As a general rule, the most successful man in life is the man who has the best information

Gold was up slightly on Friday, due partly to continued weakness in North American stock markets; Wall Street was down for the third day in a row and the Nasdaq and Dow were headed for their first weekly losses of the year.

The precious metal closed at US$1,314 in New York, $4.20 higher than the previous session. Gold is up so far this year

due to a number of factors we outlined in a previous article.

Among this week’s worries, President Trump said he wasn’t planning on meeting the Chinese president before a March 1 deadline that, if a trade deal isn’t reached, will push tariffs on billions worth of Chinese imports from 10% to 25%. US trade negotiators had earlier suggested talks were going well and a deal could be within their grasp. Worries about slowing growth in the EU and the UK added to the malaise in the markets.

What caught my eye earlier in the week though, wasn’t the usual inverse relationship between gold and stocks, but a

report about ETFs.

According to the World Gold Council, holdings in gold-backed ETFs hit their highest level in six years, at 80 million ounces. The “paper gold” instruments, which offer investors exposure to the gold price through an exchange-traded fund rather than physical gold or gold stocks, have been on a tear of late. January is the fourth consecutive months of net inflows; $8 billion, the equivalent of 85 tonnes of gold invested over the same period.

My question is, why? Sure the gold price has gone up, prompting retail and institutional investors to bulk up on their paper gold, hoping to catch a decent gain. Or it could be the other way around - big institutional funds buying blocks of ETF shares, increasing the demand for gold held in vaults, thereby causing the gold price to go up. Research confirms it’s more the latter.

Either way, if gold investors want an investment to leverage the rising price, at AOTH we believe a gold ETF is the last place they should be looking. The best place? Junior gold miners.

This article will explain the foolishness of gold ETF investing and why it makes sense to stock-pick the right juniors with the best projects.

How ETFs changed gold

First, a primer on gold ETFs and how they have changed the gold market. Let’s start with the basics. An exchange-traded fund sells shares, then pools the money it collects for investing into the areas that fit their objectives, whether it’s US market indices, foreign currencies, bonds, commodities futures, or in this case, gold.

ETFs are popular because the investor doesn’t have to pick a stock. The ETF holds many investments, all get factored into its price. This reduces the risk of losing on one particular stock, but it also significantly dilutes the potential gains.

Gold ETFs have been around now for about 15 years. They started as a way for the mom and pop investor to become a player in the gold market without having to go and buy physical bullion (coins or bars) or pick gold mining stocks. Gold ETFs could be bought and sold just like equities, which is really what they are.

At first a niche market appealing to a relatively small investor pool, ETFs have become mainstream. In 2016 when the gold price recovered from an extended slump, inflows into gold ETFs were the second highest on record and accounted for a third of total investment demand that year.

Some gold ETFs track the gold price, either through holding bullion or entering into future contracts. Others invest in gold companies - majors and midtiers, or juniors. If you are considering buying an ETF (at AOTH we don’t) make sure you understand what the ETF is investing in. Do your homework.

The first gold ETF to be sold in the US was the SPDR Gold Trust (GLD), which is currently the largest gold fund in the world. iShares Gold Trust (IAU) is another large gold ETF, the VanEck Vectors Gold Mines ETF (GDX) tracks gold mining companies and the Sprott Junior Gold Miners ETF (SPDR) follows a group of gold exploration companies.

While gold ETFs claim to track the gold price, in fact the opposite is true. This means, as stated above, that buying a gold ETF is a

trade, not an investment in gold.

Bloomberg actually proved it. The news site did a regression analysis of the last 10 years, to try to determine whether gold was influencing ETFs, or vice versa. It found the beta for ETFs tracking gold to be 0.126. The beta for the opposite, gold tracking ETFs, was 0.59, a significantly stronger correlation.

Bloomberg also noted that a third of ETF investing is done by institutions, with the ability to purchase or sell large blocks of ETF shares at a time, allowing them to influence the gold price if enough volume is traded.

Also worth noting is that gold ETFs are the swing trade in the gold market. Central banks buy and sell gold throughout the year (

They bought more bullion in 2018 than any year since 1971), as do buyers of gold jewelry, bars and coins.

All other forms of gold buying being equal, then, when investors pile into ETFs the gold price should move up, and if they sell en masse, the price should fall. According to Bloomberg the exact opposite happens.

The trouble with trustees

As noted, investors really need to read the fine print when buying a gold ETF. Not only do many investors not understand what they are buying, they also misunderstand how safe their investment is.

ETFs claim to be as secure as bullion because the shares are backstopped with bullion that is actually held in a gold vault somewhere. The problem comes if, when, the fund holder decides to go and collect his/her bullion.

He or she would run into something called “counter-party risk,” which is a fancy way of saying that nobody is guaranteeing the gold - that is supposedly matched to your ETF shares - will be there when you need it.

Here’s how it works: First the investor buys the shares through an “authorized participant”, usually a large financial institution. The institution then purchases shares from the trustee, such as iShares Gold Trust. The trustee then gets a custodian (a bank or financial institution) to source the gold and store it for them. Sometimes the custodian assigns this task to another party, known as a sub-custodian.

Already we can see the party, YOU, that owns the gold is three or four layers removed from the ETF investor. Is this looking like a safe, transparent investment?

If the custodian (the bank or financial institution), that has the gold, also known as the “counter-party”, were to fail, would the investor be able to claim his gold? Very likely not.

Forbes notes that under London Bullion Market rules, there are no contractual agreements between trustees and custodians or sub-custodians, nor are trustees insured should anything impair their ability to part with the gold. They leave this up to the custodian, which only carry basic insurance on the gold stored in its vaults.

“

Putting it all together, if anything happens to any of the counter-parties, the investor has zero recourse,” - Forbes

Paper gold

What happens if you sell your gold ETF shares? Well if you sell your ETF, you will be paid back in cash, not gold. That’s because when an investor buys shares in an ETF, he becomes a shareholder of the trust, not a gold holder. No different than owning a stock.

A crisis of any severity may demand you have actual gold bullion in your possession. Selling for cash, kind of defeats the purpose of having gold in your portfolio as insurance against financial catastrophe, doesn’t it?

At Ahead of the Herd we love gold, but we hate ETFs. If you think the time is right to invest in precious metals, there are really only two alternatives:

- Physical gold or silver. Coins such as American Eagles or the Gold and Silver Maple Leaf coins sold through the Royal Canadian Mint are popular choices.

- Gold mining stocks.

Remember - Gold is the only financial asset that is not simultaneously somebody else’s liability.

Know - Gold ETF shares represent a paper claim on gold, not gold itself.

The best leverage

Historically junior gold stocks offer the best leverage to a rising gold price because of the huge opportunity for gains. Consider this: Say you like Goldcorp right now so you buy 500 shares at C$14.00/sh - a $7,000 investment. Goldcorp (T:G) has a really good first half and the stock price goes to $20. You think that’s a pretty good deal so you sell it, pocketing $6 a share. Your $7,000 has turned into $10,000, a 42% gain.

Option two: You find out about a junior exploration company that has a very good project in a safe jurisdiction, with experienced management, lots of cash and plenty of exploration upside. The company is trading at $0.23 a share. You only have $7K to spend so you buy 30,400 shares.

Abour five weeks into a drilling program your junior hits a discovery hole. The share price triples to $0.69. You’re smart enough to take the profit, so you sell. Your $7,000 is now worth just under $21,000.

How likely is it that a major gold company like Goldcorp would triple in six months? The odds are set pretty high against you. What are the odds of a gold junior tripling in six months? Reasonably good. Here’s one example.

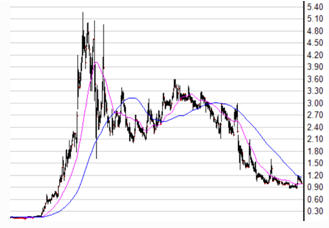

Our junior gold pick, Aben Resources (TSX-V:ABN),

hit multiple high-grade zones at its Forrest Kerr property, while drilling in BC’s Golden Triangle August 2018. In the first 20 days of August Aben tripled in price from $0.14 to $0.48.

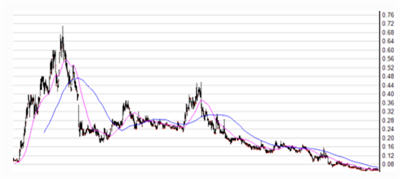

Another junior drilling in the same area, Garibaldi Resources (TSX-V:GGI), had an even more dramatic share gain after hitting a surprise nickel-copper sulfide system. On July 1, 2017 Garibaldi was trading at 33 cents. By October 1 it had run up to $4.01, making the stock a 12-bagger.

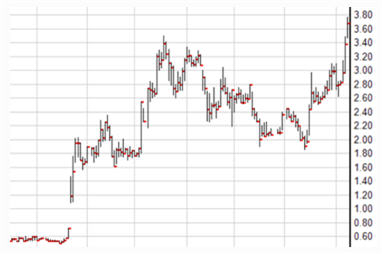

Four years earlier, Kelowna-based Colorado Resources (TSX-V:CXO), made a copper-gold porphyry discovery during inaugural drilling at its North ROK property in the Golden Triangle. The stock ran for a month following the discovery, from $0.33 to $1.32 trough to peak, netting investors who got in at $0.33 a 725% profit.

This week

RCC Mining and Mineral Exploration Services compiled a list of the best drill intersections so far this year. Among the top 10 were GGX Gold (TSX-V:GGX), which cut high-grade mineralization at its Gold Drop property in southern BC.

Great Bear Resources (TSX-V:GBR) ran after a gold hole at its Dixie project near Red Lake, Ontario.

and Regulus Resources (TSX-V:REG) for a copper-gold-silver intercept at its AntaKori property in Peru.

The day after RCC’s report, GGX Gold gained 57.1%, Great Bear Resources was up 29.4%, and Regulus Resources vaulted 11.9%. And let’s not forget our newest gold junior pick Max Resources (TSX:V.MXR) already a double going from 0.18 ten days ago to close at 0.38 today.

Conclusion

The point is, picking the right company, and selling at the right time, can be VERY rewarding for junior resource investors.

Owning physical gold is a way to preserve wealth against paper currencies which are subject to inflationary pressures and over time, lose their value. Gold is insurance against financial calamity, and at AOTH we think everyone should own some gold bullion, for their own safety.

We saw this recently in Venezuela. Outcast President Maduro reportedly sold over 40% of the country’s gold reserves in 2018 in a last-ditch attempt to fund government programs and pay bondholders. Venezuela is experiencing hyper-inflation and extreme unemployment; it is essentially broke.

Recently Maduro tried and failed to find more gold to sell, first from the Bank of England and then through a Russian airliner that landed in Caracas with the intention of shipping out 20 tons of bullion. Amid international condemnation, the plan fell through.

When your country is falling apart, you find bullion to sell, or use as a bargaining chip.

You invest in gold bullion because it’s a safe haven. That means you need to have access in times of turmoil – its there when you need it. You buy junior gold stocks because history shows they have the greatest leverage to a rising gold price, and you get exposure to news that could potentially send its shares flying.

Richard (Rick) Mills

aheadoftheherd.com

Ahead of the Herd is on

Twitter

Ahead of the Herd is

now on FaceBook

Ahead of the Herd is

now on YouTube

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Aben Resources (TSX.V:ABN) is an advertiser on Richard’s site aheadoftheherd.com. Richard owns shares of ABN