Barrick wants to buy Newmont. Trump wants a deal with China. Palladium wants to fly into space. And what does gold want?

Will Barrick and Newmont Create Gold Monster?

Do you remember our

January 24, 2019 edition of the Gold News Monitor? We analyzed in that report the historic transaction in the bullion industry, i.e. the Newmont Mining’s purchase of Goldcorp, which will create the world’s largest gold miner.

Forget it!

Today, we have something better for you. Yesterday, Barrick Gold Corporation, which is the largest gold mining company,

announced that it has made a proposal to the

Newmont Mining Corporation, the second-largest gold producer,

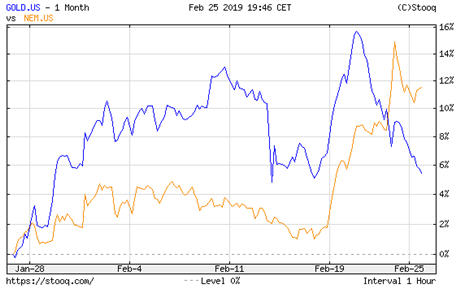

to merge. The proposal assumes that each Newmont shareholder would receive 2.5694 Barrick shares per Newmont share, so the value of the proposed acquisition is at around $18 billion. So far, it seems that Newmont shareholders received the news about the proposal much better than Barrick’s shareholders – just look at the stock market price reactions displayed in the chart below.

Chart 1: Barrick’s stock price return (blue line) and Newmont’s stock price return (orange line) over the last month.

The combination of the two would create “the world’s best gold company, with unprecedented potential for value creation” and “the largest portfolio of Tier One gold assets”, according to the Barrick. The merged company would have revenues of approximately $15.6 billion, total

gold reserves of 141 million ounces and a market capitalization at almost $52 billion, based on today’s share prices, more than three times larger than Franco Nevada, its nearest rival.

What a golden beast!

However, nobody knows whether the deal comes to fruition. It is conditional on Newmont scrapping the deal to buy Goldcorp. And Newmont’s top team seems to be skeptical, describing Barrick’s proposal as “desperate and bizarre.” In a statement published yesterday, the company said:

Newmont has previously determined that Barrick’s risk and return profile is inferior on many fronts, including factoring Barrick’s comparatively ineffective operating model, poor track record on delivering shareholder returns and unfavorable jurisdictional risk

What it certain is that the proposal is just

another sign of the continuing consolidation in the precious-metals sector. And this is not without the significance not only for people investing in

gold mining stocks but also for

bullion investors. This is because

the consolidation in the bullion industry usually occurs around gold bottoms. For example, the last big wave of M&A took place in the late 1990s, just at the end of the

bear market in gold. And we have just heard about another acquisition proposal in the industry in recent weeks –

so maybe something (read: gold’s bottom) is in the air.

Will the Trade Wars End? Will It Support Gold?

Maybe! After all, the

Fed has turned

dovish recently, which should be supportive for the yellow metal. And now not only

Powell but also Trump is extending a helping hand. What we mean here, of course, is Trump’s announcement that

he would delay a hike in tariffs on Chinese imports. It’s a sign that the end of

trade wars is not very far from us. After all, the president needs a deal before the next year’s elections. Neither China wants escalation, as the country faces many domestic problems.

As trade wars were positive for the

US dollar and negative for the gold market (we explained this in the December edition of the

Market Overview),

their conclusion should bring reverse effects.

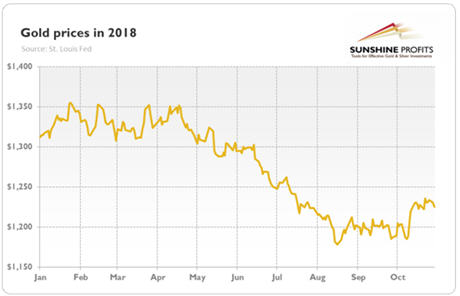

Chart 2: Gold prices (London P.M. Fix) from January to October 2018.

Just look at the chart above. Between April and September, where trade wars were the most intense, gold significantly declined. Thus,

gold bulls should welcome all positive news about the trade deal. Unless, they will be too positive and spur too strong risk-appetite which is usually negative for

safe-havens assets.

And Now For Something Completely Different

We should probably, as we often do, conclude our analysis displaying the chart of gold prices. However, we would like to call your attention to

palladium – its price has just jumped above $1,500.

Incredible! We will examine its

market in the March edition of the Market Overview. Stay tuned!

Chart 3: Palladium prices from February 22 to February 25, 2019.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly

Market Overview reports and we provide daily

Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe.

Sign up today!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘

Gold News Monitor and

Market Overview Editor

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.