What an interesting day it’s today. After yesterday’s brief moment of serenity, many currency pairs are on the move now. Where to look first? Is it the euro? The action looks great and builds on our assumptions surely to your delight. Or are you more happy about today’s move in the Australian dollar? It’s such a pleasant sound to hear the cashiers’ bell ringing… Wait, we have more for you. What about opening a new promising position right now? Let’s dive in for all the details.

EUR/USD – Sliding Down

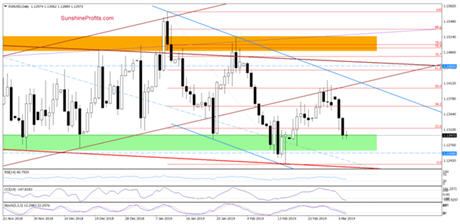

EUR/USD extended losses yesterday and that made our already profitable short position and an even more profitable one. The price slipped to the green

support zone just like we had expected yesterday:

(…) Combined with daily indicators’ sell signals, this suggests that further deterioration and a test of the green support zone is a question of time, any short-lived pause or even upside move attempt notwithstanding.

The CCI and Stochastics have now reached their oversold areas. While there hasn’t been any buy signal issued yet, it warrants caution as the space and pace of further declines may be limited for the time being. However, one more price fall attempt remains likely and wouldn’t surprise us in the least.

Therefore, it’s still advisable to patiently stick with the currently open short position.

USD/JPY – On the Lookout for Price Upside Exhaustion

One consolidation is over, and another one starts. First a blue consolidation, now an orange one. The pair is till trading above the previously broken upper border of the blue rising trend channel. As long as there is no invalidation of this breakout, a move higher and a test of the yellow resistance zone remains likely.

Let’s take a close look at the position of the daily

indicators. Their sell signals just generated suggest that we won’t likely have to wait long for a corresponding price reversal.

If we see an invalidation of the breakout above the upper border of the blue rising trend channel, we’ll consider opening short positions.

USD/CAD – A Chart Formation Activated

In our Monday’s commentary on this pair, we discussed the

reverse head and shoulders formation in the making.

We also wrote:

(…) The currency bulls not only pushed USD/CAD above the upper line of the pink channel, but also approached our next upside target – the blue resistance line, which could be a neck line of a potential reverse head and shoulders pattern.

USD/CAD indeed broke above the blue resistance line. And it means that it broke above the neck line of the reverse head and shoulders which is now an active formation carrying implications. It also broke above the yellow resistance zone, which also suggests further price improvements.

Taking the above into account, we think that opening long positions is justified from the risk/reward perspective.

If you enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts, Oil Trading Alerts and other tools.

Sign up now!

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.