale operations. This cultivation team is currently producing some of the highest quality pesticide free cannabis flower in California and will be used to manage Sunniva's production operations in Cathedral City.

As we have previously outlined, California's cannabis compliance is stringent, and non-compliance is very costly in terms of loss of product, termination of licenses, and damaged reputations. We are confident that the future of Sunniva's 60,000 KG of production is in good hands and clear evidence that management is paying close attention to its entire value chain.

Licensing

Successfully playing the California cannabis licensing game requires the right strategy, resources, and execution. Sunniva has been able to obtain 26 temporary licenses for the cultivation, distribution, manufacturing, and retailing of cannabis. In a savvy move, CP Logistics LLC holds the licenses for numerous smaller growers on

Ramon Road that will then lease parts of the Cathedral City campus.

The cultivation licenses are currently being processed and the remaining license applications are being prepared for submission to the state of California. The Company does not expect operational delays from these licensing requirements. The execution of licensing in itself is a strong testament to the quality of management.

Extraction

According to the Sunniva's reporting of their

Q3 2018 financial results:

"The Extraction Facility, licensed for both volatile and non-volatile extraction processes, commenced operations in July 2018. The extraction team has been manufacturing and perfecting its extracted product lines and developing product formulations. Sunniva is currently stockpiling inventory in preparation for the launch of Sunniva-branded product lines in Q1 2019. The Extraction Facility has the ability to produce vape oil-distillate, ultra-pure concentrates, fresh frozen, shatter, capsules, tinctures, and edibles.

The Extraction Facility adheres to cGMP standards and has the capacity to process over 10,000 lbs of cannabis biomass a month. Sunniva continues to source compliant third-party biomass and trim through existing relationships which will drive revenues in early 2019. Reliance on purchases of third-party biomass will be reduced as production from the Sunniva California Campus becomes available."

Sunniva's current white label extraction contracts are with successful local brands: terpene king Farmacy Phactory, award-winning Caligold, PureOrganix extracts, and an unnamed customer to date. At full capacity, the monthly output from the extraction facility is estimated at 180,000 grams of distillate and 125,000 grams of live resin extracts, which will supply all Sunniva branded product categories. Sunniva is currently stockpiling product for the imminent house of brands launch. In fact, a

4-month, $2.4 million contract was just announced. Expansion plans beyond the current manufacturing capacity are underway to accommodate future sales growth.

Sunniva House of Brands

According to recent talks with management, Sunniva is currently in the process of stockpiling inventory for the launch of its branded products commencing Q1 2019. One of these products is Paradiso, a high-end vape cartridge that contains among the highest THC content available on the market.

In addition to their flagship dispensary in Cathedral City, Sunniva is actively pursuing retail opportunities that will complement their vertical integration strategy and allow them to capture attractive margins.

Source:

Sunniva

Lightyear Logistics (LTYR) Acquisition

After July 1st, 2018, all sales of cannabis products must go through licensed distributors. Unlike Canada, where there is heavy involvement from the provinces and Health Canada, distribution in California is done by private companies according to the

following guidelines put forth by the State of California:

- Distributors are the only license type that can transport marijuana products, and they're also the only licensees that can coordinate the required third-party testing of licensees' products.

- Prior to any retail sale, licensees must ensure that a distributor undertakes quality assurance packaging and labeling reviews of their products.

- Perhaps, most importantly, distributors are almost exclusively in charge of collection and remittance of the cultivation and excise taxes to the California Department of Tax and Fee Administration ("CDTFA").

- As of January 1st, 2019,

"California's cannabis operators must adhere to strict compliance guidelines that include oversight by the state's new track-and-trace system, Metrc. Failure to do so puts businesses at risk of criminal liabilities and has the potential to invite federal prosecution."

- What is Track and Trace?: Track-and-Trace programs enable government oversight of commercial cannabis throughout its lifecycle-from "seed-to-sale."

Sunniva, like

Origin House (

OTCQX:ORHOF) (formerly CannaRoyalty), has recognized the strategic importance of distribution in California. It is crystal clear that the LTYR acquisition, combined with the cultivation, extraction, and branded products, gives Sunniva firm control over a value chain that will soon turn into a cash machine.

Here are the key points for investors to consider:

- Cannabis Compliance: The experienced team at LTYR significantly boosts Sunniva's ability to execute on the distribution retail portions of the value chain. Due to the aforementioned regulations, successful legal cannabis operators must permanently remain on the right side of the law. In fact, as of January 10, 2019, it is a potential felony to operate a cannabis business without a license.

- Expanding Footprint: LTYR offers a statewide, distribution network of more than 120 licensed distributors and the proven ability to significantly grow this network backed by great Sunniva products. It is also notable that recent regulations allowing distribution to communities that do not allow cannabis dispensaries is sure to provide Sunniva's distribution team far greater reach and market penetration for Sunniva products. It is estimated that two-thirds of California cities and counties still have MJ business bans in effect. We believe this situation to significantly improve in 2019.

- Sales and Management: The LTYR team will also be heavily involved in sales, which is consistent with how they were able to cultivate relationships with 120 dispensaries thus far.

- Long Beach Warehouse: Sunniva is also in the process of purchasing a 4,200 sq. ft warehouse in Long Beach, California.

- The LTYR Deal Closed: On December 31st, 2018, the LTYR acquisition by Sunniva was completed.

- December 2018 - May 2020: The addition of 5 to 10 retail stores in California (including dispensary at California Campus).

Source:

Medium

The Spin-Out

It has been coined the "

Spinout Transaction", which entails the spin-out of Canadian assets into a separate entity that will ultimately be listed on the Toronto Stock Exchange ("TSX") and the NASDAQ. Sunniva has retained Canaccord Genuity (

OTCPK:CCORF) to advise them on how to restructure the company in an effort to maximize shareholder value.

The Canadian Spin

Source:

SurveyPolice

Sunniva Medical Inc. (SMI): This company is currently building the

Sunniva Canada Campus.

- SMI is currently renegotiating the Canopy deal.

- SMI received Confirmation of Readiness for a cultivation license under the Access to Cannabis for Medical Purposes Regulation from Health Canada on May 26, 2018 - SMI's application is approved and subject to initial phased build and readiness

Natural Health Services Ltd.:

- Owns and operates 7 clinics in Canada that deliver free cannabis advice from medical professionals.

- There are three NHS affiliates: Calgary Integrative Medicine, Varsity Medical Clinic, Civic Family Health Center.

- Recently signed a deal with HelloMD in Canada to expand patient reach by delivering enhanced medical cannabis services.

Spinco

This will be the new Canadian entity holding the assets of Sunniva Medical Inc. and Natural Health Services. More on Spinco later on.

The U.S. Stays

Source:

SmartWallSation

Sunniva's U.S. assets are the following and will continue to trade on the CSE under the ticker SNN (

OTCQB:SNNVF).

- Sunniva California Campus

- CP Logistics (CPL): Owner and operator of the extraction facility in Cathedral City.

- Full Scale Distributors LLC: Owner and operator of Vapor Connoisseur, a high end, vaporizer design, and manufacturing company.

In a July 10th,

2018 press release, Sunniva's CEO, Dr. Anthony Holler, made the following comments about the logic behind the Spin-Out:

"We feel Sunniva is undervalued and through the Spinoff Transaction we hope to unlock significant value for our existing shareholders. Creating a new Canadian company with our Canadian assets and listing them on the TSX and NASDAQ would be expected to bring added visibility and additional analyst coverage to our story and has the potential to attract institutional investors that are currently unable to purchase stock on the CSE or purchase companies holding US assets."

Spin-Out Roadmap

According to

Sunniva's Q3 financial report, the company outlined the following steps and timelines:

- Borden Ladner Gervais LLP hired to handle legal aspects of Spin-Out.

- PricewaterhouseCoopers LLP will be engaged as a tax advisor for the Spin-Out

- MNP LLP retained as Spinco auditor.

- Q1 2019: Spinco management, the board of directors, and financial statements disseminated.

- Q1/Q2 2019: Shareholders vote on the Spin-Out.

- Q2 2019: If the green light is given, shares of Spinco start trading on the TSX-V.

Spinco (Canada)

Here is a breakdown of what is happening in Canada:

The Strategy:Wholesale to Medical

- Canada's biggest cannabis players clearly recognize the importance of creating strong brands and securing a powerful network of retail outlets. This is why Canopy bought Hiku, and Aurora (OTC:ACB) has invested in the likes of High Tide, Alcanna, and Choom. More production does not translate into more profits if a company is unable to defend itself against falling prices and tightening margins, a point Bruce Linton has reiterated many times over the past few years.

- Sunniva has realized that life as a wholesaler is a race to the bottom. The company needed to find a way to compete in Canada where it can realize and sustain healthy margins realized from selling branded products directly to customers. Their shift in Canadian strategy smartly reflects this.

- The following excerpt comes from Sunniva's Q3 2019 financial report:

"Our business strategy in Canada will shift from becoming a wholesaler of cannabis to a focus on the higher margin direct to patient medicinal cannabis market. Currently in Canada, there are approximately 400,000 registered cannabis patients, with that number forecasted to grow to over two million registered patients in the next three years. NHS has 105,000 registered patients to date and with 100% ownership of seven physician-based clinics across Canada, we feel we have a significant competitive advantage in capturing additional market share in this area."

Okanagan Falls 2.0

- Back on June 18th, 2018, Sunniva announced the closing of its purchase of a 126 acre industrial zoned property in Okanagan Falls, BC, for an amount of $7 million. This property will be the home of the Sunniva Canada campus, purpose-built current Good Manufacturing Practice ("cGMP") designed greenhouse facility.

- In its Q2 2018 financial results, Sunniva announced that the construction of the 759,000 Canadian campus was underway and this progress was visible from its website. We estimate that Sunniva has paid out roughly $20 million developing this facility so far.

- In its Q3 2019 financial report, Sunniva did change their timeline for the Canadian campus, but their ultimate goal to create a 759,000 sq. foot cGMP facility remains in place. This shift in strategy reflects a "wait and see" approach by enabling management in an effort to avoid the costly mistakes made by other cannabis companies. It also reflects a shift in resources towards the California cannabis market, where Sunniva has unique advantages that have been previously mentioned. Furthermore, the legalization of cannabis in the U.S. remains a fluid topic and one that could open up huge opportunities for a company that is a market leader in California, currently, the world's biggest cannabis market and a global trendsetter in the space.

Phase 1: Modular and Medical

- Capacity: approximately 5,000 kg/year

- Cultivation modules: expected delivery date is January 2019

- Cannabis genetics already sourced for production

- Cultivation license: will be submitted in January 2019 for approval

- Medical patients: Forecasting the registration of 20,000 medical patients in 2019 and over 50,000 in 2020

- Production costs: below $2.50 per gram for pharmaceutical grade pesticide-free product

- Capital Requirement: An initial capital of $1.5 million is required.Additional production modules will be vendor financed

- Sales License: The receipt of Spinco sales license and first harvest is Q3 2019

Phase 2: State-of-the-art, purpose-built, cGMP designed greenhouse

- Size: 458,000 sq. feet

- Capacity: 50,000 kg/year production of flower

- Production cost: less than $1.00/gram per gram for pharmaceutical grade pesticide-free product

- Financing: the separation of the U.S. and Canadian assets will open up financing options

- Licensing: continuation of Phase 1, experience in building California campus a big plus

Phase 3 - 301,000 sq. ft (50,000 kg per year flower capacity)

- Size: 301,000 sq. feet

- Capacity: 50,000 kg/year production of flower

- Production cost: less than $1.00/gram per gram for pharmaceutical grade pesticide-free product

Source:

Greencamp

Financials

Dilution and Bought Deals

According to our recent conversation with Rob Knowles, VP of Corporate Development at Sunniva, a bought deal in Q1 or Q2 is not likely as it would disrupt the Spin Out and shareholder voting process and delay everything at least another month. Revenues are coming in from extraction activities, including the

latest announcement from January 4th.

Liquidity Concerns

The Canadian buildout has been delayed at the Okanagan site, pending a strategic partnership or equity financing arrangement that will allow Sunniva to complete the cGMP facility. This will reduce the companies' monthly capital expenditures by $8-10 million on a quarterly basis.

The California campus is now near completion with capital expenditures near conclusion. In terms of revenue, the California campus is now producing revenue at its extraction facility and began running at full capacity to begin 2019. The latest contract announcement, the first for its branded products is for $1.8 million for Q1, 2019. As well, the 3 white label extraction contracts are estimated to bring in conservatively the same revenue for the Q4, 2018 period and increasingly higher for Q1 and Q2, 2019.

It is expected that the Q1 revenue will be at least double the 2018 running rate. According to our estimates, investors can expect a range of $10-14 million with a $.5 million monthly cash burn rate in Q1.

While liquidity remains a legitimate concern, with the first harvest in Q2, 2019, we expect an additional large revenue stream from the completed campus to commence in Q3, 2019.

Hostile Take-Over Protection

It seems that Green Growth's (

OTCQB:GGBXF) recent hostile bid for Aphria (

OTC:APHA) may have kicked off a trend in the industry. Origin House (formerly CannaRoyalty) is currently taking defensive measures to fend off

hostile takeovers as well. The good news for Sunniva investors is that the management owns a large stake in the company which is a significant deterrent for paper-driven takeovers.

According to

Marketscreener.com, the following reflects the extent of management's ownership of the total float and it is significant.

| Name |

Equities |

% |

| Leith Pedersen |

4,678,251 |

12.8% |

| Tony F. Holler, MD |

2,882,612 |

7.91% |

| Daniel Vass |

1,119,532 |

3.07% |

| Kevin V. Wilkerson |

680,283 |

1.87% |

| Michael Barker, MBA |

678,066 |

1.86% |

| Ian A. Webb |

260,000 |

0.71% |

| Todd R. Patrick, MBA |

80,000 |

0.22% |

| Horizons ETFs Management (Canada), Inc. |

65,438 |

0.18% |

| Stonebridge Capital Management, Inc. |

43,170 |

0.12% |

| March Asset Management SGIIC SAU |

9,959 |

0.027% |

|

Source:

Marketscreener.com

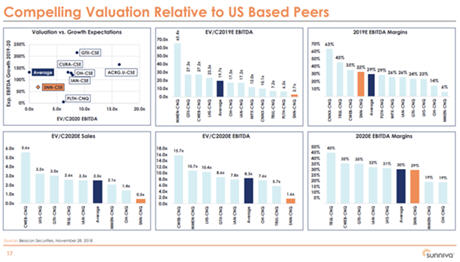

A valuation approach to the California entity (post spinout)

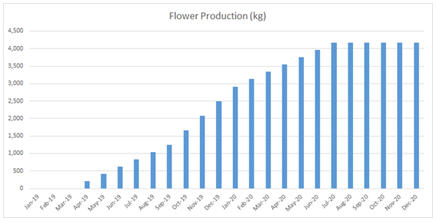

We have assembled a financial analysis that incorporates material company presentations and news releases to demonstrate the revenue potential of the company. Immense credit is due to the many community members who have helped to confirm timelines, pricing, and support the quality of this information.

For starters, we are assuming that the greenhouse will ramp up to a steady state of production of 50,000 kg per year (4,166 kg per month). Our analysis only incorporates the completion of Phase 1 at this time. Beacon Securities' research from the latest

Sunniva Corporate Presentation is provided as an appendix to support our valuation approach.

Source: Our own projections

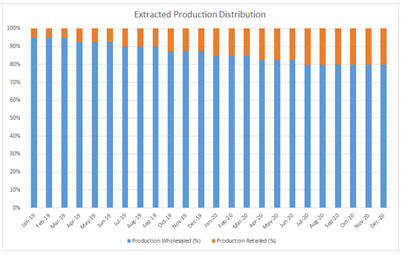

The flower production will be held for extraction or sold via wholesale and retail channels. To be conservative, we will assume mostly wholesale after accounting for the company-stated 30% planned to be held for extraction.

Source: Our own projections

The extraction facility is currently producing and will ramp operations to reflect the recent news release that states:

"At full capacity, monthly output from the extraction facility is estimated at 180,000 grams of distillate and 125,000 grams of live resin extracts, which will supply all Sunniva branded product categories. Expansion plans beyond the current manufacturing capacity are underway to accommodate future sales growth."

No expansion is assumed at this time. The feedstock for this facility is comprised of 3rd party clean biomass, greenhouse trim, and greenhouse flower (30% at full ramp).

Source: Our own projections

The extraction facility production will be sold via wholesale and retail channels. To be conservative, we will assume a mostly wholesale sales mix.

Source: Our own projections

Appendix:

Source:

Sunniva Corporate Presentation, December 10th, 2018

The following key assumptions drive a compelling revenue and value ramp.

Flower Wholesale Price ($/g)

Flower Retail Price ($/g) |

$4.50

$9.00 |

| Cartridge Wholesale Price (.5g) |

$15.00 |

| Cartridge Retail Price (.5g) |

$35.00 |

| Live Resin Wholesale Price ($/g) |

$20.00 |

| Live Resin Retail Price ($/g) |

$50.00 |

| Shares Outstanding: 47,693,613 |

| 2020 EBITDA Margin: 29% |

| USD/CAD exchange rate: 1:33 |

Source: Our own projections

| Valuation Estimates |

CAD Valuation |

USD Valuation

(USD/CAD:1.33) |

Enterprise Value

(EV)/C2020E

2.5x Sales |

$21.26 |

$15.98 |

Enterprise Value

(EV)/C2020E

8.3x EBITDA |

$20.47 |

$15.39 |

Source: Our own projections

A New Interactive Valuation Model (Using Sunniva)

One of the leading members in the Sunniva investor community has recently created an interactive valuation model based off of estimated 2020 EBITDA. This model provides a lot more detail and insight into how the price target is constructed and is very consistent with our projections previously cited.

For an introduction to this model and access to the Sunniva Valuation Calculator, please go to

Say Goodbye to Napkin Math.

Conclusion

Around $2.5 billion of legal cannabis was sold in California in 2018, half a billion dollars less than in 2017 when only medical marijuana was legal. The reality of a legal market quickly extinguished the euphoria the world witnessed on January 1st, 2018, as cannabis compliance became a painful hangover. While 2018 was a year of turbulence, we see 2019 as a rebound year where legal cannabis sales could

realistically double in 2019.

With final regulations now officially in play, California can now build on an established legal foundation in 2019 while systematically dismantling a stubborn black market. The heavy burden of compliance, combined with felony charges for black market players, presents a powerful advantage for a large, compliant company with significant economies of scale.

Sunniva's vertical integration in California will enable them to maximize margins and maintain forensic oversight of their entire value chain. According to our model, we believe it is reasonable to expect Sunniva's stock to trade in a range of $10-20 USD by the end of 2019. We further contend that our investment thesis will continue to be de-risked as the stock trades more in line with its peer group whose members enjoy significantly higher valuations. It is important to note that this price range only reflects the California operations and does not include any revenues from the Canadian operations, which is icing on the California cannabis cake.

Investing in Sunniva in 2018 has been a painful reversal of fortune for many shareholders. We see 2019, however, as an emphatic redemption year for these same investors and an amazing gift to new investors.

We would love to hear your thoughts and comments regarding this article, so fire away. A special thanks to those who supported the creation of this article.

Disclosure: I am/we are long SNNVF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.