The 2018-2019 bear market rally that we identified during the last week of 2018 via the 2019 Forecast Issue, entitled "2019: Mayhem, Misallocation and the Mockery of True Price Discovery," is now on record as one of the most ferocious rallies ever recorded, as short sellers are being carried out on stretchers and in body bags left, right and center. The youngsters out there who think their new and highly sophisticated analytical software will guide them through this minefield of intervention and deceit have obviously forgotten (or conveniently ignored) the immortal phrase from the lips of the legendary Marty Zweig, "Don't fight the tape and don't fight the Fed."

Earlier this month, I did fight the tape and the Fed by shorting the S&P 500 slightly beneath the 200-dma (daily moving average) at 2,738, placing the stop-loss at a 2-day close over 2,755. This resulted in a modest haircut of 23 S&P points and an ample serving of humility. I now have Marty's picture up on my wall right above the monitor to remind me that only in free markets can you use the old tools from preintervention eras.

Nevertheless, the S&P in the past few days has moved into overbought territory, before retreating on Wednesday, so given the pause we are seeing in this enormous rally, I think it is time to once again tiptoe into the SPY April $270 puts for $2.60.

I met Marty Zweig in Philadelphia on the closing night of the 1985 Securities Industry Association Course Conference sponsored by the Wharton School at the University of Pennsylvania. He was having a beer at the bar and I asked him whether he was heading back to New York after the dinner (where he was guest speaker). He said he had decided to head to Atlantic City instead, "where the odds at a crap table are better than Wall Street."

I thought that was pretty earthy for a guy so fawned over by Wall Street Week's Louis Rukeyser. I had dinner with him and Gail Dudack that night and after a few bottles of fine shiraz, the stories that were told about some of the Wall Street "legends" were astounding, on a par with some of the locker room stories I used to hear about the National Hockey League greats and their—shall we say—idiosyncrasies. In fact, I was actually watching the show on Oct. 16, 1987, when Marty told Rukeyser, in response to whether he thought we had entered a bear market, that "I haven't been looking for a bear market, per se. . .I've been really, in my own mind, looking for a crash."

On the following Monday, Marty was proven a genius when the Dow Jones crashed 508 points, or 22.26%, in a single trading session. You can watch for yourself thirty-two years later thanks to the wonderment of the internet. (Zweig Crash Call)

I think it is important to remember the wisdom of investors like Zweig in that many of their most important messages highlighted the application of common sense in formulating an investment strategy. I regret that Marty is not with us today to shed light on how he would trade markets given the accelerated impact of the Fed (and their global central bank brethren) on strategy.

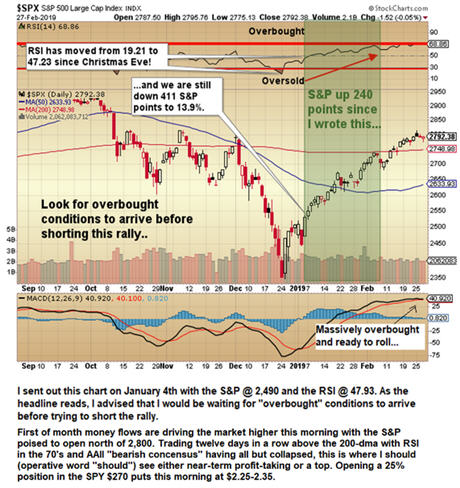

Back on Jan. 4, I sent out a chart of the S&P to highlight the enormous move in the RSI (relative strength index) off the Christmas Eve lows and cautioned the bears that it would be wise to wait for truly "overbought" conditions to arrive, which would entail a move north of 70 (and preferably 75-80) for the RSI. The second chart shows how, two months later, the S&P has added yet another 310 points. While the RSI is verging on overbought status at just under 70, what leaps off the page is that the MACD (moving average convergence-divergence) is back to levels exceeding January 2018, just before the markets tanked. We are dangerously close to a MACD negative crossover, which we got in January 2018 and September 2018, and which immediately preceded the selloffs. I opened a 25% position in the SPY April $270 puts at around $2.70 earlier last week week and added 25% more into the upside spike opening at around $2.25.

There is a possibility that we could be in the throes of an "upside melt-up," which would climax in and around quadruple witching expiry day on the Ides of March (March 15). If that happens, then the range of 2,870-2,940, which is the January 2018 top/October top range, would be the logical level at which to endeavor a probe to the short side.

However, I am not waiting for that possibility. I have opened a 50% position in SPY puts on the assumption that the snoozing bear is about to awaken, hungry and in foul humor, this week. I am going to add the remaining 50% in the event that one of two events transpire: 1) melt-up arrives and keeps on gapping higher into the Ides; or 2) three prior tops from September through December in the 2,800-2,816 prove inviolate and markets reverse.

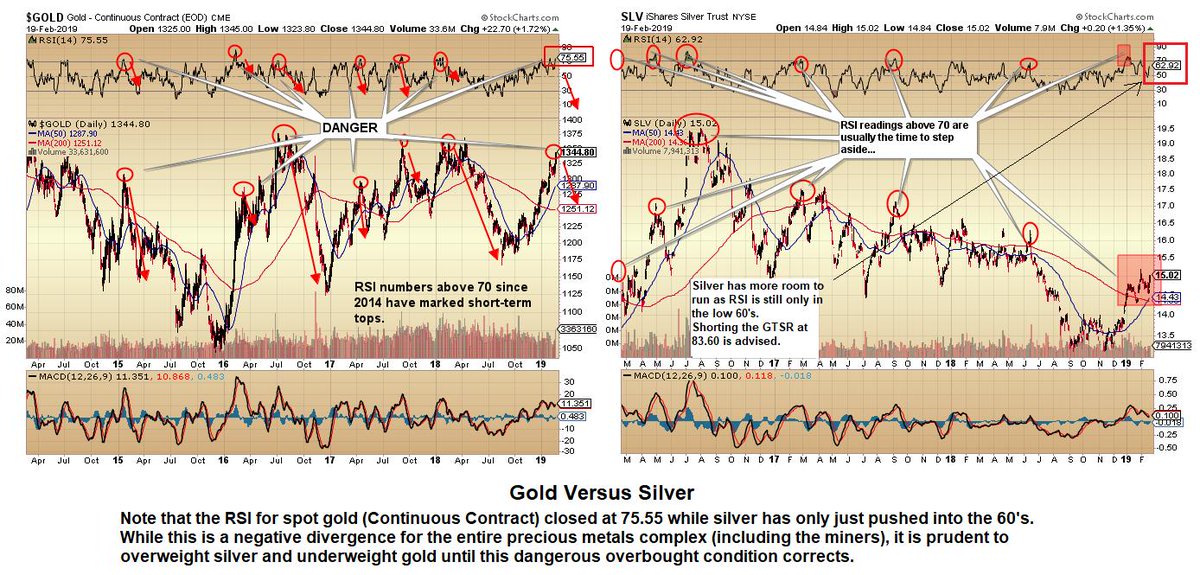

Turning to gold, I will simply allow you to read my tweet from Feb. 20, the exact date gold put in its intraday top at $1,349.80. I put this out there because in the world of social media, fake news and accountability demands, the community of trolls take great delight in lobbing credibility bombs into the mixture. Since the integrity of markets absolutely depends on credible sources of information, I want to start this precious metals discussion with the backdrop of my call-to-arms (the tweet).

Here is the tweet: Taking big profits on all gold options/futures/leveraged ETF positions NOW with gold RSI at 76;10:17 AM - 20 Feb 2019 (note the time stamp here).

During the prior weekend, the blogosphere and social media delivery systems such as Twitter and Facebook were absolutely rife with bullish prognostications to the extent that it was reminiscent of the heady days of August 2016, when bullish consensus blew through 90% and RSI for gold was in the mid-70s. Every technical measure I follow was screaming "sell" for gold, and while silver appeared less technically vulnerable, it has since succumbed and sits some $0.82/ounce lower than its Feb. 20 closing price.

So it is "back to the drawing board," as we are now flat all gold leveraged positions and have taken profits on the DUST trade, bought at $16.15 and pitched last week at $19.00.

Speaking of the miners, this is PDAC Week and is historically the seasonal top for mining stocks of all flavors and fragrances. I am going to watch the DUST very closely, and if by Wednesday the miners have failed to mount any form of rebound, I may buy the DUST again, regardless of price on the assumption that a) gold has broken trend and b) the HUI is headed back to 140. taking the DUST back to $38 (which would make my $19 sale at best "premature" and at worst "imbecilic").

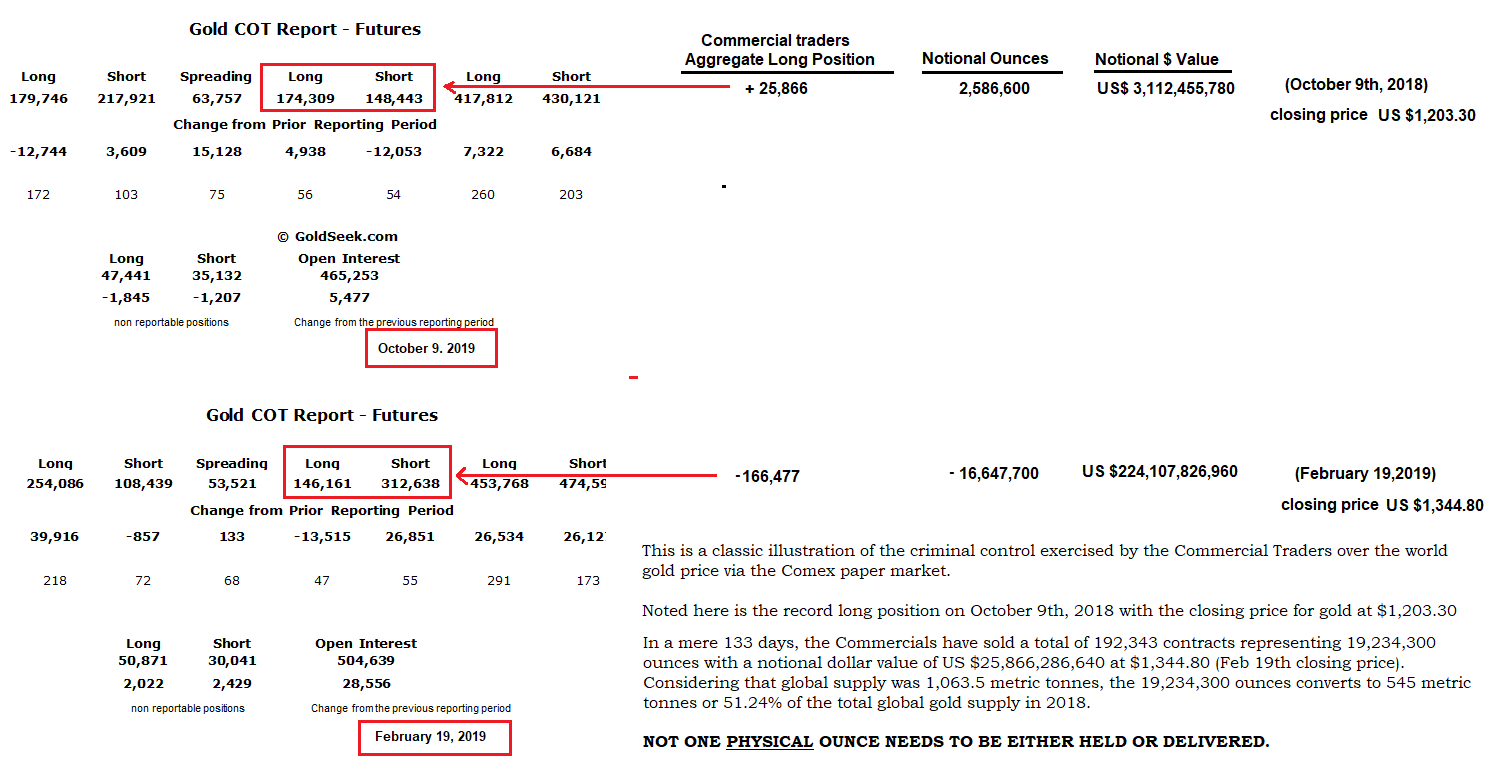

Now, in the category of "Ten Top Reasons to Knee-cap Bankers," I offer a review of the hideous activities of the Commercials traders, whose Crimex hunting grounds are on a par with the South African veldt (home to the world's largest and most-ferocious predators).

Late last summer, these unregulated bankster hooligans began a short-covering campaign in the gold pit that resulted in them amassing, for the first time that I can recall, an actual long position in Crimex gold futures. By the time we got to October, they were the proud, salivating possessors of a mind-numbing 25,866 contracts representing 2,586,600 ounces of gold worth about US$ 3 billion. In three of my missives from August through December, I was doing handstands and cartwheels while screaming about the bullish implications of such unruly behavior by the normally gold-hating Commercials.

Shockingly predictable, over the next 133 days, these bullion bank cretins were allowed to sell the equivalent of 51.24% of the 2018 global supply of 1,063.5 metric tonnes, the impact of which resulted in the muting of gold's price rise and the eventual dissipation of momentum, demand and support, giving way to the current weakness and widespread scurrilous commentary in the blogosphere from those that failed to exit as we did on Feb. 20.

However, you all know, from my years of writing, that all things technical for gold are "not what they seem." We know this, and all of those breathless commentaries from the gold newsletter bulls about the "off-the-scale" global demand and "golden crosses" and "bull flags" can now be officially pitched into the bin because they all failed, and they did so because of the sanctioned interference and planned intervention of the bullion banks. My friends over at GATA (https://www.lemetropolecafe.com/) have been all over this so well over the years and I urge you all to listen to Bill Murphy's interview with TF Metals Report's Craig Hemke, which you can find here.

In the absence of anything new to report, I will simply capsulate today's remarks with a suggestion. When you are doing your due diligence on any investment idea, remember that the data with which you work is not necessarily pristine, in that it can be compromised. Whether it is Elon Musk and his stock-fueling tweets or an e-mail from a stock-pumping wire house, the purpose of every piece of literature that ever leaves a desk is designed to drive buying into something that someone else wishes to sell.

So when Goldman Sachs came out in January calling for a $1,425 gold price in 2019 (Goldman link here), do you think that their prop desk was waiting for you to get in before they did? Or do you think they were probably long around the time the Commercials started their program back in August, and were then looking to unload into the retail frenzy that we ultimately saw in mid-February? If you choose the former, then I have some farmland in the Ukraine near Chernobyl that has your glowing name written all over it.

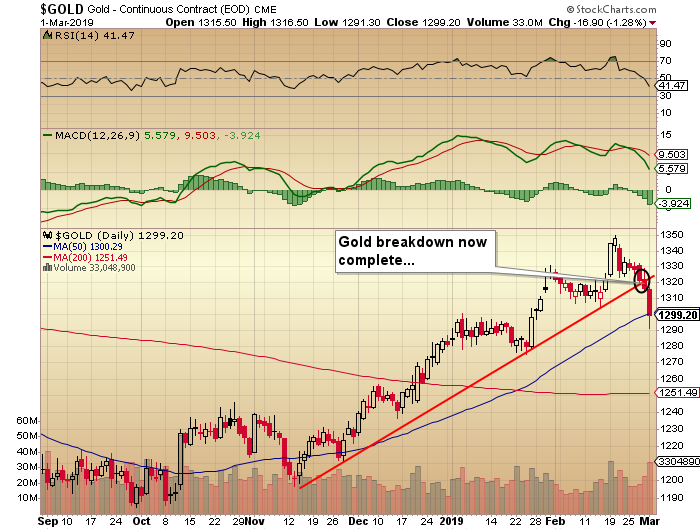

With the gold price now down below $1,300 per ounce, you will recall it took the entire month of January, replete with Fed policy reversals, dovish fireside chats, a declining US dollar and rising Dr. Copper to finally punch out through the magically fortified $1,300 resistance level. It then took 27 more days to get to the ominous $1,350-1,375 resistance zone, where it churned for one day—one day.

Amazingly, and by contrast, it has taken seven—seven (!)—trading sessions to drop form $1,349.80 to the current $1,294.50, thus obliterating that beautiful uptrend line from November and shattering all bullish sentiment with the finality of a Joe Frazier left hook. RSI is now at 41 and MACD and the histograms are all in "crash mode," so I am now looking for an entry level for the same leveraged vehicles (GLD calls, JNUG, NUGT, June Gold futures) that I jettisoned $50/ounce and twelve days ago. Keep your eye on your e-mail inbox for the Goldman Sachs "note to clients" that says they are reversing forecast to a $1,050 2019 gold price. Then, as suggested last August, I will "back up the truck."

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.