This company is transforming the model for mineral exploration in the Western United States.

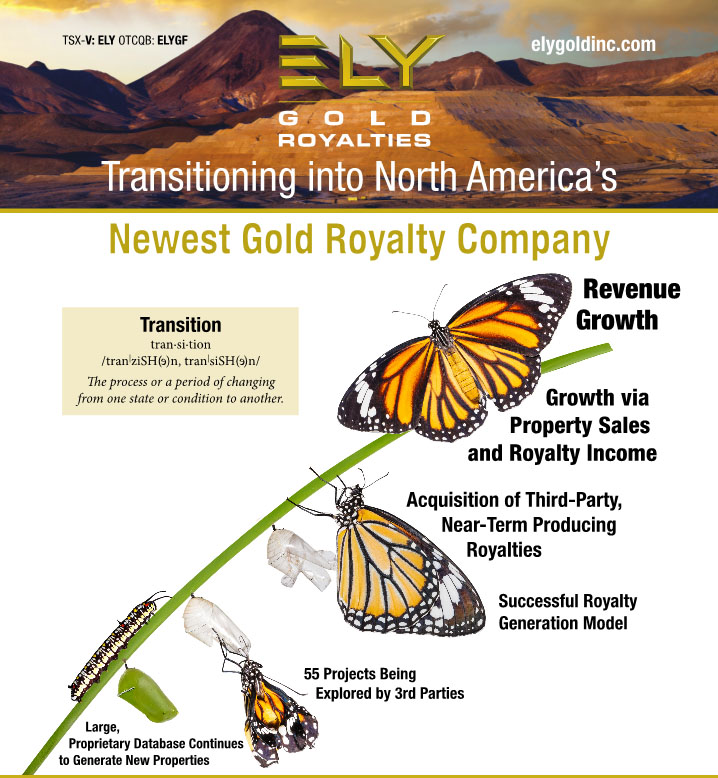

Ely Gold Royalties Inc. (ELY:TSX.V; ELYGF:OTCQB) has turned the parameters and expectations of a typical project generator around by substituting the traditional joint venture business model with its Option/Royalty Model.

Trey Wasser, Ely Gold's President and CEO, told Streetwise Reports, "In just three years, Ely Gold, armed with a large database of Western U.S. properties and a growing reputation for generating new underexplored projects, has built a top-quality portfolio of royalties and option properties."

The company's partners include majors, mid-tier producers and junior exploration companies. Under Ely Gold's Option/Royalty Model, the company sells 100% of its projects in an outright sale or a four-year option contract. On every property, Ely Gold retains a royalty on future production.

"I am very excited for the future of the company and its shareholders with such great model and team for building real value." - Greg McCoach, The Mining Speculator

"Ely Gold's Option/Royalty Model is such a success," Wasser explained, "because in a traditional joint venture model (JV), the 'earn-in' partner will have significant work and financial commitments while on its way to earning only a percentage of the project. The minority partner receives little or no revenue from the transaction yet will still have significant management responsibilities within the JV. In the current market environment where larger companies are cutting budgets and juniors are having difficulty raising capital, the large work commitments for the JV earn-ins are problematic. When the 'earn-in' partner walks away due to participation expenses or lack of market support, the minority partner is returned a partial minority ownership or a perceived 'difficult' project. Even in a successful JV, after earn-in, the junior partner is required to start contributing their share of costs in the JV or be reduced to a net smelter royalty."

With Ely Gold's Option/Royalty Model, the option payments are escalating annual payments with a final balloon payment. Should the project partner make the last payment, it earns 100% of the property, and Ely Gold retains a royalty on any future production. If the partner doesn't make the last payment, Wasser explained, "The property is returned to us 100%, thereby allowing us to evaluate the work completed and return the project to our property portfolio."

Wasser went on to say, "There are no work commitments. This allows our partners to control their exploration expense according to budget requirements and market conditions. They can maintain the project by simply making the option payments. Our model is much more scalable than the traditional JV model, as we have no property/exploration management responsibilities. This allows us to build a much larger portfolio that is constantly generating new royalties. It also allows us to keep our overhead very low and operate just like a royalty company. This keeps the company's cash flow positive. We, in turn, then can actively seek and purchase additional existing third-party royalties. This is how Ely Gold is transitioning into North America's newest gold royalty company."

"Ely Gold Royalties is executing its game plan to perfection." - Mickey Fulp, Mercenary Geologist

Wasser continued, "We operate one of the best databases in the U.S. gold mining industry. Our partners and investors know that this extensive database is what sets Ely Gold apart from other royalty companies and prospect generators. In addition to geologist/prospector Jerry Baughman's data and Bill Sheriff's database (purchased in 2016), over the past few years, we've been able to buy portfolio projects that come with full data sets, sometimes on multiple properties. The database includes work completed by companies as far back as the 1970s. Because project names are always changing, our data is fully digitized by location. When our partners option a property, they can review a full data room on the project. This makes a huge difference because our partners can not only fully evaluate the project, but can also accelerate their development programs."

Wasser also discussed another aspect of Ely Gold's projects. "Besides the favorable structure and data, another important reason for the rapid success of our Option/Royalty Model is the quality of our projects. Our core strength lies in being able to consolidate underexplored land packages for our partners. Some of the best undeveloped properties in Nevada and the Western U.S. have 'conflicting' claims problems that may have existed for years or even decades. We have the ability and patience to get the claim issues resolved and fully consolidate a property package."

Wasser went on to explain, "Majors and mid-tier producers won't tackle these title issues. It's simply a level of risk they are not willing to accept these days. We have a distinct advantage because our database includes all the title and ownership history of the properties. In addition, Jerry and Bill have a deep knowledge of the surrounding claim packages and have relationships with the Nevada landowners. Jerry and Bill are two of the most well-known Nevada prospectors and have each been operating in Nevada for over 30 years."

"The success of Ely Gold's Option/Royalty Model is evidenced by not only the quality of our partners but by the fact that several partners have purchased multiple projects," Wasser told Streetwise Reports.

Using cash flow from its Option/Royalty portfolio, in October 2018, Ely Gold purchased a third-party royalty on Wallbridge Mining Company Ltd.'s (WM:TSX; WC7:FSE) Fenelon Project, located in northern Quebec. Wallbridge is currently conducting a large bulk sample program. "Wallbridge is producing excellent exploration results and has produced over 13,000 ounces of gold from a bulk sample program," Wasser noted.

Also in October, Ely Gold announced the purchase of a royalty on Gold Resource Corp.'s (GORO:NYSE.American) Isabella Pearl Project, located in prolific Walker Lane, Nevada. This project is currently under construction and is a key part of Gold Resource's newly minted Nevada Mining Unit. Since August 2016, Ely Gold has completed four separate property transactions with Gold Resource and has been instrumental in helping the company establish its presence in Nevada.

Ely Gold expects royalty income from both these assets in 2019.

In January 2019, Ely Gold closed its first equity financing in four years. "The financing," Wasser stated, "not only brought in additional capital to seek out third-party royalty opportunities, but most importantly, the financing brought Ely Gold's first major institutional shareholder, Capital Exploration Partners LLC (Sprott), which now holds a 10% stake in the company."

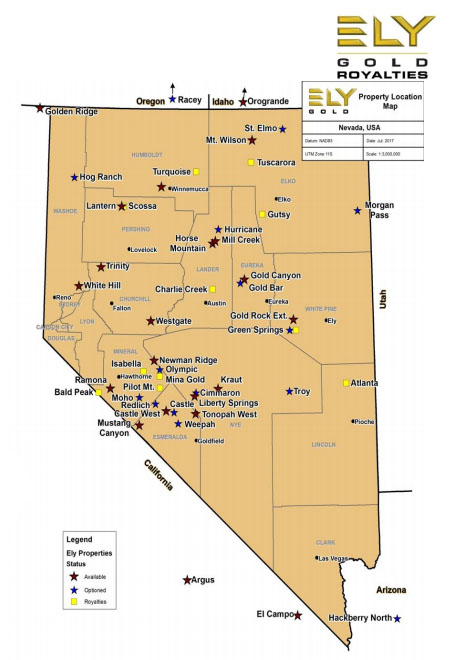

Ely Gold stresses that Option/Royalty Model is highly scalable and allows the company to manage a very large portfolio of projects, since they do not directly develop or manage any of the properties. Currently Ely Gold has over 70 projects in its portfolio, primarily in Nevada but with a few located in the surrounding states. Of those projects, 50 are being explored and developed by its high-profile partners. Some 31 of these active projects are deeded royalties, where Ely Gold has already sold 100% of the property. An additional 19 projects are in the option portfolio, where option payments stretch to 2023.

"Our scheduled Option/Royalty Model income in 2019 is estimated at over CA$1.2 million. Furthermore, there are over 20 properties in our 'Available Property' portfolio, providing the company with plenty of current inventory for potential partners. In addition, we are constantly adding new properties through staking and acquisition," Wasser explained.

Ely Gold's most recent transactions include:

- In January, Ely Gold announced the optioning of a state lease on the high-grade War Eagle Property in Idaho to a subsidiary of Integra Resources Corp. (ITR:TSX.V; IRRZF:OTCQB). The leased land is located 3 kilometers (3 km) from Integra's Florida Mountain deposit and 9 km from its DeLamar Mine. Under the agreement, Integra will pay $200,000 over four years to acquire 100% of the state lease, with Ely Gold retaining a 1% net smelter royalty on any future production.

- In November 2018, Ely Gold optioned 31 claims in the Carlin Trend, Nevada, to Premier Gold Mines (PG:TSX) for CA$506,572 while retaining a 2% net smelter royalty on any future production. These claims lie within the boundary of Premier's South Arturo joint venture with Barrick Gold Corp. (ABX:TSX; GOLD:NYSE), which is currently producing gold and silver from an open-pit operation.

Jerry Baughman, president of Ely Gold's royalty subsidiary, Nevada Select Royalty Inc., explained, "These types of transactions are a clear demonstration of our successful Option/Royalty Model and our extensive database at work. We are able to consolidate important properties, on flagship assets, for our senior partners. Securing and optioning the War Eagle Lease was instrumental in consolidating an important high-grade asset for Integra in the DeLamar District. The Rodeo Creek Claims were held by a third party for over 30 years with neither Barrick nor Premier able to consolidate these complicated property claims. Rodeo Creek is a classic Carlin Trend prospect surrounded by producing mines."

"Ely Gold's transition into North America's newest gold royalty company will be exciting for our shareholders this year," Baughman stated. "We will continue to add to the Option/Royalty Portfolio in 2019 with several deals currently in the pipeline. We also expect to purchase new existing third-party royalties on producing assets, development projects and high-quality exploration properties. Lastly, 2019 will be a very important year for exploration and development news flow from our partners in the Option/Royalty Portfolio. We will continue to add new properties and, together with our current inventory of available properties, this ensures years of future growth and expansion of the Ely Gold Option/Royalty Portfolio."

Several industry observers have their eyes on Ely Gold Royalties, including:

- Jay Taylor, in his February 8, Gold, Energy & Tech Stocks letter to subscribers wrote, "Compared to its peers, this company carries a very low valuation. I see very little downside compared to upside at a time when growth should really start to accelerate first from developing projects and longer term from the pipeline."

- Gwen Preston, in the January 23 issue of Resource Maven, wrote that Ely Gold "continues to execute on its strategy of monetizing its assets and building up its royalty portfolio. . .the move is a great example of the company's business model, using its Nevada expertise to secure assets that others want but cannot get."

- Greg McCoach stated in The Mining Speculator on January 22, "Overall, I am very excited for the future of the company and its shareholders with such great model and team for building real value. Ely Gold Royalties is a Buy."

- In his November 2018 update, Mickey Fulp told his audience, "Ely Gold Royalties is executing its game plan to perfection."

As noted above, Ely Gold Royalties recently closed a non-brokered private placement, raising aggregate gross proceeds of CA$1.43 million in two tranches. It issued 13 million units at CA$0.11 apiece. As per the news release, one unit consists of one common share of Ely Gold and one warrant to buy an additional share at CA$0.22.

Currently the company has 93 million shares outstanding, 115 million fully diluted. Management and insiders hold 11%, a small group of long-term shareholders hold another 25% and Sprott's Exploration Capital Partners holds 10%. At the current price of CA$0.17, Ely's market cap is under CA$15 million and the company has CA$2.5 million in cash and marketable securities.

If you are interested in the Ely Gold story and to follow its partners' news flow, you can sign up for notifications here.